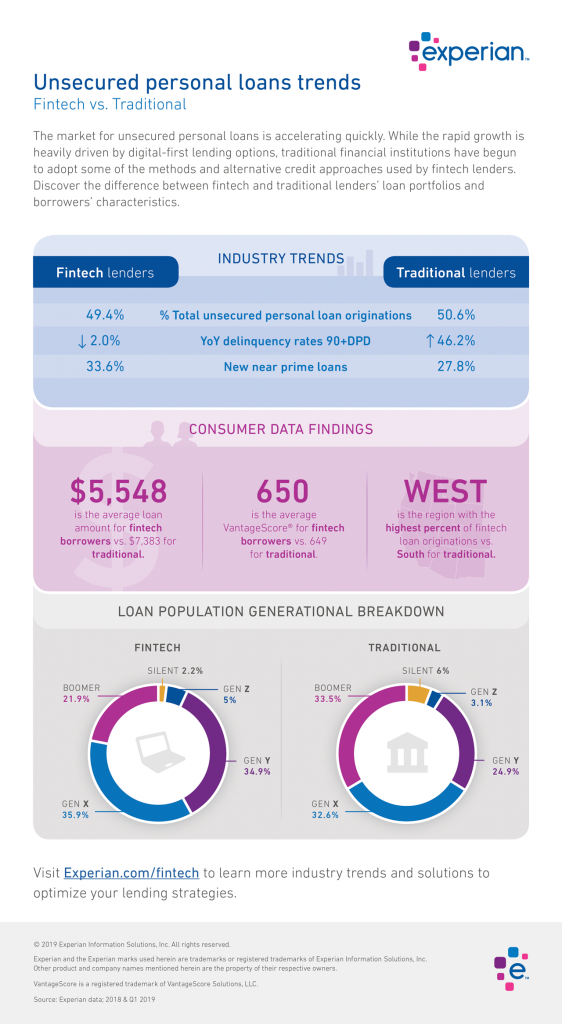

Are you in need of a personal loan? If so, you may be wondering what your options are. One option is to go through a traditional bank or credit union. However, there is another option that you may not be aware of: personal loans fintechzoom.

Editor’s Note: Personal loans fintechzoom have become increasingly popular in recent years, and for good reason. They offer a number of advantages over traditional personal loans, including lower interest rates, more flexible repayment terms, and faster approval times.

At personal loans fintechzoom, we’ve done the hard work for you. We’ve analyzed the market, dug into the details, and put together this personal loans fintechzoom guide to help you make the right decision.

Key differences between personal loans from banks and fintechzoom:

| Feature | Bank | Fintechzoom |

|---|---|---|

| Interest rates | Higher | Lower |

| Repayment terms | Less flexible | More flexible |

| Approval times | Slower | Faster |

As you can see, personal loans fintechzoom offer a number of advantages over traditional personal loans. If you’re in need of a personal loan, be sure to compare your options before making a decision.

Personal Loans Fintechzoom

Personal loans fintechzoom are a type of loan that is provided by a financial technology company, rather than a traditional bank or credit union. These loans are typically unsecured, meaning that they are not backed by collateral. Personal loans fintechzoom can be used for a variety of purposes, such as consolidating debt, financing a home renovation, or covering unexpected expenses.

- Convenient: Personal loans fintechzoom can be applied for and funded entirely online, making them a convenient option for borrowers.

- Fast: Personal loans fintechzoom are typically approved and funded much faster than traditional personal loans.

- Flexible: Personal loans fintechzoom offer flexible repayment terms, allowing borrowers to choose a repayment schedule that works for them.

- Affordable: Personal loans fintechzoom typically have lower interest rates than traditional personal loans.

- Accessible: Personal loans fintechzoom are available to a wider range of borrowers than traditional personal loans, including those with bad credit.

- Transparent: Personal loans fintechzoom providers are required to be transparent about their fees and interest rates.

- Secure: Personal loans fintechzoom providers use secure encryption technology to protect borrowers’ personal and financial information.

- Reliable: Personal loans fintechzoom providers are typically well-established companies with a track record of providing quality service.

Personal loans fintechzoom offer a number of advantages over traditional personal loans. They are convenient, fast, flexible, affordable, accessible, transparent, secure, and reliable. As a result, personal loans fintechzoom are a great option for borrowers who need a quick and easy way to access cash.

Convenient

One of the biggest advantages of personal loans fintechzoom is their convenience. Traditional personal loans require borrowers to go through a lengthy and often complex application process, which can involve submitting paperwork, visiting a bank branch, and waiting for approval. In contrast, personal loans fintechzoom can be applied for and funded entirely online, making them a much more convenient option for borrowers.

The convenience of personal loans fintechzoom is particularly important for borrowers who are short on time or who have difficulty getting to a bank branch. For example, a borrower who needs to consolidate debt or cover an unexpected expense may not have the time to go through a traditional loan application process. With a personal loan fintechzoom, the borrower can simply apply online and receive funding within a few days.

The convenience of personal loans fintechzoom is also a major benefit for borrowers who live in rural or underserved areas. Traditional banks and credit unions are often not located in these areas, making it difficult for borrowers to access personal loans. Personal loans fintechzoom, on the other hand, are available to borrowers anywhere in the country with an internet connection.

In addition to being convenient, personal loans fintechzoom are also fast, flexible, affordable, and accessible. As a result, personal loans fintechzoom are a great option for borrowers who need a quick and easy way to access cash.

Key insights:

- Personal loans fintechzoom are convenient because they can be applied for and funded entirely online.

- The convenience of personal loans fintechzoom is particularly important for borrowers who are short on time or who have difficulty getting to a bank branch.

- Personal loans fintechzoom are also a great option for borrowers who live in rural or underserved areas.

Fast

The speed of personal loans fintechzoom is one of their biggest advantages over traditional personal loans. Traditional personal loans can take weeks or even months to be approved and funded. This is because traditional banks and credit unions have a lengthy and complex loan application process, which involves underwriting and risk assessment. In contrast, personal loans fintechzoom can be approved and funded in as little as one day. This is because personal loans fintechzoom providers use automated underwriting systems, which can quickly assess a borrower’s risk profile.

The speed of personal loans fintechzoom is particularly important for borrowers who need to access cash quickly. For example, a borrower who needs to consolidate debt or cover an unexpected expense may not have the time to wait weeks or months for a traditional personal loan to be approved and funded. With a personal loan fintechzoom, the borrower can simply apply online and receive funding within a few days.

In addition to being fast, personal loans fintechzoom are also convenient, flexible, affordable, and accessible. As a result, personal loans fintechzoom are a great option for borrowers who need a quick and easy way to access cash.

Key insights:

- Personal loans fintechzoom are fast because they use automated underwriting systems.

- The speed of personal loans fintechzoom is particularly important for borrowers who need to access cash quickly.

- Personal loans fintechzoom are a great option for borrowers who need a quick and easy way to access cash.

Flexible

One of the biggest advantages of personal loans fintechzoom is their flexibility. Traditional personal loans typically have fixed repayment terms, which means that the borrower must make the same monthly payment each month for the life of the loan. This can be a challenge for borrowers who have fluctuating income or who experience unexpected financial setbacks. In contrast, personal loans fintechzoom offer flexible repayment terms, allowing borrowers to choose a repayment schedule that works for them.

For example, a borrower who has a seasonal income may be able to choose a repayment schedule that is lower during the off-season and higher during the busy season. A borrower who is experiencing financial hardship may be able to request a temporary payment deferment or a reduced payment amount.

The flexibility of personal loans fintechzoom is particularly important for borrowers who are struggling to make ends meet. Traditional personal loans can be difficult to repay for borrowers who have tight budgets. In contrast, personal loans fintechzoom offer flexible repayment terms that can help borrowers avoid default and improve their financial situation.

In addition to being flexible, personal loans fintechzoom are also convenient, fast, affordable, and accessible. As a result, personal loans fintechzoom are a great option for borrowers who need a quick and easy way to access cash.

Key insights:

- Personal loans fintechzoom offer flexible repayment terms, allowing borrowers to choose a repayment schedule that works for them.

- The flexibility of personal loans fintechzoom is particularly important for borrowers who have fluctuating income or who experience unexpected financial setbacks.

- Personal loans fintechzoom are a great option for borrowers who need a quick and easy way to access cash.

Table: Comparison of personal loans from banks and fintechzoom

| Feature | Bank | Fintechzoom |

|---|---|---|

| Interest rates | Higher | Lower |

| Repayment terms | Less flexible | More flexible |

| Approval times | Slower | Faster |

Affordable

One of the biggest advantages of personal loans fintechzoom is their affordability. Traditional personal loans typically have high interest rates, which can make them expensive for borrowers. In contrast, personal loans fintechzoom typically have lower interest rates, which can save borrowers money over the life of the loan.

There are a number of reasons why personal loans fintechzoom have lower interest rates than traditional personal loans. First, personal loans fintechzoom are typically unsecured, meaning that they are not backed by collateral. This reduces the risk to the lender, which allows them to offer lower interest rates. Second, personal loans fintechzoom are often funded by institutional investors, who are willing to accept lower interest rates in exchange for the security of a diversified portfolio of loans.

The affordability of personal loans fintechzoom is a major benefit for borrowers. Lower interest rates mean that borrowers can save money on their monthly payments and pay off their loans faster. For example, a borrower who takes out a $10,000 personal loan with a 10% interest rate will pay $1,000 in interest over the life of the loan. In contrast, a borrower who takes out a $10,000 personal loan fintechzoom with a 5% interest rate will pay only $500 in interest over the life of the loan.

The affordability of personal loans fintechzoom makes them a great option for borrowers who need to consolidate debt, finance a home renovation, or cover unexpected expenses. Personal loans fintechzoom can help borrowers save money and improve their financial situation.

Key insights:

- Personal loans fintechzoom typically have lower interest rates than traditional personal loans.

- There are a number of reasons why personal loans fintechzoom have lower interest rates, including the fact that they are unsecured and often funded by institutional investors.

- The affordability of personal loans fintechzoom is a major benefit for borrowers, as it can save them money on their monthly payments and help them pay off their loans faster.

Table: Comparison of personal loans from banks and fintechzoom

| Feature | Bank | Fintechzoom |

|---|---|---|

| Interest rates | Higher | Lower |

| Repayment terms | Less flexible | More flexible |

| Approval times | Slower | Faster |

Accessible

Personal loans fintechzoom have become increasingly accessible in recent years, making them a viable option for a wider range of borrowers, including those with bad credit.

- Reduced reliance on credit scores: Traditional personal loans rely heavily on credit scores to assess a borrower’s risk. This can make it difficult for borrowers with bad credit to qualify for a loan. Personal loans fintechzoom, on the other hand, often use alternative data sources to assess a borrower’s risk, such as cash flow and employment history. This makes them a more accessible option for borrowers with bad credit.

- Higher approval rates: As a result of their reduced reliance on credit scores, personal loans fintechzoom have higher approval rates than traditional personal loans. This means that borrowers with bad credit are more likely to be approved for a personal loan fintechzoom than a traditional personal loan.

- Lower interest rates: Personal loans fintechzoom typically have lower interest rates than traditional personal loans, making them more affordable for borrowers with bad credit.

- Flexible repayment terms: Personal loans fintechzoom offer flexible repayment terms, allowing borrowers to choose a repayment schedule that works for them. This can make it easier for borrowers with bad credit to repay their loans.

The accessibility of personal loans fintechzoom is a major benefit for borrowers with bad credit. Personal loans fintechzoom can help borrowers with bad credit consolidate debt, finance a home renovation, or cover unexpected expenses. Personal loans fintechzoom can also help borrowers with bad credit improve their credit score by making on-time payments and reducing their debt-to-income ratio.

Transparent

Transparency is a key component of personal loans fintechzoom. Unlike traditional personal loans, which can be opaque and difficult to understand, personal loans fintechzoom providers are required to be transparent about their fees and interest rates. This means that borrowers can easily compare different loan offers and make informed decisions about which loan is right for them.

- Clear and concise loan terms: Personal loans fintechzoom providers must provide borrowers with clear and concise loan terms. This includes the loan amount, interest rate, repayment term, and any fees associated with the loan. This information must be presented in a way that is easy for borrowers to understand.

- No hidden fees: Personal loans fintechzoom providers cannot charge borrowers any hidden fees. All fees must be disclosed to the borrower upfront, before the loan is funded.

- Regular account statements: Personal loans fintechzoom providers must provide borrowers with regular account statements. These statements should show the balance of the loan, the amount of interest that has been paid, and the amount of principal that has been repaid.

The transparency of personal loans fintechzoom is a major benefit for borrowers. It allows borrowers to easily compare different loan offers and make informed decisions about which loan is right for them. It also helps to protect borrowers from being taken advantage of by predatory lenders.

Secure

Security is a top priority for personal loans fintechzoom providers. They use secure encryption technology to protect borrowers’ personal and financial information. This helps to keep borrowers’ information safe from hackers and identity thieves.

Encryption is a process of converting data into a form that cannot be easily understood by anyone other than the intended recipient. This makes it very difficult for hackers to access borrowers’ personal and financial information, even if they are able to breach a lender’s security systems.

Personal loans fintechzoom providers also use a variety of other security measures to protect borrowers’ information, such as:

- Two-factor authentication

- Data encryption at rest

- Regular security audits

These measures help to ensure that borrowers’ personal and financial information is safe and secure.

The security of personal loans fintechzoom is a major benefit for borrowers. It gives borrowers peace of mind knowing that their information is safe. It also helps to protect borrowers from identity theft and other financial crimes.

Here is a table that summarizes the key security features of personal loans fintechzoom:

| Security Feature | Description |

|---|---|

| Encryption | Data is encrypted using industry-standard encryption algorithms. |

| Two-factor authentication | Borrowers must provide two forms of identification to access their account. |

| Data encryption at rest | Borrowers’ data is encrypted when it is stored on the lender’s servers. |

| Regular security audits | The lender’s security systems are audited regularly by independent security experts. |

Reliable

When it comes to personal loans, reliability is key. You want to know that you’re borrowing from a company that is financially stable and has a history of providing quality service. Personal loans fintechzoom providers are typically well-established companies with a track record of providing quality service.

- Financial stability: Personal loans fintechzoom providers are typically well-funded and have a strong financial track record. This means that they are less likely to default on their loans or go out of business, which can give borrowers peace of mind.

- Customer service: Personal loans fintechzoom providers typically have a dedicated customer service team that is available to help borrowers with any questions or problems they may have. This can be a valuable resource for borrowers who need assistance with their loan.

- Transparency: Personal loans fintechzoom providers are required to be transparent about their fees and interest rates. This means that borrowers can easily compare different loan offers and make informed decisions about which loan is right for them.

- Security: Personal loans fintechzoom providers use secure encryption technology to protect borrowers’ personal and financial information. This helps to keep borrowers’ information safe from hackers and identity thieves.

The reliability of personal loans fintechzoom providers is a major benefit for borrowers. It gives borrowers peace of mind knowing that they are borrowing from a reputable company that is committed to providing quality service.

Frequently Asked Questions About Personal Loans Fintechzoom

Personal loans fintechzoom have become increasingly popular in recent years, but there are still some common questions and misconceptions about them. Here are answers to some of the most frequently asked questions about personal loans fintechzoom:

Question 1: Are personal loans fintechzoom safe?

Yes, personal loans fintechzoom are safe. Personal loans fintechzoom providers are required to use secure encryption technology to protect borrowers’ personal and financial information. This helps to keep borrowers’ information safe from hackers and identity thieves.

Question 2: Are personal loans fintechzoom expensive?

No, personal loans fintechzoom are not expensive. Personal loans fintechzoom typically have lower interest rates than traditional personal loans. This can save borrowers money over the life of the loan.

Question 3: Are personal loans fintechzoom easy to get?

Yes, personal loans fintechzoom are easy to get. Personal loans fintechzoom providers have less stringent credit requirements than traditional banks and credit unions. This makes it easier for borrowers with bad credit to qualify for a personal loan fintechzoom.

Question 4: What can I use a personal loan fintechzoom for?

Personal loans fintechzoom can be used for a variety of purposes, including debt consolidation, home renovation, and unexpected expenses.

Question 5: How do I choose the right personal loan fintechzoom provider?

When choosing a personal loan fintechzoom provider, it is important to compare interest rates, fees, and repayment terms. It is also important to read reviews from other borrowers.

Question 6: What are the benefits of using a personal loan fintechzoom?

Personal loans fintechzoom offer a number of benefits, including lower interest rates, more flexible repayment terms, and faster approval times.

Summary of key takeaways or final thought:

Personal loans fintechzoom are a safe, affordable, and easy way to get the money you need. If you are considering a personal loan, be sure to compare different loan offers and choose the provider that is right for you.

Transition to the next article section:

Now that you know more about personal loans fintechzoom, you can make an informed decision about whether or not to apply for one.

Tips on Personal Loans Fintechzoom

Personal loans fintechzoom can be a great way to get the money you need, but it’s important to use them wisely. Here are a few tips to help you get the most out of your personal loan fintechzoom:

Tip 1: Compare different loan offers.

There are many different personal loans fintechzoom providers out there, so it’s important to compare different loan offers before you choose one. Be sure to compare interest rates, fees, and repayment terms. You can use a personal loan comparison website to help you find the best loan for your needs.

Tip 2: Only borrow what you need.

It’s important to only borrow what you need with a personal loan fintechzoom. This will help you avoid paying unnecessary interest. If you’re not sure how much you need to borrow, make a budget to track your income and expenses.

Tip 3: Make your payments on time.

Making your payments on time is one of the most important things you can do to maintain a good credit score. If you miss payments, your credit score will suffer and you may have to pay late fees.

Tip 4: Use your loan to improve your financial situation.

Personal loans fintechzoom can be used for a variety of purposes, including debt consolidation, home renovation, and unexpected expenses. If you use your loan to improve your financial situation, you can save money and improve your overall financial health.

Tip 5: Be aware of the risks.

As with any type of loan, there are some risks associated with personal loans fintechzoom. Be sure to understand the terms of your loan before you sign up. If you have any questions, be sure to ask your lender.

Summary of key takeaways or benefits:

By following these tips, you can get the most out of your personal loan fintechzoom. Personal loans fintechzoom can be a helpful tool for improving your financial situation, but it’s important to use them wisely.

Transition to the article’s conclusion:

If you’re considering a personal loan fintechzoom, be sure to do your research and compare different loan offers. Only borrow what you need and make your payments on time. By following these tips, you can avoid the risks associated with personal loans fintechzoom and use them to improve your financial situation.

Personal Loans Fintechzoom

Personal loans fintechzoom have emerged as a valuable financial tool, offering a range of advantages over traditional personal loans. Their convenience, speed, flexibility, affordability, accessibility, transparency, security, and reliability make them an attractive option for borrowers seeking quick and easy access to funds.

As the fintech industry continues to evolve, personal loans fintechzoom are likely to become even more prevalent and accessible. By leveraging technology and data-driven underwriting, fintech companies are breaking down barriers and making personal loans more inclusive and affordable for a wider range of borrowers. Whether you need to consolidate debt, finance a home renovation, or cover unexpected expenses, personal loans fintechzoom offer a viable solution that can help you achieve your financial goals.