Program name activities who's eligible program requirements who to contact; Any negotiated program will be effective after the local government officials have thoroughly reviewed the owner’s ability to pay and the request from the homeowners.

89uwxi8ijajokm

Apply for the housing choice voucher program.

Property tax assistance program georgia. The maximum amount is limited to $1,000 for prepaids (taxes and insurance), plus 5% of the sales price. If you're 62 years old or older and living within a school district, and your annual family income is $10,000 or less, then up to $10,000 of your. If the home is valued at less than $70,000, please see financial assistance with selling the home for full market value.

Dca strives to provide online resources in a safe, secure manner that respects your privacy when you visit our site. Homebuyer assistance down payment assistance program: Some programs allow the creation of property tax installment plans for property owner(s) who are delinquent in paying taxes as a result of saying being unemployed for the last several months.

Information about actions being taken by the u.s. The stated purpose of the act was to “provide for income tax credits with respect to qualified donations of real property for conservation purposes.” the official code of georgia was amended in 2012 adding further stipulations taking effect in 2013. Property owners can choose to pay 0% (full deferral), 25%, 50%, or 75% of the delinquent and future property taxes.

Centers for disease control and prevention (cdc) for health information. No one enjoys paying one penny more than required when it comes to paying taxes. Georgia provides programs to help residents in need find safe and affordable housing.

Property owner must be 65 or older. The amount may need to be paid if/when the home is ever sold in the future. Property tax returns and payment.

The property must be in insurable condition. This statewide assistance program may allow up to one half of the annual property taxes to remain unpaid. Correspondence with attorneys, banks, and.

Donations recorded in 2012 or earlier will be reviewed using the rules in effect in 2012. State of maine property tax fairness credit program ; If you’re struggling to pay your property taxes, this could help you make sure you’re able to actually get the help you need.

The property taxes that have defaulted or escaped during the prior fiscal tax year. We require clients to carry insurance on the property. Apply for the georgia dream homeownership program.

If you need more information, email our team at housing@dca.ga.gov. Tasks related to the finance/tax collection department include: They alleviate the tax burden on homeowners for a variety of reasons.

Our georgia dream program was created with you in mind. Individuals or families who are low income. Property taxes in georgia county property tax facts.

Senior citizen exemptions from georgia property tax if you are 65 years old or older, and your net income the previous year wa s $10,000 or less, you qualify for a $4,000 property tax exemption. Georgia property tax relief, inc. The property must be insurable and in good condition.

Clients need proof of income. State of georgia rental assistance program. You could be eligible for property tax relief in georgia!

View tax bills and due dates; You might be able to get up to $2,000 in tax exemptions as a homesteader. P roperty tax assistance program for seniors.

The bottom line on property tax relief for retirees. Keep reading for answers to some of our frequently asked questions. Check with your local government on the details, but good examples include homestead exemptions for primary residences, agricultural property tax exemptions, and disabled veteran exemptions.

Owners of historic buildings, structures, and objects listed in or eligible for the national register of historic places in georgia counties designated for general public. We lower the property tax burden for parcels all across georgia and the atlanta. The georgia department of revenue has provided relief as specified in the below faq’s and press releases:

Entrepreneur & small business loan guarantee program provides new financial programs for entrepreneurs and small businesses in rural georgia. Senior property tax assistance program application; Funds cannot be used for closing costs.

View information regarding real estate taxes and personal property taxes; Training programs unclaimed property about dor hearings, appeals & conferences information and records requests office of legal affairs. Also, you may qualify for clean energy property tax credits up to 35% or $100,000 of the project cost.

Click here (pdf) for key networks and funding sources. The state of georgia received $989 million from u.s. Property tax exemptions are exactly what they sound like.

Property tax postponement a state program offered to senior, blind, or disabled citizens to defer their current year property taxes on their principal residence if they meet certain criteria. Your local government has options for enforcing payment when you fall behind with your property taxes, such as the seizure and sale of your property through a. Help is only available for income qualified residents, and they need to contact their local assessor, department of revenue, or county treasurer.

Disabled Veterans Property Tax Exemptions By State

First-time Home Buyer Faq Georgia Department Of Community Affairs

Exemptions To Property Taxes Pickens County Georgia Government

Dekalbs Tenant-landlord Assistance Coalition To Hold Webinar For Landlords Dekalb County Ga

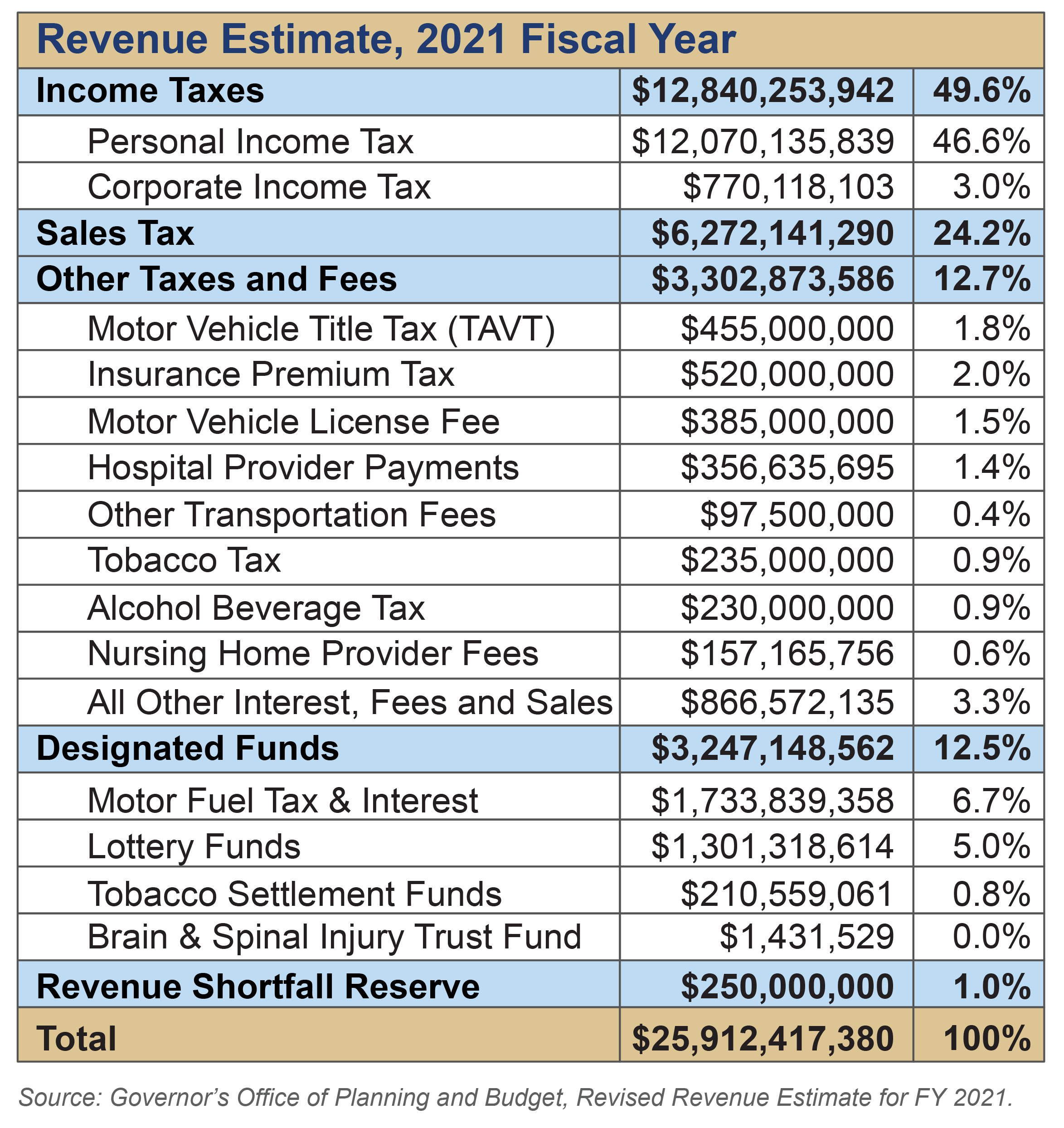

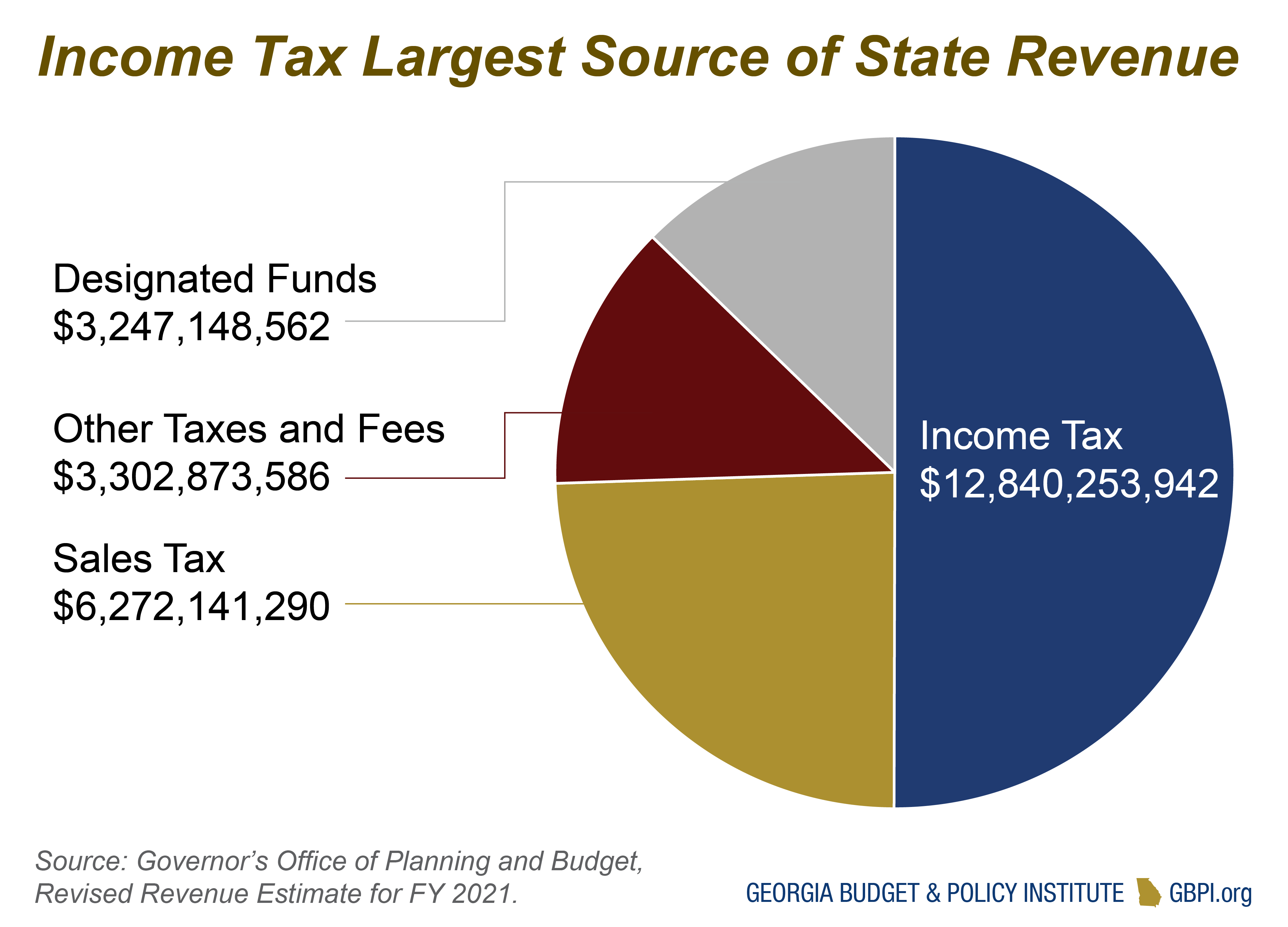

Georgia Revenue Primer For State Fiscal Year 2021 – Georgia Budget And Policy Institute

Covid-19 Information Resources – City Of East Point Georgia

2021 Property Tax Bills Sent Out Cobb County Georgia

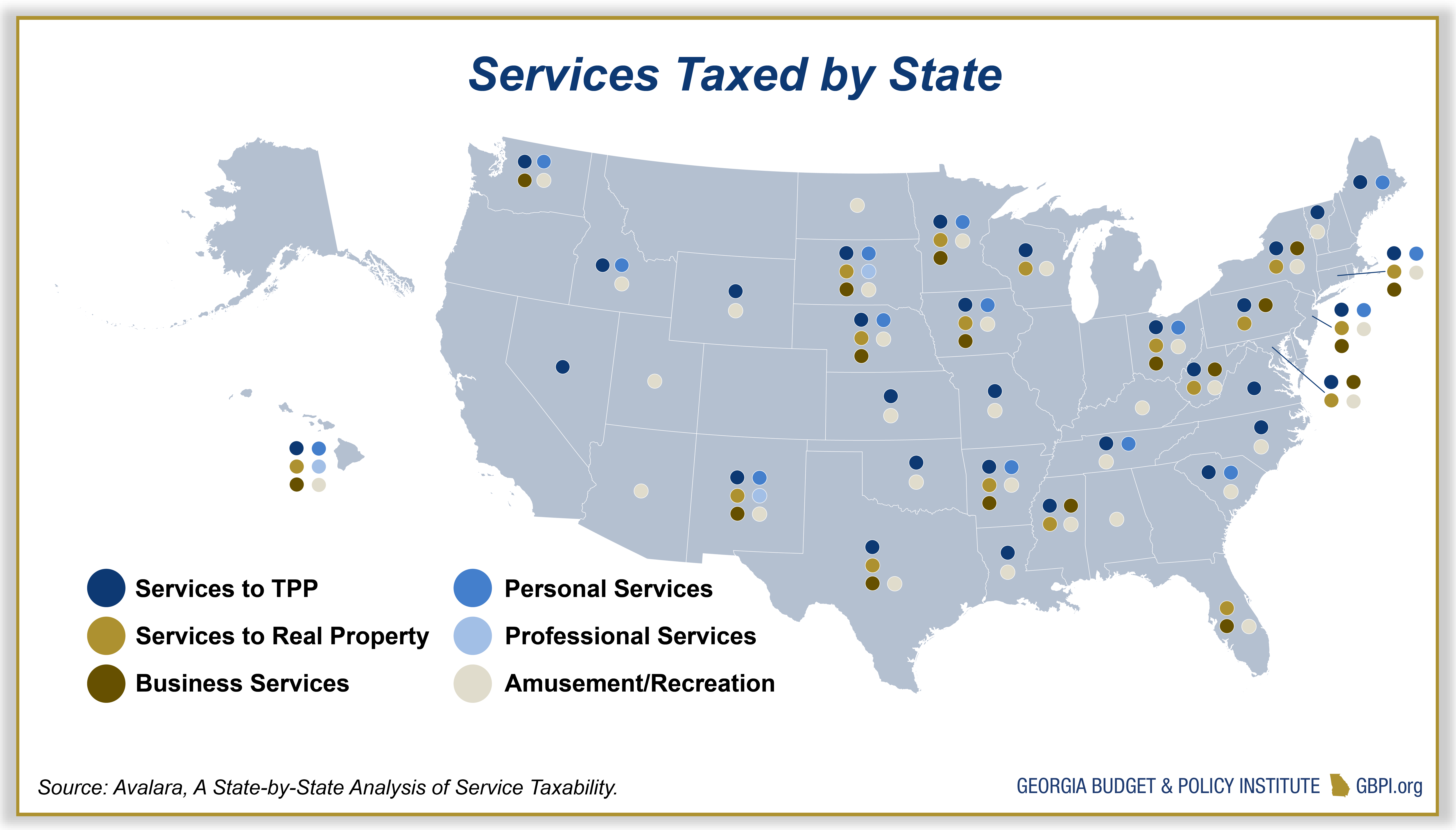

Reimagining Revenue How Georgias Tax Code Contributes To Racial And Economic Inequality – Georgia Budget And Policy Institute

Dekalb Announces 21 Million Federal Grant To Prevent Tenant Evictions Dekalb County Ga

States With Highest And Lowest Sales Tax Rates

Georgia Revenue Primer For State Fiscal Year 2021 – Georgia Budget And Policy Institute

Pay Taxes Online Peach County Ga Peach County Georgia Peach County – Peach County

Utility Rental Assistance For East Point Residents Facing Eviction – City Of East Point Georgia

Reimagining Revenue How Georgias Tax Code Contributes To Racial And Economic Inequality – Georgia Budget And Policy Institute

Reimagining Revenue How Georgias Tax Code Contributes To Racial And Economic Inequality – Georgia Budget And Policy Institute

Reimagining Revenue How Georgias Tax Code Contributes To Racial And Economic Inequality – Georgia Budget And Policy Institute

2021 Property Tax Bills Sent Out Cobb County Georgia

State Rental Assistance Program Expands Eligibility Georgia Department Of Community Affairs

Property Taxes Milton Ga