Title loans are a type of secured loan that uses your vehicle’s title as collateral. If you need cash quickly and have a vehicle that is paid off or has a low balance, a title loan may be an option for you.

Editor’s Notes: Title loans in Illinois have been published today, date, as per our latest research. This topic is imperative to read as it can help answer some of your questions regarding title loans in Illinois and can help you make a wise decision regarding title loans.

After doing some analysis, digging through information, and gathering data, we put together this title loans in Illinois guide to help you make the right decision.

Key differences or Key takeaways

| Title Loans | |

|---|---|

| Loan Amount | Typically up to $10,000 |

| Loan Term | Typically 15 to 30 days |

| Interest Rate | Varies by lender, but can be high |

| Fees | Lenders may charge various fees, such as origination fees, late fees, and prepayment penalties |

Transition to main article topics

In this article, we will discuss the following topics:

- What are title loans?

- How do title loans work?

- What are the benefits of title loans?

- What are the risks of title loans?

- How to apply for a title loan

- How to choose a title loan lender

- Alternatives to title loans

Title Loans in Illinois

Title loans in Illinois are a type of secured loan that uses your vehicle’s title as collateral. To qualify for a title loan, you must have a vehicle that is paid off or has a low balance, and you must be able to provide proof of income and identity.

Key aspects of title loans in Illinois:

- Loan amount: Typically up to $10,000

- Loan term: Typically 15 to 30 days

- Interest rate: Varies by lender, but can be high

- Fees: Lenders may charge various fees, such as origination fees, late fees, and prepayment penalties

- Vehicle requirements: Must have a vehicle that is paid off or has a low balance

- Income requirements: Must be able to provide proof of income

- Identity requirements: Must be able to provide proof of identity

- Default: If you default on your loan, the lender can repossess your vehicle

- Alternatives: There are other options available if you need cash, such as personal loans, payday loans, and credit cards

Detailed discussion on the key aspects:

The loan amount for a title loan in Illinois is typically up to $10,000. The loan term is typically 15 to 30 days, but it can be longer if you make regular payments. The interest rate on a title loan can vary by lender, but it is typically high. Lenders may also charge various fees, such as origination fees, late fees, and prepayment penalties.

To qualify for a title loan in Illinois, you must have a vehicle that is paid off or has a low balance. You must also be able to provide proof of income and identity. If you default on your loan, the lender can repossess your vehicle.

There are other options available if you need cash, such as personal loans, payday loans, and credit cards. However, title loans can be a good option if you have bad credit or no other options.

Loan amount

In the context of title loans in Illinois, the loan amount is a crucial aspect that determines the accessibility and viability of this financial option. Title loans are short-term loans secured against the borrower’s vehicle title, and the loan amount is typically capped at $10,000. This specific loan amount range is shaped by several factors:

- Vehicle value: The value of the vehicle used as collateral plays a significant role in determining the loan amount. Lenders typically assess the vehicle’s condition, mileage, and market value to determine the maximum loan amount they are willing to offer.

For instance, a newer vehicle with low mileage and a higher market value will generally qualify for a higher loan amount compared to an older vehicle with high mileage and a lower market value.

Loan-to-value ratio: Lenders also consider the loan-to-value (LTV) ratio when determining the loan amount. The LTV ratio represents the percentage of the vehicle’s value that the loan amount covers. Lenders typically set a maximum LTV ratio to manage their risk, which can impact the loan amount offered.

For example, if a lender has a maximum LTV ratio of 75%, and the vehicle used as collateral is valued at $10,000, the maximum loan amount the borrower can receive would be $7,500.

Repayment ability: Lenders assess the borrower’s repayment ability to ensure they can comfortably repay the loan. This involves evaluating the borrower’s income, expenses, and debt obligations.

If a borrower has a stable income and a manageable debt-to-income ratio, they are more likely to qualify for a higher loan amount.

State regulations: The loan amount for title loans may also be influenced by state regulations. Different states have varying laws governing title loans, including limits on loan amounts and interest rates.

For instance, Illinois has a maximum loan amount of $10,000 for title loans, while some other states may have different limits.

In summary, the loan amount of up to $10,000 for title loans in Illinois is shaped by factors such as vehicle value, loan-to-value ratio, repayment ability, and state regulations. Understanding these factors can help borrowers make informed decisions about whether a title loan is the right financial option for them.

Loan term

The loan term for title loans in Illinois is typically 15 to 30 days, which is a crucial aspect of this type of financing. The short loan term is designed to meet the urgent financial needs of borrowers who require quick access to cash.

The short loan term has several implications:

- High interest rates: Due to the short loan term and the high risk associated with title loans, lenders typically charge higher interest rates compared to other loan products. The interest rates can vary depending on the lender, the borrower’s creditworthiness, and the loan amount.

- Repayment pressure: The short loan term puts pressure on borrowers to repay the loan quickly, which can be challenging for those with limited income or unexpected expenses. If borrowers are unable to repay the loan on time, they may face additional fees and penalties, or even risk losing their vehicle.

- Limited loan amounts: The short loan term often limits the loan amount that borrowers can access. Lenders may be hesitant to offer large loan amounts with such a short repayment period, as it increases their risk of default.

Despite the challenges, title loans can provide a lifeline for individuals who need emergency funding and have limited access to other financial options. However, it is crucial for borrowers to carefully consider the short loan term and the potential risks before taking out a title loan.

In comparison to traditional installment loans, which may have loan terms of several months or years, the short loan term of title loans makes them a more short-term and high-cost financing option. Borrowers should explore all available options and consider the long-term financial implications before committing to a title loan.

Interest rate

The interest rate on title loans in Illinois is one of the most important factors to consider before taking out a loan. Interest rates can vary significantly from lender to lender, and they can have a major impact on the total cost of your loan.

-

Facet 1: Lender’s risk assessment

One of the biggest factors that affects interest rates on title loans is the lender’s assessment of risk. Lenders consider a variety of factors when assessing risk, including your credit score, income, and debt-to-income ratio. If you have a low credit score or a high debt-to-income ratio, you may be considered a higher risk borrower and may be charged a higher interest rate.

-

Facet 2: Loan-to-value ratio

Another factor that can affect interest rates is the loan-to-value ratio (LTV) of your loan. The LTV is the percentage of the value of your vehicle that is being financed. If you have a high LTV, you may be considered a higher risk borrower and may be charged a higher interest rate.

-

Facet 3: Loan term

The loan term is the length of time that you have to repay your loan. Longer loan terms typically have higher interest rates than shorter loan terms. This is because lenders are taking on more risk by lending you money for a longer period of time.

-

Facet 4: State regulations

The state in which you live can also affect the interest rate on your title loan. Some states have laws that limit the interest rates that lenders can charge on title loans. However, in Illinois, there is no such limit, so interest rates can vary significantly from lender to lender.

It is important to compare interest rates from multiple lenders before taking out a title loan. By shopping around, you can find the best possible interest rate and save money on your loan.

Fees

When it comes to title loans in Illinois, it’s crucial to be aware of the various fees that lenders may charge. These fees can add to the overall cost of your loan and impact your financial situation.

Common Fees Associated with Title Loans in Illinois

| Fee | Description |

|---|---|

| Origination fee | A fee charged by the lender for processing and underwriting the loan |

| Late fee | A fee charged if you fail to make a payment on time |

| Prepayment penalty | A fee charged if you pay off your loan early |

Impact of Fees on Borrowers

The fees associated with title loans can have a significant impact on borrowers. Origination fees can range from $50 to $500, increasing the overall cost of the loan. Late fees can also add up quickly, especially if you are unable to make your payments on time. Prepayment penalties can discourage borrowers from paying off their loans early, which can lead to higher interest charges over time.

It’s important to carefully consider the fees associated with title loans before taking out a loan. Be sure to compare fees from multiple lenders and factor them into your budget to avoid any unexpected financial burdens.

Vehicle requirements

In the realm of title loans in Illinois, the requirement of having a vehicle that is paid off or has a low balance is of paramount importance. This requirement serves as the cornerstone of title lending, as it establishes the collateral that secures the loan.

Title loans, by nature, are secured loans that utilize the borrower’s vehicle title as collateral. When a borrower obtains a title loan, they are essentially pledging their vehicle as security for the loan amount. The lender retains the vehicle’s title until the loan is fully repaid.

The requirement for a vehicle with a paid-off or low balance stems from the lender’s need to mitigate risk. Lenders want to ensure that the collateral they are holding has sufficient value to cover the loan amount in the event of a default. A vehicle that is fully paid off or has a low balance indicates that the borrower has a significant equity stake in the vehicle, making it less likely that they will default on the loan.

In contrast, if a borrower has a vehicle with a high balance, the lender’s risk is increased. This is because the borrower may be more likely to default on the loan if they are already struggling to make payments on their vehicle. Additionally, a vehicle with a high balance may have less market value, making it more difficult for the lender to recoup their losses in the event of a default.

Therefore, the requirement for a vehicle that is paid off or has a low balance is a crucial aspect of title loans in Illinois. It helps to ensure that lenders are lending responsibly and that borrowers are not taking on more debt than they can afford.

Key Insights:

- Title loans require a vehicle that is paid off or has a low balance to serve as collateral.

- This requirement helps to mitigate risk for lenders by ensuring that the collateral has sufficient value.

- Borrowers with vehicles that have high balances may be more likely to default on their loans, increasing the lender’s risk.

Income requirements

In the realm of title loans in Illinois, the requirement to provide proof of income plays a crucial role in the loan approval process. Lenders need to assess the borrower’s ability to repay the loan, and income verification is a key component of this assessment.

Title loans, akin to other financial products, are subject to responsible lending practices. Lenders have an obligation to ensure that borrowers have the financial means to repay the loan without causing undue financial hardship. By requesting proof of income, lenders can evaluate the borrower’s income stability, debt-to-income ratio, and overall financial situation.

The income requirement serves several purposes:

- Assessing Repayment Capacity: Proof of income allows lenders to determine whether the borrower has sufficient income to cover the loan payments, including principal, interest, and fees.

- Reducing Default Risk: By verifying income, lenders can mitigate the risk of default. Borrowers with stable and sufficient income are more likely to make timely payments and repay the loan in full.

- Complying with Regulations: Many states, including Illinois, have regulations that require lenders to assess a borrower’s ability to repay before approving a title loan. Proof of income is a key part of this assessment process.

In practical terms, borrowers can provide various forms of income verification, such as pay stubs, tax returns, or bank statements. Lenders may also consider alternative forms of income, such as self-employment income or government benefits.

Overall, the income requirement for title loans in Illinois is a crucial component of responsible lending. It helps to ensure that borrowers have the financial means to repay their loans, reduces the risk of default, and complies with regulatory requirements.

Identity requirements

In the context of title loans in Illinois, the requirement to provide proof of identity is of utmost importance. It serves as a fundamental component of responsible lending practices and plays a critical role in preventing fraud and ensuring the integrity of the loan process.

Title loans, like other financial transactions, necessitate the verification of the borrower’s identity to mitigate the risk of fraudulent activities. By requesting proof of identity, lenders can confirm that the individual applying for the loan is who they claim to be and that they are legally eligible to enter into a loan agreement.

The identity requirement serves several key purposes:

- Preventing Fraud: Proof of identity helps to prevent fraud by verifying that the person applying for the loan is the actual owner of the vehicle being used as collateral. This reduces the risk of identity theft and ensures that the loan is not being obtained fraudulently.

- Compliance with Regulations: Many states, including Illinois, have regulations that require lenders to verify the identity of borrowers before approving a title loan. This requirement helps to ensure compliance with anti-money laundering and other financial regulations.

- Protecting Lenders and Borrowers: Identity verification protects both lenders and borrowers by ensuring that the loan agreement is entered into between the correct parties. This helps to prevent disputes and legal complications down the road.

In practical terms, borrowers can provide various forms of proof of identity, such as a driver’s license, state ID card, or passport. Lenders may also request additional documentation, such as a utility bill or bank statement, to further verify the borrower’s identity and address.

Overall, the identity requirement for title loans in Illinois is a crucial component of responsible lending and fraud prevention. It helps to ensure the integrity of the loan process, protect lenders and borrowers, and comply with regulatory requirements.

Key Insights:

| Purpose | Significance |

|---|---|

| Preventing Fraud | Reduces the risk of identity theft and fraudulent loan applications. |

| Compliance with Regulations | Ensures compliance with anti-money laundering and other financial regulations. |

| Protecting Lenders and Borrowers | Prevents disputes and legal complications by verifying the identity of the parties involved in the loan agreement. |

Default

In the landscape of title loans in Illinois, the consequence of default looms large. Defaulting on a title loan carries a significant risk: the lender has the legal right to repossess your vehicle.

Title loans, by their very nature, are secured loans that use your vehicle’s title as collateral. This means that when you take out a title loan, you are essentially pledging your vehicle as security for the loan amount. The lender retains the title to your vehicle until the loan is fully repaid.

Defaulting on your loan occurs when you fail to make the required payments as agreed in the loan contract. This can happen for various reasons, such as loss of income, unexpected expenses, or financial mismanagement.

When a default occurs, the lender has the legal authority to repossess your vehicle. Repossession involves the lender taking physical possession of your vehicle, typically through a towing service. The lender can then sell the vehicle to recover the outstanding loan balance.

The prospect of losing your vehicle can be extremely stressful and have severe financial consequences. It can disrupt your daily routine, affect your ability to get to work or school, and damage your credit score.

Therefore, it is crucial for borrowers to carefully consider their financial situation before taking out a title loan. It is essential to ensure that you have the means to make the required payments on time to avoid the risk of default and potential repossession.

Key Insights:

Title loans are secured loans that use your vehicle’s title as collateral.

Defaulting on a title loan can result in the lender repossessing your vehicle.

Repossession can have significant financial and personal consequences.

Borrowers should carefully consider their financial situation before taking out a title loan to avoid the risk of default and repossession.

Alternatives

When considering title loans in Illinois, it is essential to be aware of the available alternatives. These alternatives offer different terms, interest rates, and repayment options, making it crucial to compare and choose the most suitable option for your financial situation.

-

Facet 1: Personal Loans

Personal loans are unsecured loans that do not require collateral. They offer fixed interest rates and monthly payments, making them a more predictable and stable option compared to title loans. Personal loans may have higher credit score requirements and stricter qualification criteria.

-

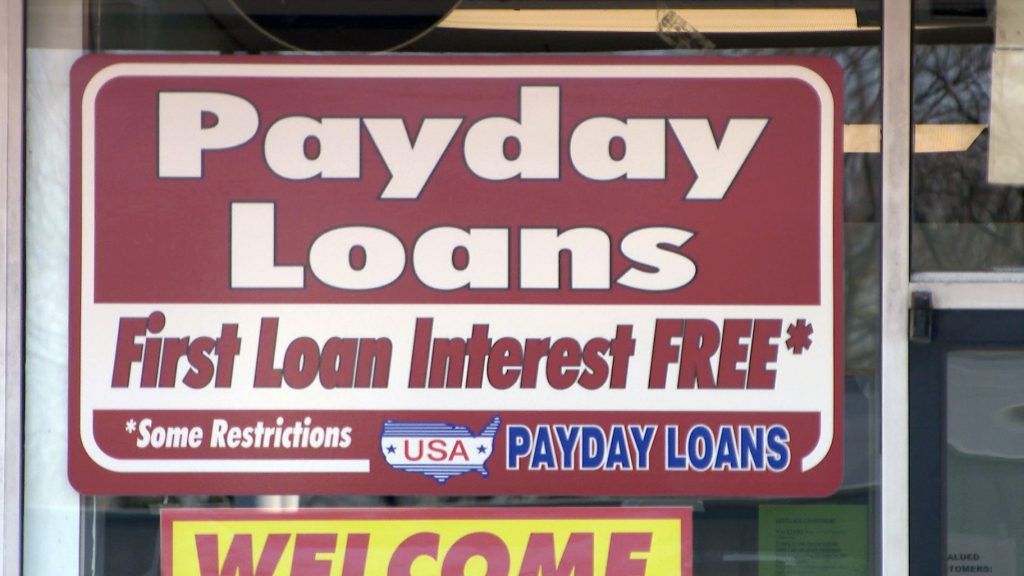

Facet 2: Payday Loans

Payday loans are short-term, high-interest loans designed to provide quick access to cash. They are typically due on your next payday and may have extremely high interest rates and fees. Payday loans should be considered a last resort due to their high cost and potential to trap borrowers in a cycle of debt.

-

Facet 3: Credit Cards

Credit cards allow you to borrow money up to a certain limit and repay it over time. They offer more flexibility than title loans and payday loans but may have high interest rates if you carry a balance. It’s important to use credit cards responsibly and pay off your balance in full each month to avoid accumulating debt.

Exploring these alternatives can help you make an informed decision about the best way to meet your financial needs. Title loans in Illinois may be a suitable option for some, but it is crucial to carefully consider the risks and compare it with other available options.

Title Loans in Illinois

This section addresses frequently asked questions to provide comprehensive information about title loans in Illinois.

Question 1: What is a title loan?

Answer: A title loan is a secured loan that uses your vehicle’s title as collateral. If you need cash quickly and have a vehicle that is paid off or has a low balance, a title loan may be an option for you.

Question 2: How much can I borrow with a title loan in Illinois?

Answer: The loan amount for title loans in Illinois typically ranges from $500 to $10,000, depending on the value of your vehicle and your ability to repay the loan.

Question 3: What are the requirements for a title loan in Illinois?

Answer: To qualify for a title loan in Illinois, you must have a vehicle that is paid off or has a low balance, proof of income, and proof of identity.

Question 4: What is the interest rate on a title loan in Illinois?

Answer: Interest rates on title loans in Illinois vary depending on the lender and your individual circumstances. It’s important to compare interest rates from multiple lenders to find the best deal.

Question 5: How long do I have to repay a title loan in Illinois?

Answer: The loan term for title loans in Illinois typically ranges from 15 to 30 days, but it can be longer if you make regular payments.

Question 6: What happens if I default on my title loan in Illinois?

Answer: If you default on your title loan in Illinois, the lender has the right to repossess your vehicle. It is important to carefully consider your financial situation before taking out a title loan to avoid the risk of default.

Summary: Title loans in Illinois can be a quick and convenient way to get cash, but it’s important to understand the terms and risks involved before taking out a loan. Be sure to compare interest rates and fees from multiple lenders, and only borrow what you can afford to repay.

Transition: For more information on title loans in Illinois, please visit our website or contact a local lender.

Title Loans in Illinois

Title loans can provide quick access to cash, but it’s crucial to approach them with caution and knowledge. Here are some valuable tips to consider:

Tip 1: Explore Alternatives:

Before resorting to a title loan, explore alternative funding options such as personal loans, credit cards, or payday loans. Compare interest rates, fees, and repayment terms to find the most suitable option for your financial situation.

Tip 2: Research Lenders:

Not all title loan lenders are created equal. Research and compare different lenders to find one with a reputable track record, competitive rates, and transparent terms. Read online reviews and check with the Better Business Bureau for any complaints.

Tip 3: Understand the Loan Terms:

Before signing a title loan agreement, thoroughly read and understand all the terms, including the loan amount, interest rate, repayment period, and any fees or penalties. Ensure you can comfortably meet the repayment obligations to avoid default.

Tip 4: Maintain Your Vehicle:

Your vehicle serves as collateral for the title loan. Regularly maintain your vehicle to preserve its value and avoid any issues that could affect your ability to repay the loan or lead to repossession.

Tip 5: Make Payments on Time:

Timely payments are crucial to avoid late fees and damage to your credit score. Set up automatic payments or reminders to ensure you never miss a due date. Consistent on-time payments will also help you build a positive payment history.

Tip 6: Repay the Loan Early:

If possible, prioritize repaying your title loan early to minimize the total interest you pay. Some lenders may offer incentives or discounts for early repayment. By paying off the loan sooner, you can regain full ownership of your vehicle and save money.

Tip 7: Avoid Multiple Title Loans:

Taking on multiple title loans can quickly lead to a debt spiral. Avoid taking out additional title loans to repay existing ones, as this can worsen your financial situation and increase the risk of losing your vehicle.

Summary: Title loans can be a helpful financial tool in emergencies, but it’s essential to proceed with caution and responsibility. By following these tips, you can make informed decisions, protect your vehicle, and manage your finances effectively.

Conclusion

Title loans in Illinois offer a quick and accessible way to secure financing, using a vehicle’s title as collateral. However, it is imperative to approach title loans with prudence and a thorough understanding of the terms and risks involved.

Exploring alternative funding options, researching reputable lenders, and carefully evaluating the loan agreement are crucial steps in making an informed decision. Timely payments, vehicle maintenance, and responsible financial management are essential for a successful title loan experience.

Title loans can be a valuable financial tool when utilized responsibly. By following the tips outlined in this article, you can navigate the process effectively, protect your vehicle, and meet your financial obligations.