The difference is how the taxes are collected and paid to the city of philadelphia. The tax has often been cited as a job killer, but it raises so much money that the city can’t easily replace it.

Invest Nria National Realty Investment Advisors Investment Advisor Investing Real Estate Investment Companies

The city issued new wage tax policy guidance on november 4 th, 2020.

Philadelphia wage tax for non residents. Who pays the tax the city wage tax is a tax on salaries, wages, commissions, and other compensation. Download it for ios or. And more than 240,000 residents commute to philadelphia from surrounding counties in pennsylvania, new jersey, and delaware, according to an analysis of u.s.

Census data completed last year by the pew charitable trusts. All philadelphia residents owe the city wage tax, regardless of where they work. The wage tax rate for residents of philadelphia remains 3.8712% (.038712).

They are two sides of the same coin. The tax applies to payments that a person receives from an employer in return for work or services. Who is subject to wage tax?

About 40% of wage tax revenue is paid by nonresidents, according to the city’s financial data. Philadelphia imposes a wage tax on all salaries, wages, commissions, and other compensation received by an individual for services. A resident is never exempt from the wage tax, and is subject to the tax on his or her entire, worldwide income.

For more information about the city of philadelphia wage tax, go here. All philadelphia residents regardless of where they work are subject to wage tax at the rate of 3.8712%. If your employer requires you to work outside of the city on any day, you are not subject to the wage tax for that day.

The department has traditionally employed a “convenience of the employer” rule under which nonresident employees who are based in philadelphia are subject to wage tax unless they are working remotely for the convenience of their employer (e.g., a nonresident employee who works at home one day per week for personal reasons is subject to wage. All philadelphia residents owe the city wage tax, regardless of where they work. Our redesigned local news and weather app is live!

Ad a tax advisor will answer you now! Schedules to withhold and remit the tax to the city remain the same. Philadelphia has the nation’s highest wage tax, currently 3.87% for residents and 3.5% for nonresidents who commute to work in the city.

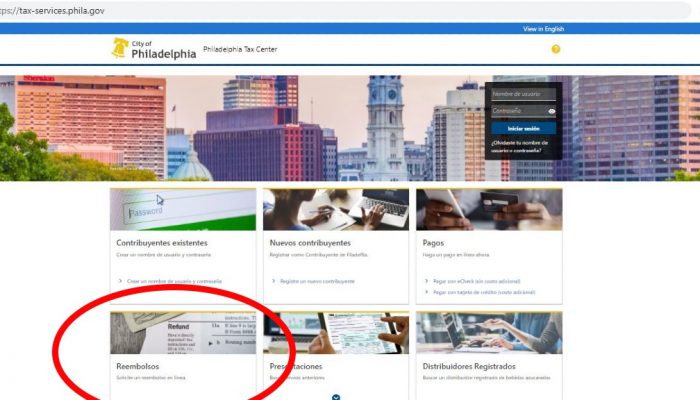

The wage and earnings taxes apply to salaries, wages, commission, and other compensation. Nonresident employees who mistakenly had wage tax withheld during the time they were required to perform their duties from home in 2020, will have the opportunity to file for a refund with a wage tax reconciliation form in 2021. The resident rate of 3.871% stays the same.

All philadelphia residents regardless of where they work are subject to wage tax at the rate of 3.8712%.

Pin On Rb Inspirationui

Pin By 1800 Clicks On Breaking News Top Stories Tax Return Irs Taxes Wage Garnishment

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

Sunnyvale City Minimum Wage-mainimage Sunnyvale Minimum Wage City

City Of Philadelphia Announces Wage Tax Rate Increase For Non-residents Starting July 1 2020 – Wouch Maloney Cpas Business Advisors

Drktvna3xtzplm

Tax Problem Resolution Philadelphia Pa Va Md Strategic Tax Resolution Tax Lawyer Tax How To Find Out

City Of Philadelphia Announces Wage Tax Rate Increase For Non-residents Starting July 1 2020 – Wouch Maloney Cpas Business Advisors

Philadelphia Wage Tax For Non-residents Increases On July 1 Department Of Revenue City Of Philadelphia

Limits Of Salary Deductions Surcharges And Salary Advances Wage Garnishment Wage Tax Debt

City Of Philadelphia Announces Wage Tax Rate Increase For Non-residents Starting July 1 2020 – Wouch Maloney Cpas Business Advisors

Unfiled Taxes Md Va Pa Strategic Tax Resolution Tax Consulting Irs Taxes Tax Attorney

Phillydotcom Infographic Infographic Gambling Information Graphics

Tax Preparation Service In Maryland Pennsylvania Tax Debt Irs Taxes Tax Debt Relief

Calculator How Much Must You Earn At A Job In Another State To Maintain Your Quality Of Life Best Places To Live Cheapest Places To Live States In America

Pin By Tadross Law On Tadross Law Bankruptcy Attorneys Clients

Wage Garnishments Can Leave You Struggling To Pay The Essential Living Expenses Wage Garnishment Irs Taxes Tax Help

City Of Philadelphia Announces Wage Tax Rate Increase For Non-residents Starting July 1 2020 – Wouch Maloney Cpas Business Advisors

Youtube Prince Music Hands Up Dont Shoot Duvernay