The new law took effect july 1. However, oregon does have a vehicle use tax that applies to new vehicles purchased outside of the state.

Marijuana Oregon Office Of Economic Analysis

The minimum combined 2021 sales tax rate for portland, oregon is.

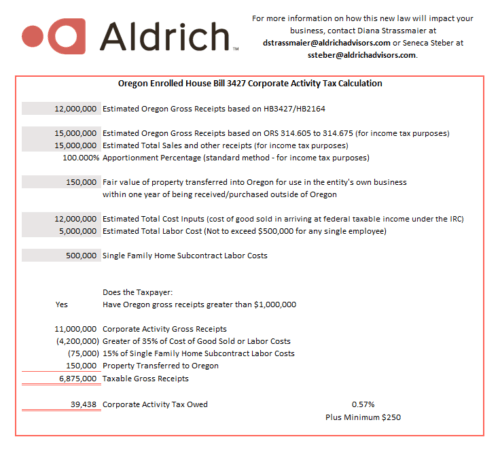

Portland oregon sales tax 2019. View city sales tax rates. In may 2019, oregon imposed a new 0.57% tax on oregon gross receipts above $1 million that is set to go into effect for 2020. For most businesses required to pay the tax on their 2019 sales, the first year’s payment is due april 15, 2020, wallace said.

Portland city rate(s) 0% is the smallest possible tax rate (97201, portland, oregon) the average combined rate of every zip code in portland, oregon is 0%. There are two additional tax districts that apply to some areas geographically within portland. Tax rates last updated in august 2021.

Oregon doesn't have a general sales or use/transaction tax. Ces imposes a 1% surcharge on the retail sales within portland of certain large retailers. 2020 portland/multnomah county combined business tax returns beginning with tax year 2020, taxfilers will request an exemption from the business taxes on the combined tax return.

The first thing to know about the state of oregon’s tax system is that it includes no sales tax. Oregonians can no longer request an exemption to washington’s sales tax at the point of sale. It’s a bargain considering that portland, oregon still has a low property tax rate compared to many other cities and states across the country.

This means that neither state nor local authorities collect taxes on the sale of products or services. Enjoy the pride of homeownership for less than it costs to rent before it's too late. Beginning with tax year 2021, the new taxes are imposed on businesses and individuals in.

The tax is expected to raise $1.4 billion per year. The portland sales tax rate is %. The annual exemption form is no longer valid.

On february 21, 2019, the portland city council passed ordinance 189389 and ordinance 189390 implementing the ces in the portland city code, pcc 7.02 ,. File a combined tax return go to the tax forms in the business taxes forms library learn about exemptions certain business activities are exempt from paying business taxes in portland and/or multnomah county. Now, oregonians need to save their receipts.

The oregon state sales tax rate is 0%, and the average or sales tax after local surtaxes is 0%. The portland's tax rate may change depending of the type of purchase. Oregon is one of five states with no statewide sales tax, but oregon law still allows municipalities or cities to enact their own local sales taxes at their discretion.

There is no city sale tax for portland. About sales tax in oregon. How the new law works.

The tax must be paid before the vehicle can be titled and registered in oregon. Oregon shoppers will no longer receive exemptions from washington's sales. The oregon sales tax rate is currently %.

Instead, the state generates revenue with a statewide income tax of 4.75% to 9.9%, ranking among the highest in the nation. Inventory at the made in oregon warehouse in portland, oregon, july 24, 2019. Combined with the state sales tax, the highest sales tax rate in oregon is n/a in the cities of portland, portland, salem, beaverton and eugene (and 102 other cities).

Please refer to the oregon website for more sales taxes information. View county sales tax rates. There is no special rate for portland.

Oregon state cannabis tax revenue kept growing in the 2019 fiscal year, which ended on june 30, topping $102 million, a 24.2 percent increase over. Portland tourism improvement district sp. The company is now collecting sales tax for online sales in at least 11 other states.

Revenue generated by the new taxes will help fund homeless services. This is the total of state, county and city sales tax rates. The county sales tax rate is %.

If you qualify for one or more of the exemptions, you must file a request for exemption each year and provide supporting tax pages

2

What To Know Before Moving To Portland Oregon

Why Cant I Pump My Own Gas In Oregon Star Oilco

2

Xafjmike1hrsom

Souvenir Series What Souvenirs To Bring Back From Portland Oregon – Darling Down South

2

20 Honest Pros And Cons Of Living In Portland Oregon Tips

20 Honest Pros And Cons Of Living In Portland Oregon Tips

Corporate Activities Tax In Oregon Aldrich Cpas Advisors

2

2

Marijuana Oregon Office Of Economic Analysis

Lily Seika Jones – Morrigan Fairytale Art Animal Art Fantasy Artwork

Portland Cannabis Program Social Equity Educational Development Initiatives Cannabis Program The City Of Portland Oregon

20 Honest Pros And Cons Of Living In Portland Oregon Tips

Buying An Iphone In Oregon Non Resident Macrumors Forums

2021 Pdx Pop Up Shops Calling All Makers Downtown Portland Clean Safe

2