Unfortunately, the state of ri taxes **everything** associated with an auto lease, which means that when i get my bmwfs bill each year with the property tax on it,. If you didn’t already know, the following states apply a “personal property tax” on all leased vehicles:

2

Motor vehicles are subject to a local property tax under connecticut state law.

Property tax on leased car connecticut. Any leases or rentals of certain passenger cars which utilize the hybrid technology are considered to be exempt. Excise taxes in maine, massachusetts, and rhode island; Alaska (juneau only) arkansas connecticut

The local property tax is computed and issued by your local tax collector. If your filing status for connecticut income tax purposes is single, filing separately for connecticut only, or head of household, you may include qualifying property tax payments on only one motor vehicle you own or lease even if you sell a motor vehicle and purchase (or lease) a replacement motor vehicle during the taxable year and only own (or lease) one motor vehicle at any time during the taxable year. Tax assessors bill the car dealer for vehicle taxes, but whether or not they pass that on to you will be delineated in your lease contract.

They will pay the bill when it is received, and then they will charge you the actual amount of the tax. Some states, including maine, massachusetts, and rhode island, impose these taxes on motor vehicles in lieu of a property tax for the You may take credit against your 2017 connecticut income tax liability for qualifying property tax payments you made on your primary residence, privately owned or leased motor vehicle, or both, to a connecticut political subdivision.

Excise taxes are generally levied on specific products, in addition to sales and use taxes. Some states (like mine) have a personal property tax on vehicles: If you do not register a motor vehicle but retain ownership, you must annually file a declaration form with your assessor(s) between october 1.

Tax may become due many times during the term of a lease. This applies whether or not the vehicle is registered. The property tax is assessed to the leasing company based on the lessee’s residence as of january 1 of each year.

Connecticut, taxable property, including motor vehicles, are assessed for taxes at 70% of fair market value and taxed at a locally determined rate. All tax rules apply to leased vehicles. Check with your state’s tax or revenue department.

By law, municipalities must provide a property tax exemption for one motor vehicle owned by, leased to, or held in trust for each eligible service member. And motor vehicle registration fees in new hampshire. All leased vehicles for lessees residing in the city of carrollton are taxable.

In most cases, the agreement made between the dealer or leasing agency and the person leasing the vehicle will pass the cost of property taxes on to the lessee, most frequently as part of the monthly payments. The property tax liability for a motor vehicle that is leased rather than sold outright to someone remains with the business that holds title to the vehicle, i.e., the leasing agency or dealer. In order to do so, the leasing company must have the correct garaging address of the vehicle.

If you do pay the personal property tax you can deduct it on your taxes if you itemize. If you terminate your lease it is very important that you provide the tax assessor's with a return of plate receipt or a letter from your insurance company showing the vehicle cancelled. Ct property tax on cars that are leased.

Do you pay property tax on leased vehicles in ct. The leasing company will be billed for personal property tax directly. The vehicle can be leased financed or purchased outright.

When you lease a vehicle the car dealer maintains ownership. Armed forces from local property tax if it is garaged outside the state. However, the state has an effective vehicle tax rate of 2.6%, according to a property tax report published earlier this year by wallethub, which calculated taxes on a $25,000 vehicle.

Arkansas, connecticut, kentucky, massachusetts, missouri, north carolina, rhode island, texas (haha i always found it funny how when you flip the a and the e in texas, you get taxes, lol), virginia, west virginia and. In order to claim the exemption, the law requires the soldier to file a written application by the december 31 following the date the property tax on the vehicle is due. It decreases annually as the vehicle depreciates in value.

Ask your honda dealer for information about the tax regulations in your state or contact the tax assessor office. Motor vehicles are subject to a local property tax under connecticut state law, whether registered or not, as well as by taxing districts within a municipality. When you lease a vehicle, the car dealer maintains ownership.

Since the leasing company owns the vehicle you are leasing, they are responsible for these taxes, however, the cost is usually passed on to the lessee. Leased and privately owned cars are subject to property taxes in connecticut; Connecticut exempts one motor vehicle belonging to, leased by, or held in trust for a member of the u.s.

In the state of connecticut, any rentals for a maximum of 31 days will be subject to some additional surcharges. The law is silent as to whether the service member must be a If you do pay the personal property tax, you can deduct it on your taxes if you itemize.

However, the bill is mailed directly to the leasing company since leased cars are registered in the company's name. If you are a lessee and your vehicle is garaged in one of the following states, you may be responsible for paying state or local property taxes. Cars, trucks, rvs, boats, etc.

They are not subject to local taxes in new jersey, new york, and vermont. Who is responsible for ct property tax on cars when you are leasing?

Lease Three Classic Porsches For Just 20000 Per Month

Car Tax By State Usa Manual Car Sales Tax Calculator

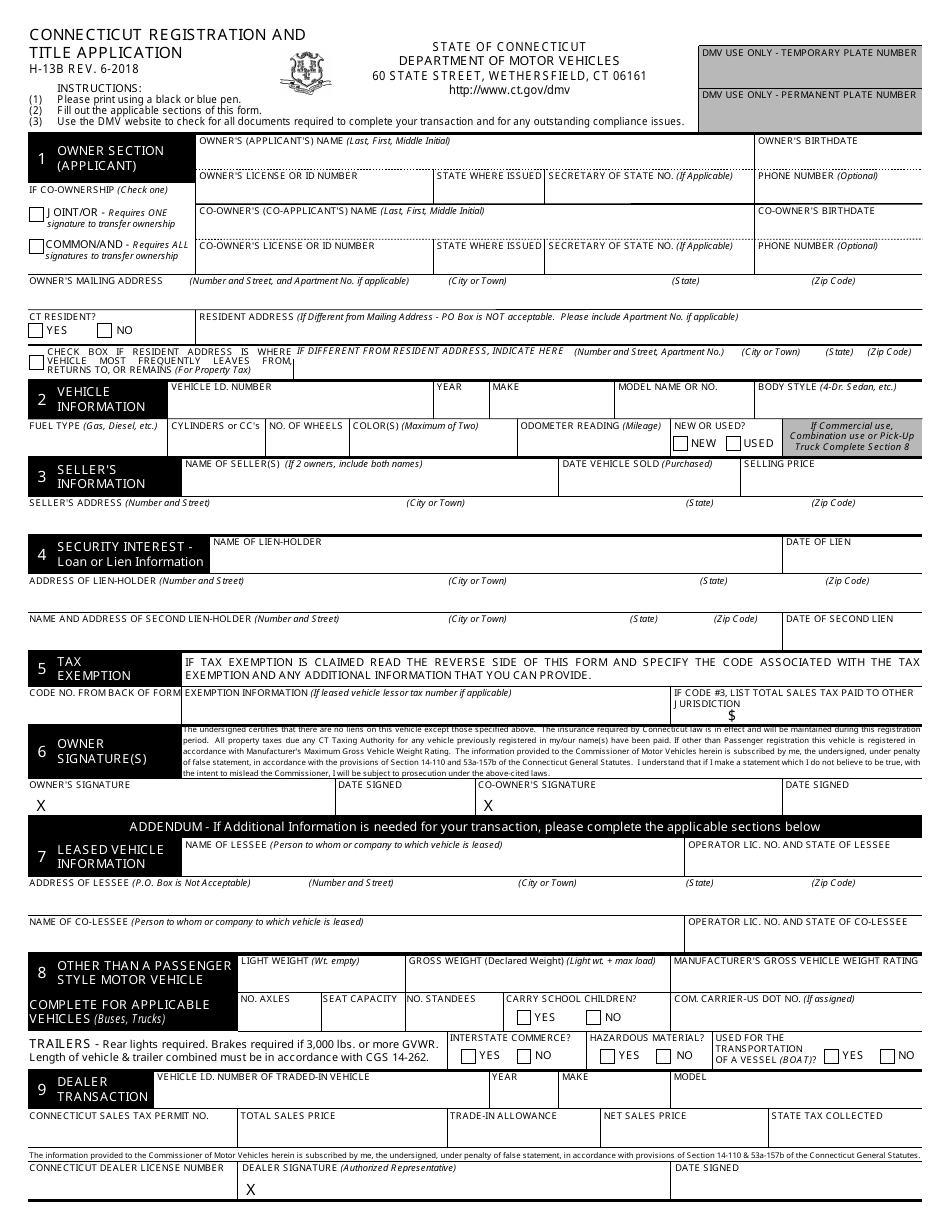

Form H-13b Download Fillable Pdf Or Fill Online Connecticut Registration And Title Application Connecticut Templateroller

Tesla Lease Guide Prices Estimated Payments Faqs And More – Electrek

Connecticuts Sales Tax On Cars

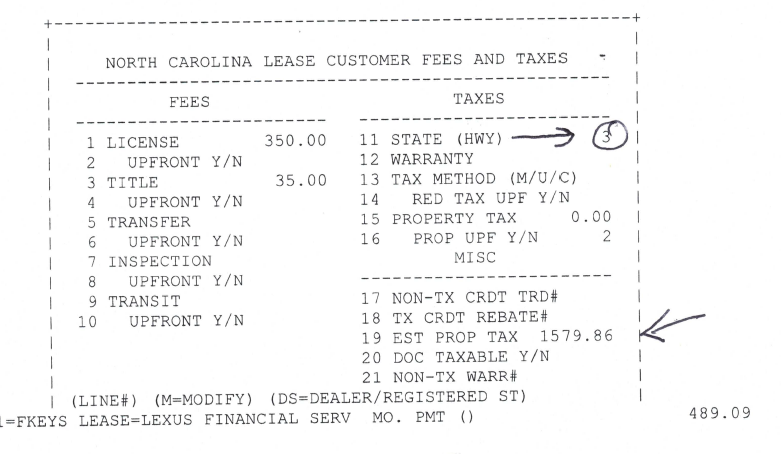

Property Tax When Leasing In Nc – Ask The Hackrs – Forum Leasehackr

2

Connecticuts Sales Tax On Cars

2

Which Us States Charge Property Taxes For Cars – Mansion Global

Connecticut Leasees – Property Taxes – Off-ramp – Forum Leasehackr

Kevin Hunt Why Am I Paying Sales Tax On Leased-cars Dmv Renewal Fees – Hartford Courant

Chapter 203 – Property Tax Assessment

City Of Stamford – Tax Bills Search Pay

Do You Have To Pay A Vehicle Tax Heres Some Good News The Motley Fool

What You Should Know About Leasing A Car In Ct Ct Sales Tax On Cars

Local Taxes On Leased Cars

2

Pay Personal Property Tax