Amount without sales tax * qst rate = qst amount. The howell, new jersey, general sales tax rate is 6.625%.

Sales Tax Reverse Calculator Internal Revenue Code Simplified

Input the 'tax rate' (%).

Reverse sales tax calculator nj. Reverse sales tax calculator of paterson calculation of the general sales taxes of the city paterson, new jersey for 2021 amount after taxes sales tax rate(s) 6.625% 7% amount of taxes amount before taxes In case you don’t know, there is a reverse sales tax formula that you can use: The following formula can be used to calculate the original price of an item given the sales tax % and the final price of the item.

To find the original price of an item, you need this formula: Try it now & grow your business! Amount after taxes sales tax rate (s) 6.625% 7% amount of taxes amount before taxes.

Sales tax amount or rate: This can be useful for making sure you are being charged the correct amount out at stores, and for understanding the total percent of the final price that is coming from the sales tax. We can not guarantee its accuracy.

This app is especially useful to all manner of professionals who remit taxes to government agencies. Input the 'tax rate (%)'. 101 rows the 07111, irvington, new jersey, general sales tax rate is 6.625%.

Input the 'before tax price' (price without tax added on). New jersey has a 6.625% statewide sales tax rate , and does not allow local governments to collect sales taxes. Try it now & grow your business!

Reverse sales tax calculator (remove tax) ? See also the reverse sales tax calculator (remove tax) on this page. Reverse sales tax calculator of clifton calculation of the general sales taxes of the city clifton, new jersey for 2021 amount after taxes sales tax rate(s) 6.625% amount of.

Input the 'tax rate' (%). Input the 'before tax price' (price without tax added on). Local tax rates in new jersey range from 0.00%, making the sales tax range in new jersey 6.63%.

The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Input the 'final price including tax' (price plus tax added on). The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim.

We can not guarantee its accuracy. Reverse tax calculator is a simple financial app that allows you to quickly and easily figure out just how much of that sales total was actually taxes! Every 2021 combined rates mentioned above are the results of new jersey state rate (6.625%).

Please, check the value of 'sales tax' in other sources to ensure that it is the correct value. There is no city sale tax for howell. The base state sales tax rate in new jersey is 6.625%.

Create your own online store and start selling today. See also the reverse sales tax calculator (remove tax) on this page. Find your new jersey combined state and local tax rate.

Instead of using the reverse sales tax calculator, you can compute this manually. There are times when you may want to find out the original price of the items you’ve purchased before tax. Cities and/or municipalities of louisiana are allowed to collect their own rate that can get up to 7% in city sales tax.

Enter either the sales tax amount in dollars (such as 10 for $10) or the sales tax rate (such as 8.5 for 8.5%0. Every 2021 combined rates mentioned above are the results of louisiana state rate (4.45%), the county rate (0% to 6%), the louisiana cities rate (0% to 7%), and in some case, special rate (0% to 6.75%). The sales tax rate is always 6.625%.

Op with sales tax = [op × (tax rate in decimal form + 1)] Calculation of the general sales taxes of the city jersey city, new jersey for 2021. Please, check the value of sales tax in other sources to ensure that it is the correct value.

So, it’s crucial that you understand how the process goes since this way, you can always calculate the reverse sales tax by hand without any restrictions. Enter the final price or amount. Selling price = final price / 1 + sales tax.

There is no county sale tax for howell, new jersey. This script calculates the 'before tax price' and the 'tax value' being charged. See also the reverse sales tax calculator (remove tax) on this page.

We can not guarantee its accuracy. We can not guarantee its accuracy. Input the 'before tax price' (price without tax added on).

Please, check the value of sales tax in other sources to ensure that it is the correct value. Calculating sales tax backward from the total You will need to input the following:

Please, check the value of sales tax in other sources to ensure that it is the correct value. Input the 'tax rate' (%). New jersey sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache.

Reverse sales tax calculator of jersey city. Amount with sales tax / (1+ (gst and qst rate combined/100)) or 1.14975 = amount without sales tax. Amount without sales tax * gst rate = gst amount.

Here is how the total is calculated before sales tax: Create your own online store and start selling today.

Reverse Sales Tax Calculator – Calculator Academy

How To Calculate Sales Tax Backwards From Total

Sales Tax Calculator For Purchase Plus Tax Or Tax-included Price

Reverse Sales Tax Calculator – Calculator Academy

Reverse Sales Tax Calculator De-calculator – Accounting Portal

Reverse Sales Tax Calculator – Calculator Academy

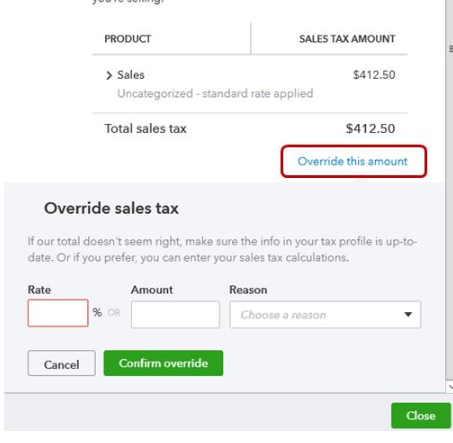

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Reverse Sales Tax Calculator – 100 Free – Calculatorsio

Sales Tax Calculator

New Jersey Sales Tax Calculator Reverse Sales Dremployee

Best Practices For Sales Tax Display In The Checkout

Kentucky Sales Tax Calculator Reverse Sales Dremployee

Sales Tax Decalculator – Formula To Get Pre-tax Price From Total Price

Reverse Sales Tax Calculator – 100 Free – Calculatorsio

Reverse Sales Tax Audits

How To Calculate Sales Tax Backwards From Total

Us Sales Tax Calculator Reverse Sales Dremployee

Sales Tax Calculator

Jyoti –