Registration begins at 9 a.m. Lease alert > california placer county 2954 richardson drive auburn, ca 95604 number:

2

Placer county relies on the revenue generated from real estate property taxes to fund daily services.

Placer county tax deed sales. The county tax collector may offer the property for sale at public auction, a sealed bid sale, or a negotiated sale to a public agency or qualified nonprofit organization. Placer county recorder of deeds contact information. If the document is exempt from transfer taxes, a statement and/or appropriate revenue and taxation code should be stated on the face of the exempt document.

Enjoy the pride of homeownership for less than it costs to rent before it's too late. Sign up today because the best tax deals might disappear as soon as. Tax lien sales allow storey county to collect virtually all unpaid property taxes.

1 los angeles county 10,163,507 2 san diego county 3,337,685 3 orange county 3,190,400 4 riverside county 2,423,266 5 san bernardino county 2,157,404 6 santa clara county 1,938,153 7 alameda county 1,663,190 8 sacramento county 1,530,615 9 contra costa county 1,147,439 10 fresno county 989,255 11 kern county 893,119 12 san francisco county 884,363 3091 county center dr auburn, ca. Properties in alpine county that have had tax delinquencies for five or more years may be offered for sale by the tax collector.

List of parcels subject to tax sale in december 2021. 4 hours ago sales.all sales require full payment, which includes the transfer tax and recording fee.this tax is calculated at the rate of $0.55 for each $500 or fractional part thereof, if the purchase price exceeds $100. El dorado county relies on the revenue generated from real estate property taxes to fund daily services.

Address, phone number, and fax number for placer county recorder of deeds, a recorder of deeds, at richardson drive, auburn ca. The buyer of the tax lien has the right to collect the lien, plus interest based on the official specified. El dorado county sells tax deed properties at the el dorado county tax sale auction which is held annually during the month of november each year.

The auction is conducted by the county tax collector, and the property is sold to the highest bidder. View or pay taxes online Deed can be redeemed within one year following the sale, and the investor earns a flat 20 percent fee.

Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more years. These records can include placer county property tax assessments and assessment challenges, appraisals, and. Many tax deed sales in california occur in february, march, april and may.

And the sale begins at 10 a.m. Placer county tax records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in placer county, california. The primary purpose of the tax sale is to return the tax defaulted property to the tax rolls.

Values, exemptions, change of address. Should a property have continuing delinquent outstanding taxes at the end of three years, the treasurer will take a trustee deed to the property and begin the process of selling the property at a tax sale. Californiataxdeedsales.com has been informing visitors about topics such as tax lien certificate auction, online tax deed sales and tax lien sales.

California tax lien auctions are allowed by state law but are not currently conducted by any counties. Join thousands of satisfied visitors who discovered buying tax lien certificates, homes foreclosure and property tax records.this domain may be for sale! 825 5th st, room 125 eureka, ca 95501.

The certificate is then auctioned off in placer county, ca. Tax land sale placer county, ca.cashier's placer.ca.gov show details. December 20, 2021, properties postponed from the october 5th, 2021 tax land sale.

Placer county sells tax deed properties at the placer county tax sale auction which is held annually during the month of october each year. Offering the property for sale achieves this by either selling the property or forcing redemption. How does a tax lien sale work?

For more information on these sales, please contact the. We provide details investors care about regarding sales and it is specific to each state. Tax deed sales occur year round, depending on the county.

Tax sale resources (tsr) is a dynamic online tax lien & deed database that is continually being monitored for information accessed, and updated appropriately so investors always have the most up to date information. Tax deeds convey title to the purchaser free of all prior encumbrances (mortgage liens, judgment creditors, etc.) of any kind except liens specified by revenue and taxation code section 3712, lis pendens actions and any federal internal revenue service (irs) liens that are not discharged by the sale, even though the tax collector has provided proper notice to the. Deed and lien run sheet.

The foreclosure process can be tricky and may. Currently el dorado county california does not sell tax lien certificates.

Buying Tax Deeds In California – Know The Rules Ted Thomas

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Notice Of Preparation – Placer County Government – State Of California

Max Properties Llc On Twitter Selling Real Estate Getting Into Real Estate Home Buying

Pin On Health

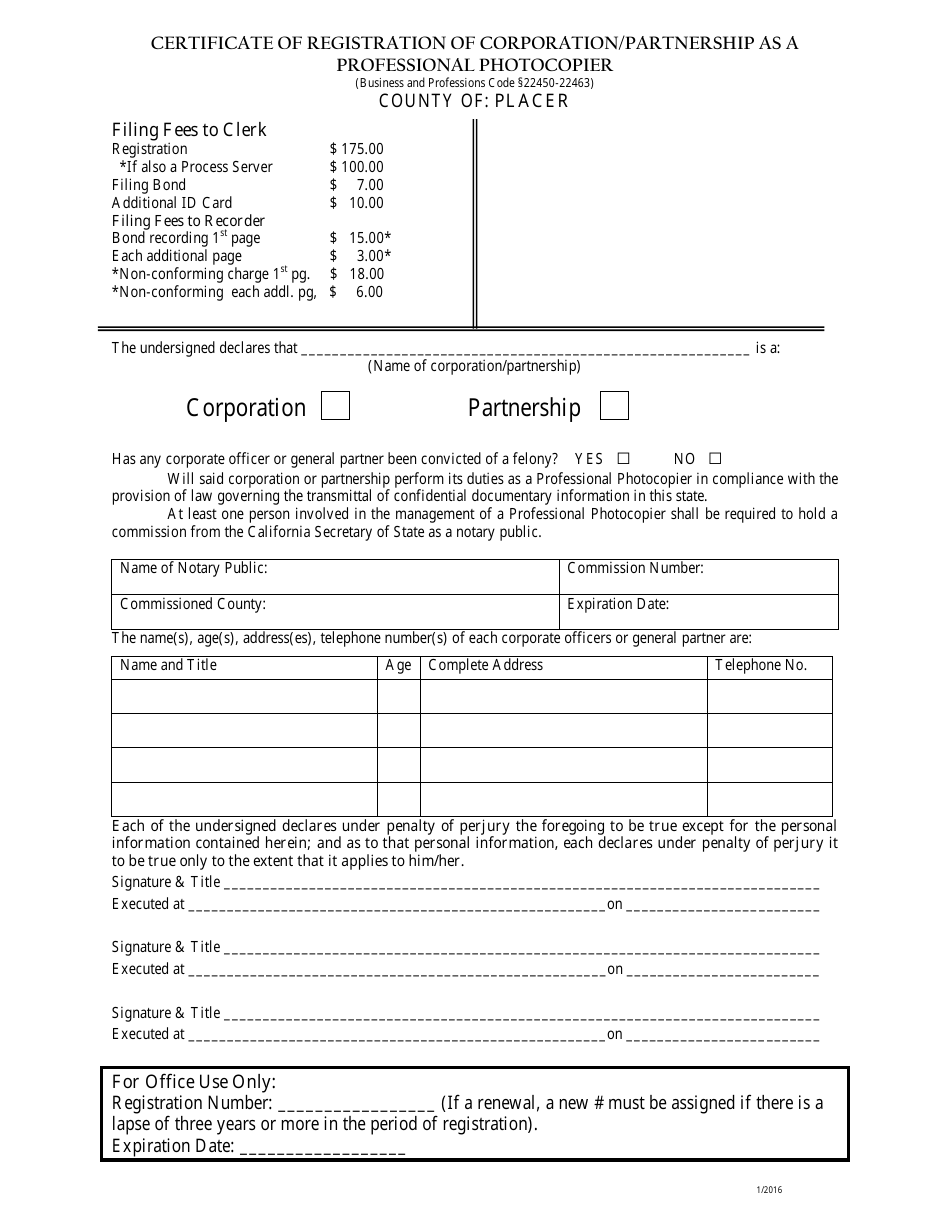

County Of Placer California Certificate Of Registration Of Corporationpartnership As A Professional Photocopier Download Printable Pdf Templateroller

Business Property Owners Placer County Ca

1999 – Placer County Government – State Of California

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Pin On Health

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

In Escrow Understanding The Process For Sellers Loans Loans Officer Marketing Ideas Escrow Process Transaction Coordinator Mortgage Tips

Placer Title Company – The Experts You Need The Partners You Can Trust

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Teller County Tax Lien 2013 By Colorado Community Media – Issuu

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

State Of Nevada Marriage Certificate Issued By Lawrence R Burtness Washoe County Recorder Nevada Carson City Marriage Certificate

New Placer Program Offers Another Path To Homeownership For Workforce Publicceo

Solano County Offers Tax Relief To Property Owners In California