This tool calculates gross income based on net income, using ato's personal income tax rates and thresholds. How the tax calculator works?

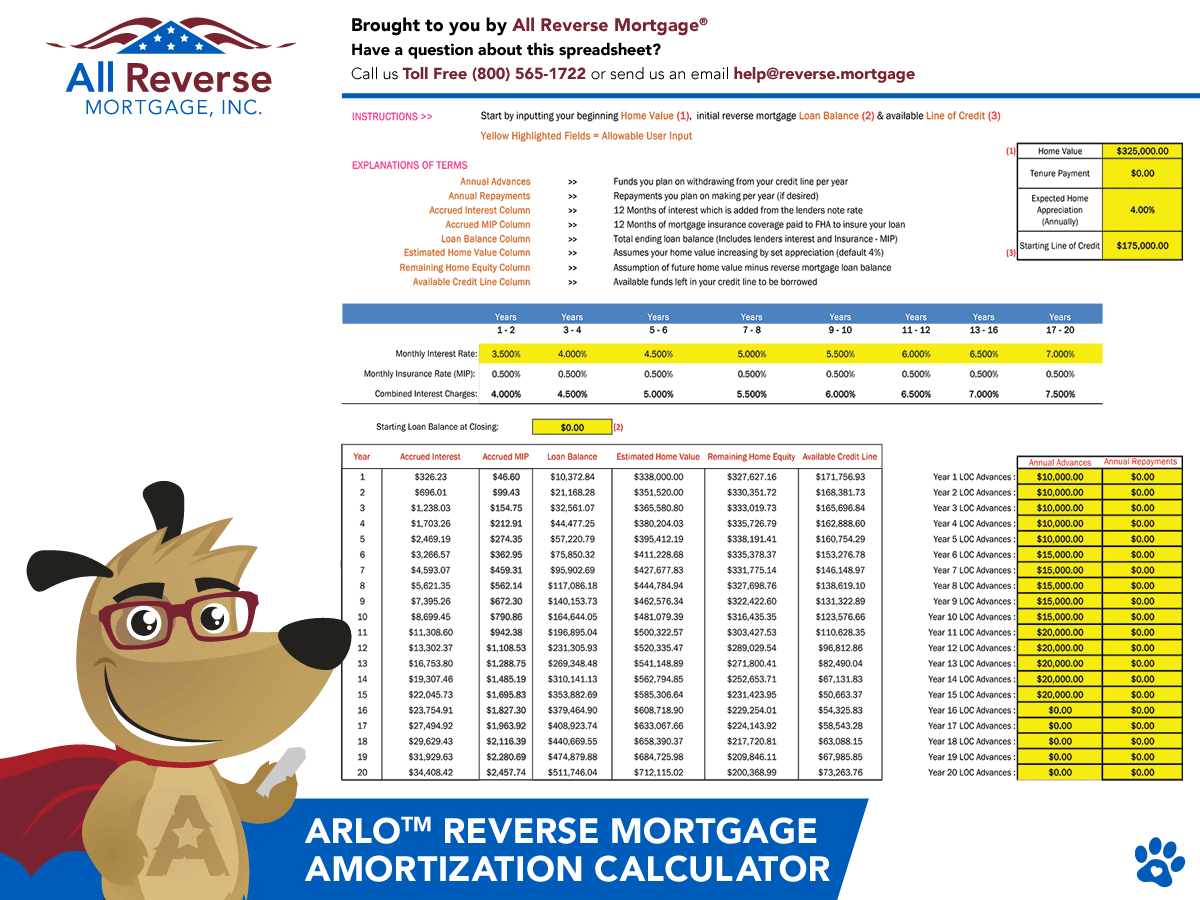

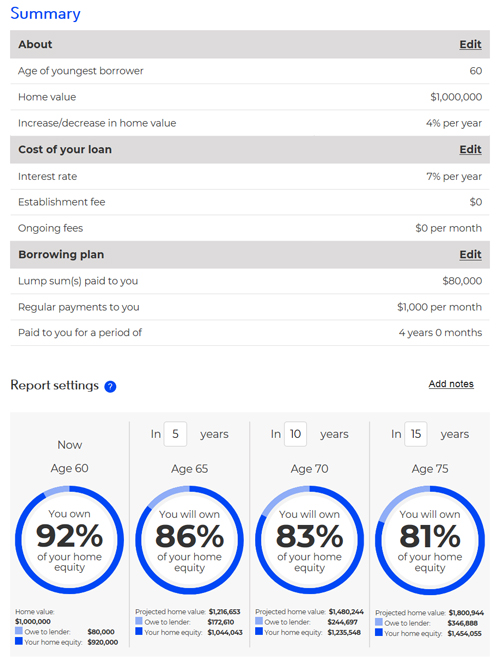

Free Reverse Mortgage Calculator Reverse Mortgage Mortgage Amortization Calculator Mortgage Calculator

Income taxon your gross earnings , medicare levy(only if you are using medicare) , superannuationpaid by your employer (standard rate is 9.5% of your gross earnings).

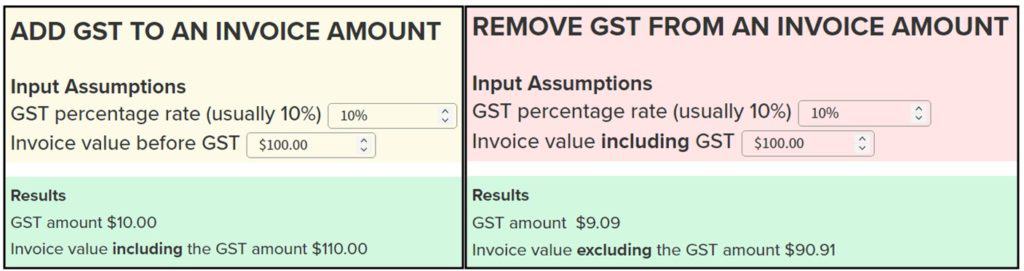

Reverse tax calculator australia. So, we believe that it makes perfect sense to tell you a bit more about the gst inclusive and the gst exclusive. The cost of gst is then added to the purchase. The reverse tax calculator calculate net earnings to gross earnings.

Calculate the amount of gst by applying the following formula: This australian tax calculator will show you what your weekly, fortnightly & monthly income or net salary will be taking into account current ato tax rates. Ad a tax agent will answer in minutes!

Use this calculator to quickly estimate how much tax you will need to pay on your income. Here is how the total is calculated before sales tax: Calculate australian tax figures fast!

Current financial year, 2020, 2019, 2018, 2017, 2016, 2015, 2014, 2013, 2012, 2011, 2010, 2009, 2008, 2007. Reverse tax calculator is a simple financial app that allows you to quickly and easily figure out just how much of that sales total was actually taxes! Amount without sales tax * gst rate = gst amount.

Includes 2% medicare levy and low income tax offset. The tax calculator will also calculate what your employers superannuation contribution will be. Simply enter any one field, press the calculate button and all the other fields will be shown.

This calculator does not take into account possible tax deductions and tax offsets that may lower the tax you pay.the rates are for australian residents. To figure out how much gst was included in the price you have to divide the price by 11 ($220/11=$20); Why a “reverse sales tax calculator” is useful.

The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim. This calculator is always up to date and conforms to official australian tax office rates and formulas. Simply select the appropriate tax year you wish to include from the pay calculator menu when entering in your income details.

Simply enter your gross income and select earning period. To figure out how much gst was included in the price you have to divide the price by 11 ($110/11=$10); Adding 10% to the price is relatively easy (just multiply the amount by 1.1), reverse gst calculations are quite tricky:

Amount with gst = amount excluding gst + gst amount. $75 of goods x 10% gst = $7.50 gst. The video below explains how you will be able to input your answers into a table and plot onto a graph.

Tax to gross income ratio 26.87%. Amount without sales tax * qst rate = qst amount. Gst amount = amount excluding gst x ( gst rates /100) the amount with gst (including taxes) use this formula:

Navigating australia’s tax system including medicare levies. You may also choose to pay gst for purchases, even though you are the purchaser. How to calculate reverse gst (formula)

How much australian income tax you should be paying; Our tax calculator will help you determine your net income from your gross annual income received. What your take home salary will be when tax and the medicare levy are removed;

Its a reverse income tax calculator which calculates net income based on gross income. One of the things that you probably noticed in our reverse gst calculator is that you have the option to choose between determining the reverse gst inclusive as well as the reverse gst exclusive. This app is especially useful to all manner of professionals who remit taxes to government agencies.

Ad a tax agent will answer in minutes! Questions answered every 9 seconds. Formulas to calculate the austrlia gst.

Reverse charge is required on some offshore purchases, even though you are the purchaser and even if the sale would not normally be subject to gst. Requirement to reverse charge gst Questions answered every 9 seconds.

This calculator can also be used as an australian tax return calculator. The calculator takes into account medicare levy and the low income tax rebate, but does not take into account other rebates such as the family tax benefits & social security rebates This calculator will give you an estimate of your gross pay based on your net pay for a particular pay period (weekly, fortnightly or monthly).

This post will explain calculating tax based on a person’s income in australia in prelim standard math. $75 of goods + $7.50 gst = $82.50 total. Amount with sales tax / (1+ (gst and qst rate combined/100)) or 1.14975 = amount without sales tax.

It uniquely allows you to specify any combination of inputs when trying to figure out what your gross income needs to be for the desired net income. How to calculate gst in australia? When adding 10% to the price is relatively easy (just multiply the amount by 1.1), reverse gst calculations are quite tricky:

Its a reverse income tax calculator which calculates net income based on gross income. Show me tax rates for:

Mortgage Calculator App – Google Search Mortgage Loans Mortgage Loan Calculator Reverse Mortgage

Fascinating Rental Property Management Spreadsheet Template In 2021 Rental Property Management Investment Property Spreadsheet Template

Professionally Designed Real Estate Mortgage Brokers Email Flyer

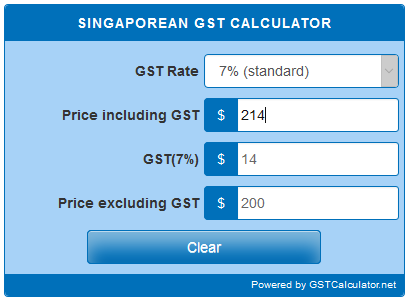

Indian Gst Calculator – Gstcalculatornet

Free Reverse Mortgage Amortization Calculator Excel File

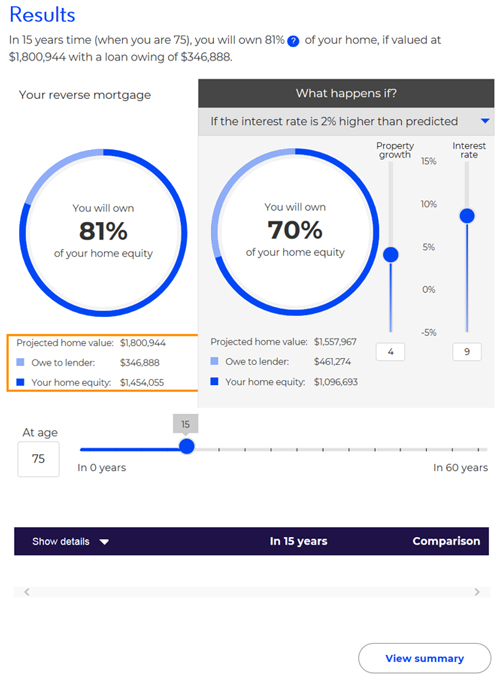

Using Asics Reverse Mortgage Calculator Asic – Australian Securities And Investments Commission

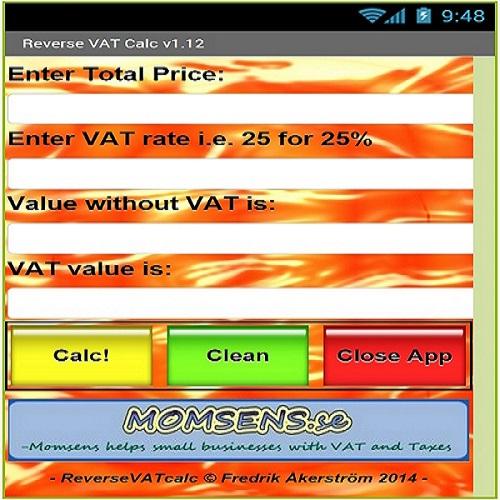

Vat Calculator 2021 – Add Or Remove Value Added Tax Online

Canada Provides More Study And Work Permit Flexibility For Candidates Earn Money Online Ways To Earn Money Income Tax

Excel Formula For Reverse Tax Calculation Excel Formula Reverse Excel

Commercial Property Lease Or Buy Analysis Calculator Investment Analysis Commercial Property Analysis

Reverse Tax Calculator – Net To Gross

Singaporean Gst Calculator – Gstcalculatornet

Backward Vat Calculator – Accounting Finance Blog

Reverse Tax Calculator – Net To Gross

Gst Calculator Australia – Atotaxratesinfo

Family Caregivers Spend A Huge Percent Of Their Income On Care Costs Reverse Mortgage Pay Off Mortgage Early Mortgage Calculator

Home Equity Loan Calculator – Mls Mortgage Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

Using Asics Reverse Mortgage Calculator Asic – Australian Securities And Investments Commission

Rental Investment Property Record Keeping Spreadsheet Investing Investment Property Real Estate Investing Flipping