Report high mileage for a vehicle. $3,402.00 9 hours ago the median property tax (also known as real estate tax) in prince william county is $3,402.00 per year, based on a median home value of $377,700.00 and a median effective property tax rate of 0.90% of property value.

.jpg)

World Trade Center Steel

Houses (1 days ago) real estate assessments.

Prince william county real estate tax lookup. For example, if the total tax rate were $1.2075 per $100 of assessed value, then a property with an assessed value of $300,000 dollars is calculated as: The county also levies a supplemental. Included on the real estate tax bills is the special district tax for the gypsy moth abatement program.

Free prince william county property records search. Simply fill in the exact address of the property in the search form below: The real estate tax is paid in two annual installments as shown on the tax calendar.

(8 days ago) the median property tax (also known as real estate tax) in prince william county is $3,402.00 per year, based on a median home value of $377,700.00 and a median effective property tax rate of 0.90% of property value. Prince william county accepts advance payments from individuals and businesses. If you have questions about this site, please email the real estate assessments office.

Making advance payments for a future tax bill. Find prince william county residential property records including property owners, sales & transfer history, deeds & titles, property taxes, valuations, land, zoning records & more. You can pay a bill without logging in using this screen.

You will need to create an account or login. Included on the real estate tax bills is the special district tax for the gypsy moth abatement program. Real estate tax prince william county, virginia.

Find prince william county residential property tax records including land & real property tax assessments & appraisals, tax payments, exemptions, improvements, valuations, deeds, mortgages, titles & more. Enter street name without street direction (n,s,e,w) or suffix (st,dr,av,etc.). * use both house number and house number high fields when searching for range of house numbers.

Searching by name is not available. Advance payments are held as a credit on your real estate, personal property or business tax account and applied to a future tax bill (when the tax rate and assessment are set or when you file your business tax return). Netr online • prince william • prince william public records, search prince william records, prince william property tax, virginia property search, virginia assessor from the marvel universe to dc multiverse and beyond, we cover the greatest heroes in print, tv and film

Than 6 characters, add leading zeros to it before searching. The assessments office mailed the 2021 assessment notices beginning march 9, 2021. Account numbers/rpc’s must have 6 characters.

If your account number/rpc has less. Free prince william county treasurer & tax collector office property records search find prince william county residential property records including owner names, property tax assessments & payments, rates & bills, sales & transfer history, deeds, mortgages, parcel, land, zoning & structural descriptions, valuations & more. All real property in prince william county, except public service properties (operating railroads, interstate pipelines, and public utilities), is assessed annually by the real estate assessments office.

Report change in use for a vehicle. Houses (2 days ago) the real estate tax is paid in two annual installments as shown on the tax calendar. The real estate tax is paid in two annual.

Free prince william county property tax records search. (9 days ago) the median property tax (also known as real estate tax) in prince william county is $3,402.00 per year, based on a median home value of $377,700.00 and a median effective property tax rate of 0.90% of property value. You may view the 2021 assessments via the online real estate.

($300,000 / $100) x $1.2075 = $3,622.50. Your search for prince william county, va property taxes is now as easy as typing an address into a search bar! Houses (2 days ago) prince william county real estate assessment search.

Report a change of address. (9 days ago) the median property tax in prince william county, virginia is $3,402 per year for a home worth the median value of $377,700. Houses (6 days ago) prince william county real estate assessments lookup.

2 hours ago the tax rate is expressed in dollars per one hundred dollars of assessed value. Prince william county, virginia > home. Report changes for individual accounts.

Prince william county, virginia property tax rates. These records can include prince william county property tax assessments and assessment challenges, appraisals, and income taxes. Enter the house or property number.

Prince william county real estate assessments. Prince william county collects, on average, 0.9% of a property's assessed fair market value as property tax. Houses (5 days ago) houses (7 days ago) the median property tax (also known as real estate tax) in prince william county is $3,402.00 per year, based on a median home value of $377,700.00 and a median effective property tax rate of 0.90% of property.

By creating an account, you will have access to balance and account information, notifications, etc. If you are searching by gpin, please enter it in the following format: (6 days ago) prince william county tax records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in prince william county, virginia.

Click here to register for an account (or here to login if you already have an account).

House Location Survey Plat

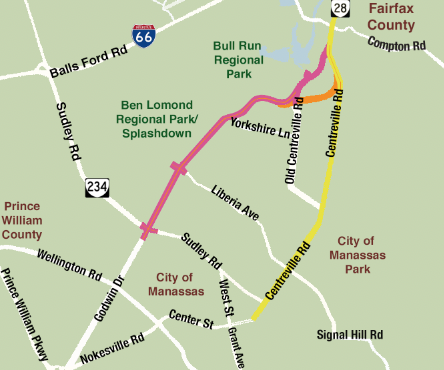

Prince William Area Leaders Call For Reconsideration Of Route 28 Bypass Headlines Insidenovacom

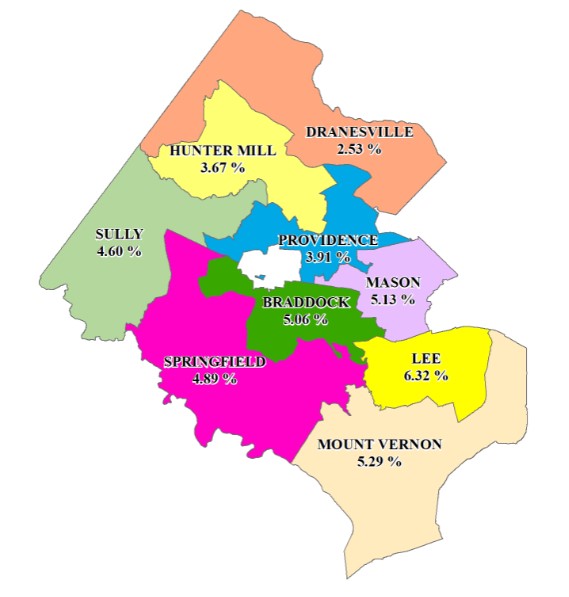

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Report Rents Rapidly Increasing In Eastern Prince William News Princewilliamtimescom

New 800-acre Data Center Campus Proposed In Prince William County Virginia – Dcd

Historic-preservation-coordinator Job Details Tab Career Pages

About Us

Pwc Park Rangers Establish A New Unit Of Public Safety Cyclists

Prince William County Partners With George Mason University And The Claude Moore Foundation For Medical School Feasibility Planning Study Business Wire

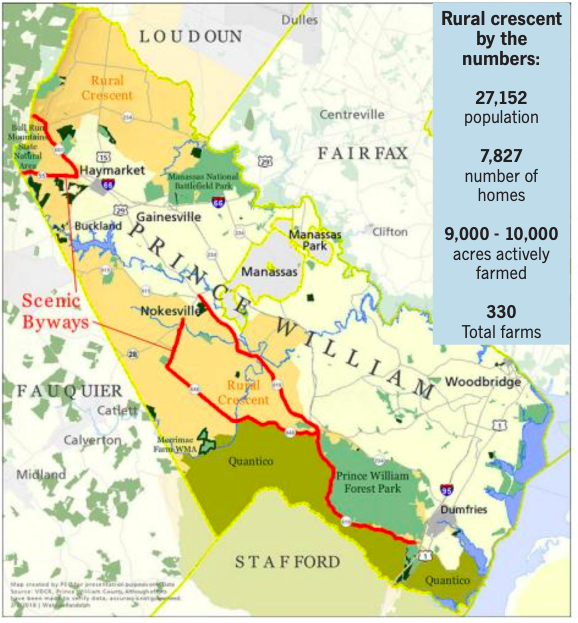

Democratic Supervisors Open To More Homes Industrial Uses In The Rural Crescent News Princewilliamtimescom

A Message From The Chief

Prince William Supervisors To Take Up Tax Rate Tuesday Wtop News

Real Estate Assessments Comparisons For Residential Properties Tax Administration

Where Residents Pay More In Taxes In Northern Va Wtop News

Chair At-large Ann B Wheeler

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenovacom

Office Of Communication

Report Rents Rapidly Increasing In Eastern Prince William News Princewilliamtimescom