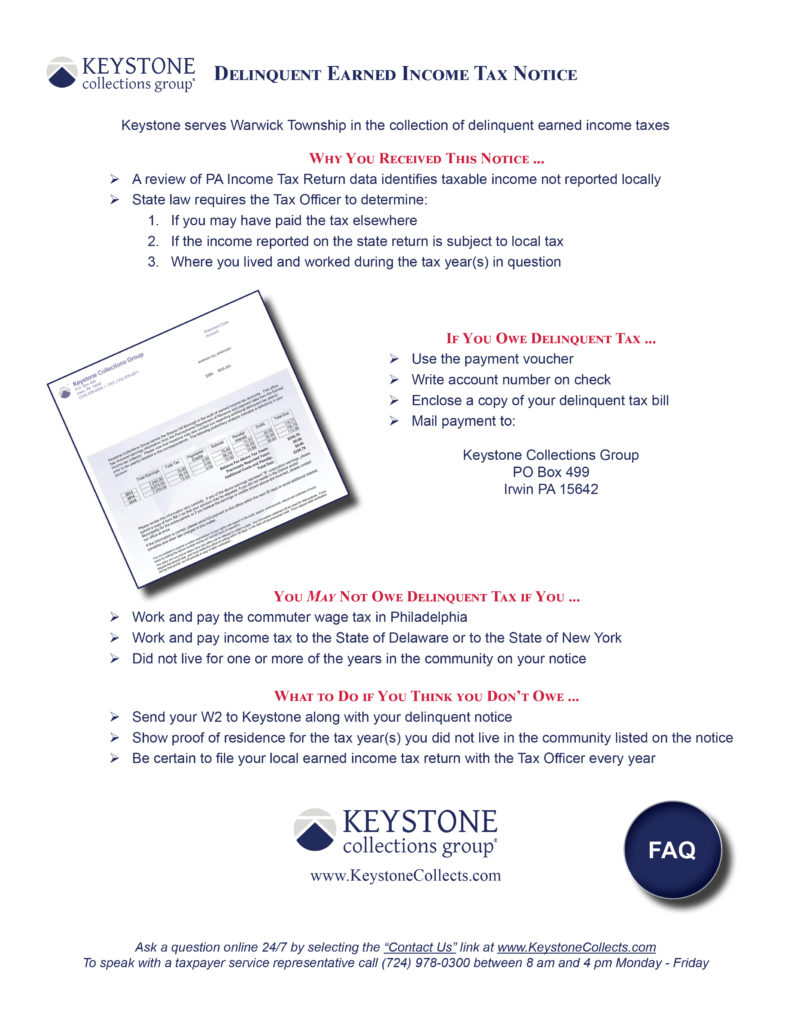

John’s employer in philadelphia correctly withholds philadelphia wage tax at nonresident rates ($75,000 x 3.4985% =$2,624), while no tax is withheld on his small business net income earned in the township (note this example ignores any business privilege taxes that may apply to john's small business). Please file your local earned income tax return every year by april 15 to avoid potentially receiving delinquent notices in the future.

Philly Workers Who Stayed Home May Be Due A Wage Tax Refund Newtown Township Bucks County Pennsylvania

The city issued new wage tax policy guidance on november 4 th, 2020.

Philadelphia wage tax return. The city wage tax is a tax on salaries, wages, commissions, and other compensation or payments that a person receives from an employer in return for work or services. Wage tax (employers) payment plans Philadelphia has the nation’s highest wage tax, currently 3.87% for residents and 3.5% for nonresidents who commute to work in the city.

All philadelphia residents owe the city wage tax, regardless of where they work. Philadelphia beverage tax (pbt) liquor tax; The employee earnings tax is a tax on salaries, wages, commissions, and other compensation paid to an individual who works or lives in philadelphia.

About 40% of wage tax revenue is paid by nonresidents, according to the city’s financial data. A few taxes must be filed online. No information from the federal return nor the pennsylvania return flows to the npt other than the taxpayer's name, address, phone, and ssn.

The tax applies to payments that a person receives from a philadelphia employer in return for work in philadelphia. Enter the business's tax account number in the city account number field. All philadelphia residents must pay the tax, regardless of where they work.

The city wage tax is a tax on salaries, wages, commissions, and other compensation. Nj is just giving you credit for tax paid twice on the same income. Also known as the wage tax, it is typically withheld and remitted by employers with nexus in philadelphia, and employees working for employers who withhold and remit 100% of the tax due do not need to file an annual return.

The city of philadelphia is not a party to any reciprocal tax agreements with any other municipality. The july 1 st city wage tax increase will take effect the same week that philadelphia moves into the green phase for businesses to reopen. Philadelphia local wage tax is separate from your pa state return and there is no available deduction for these taxes on your state return.

All philadelphia taxes can be filed online. The city wage tax is a tax on salaries, wages, commissions, and other compensation. However, this amount would be a deduction from your federal return as a local income tax paid on schedule a if you are itemizing your deductions.

Sales, use, & hotel occupancy tax; The tax still went to philly. The earnings tax and the wage tax refer to the same tax, and an employer with nexus in philadelphia will normally withhold and remit the philadelphia wage tax on its employees.

What is subject to the tax; You can now also request any wage tax refund online. All philadelphia residents owe the city wage tax, regardless of where they work.

The tax applies to payments that a person receives from an employer in return for work or services. You can also file and pay wage tax online. Philadelphia net profits tax return.

Here are the new rates: The new wage tax rate for residents is 3.8398%. The wage tax rate for residents of philadelphia was not increased and remains at 3.8712% (.038712).

If you don’t, you can claim credit on the nj return for all your philadelphia wage tax. All philadelphia residents owe the wage tax regardless of where they work. If you do not file a wage refund petition.

All philadelphia residents are subject to the city wage tax, regardless of where they work. The nine months of taxes are not really going to new jersey. When no wage tax is withheld, philadelphia residents must file and pay the earnings tax themselves.

The tax has often been cited as a job killer, but it raises so much money that the city can’t easily replace it. But workers who live outside the city and have been told to work from home, do not have to pay the tax. The city of brotherly love will be happy.

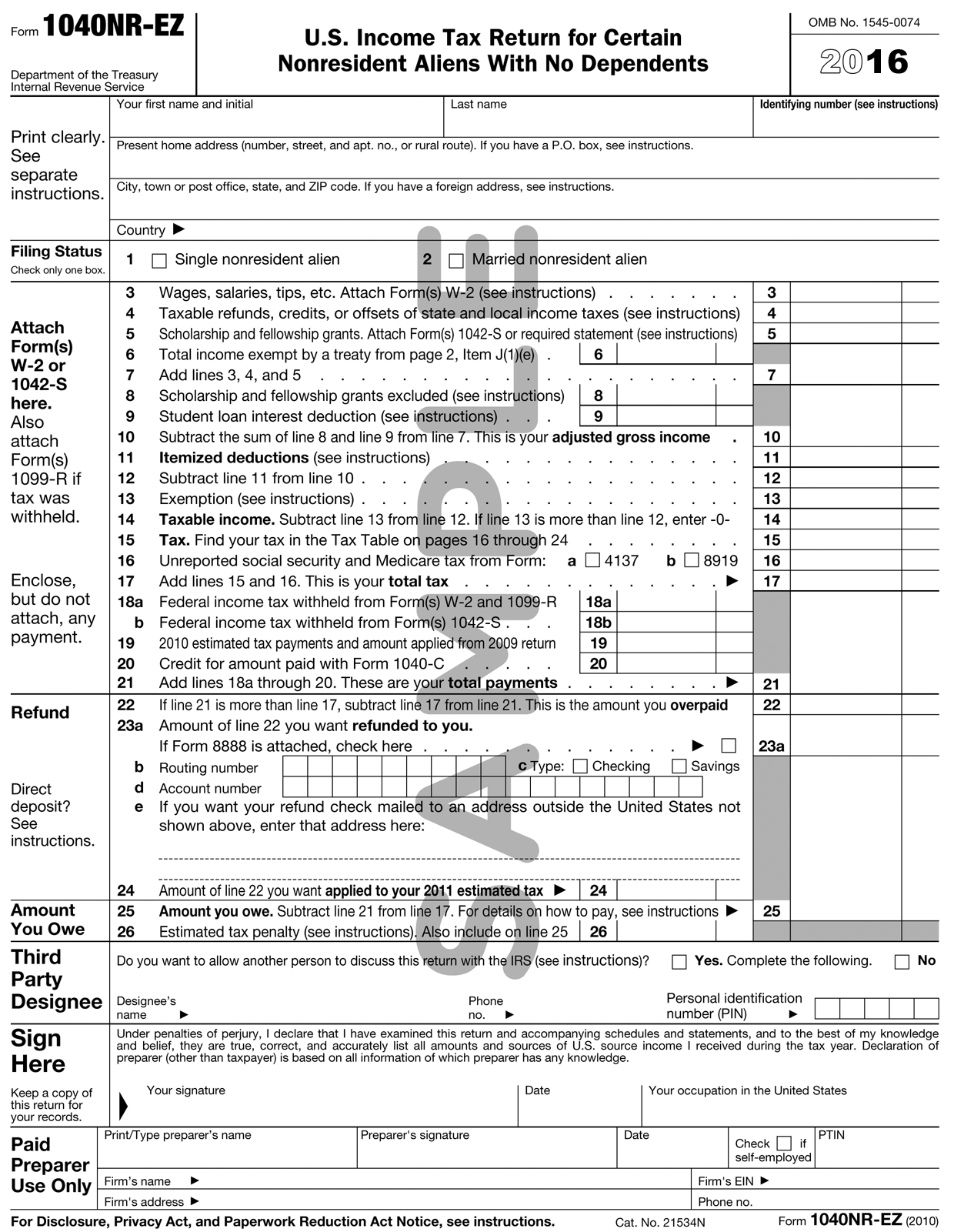

[/callout] these forms help taxpayers file 2020 wage tax. Use & occupancy (u&o) tax;

2

Check The Po Box Mailing Tax Payments Forms To Revenue Department Of Revenue City Of Philadelphia

2

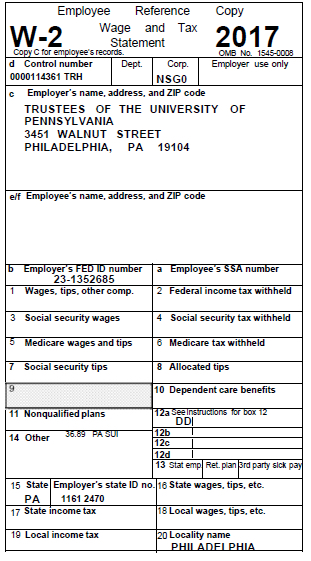

The W-2 Form For Calendar Year 1999 – Almanac Vol 46 No 18 1252000

Philly Workers Who Stayed Home May Be Due A Wage Tax Refund Newtown Township Bucks County Pennsylvania

Faqs On Tax Returns And The Coronavirus

1292002 The W-2 Form For Calendar Year 2001 – Almanac Vol 48 No 20

You Pay Lots Of Philly Taxes But Do You Know Why – Philadelphia Magazine

31114 Income Tax Returns For Estates And Trusts Forms 1041 1041-qft And 1041-n Internal Revenue Service

Important Tax Information And Tax Forms Camp Usa Interexchange

2

2

Philadelphia Refunds Millions In Wage Taxes To Suburban Commuters

Publication 908 022021 Bankruptcy Tax Guide Internal Revenue Service

Taxes Warwick Township Bucks County

Tax Forms For 2017 University Of Pennsylvania Almanac

2

2

Theres A New Tax Refund Available In Philadelphia This Year Philadelphia Legal Assistance