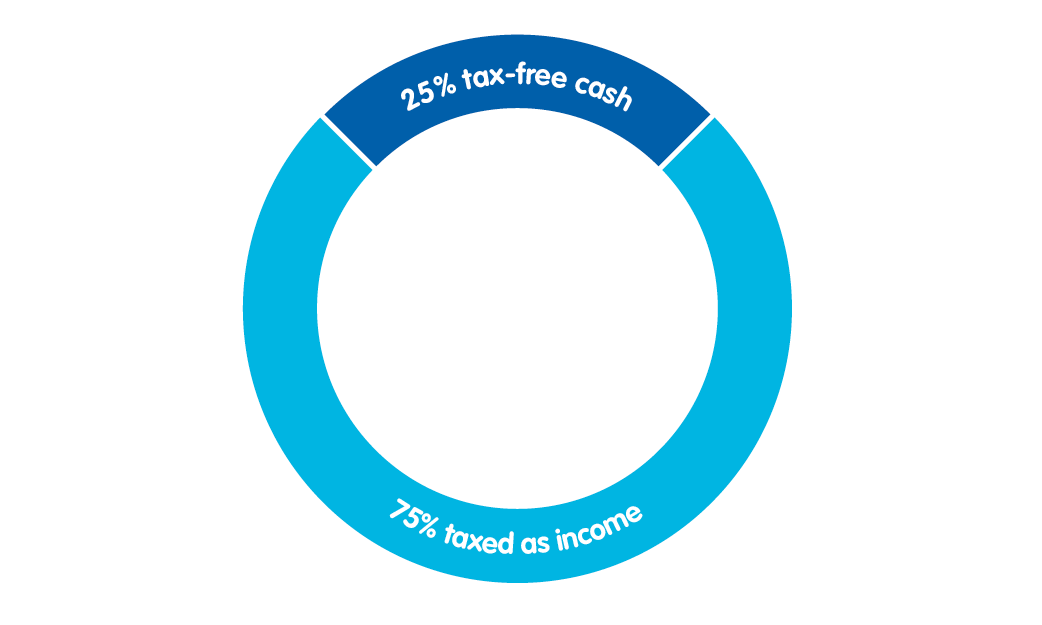

Relief at source is a way of giving tax relief on contributions a member makes to their pension scheme. Everybody is entitled to claim the basic 20.

Workplace Pension Contributions The Peoples Pension

So, if you earn £300 a week, and pay 5% (£15) in pension contributions, you will only pay tax on wages of £285.

People's pension higher rate tax relief. Pay £30,000 a year into a pension fund for 35 years and you will not be liable for tax at 55% if your investment return is zero, but pay in just £10,000 a year with an investment return of 10%. Prior to making the pension contribution, cynthia only had £9,730 of earnings subject to higher rate tax. Pension income is then taxed at point of withdrawal, opposite to the isa.

There is no relief from universal social charge (usc) or pay related social insurance (prsi) for employee pension contributions. There are two ways for higher rate tax relief to be claimed on a personal contribution to a personal pension: You should do this by filing a tax return.

When you earn more than £50,270 per year, you can claim an additional tax relief (either an extra 20% for higher rate taxpayers or 25% for additional rate taxpayers) to be added to your pension pot. The effective rate of tax relief is 35% (4,446/12,500 x100). You can get tax relief up to the relevant.

Basic rate taxpayers pay 20% income tax and get 20% pension tax relief; Intermediate rate taxpayers pay 21% income tax and can claim 21% pension tax relief; Tax relief for employee pension contributions is subject to two main limits:

You may be able to claim tax relief on pension contributions if: But with no higher rate relief, the teacher would end up with an actual tax. Top rate taxpayers pay 46% income tax.

See how much tax relief you could receive on your pension contributions this year. As the pension scheme provider gives basic rate tax relief at source, the member claims any higher rate and additional rate tax relief from hmrc. He said, ‘if [the rate is] set below 30 per cent, higher rate tax payers expecting to pay higher rate tax in retirement might find pension saving unattractive, undermining the success of automatic enrolment.’

The tax rules currently state that every £1,000 rise in pension payout is taxable as a £16,000 pension contribution. We then add to this the difference between the higher rates and basic rates on the income that being relieved. Your pension contributions are deducted from your salary by your employer before income tax is calculated on it, so you get relief on the amount immediately at your highest rate of tax.

Higher rate taxpayers may be entitled to further tax relief on personal contributions paid to their personal pension scheme. If your pension contributions have been deducted from net pay (after tax has been deducted) and you’re a higher rate taxpayer (eg paying 40% tax), you can claim your tax back in two ways: You pay income tax at a rate above 20% and your pension provider claims the first 20% for you (relief at source) your pension.

Currently tax relief on pension contributions is paid at the saver's marginal rate of income tax at the point of saving. Pension tax relief is 20% basic rate at source, but the basic rate on dividends is 7.5%. Call or write to hm revenue & customs if you don’t fill in a tax return.

Members will get tax relief, based on their residency status, at the relevant basic rate. According to royal london, these individuals are also risking higher tax bills by unwittingly exceeding their pension annual allowance, or by doing so and failing to report it on their tax return. Limits for tax relief on pension contributions.

If any of your employees are scottish taxpayers and they pay the scottish starter rate of income tax at 19%, we’ll still give them tax relief at 20% and hmrc won’t ask your employees to repay the difference. 20%, 40% and 45% tax relief is available on contributions.

Pension Tax Relief Cost Hits 42bn – Ftadvisercom

Pension Tax – Tax Relief Lifetime Allowance The Peoples Pension

Tax Relief On Additional Voluntary Contributions

Liberty Wealth Management

Could Higher-rate Pension Tax Relief Be Scrapped In The 2020 Budget

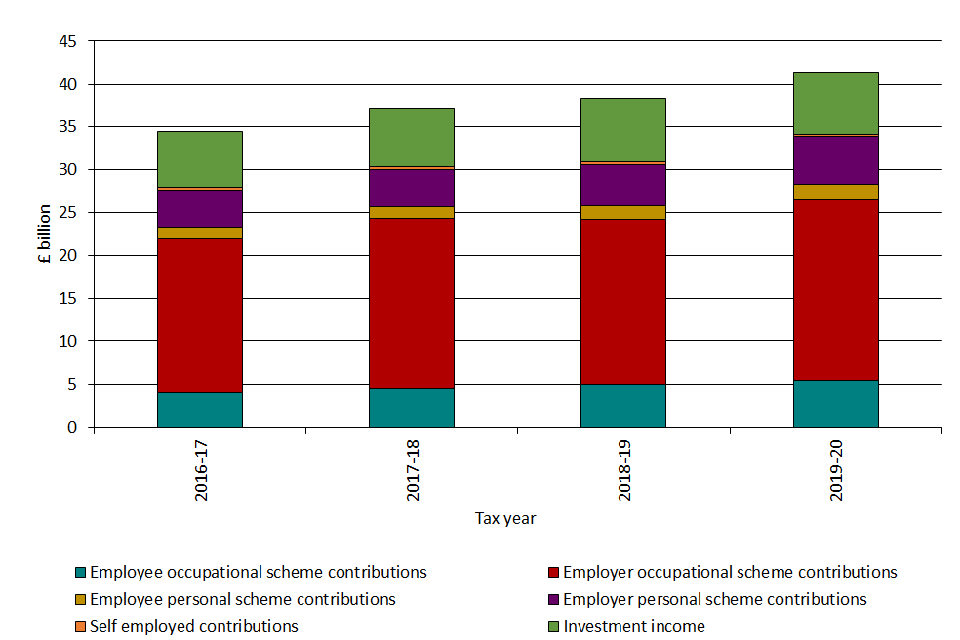

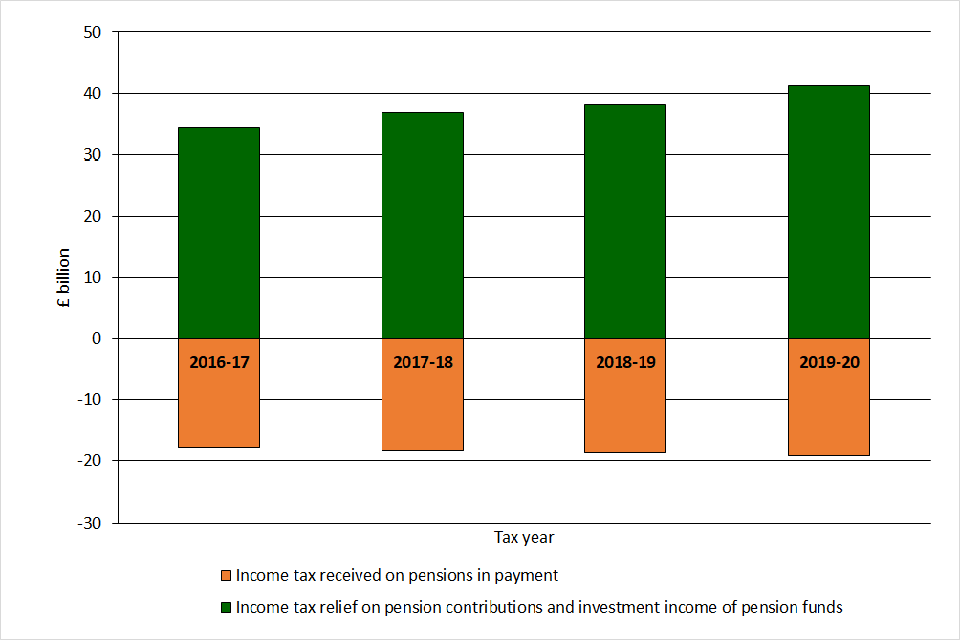

Commentary For Personal And Stakeholder Pension Statistics September 2021 – Govuk

Pensions Tax Relief Contributions Explained – Interactive Investor

Employee Tax Relief – Brightpay Documentation

How Do Pensions Work Moneybox Save And Invest

2

Commentary For Personal And Stakeholder Pension Statistics September 2021 – Govuk

How To Claim Higher Rate Tax Relief On Pension Contributions Unbiasedcouk

60 Tax Relief On Pension Contributions – Royal London For Advisers

Sipp Tax Relief Calculator Tax Relief On Pension Contributions

Prs Tax Relief Private Pension Administrator

Tax Relief On Pension Contributions For Higher Rate Taxpayers Taxassist Accountants

What Is Pension Tax Relief – Nerdwallet Uk

Pensions Tax Relief The Hidden Dangers Employers Need – Kpmg United Kingdom

How To Claim Higher-rate Tax Relief On Your Pension – Citywire