The r&d tax credit calculator is best viewed in chrome or firefox. Estimate your r&d tax credit.

Practical Documentation Of Qras For The Rd Tax Credit

This credit appears in the internal revenue code section 41 and is earmarked for businesses that have costs related to research and development.

R&d tax credit calculation example. The alternative simplified credit (asc) method looks at the amount your qualified research expenses (qre) exceed the average for your three previous tax years. If you’re not claiming those dollars, you’re losing money. Assuming your business fits these criteria, you can check below for example calculations for r&d tax credits.

How to calculate the r&d tax credit using the traditional method. Conducting a review of any mechanical computation in the r&d tax credit plays a vital role in the examination process. What is r&d tax credit?

For example, software companies that invest in their technology. This calculation example shows how r&d tax credits can benefit a company via a tax saving of £9,500 and payable tax credit of £39,875. Fifty percent of that average would be $24,167.

The kruze consulting r&d tax credit calculator is designed to estimate your r&d tax credit using federal form 6765. If, in 2019, a to z construction had qualified research expenses of $70,000, they would calculate the available r&d credit as follows: The regular research credit (rrc) method looks at the increase in research activity and investment in a taxable year compared with a base amount.

Corporation tax before r&d tax credit claim: To calculate this enhanced expenditure, you’ll need to: The credit benefits large and small companies in virtually every industry, yet our research shows many businesses are leaving money on the table.

A to z construction’s average qres for the past three years would be $48,333. A profitable sme r&d tax credit calculation let’s assume the following: This report provides a review of the nature and effect of the california r&d tax credit, including the rationale for the credit, its history, how it works, how it has changed, and whether it has

Your business has made profits of £650,000 for the year; Calculate the costs that you. We charge a fixed fee of 15% of the anticipated captured credit amount with a minimum fee of $1,000.

This is also especially beneficial for saas startups that tend to have negative income and high payroll taxes. R&d tax credit is a non refundable amount that taxpayers subtract from their total taxable income when filing taxes. R&d tax credit is £287,500 @ 14.5%=£41,687.50 (ct600 boxes 530, 875), losses to carry forward £275,000.

This can be done for the current financial year and the 2 previous years. Let kruze consulting handle your startup's r&d tax credit analysis and preparation. Structures to be used for r&d (s.766a), must be made within 12 months from the end of the accounting period in which the relevant expenditure was incurred (for more detail see part 5 of these guidelines.) 2.2 base year requirement7 the r&d tax credit was originally designed to incentivise incremental r&d expenditure.

Using the same qualifying cost, additional deduction, and enhanced expenditure. See details of example r&d tax calculations. With corporation tax at 19%, you’ll be expected to pay £123,500;

A company employing over 500 people or with an annual turnover of €100m per year is classed as a large company and is eligible for an rdec scheme. With total r&d spending in the state (36 billion dollars in 1995), as a fraction of the state subsidy, the r&d tax credit is quite important. R&d tax credit calculation using the traditional method is based on 20% of a company's current year qres over a base amount.

25% saving from r&d tax credits Under the new rules of the r&d credit, a company spending $1 million can save up to $200k on taxes. Enhanced loss including additional deduction £50,000+£162,500=£212,500

Use our simple calculator to see if you qualify for the r&d tax credit and if so, by how much. Remember to check your r&d tax credit calculation to ensure you are using the method most advantageous to your business. Your business spent £120,000 on r&d expenditures;

Loss before the additional deduction £50,000. To satisfy audit protocol, all required documentation should be available to determine that the taxpayer has properly calculated the credit for the year being submitted.

2

Rd Tax Credit Calculation Examples – Mpa

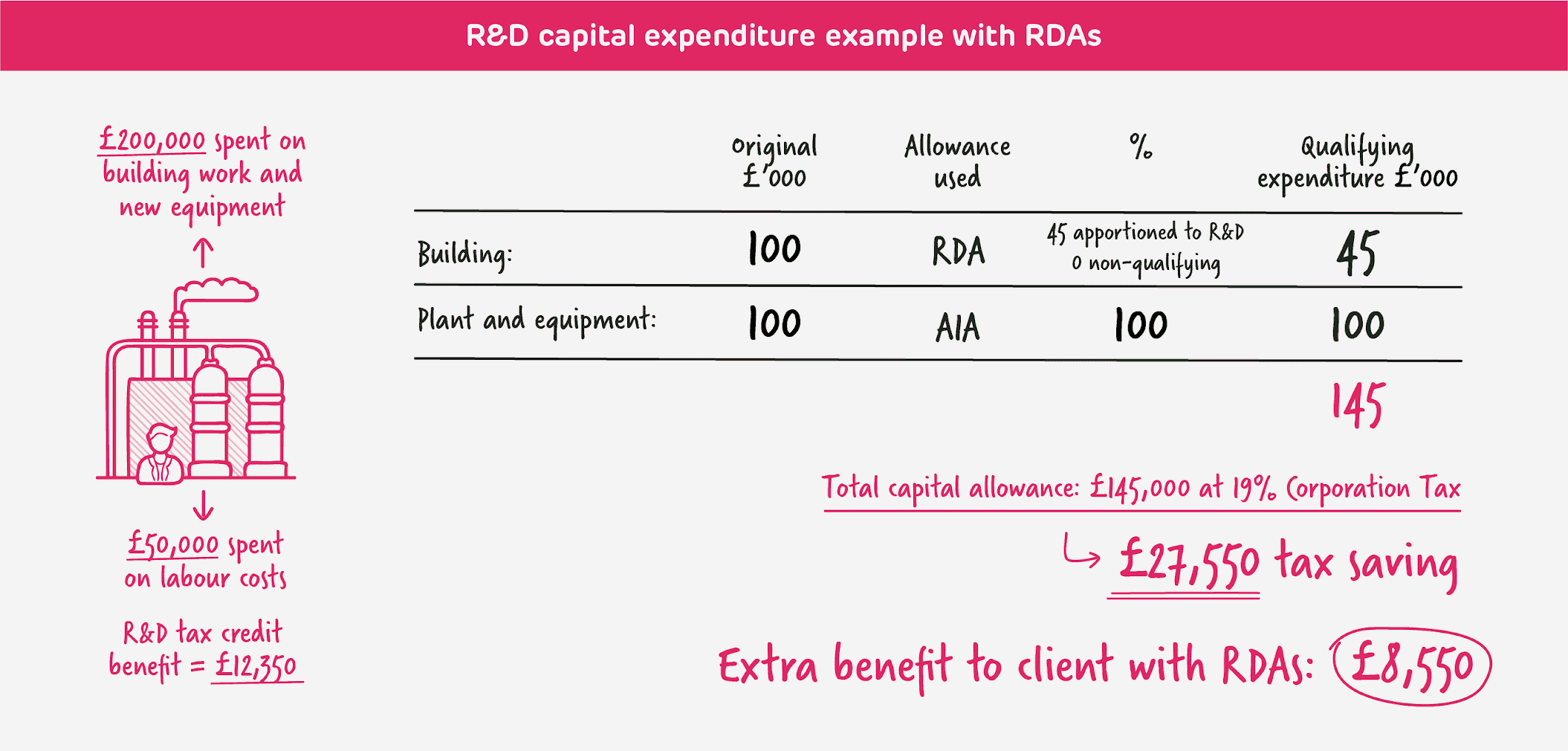

Rd Capital Allowances Rd Capital Expenditure Explained

Rdec 7 Steps Rd Tax Solutions

Rd Tax Credits Calculation Examples G2 Innovation

Alternative Simplified Method For Claiming The Research Credit

Rd Tax Credit Calculation Examples – Mpa

Rdec Scheme Rd Expenditure Credit Explained

2

Rd Tax Credit Calculation Examples – Mpa

How To File A Rd Research And Development Tax Credit Claim Easy Digital Filing

Gilti Detailed Calculation Example

Rd Tax Credit Rates For Rdec Scheme Forrestbrown

Rd Tax Credit Calculation Methods Adp

Taking The Credit Tax Adviser

Rd Tax Credit Calculation Methods Adp

Rd Tax Credit Rates For Rdec Scheme Forrestbrown

Rd Tax Credit Calculation Examples – Mpa

Rd Tax Credit Rates For Sme Scheme Forrestbrown