Mitchell miller jamie carter joseph collins. Effective january 1, 2022, the bbba reduces the gift, estate and gst tax exemptions from $11,700,000 per person (or.

2022 Tax Brackets 2022 Federal Income Tax Brackets Rates

Both the bernie sanders proposed legislation, and the september 13 th house of representatives ways and means committee bills, would have drastically reduced the $11,700,000 per person estate and.

Proposed estate tax changes 2022. The state and local tax (salt) cap remains at $10,000 On april 28, the biden administration released its fy 2022 revenue proposals. Specifically, the federal estate tax exemption would not expire at the end of 2025.

Changes to deduction limitations under the tax cuts and jobs act (tjca) (i.e., taxable income increases): The bill introduced by the house ways & means committee is attempting to change this and roll back the 2017 trump tax cuts. In short, the proposed build back better act (“bbba”) does the following:

The proposed law would reduce the federal gift and estate tax exemption from the current $10 million exemption (indexed for inflation to $11.7 million for 2021) to $5 million (indexed for inflation to roughly $6.2 million) as of january 1, 2022. Estate and gift tax exclusion amount: The proposed bill reduces the federal estate and gift tax exemption from $11.7 million per person to $5 million per person, indexed for inflation, prior to the scheduled sunset on january 1, 2026.

The $11.7m per person gift and estate tax exemption will remain in place, and will be increased annually for inflation until it’s already scheduled to sunset at the end of 2025. Effective january 1, 2022, the federal estate and gift tax exclusion will be cut in half to about $6.0 million after. Along with raising the corporate tax rate to 28% and the top individual rate to 39.6%, widespread changes have been proposed to.

The official estate and gift tax exemption climbs to $12.06 million per individual for 2022 deaths, up from $11.7 million in 2021, according to. Changes to social security taxes, proposed during the campaign; Changes to lifetime estate/gift exemptions;

The tcja doubled the gift and estate tax exemption to $10 million through 2025. Proposed regulations were published on december 31, 2020. The significant changes still need to undergo rigorous negotiations in the house and senate before being sent to the president for his signature.

The house ways and means committee released their first draft of proposed tax changes on september 14, 2021, as part of their efforts to fund the biden administration’s build back better program. Proposed changes to gift and estate tax law. The provision would also affect the taxation of gifts.

For taxable years beginning after january 1, 2021 and before january 1, 2022, the tax rate would be equal to 21 percent plus 7 percent times the portion of the taxable year that occurs in 2022. That amount is annually adjusted for inflation—for 2021, it’s $11.7 million. The effect of the change would be to reduce the basic exclusion amount for estate tax purposes to $6.02 million for 2022.

Learn what rule changes could affect you in 2022. Limitations on the irc section 199a deduction, proposed during the campaign; Final regulations establishing a user fee for estate tax closing letters.

Anticipating law changes in 2022. As we approach the end of 2021. No changes to the current gift and estate exemption provisions until 2025.

Individual top marginal income tax rate increase. Proposed and temporary regulations were published on march 4, 2016. The exemption will increase with inflation to approximately $12,060,000 per person in 2022.

The biden administration has proposed some new tax rule changes that real estate professionals won't want to miss. A lowering of the estate tax exemption and changes to the treatment of capital gains and dividends are likely to survive the spending bill negotiations in congress, according to michael townsend. Proposed estate and tax planning changes in 2021 and 2022 on september 12, 2021, the house ways and means committee introduced proposed tax changes to be incorporated in the budget reconciliation bill known as the build america back better act.”

Final regulations under §§1014 (f) and 6035 regarding basis consistency between estate and person acquiring property from decedent. Instead, the exemption would expire at the end of 2021 and, beginning in 2022, the federal estate tax will be reduced to $5. A proposed increase in the top ordinary income tax rate from 37% to 39.6% would be effective starting with the 2022 tax year.

Taxtipsca – Nunavut 2021 2022 Personal Income Tax Rates

Bidens Proposed 396 Top Tax Rate Would Apply At These Income Levels

Pin On Samples Account Statement Templates

Iowans Heres Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About – Arnold Mote Wealth Management

Irs Provides Tax Inflation Adjustments For Tax Year 2022 – Tax – United States

Build Back Better 20 Still Raises Taxes For High Income Households And Reduces Them For Others

Irs Provides Tax Inflation Adjustments For Tax Year 2022 – Tax – United States

Latest Income Tax Slab Rates For Fy 2021-22 Ay 2022-23 Budget 2021 Key Highlights – Basunivesh

Simmons Simmons Hmrc Tax Rates And Allowances For 202122

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Simmons Simmons Hmrc Tax Rates And Allowances For 202122

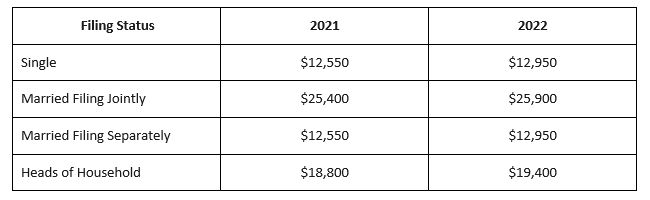

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

0fkwfi5qxqml7m

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

House Democrats Tax On Corporate Income Third-highest In Oecd

Goodbye 2017 Hello 2018 Happy New Year Festive Retro Card 1501736 Happy New Year New Year Card Happy New

Evolution Of Tax System Tax Concessions On Home Loans In India Home Loans Loan System

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More