110 west hickory street, denton, tx. They are maintained by various government offices in collin county, texas state, and at the federal level.

Frisco Isd Approves The Lowest Tax Rate In More Than 20 Years

Property tax in texas is a locally assessed and locally administered tax.

Property tax calculator frisco tx. Frisco, texas and little elm, texas change places. The property tax is used to finance the state’s 254 counties, over 1,200 cities, 1,022 independent school districts, and more than 1,800 special districts. Frisco keeps property tax rate 'same' for fifth consecutive year (september 22, 2021) for the fifth consecutive year, the city of frisco’s property tax rate will stay the same at.4466.

Receive a free detailed analysis of your house value. Last night, the frisco city council unanimously approved an operating balanced budget, which includes a $198 million general fund for the 2022 fiscal year. One of the fantastic things about living in texas is the absence of a state income tax.

The frisco, texas sales tax is 8.25%, consisting of 6.25% texas state sales tax and 2.00% frisco local sales taxes.the local sales tax consists of a 2.00% city sales tax. Box 90223, denton, tx 76202. The typical texas homeowner pays $3,390 annually in property taxes.

Frisco, texas property taxes are typically calculated as a percentage of the value of the taxable property. A satellite office is located in frisco government center at. 6101 frisco square blvd., suite 2000 frisco, tx 75034.

Henderson, nevada vs frisco, texas. The property tax in texas applies to all real property and some tangible personal property in the state. Enter your over 65 freeze amount:

Texas has one of the highest average property tax rates in the country, with only thirteen states levying higher property taxes. Denton county of, county judge. The property tax estimator will show you the estimated taxes assessed in a given area of travis county.

Our texas property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in texas and across the entire united states. The median property tax in texas is $2,275.00 per year for a home worth the median value of $125,800.00. 256 rows texas' taxes on a pack of 20 cigarettes totals $1.41, which ranks in the middle.

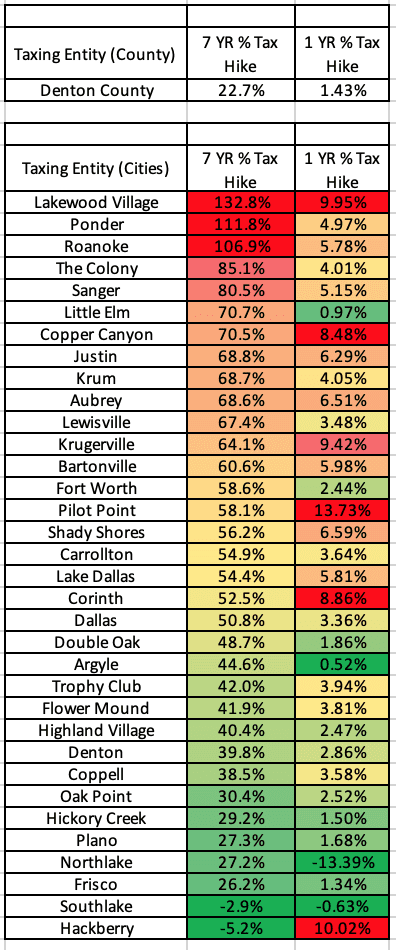

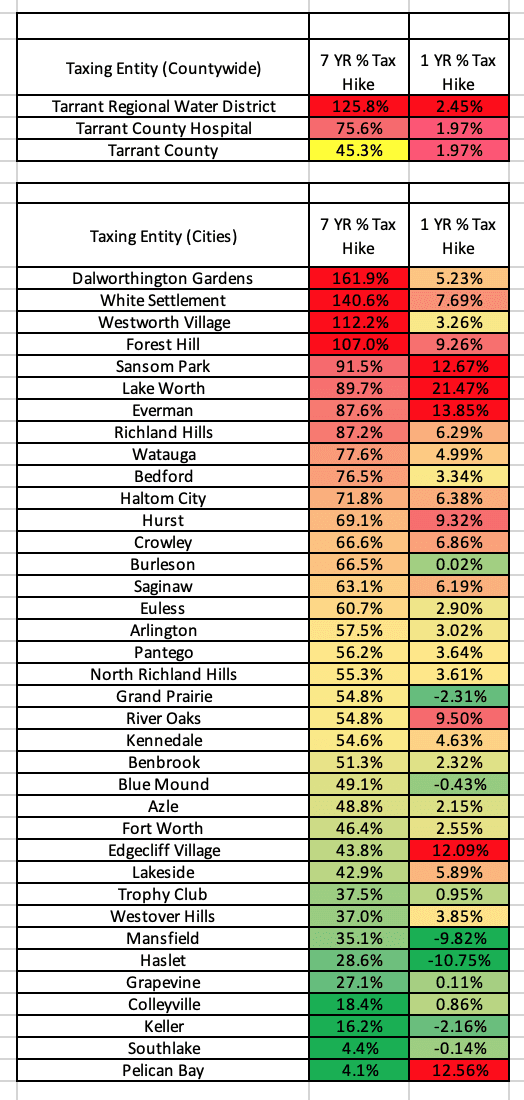

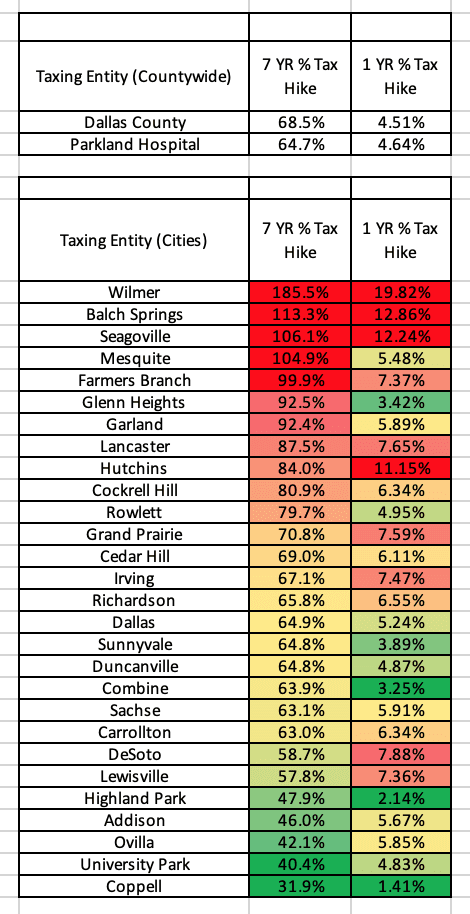

Property tax rate comparisons around north texas. This is quite appealing to those relocating from many other states around the nation. (gasoline, liquor, beer, cigarettes), corporate taxes, plus auto sales, property and registration taxes, and an online tool to customize your own personal estimated tax burden.

The frisco sales tax is collected by the merchant on all qualifying sales made within frisco; A salary of $80,000 in henderson, nevada should increase to $82,698 in frisco, texas (assumptions include homeowner, no child care, and taxes are not considered. Enter your over 65 freeze year:

2021 cost of living calculator: How property tax is calculated in frisco, texas. Locations | sitemap | webmail | privacy & accessibility | en español | website feedback copyright © 2013 collin county texas · all rights reserved.

They are a valuable tool for the real estate industry, offering both buyers. That being said, texas does fund many of. Ad use our accurate value calculator to get 5 free house value estimates now!

A tax lien attaches to property on january 1 to secure payment of taxes for the year. This amount changes each tax year, but is determined in accordance with state law. Public property records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents.

To collect the property tax, the authorities of frisco, texas have to. Compare that to the national average, which currently stands at 1.07%. There is no state property tax.property tax brings in the most money of all taxes available to local government to pay for schools, roads, police and firemen, emergency response services, libraries, parks and other services provided by local government.

The denton county tax assessor/collector bills and collects all ad valorem tax accounts for the city as identified and valued by the denton central appraisal district. Rates vary widely across the country, typically ranging from less than 1% at the low end, to about 5% at the high end. Property taxes are determined by what a property is used for on january 1, market conditions at the time and ownership of property on that date.

To use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase price). 2021 cost of living calculator for taxes: Enter the value of your property:

Counties in texas collect an average of 1.81% of a property's assesed fair market value as property tax per year. 254 rows texas property taxes. Denton county of, county judge.

Groceries are exempt from the frisco and texas state sales taxes Rate information for all jurisdictions in accordance with texas property tax code section 26.16 is available at traviscountytx.gov.

Budget And Tax Facts City Of Lewisville Tx

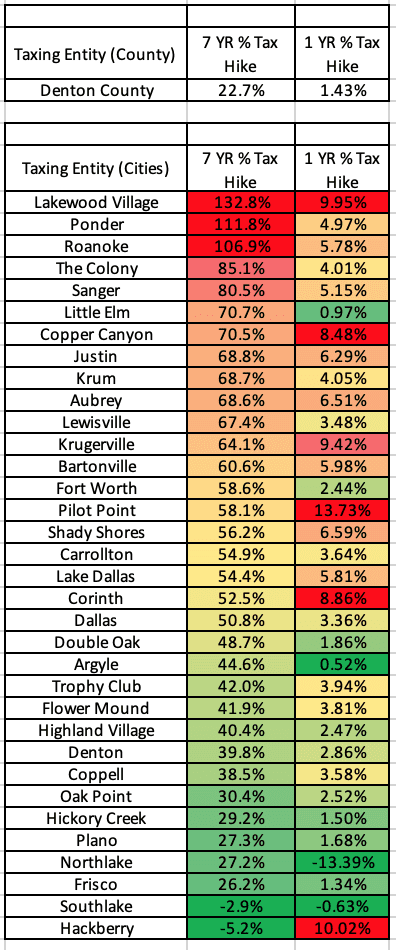

Homeowners Wallets Still Hit By City And County Property Tax Growth – Texas Scorecard

Frisco Isd Finance – School Finance Faq

City Of Humble Is Raising Its Tax Rate Preparing For Long-term Changes Community Impact

Homeowners Wallets Still Hit By City And County Property Tax Growth – Texas Scorecard

Pisd Adopts Same Tax Rate For Fifth Year In A Row Plano Star Courier Starlocalmediacom

Homeowners Wallets Still Hit By City And County Property Tax Growth – Texas Scorecard

Tarrant County Tx Property Tax Calculator – Smartasset

Fort Bend County Ranks Very Low Among Places Receiving The Most Value For Their Property Taxes

Aggressive Road Building Program Requires Slight Tax Increase – City Of Round Rock

Impact On Tax Rate Golden Penny Highland Park Independent School District

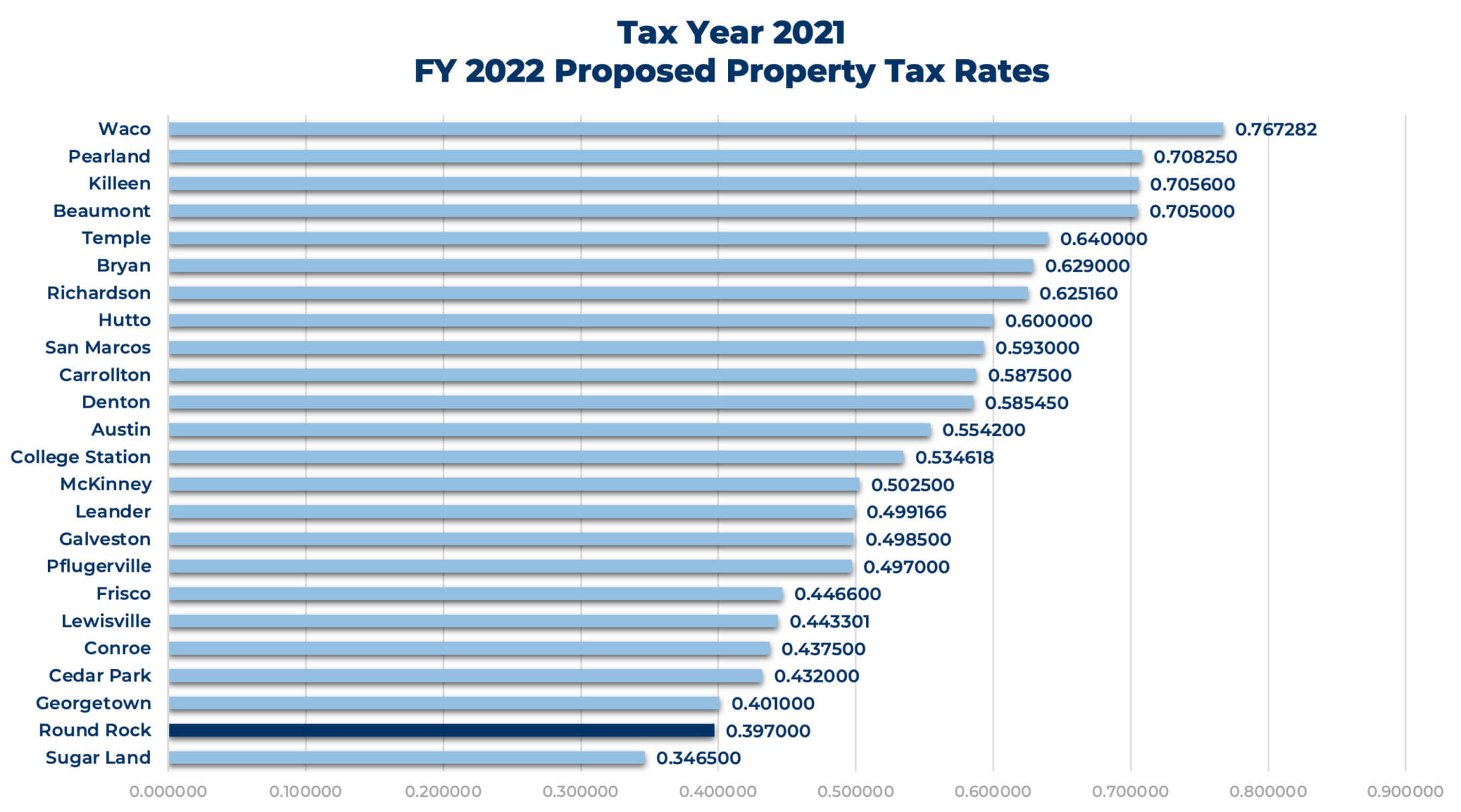

Which Texas Mega-city Has Adopted The Highest Property Tax Rate

Frisco Isd Finance – Frisco Isd Tax Rate

Tarrant County Tx Property Tax Calculator – Smartasset

Frisco Property Taxes

Homeowners Wallets Still Hit By City And County Property Tax Growth – Texas Scorecard

Taxes Celina Tx – Life Connected

Frisco Property Taxes

Tax Climate Frisco Economic Development Corporation

/cloudfront-us-east-1.images.arcpublishing.com/dmn/MNGSOUGZFZALJIAN3THOPO4DGQ.JPG)