The first result should be jump to estimated taxes paid. File your annual tax return you’ve put in a good year’s work, and you’ve paid your estimated taxes—but april 15 is drawing

Shop Womens Plus Size Womens Plus Size Bella Rosa Maxi Dress – Ivory Jeulia Chicwish Ray Bans

Only break out your spouse’s estimated county tax if your spouse owes tax to a county other than yours.

Pay estimated indiana state taxes. Visit irs.gov/payments to view all the options. After a few seconds, you will be provided with a full breakdown of the tax you are paying. 60% of your 2019 tax, or 2.

Some states also require estimated quarterly taxes. Do i have to figure county tax? Using our indiana salary tax calculator.

There are several ways you can pay your indiana state taxes. Click on this link to go directly to the input screen for this topic. Check the irs' list of state's department.

Electronic funds transfer (eft) eft allows our business customers to quickly and securely pay their taxes. If you owe $1,000 or more in state and county tax that's not covered by withholding taxes, or if not enough tax was withheld, you need to be making estimated tax payments. Individual tax returns and payments, originally due by april 15, 2021, are now due on or before may 17, 2021.

Since the change in your tax situation is not expected to repeat during the current year, the estimated tax payments would not apply (they are not a requirement, just a suggestion based upon the current return). 100% of the tax shown on your 2018 tax return.; The indiana income tax has one tax bracket, with a maximum marginal income tax of 3.23% as of 2021.

If you have any unanswered questions regarding county tax, contact the department of revenue. This calculator is intended for use by u.s. A representative can research your tax liability using your social security number.

Indiana adjusted gross income tax Certain individuals are required to make estimated income tax payments. You will if, on january 1 of the year, you lived or worked in any indiana county.

For additional information, refer to publication 505, tax withholding and estimated tax. Estimated payments may also be made online through indiana's dorpay website. If you are an indiana taxpayer, review information bulletin #3 to learn more:

Get all of the tools that you need to manage your business efficiently with wix. Detailed indiana state income tax rates and brackets are available on this page. Get all of the tools that you need to manage your business efficiently with wix.

Those individuals will have an unpaid tax liability that is $1000 or more in any of the following tax types: Visit our website at www.in.gov/dor/4340 and follow the prompts for making an estimated tax payment. Unlike the federal income tax system , rates do not vary based on income level.

The aim of the tax reforms being to simply tax for average americans, reduce the tax burden for working families and make tax. Estimated payments may also be made online through indiana's dorpay website. Estimated indiana income tax due, enter the amount from line i on line 1, state tax due, at the top of the form.

The tax reform calculator is a sister site to the tax form calculator which has supported free tax return calculations and salary estimates since 2010.in 2017, donald trump, 45 th president of the united states announced plans for sweeping tax reforms. This means you may need to make two estimated tax payments each quarter: Get state quarterly tax info.

You may be required to make estimated payments to your state department of revenue. Click on the magnifying glass, type in estimated taxes paid, and hit enter. To use our indiana salary tax calculator, all you have to do is enter the necessary details and click on the calculate button.

One to the irs and one to your state. If you did make estimated tax payments, either they were not paid on time or. Indiana has a flat state income tax rate of 3.23% for the 2020 tax year, which means that all indiana residents pay the same percentage of their income in state taxes.

No, you are not required to pay the estimated tax vouchers for 2017, which were generated to assist with tax planning and avoiding tax penalties for the current year. However, it doesn't calculate state estimated quarterly taxes. An individual may make estimated tax payments to reduce the amount that will be due when filing an income tax return.

To learn more about the eft program, please download and read the eft information guide. While some tax obligations must be paid with eft, several thousand businesses use the program for its speed and convenience. To pay by credit card, you may make an estimated tax payment online.

This breakdown will include how much income tax you are paying, state taxes, federal taxes, and many other costs. If the amount on line i also includes estimated county tax, enter the portion on lines 2 and/or 3 at the top of the form. You'll figure your county tax when you file your indiana individual income tax return.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Indiana Taxes Bill Pay – Login To Secureingov Payment Paying Bills Bills Paying

To Calculate Estimated Taxes For Business From Schedule You Must Combine Other Income Information With Business Tax Attorney Small Business Saving Attorneys

Paycheck Calculator – Take Home Pay Calculator

Quarterly Tax Calculator – Calculate Estimated Taxes

Apply My Tax Refund To Next Years Taxes Hr Block

Dor Stages Of Collection

Calculate Estimated Tax Penalties Easily

Quarterly Tax Calculator – Calculate Estimated Taxes

Business Taxes Annual V Quarterly Filing For Small Businesses – Synovus

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Dor Keep An Eye Out For Estimated Tax Payments

Sample Tax Specialist Resume Resume Summary Resume Examples Resume

State Returns – Estimated Tax Vouchers Direct Debit

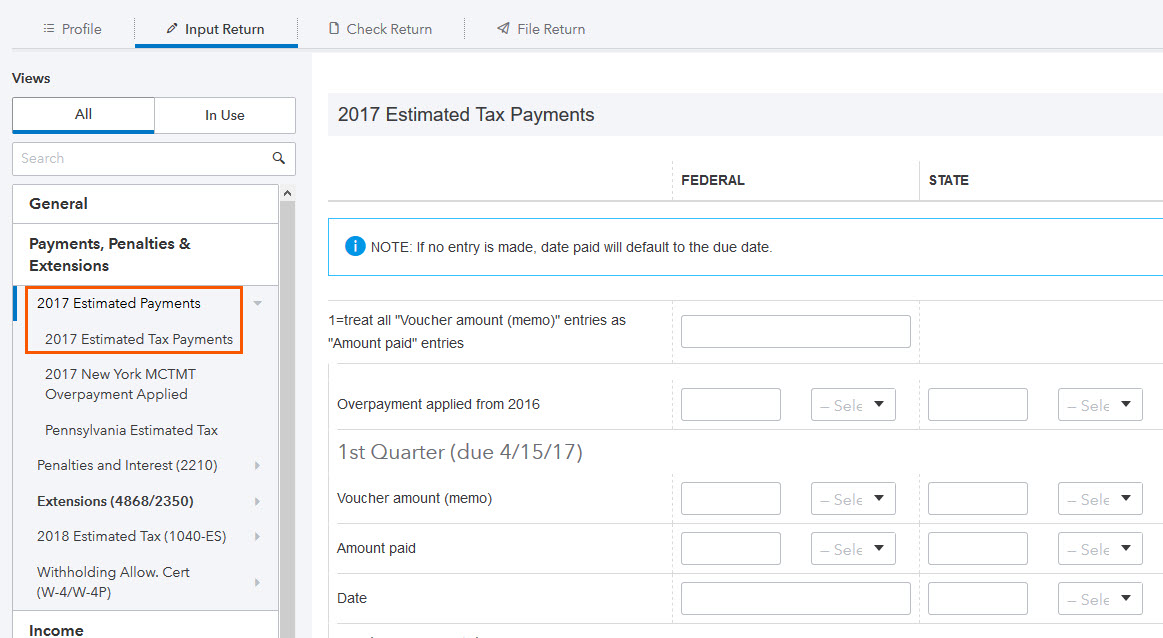

How Do I Enter Estimated Tax Payments In Proconnec – Intuit Accountants Community

Heres How Much Youll Save In Taxes With An S Corp

Here Are Key Tax Due Dates If You Are Self-employed Forbes Advisor

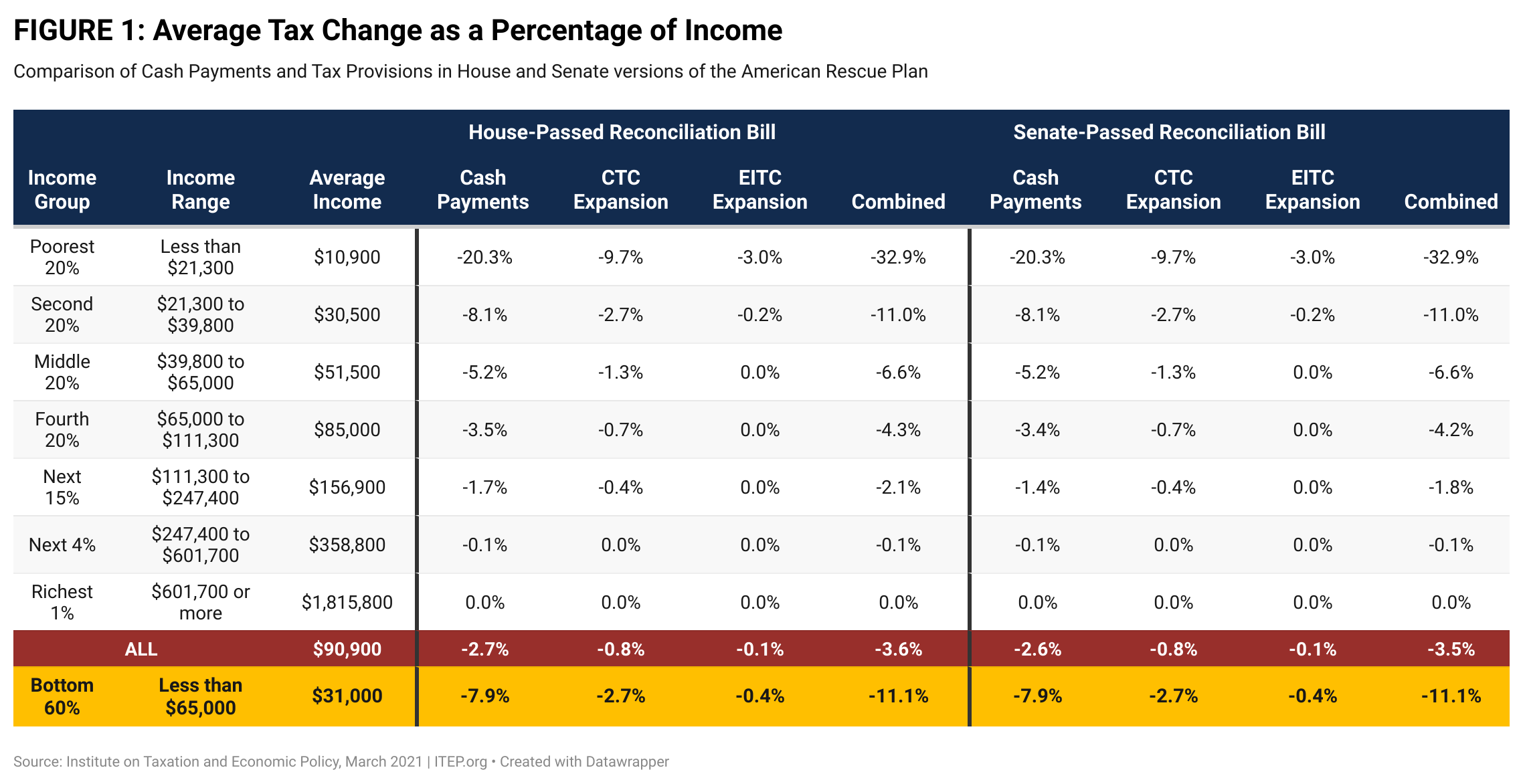

Estimates Of Cash Payment And Tax Credit Provisions In American Rescue Plan Itep

After The Retail Apocalypse Prepare For The Property Tax Meltdown Meltdowns Property Tax Tax Lawyer

Quarterly Tax Payment For Doordash Grubhub Drivers – Entrecourier