Then you may complete a local services tax refund application with acceptable proof of payments. Application for refund from local services tax

Do You Need To File A Tax Return In 2018

No refund will be paid unless the refund amount owed is more than $1.

Pa local services tax refund application. ~ a copy of this application for arefund of the local services tax (lst), and all necessary supporting documents, must be completed and presented tothe tax office charged with collecting the local services tax. For more information on mypath, visit revenue.pa.gov/mypathinformation. If the enacted lst rate exceeds $10, the tax must be withheld on a prorated basis determined by the number of pay periods established by an employer for a calendar year.

Tax year > a copy of this application for a refund of the local services tax (lst), and all necessary supporting documents, must be completed and presented to the tax office charged with collecting the lst. ¾ this application for a refund of the local services tax must be signed and dated. Po box 559 • irwin pa 15642 form lst22r2.1 local services tax refund application name address city/state zip tax year ssn phone multiple employers income exemption for local services tax is $12,000 or less from all sources of earned income and net profits, when the lst tax rate exceeds $10 per year.

Last updated october 21, 2021. Harrisburg is authorized to set the local services tax rate at $156 per year under the state financially distressed municipalities act, also known as act 47. ¾ a copy of this application for a refund of the local services tax (lst), and all necessary supporting documents, must be completed and presented to the tax office charged with collecting the local services tax.

On january 1 employee worked for an employer in municipality “a” who levies a flat $10 local services tax and paid $10. Application for refund from local services tax. The local services tax shall be deducted for the municipality or school district in which you are employed.

> no refund will be approved until proper documents have been received. The pro rata share shall be determined by dividing the. ¾ this application for exemption.

Most often, quarterly filings and remittances can be made directly through the local tax collector’s website. ¾ a copy of this application for exemption from the local services tax (lst), and all necessary supporting documents, must be completed and presented to your employer and to the political subdivision levying the local services tax for the municipality or school district in which you are primarily employed. How and when is the tax deducted from my pay?

Check & complete where necessary, the item number below that pertains to your refund request. Exemption certificates and refund forms can be downloaded here. Taxpayer application for refund of local services tax (lst) january 1, 1970.

Alternatively, you may complete and submit a paper version of the employer’s quarterly earned income tax return form. ~ this application for arefund of the local services tax must be signed and dated. Application for refund from local services tax a copy of this application for a refund of the local services tax (lst), and all necessary supporting documents, must be completed and presented to the tax office charged with collecting the local services.

Local income tax forms for individuals. Refer to schedule i on the back of this form The name of the tax is changed to the local services tax (lst).

Item number 5 often results in a refund of only the municipal portion of an lst. Tax year this application for a refund of the local services tax, and all necessary supporting documents, must be completed, signed, and presented to the bureau. Attach copy(s) of final pay statement(s) from employer(s).

A copy of this application for a refund of the local services tax (lst), and all necessary supporting documents, must be completed and presented to the tax office charged with collecting the local services tax. ¾ no refund will be approved until proper. Political subdivisions that levy an lst at a rate that exceeds $10 must exempt from the tax taxpayers whose total earned income and net profits from all sources within the political.

Tax year _____ date filed _____ borough of churchill 2300 william penn highway, pittsburgh, pa 15235. In june the employee started a new This application for a refund of the local services tax must be signed and dated.

Local income tax forms for individuals. No refund will be approved until proper documentation has been received. Lst refund applications are available online at www.keystonecollects.com.

+ does harrisburg have the legal authority to raise the local services tax? No refund will be approved until proper documents have been received. Taxpayer application for exemption from local services tax (lst) january 1, 1970.

Create date april 29, 2019. Local services tax refund application. This application for a refund of the local services tax must be signed and dated.

Mypath functionality will include services for filing and paying personal income tax, including remitting correspondence and documentation to the department electronically. > this application for a refund of the local services tax must be signed and dated. This is the date when the taxpayer is liable for the new tax rate.

Irs Tax Refund Delays Persist For Months For Some Americans – 6abc Philadelphia

California Tax Forms Hr Block

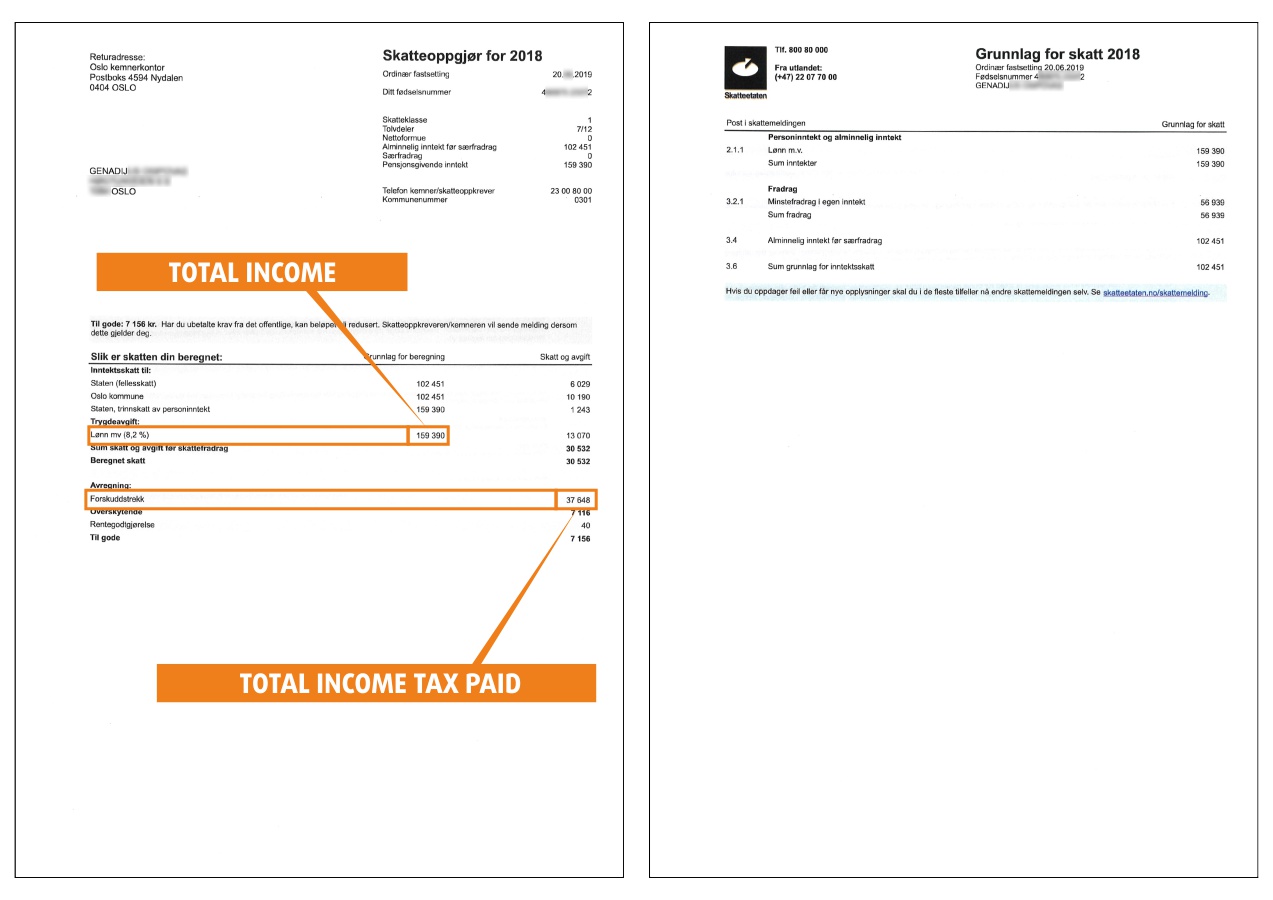

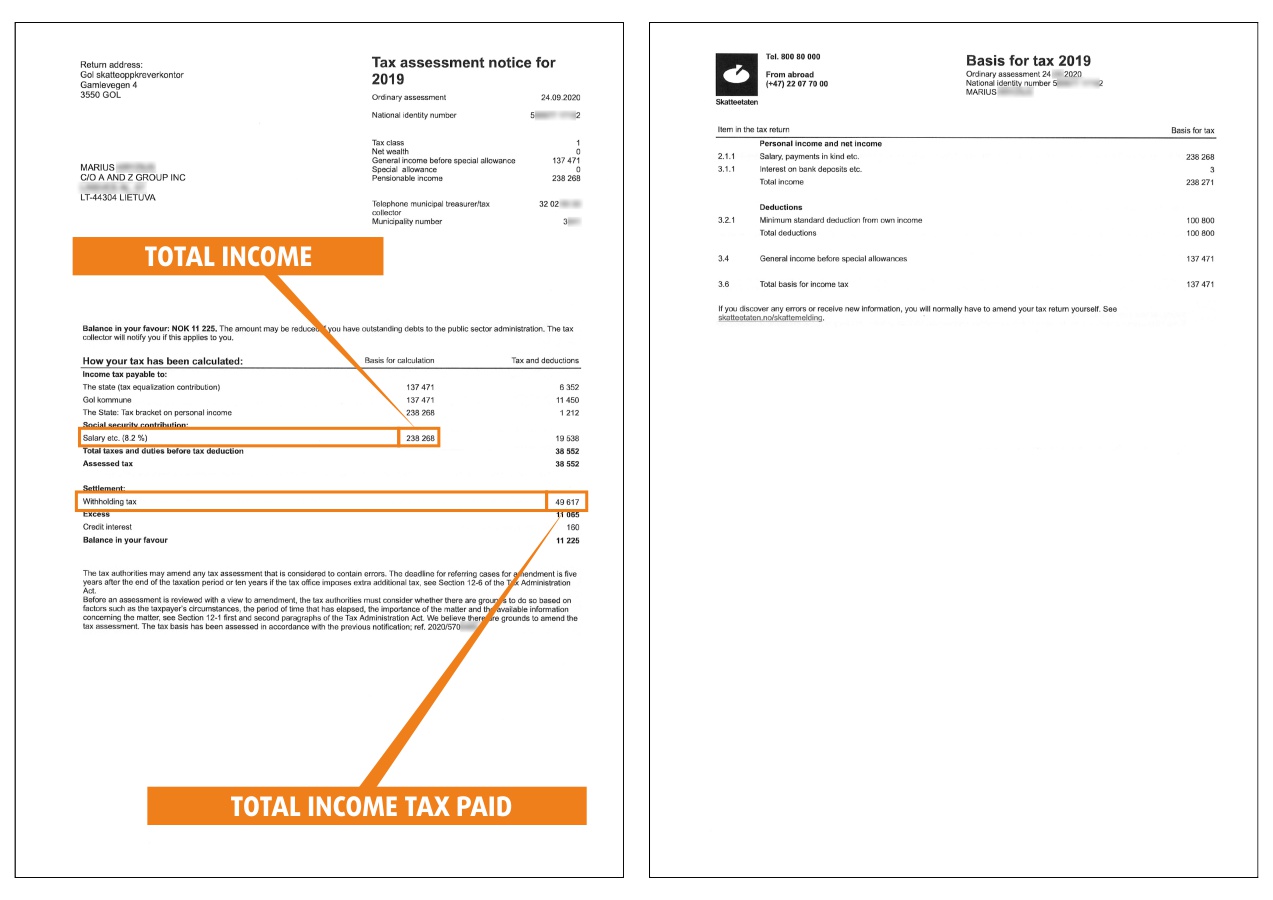

Quick Tax Refund If You Worked In Norway Rt Tax

Quick Tax Refund If You Worked In Norway Rt Tax

Best Tax Software For 2021 Turbotax Hr Block Jackson Hewitt And More Compared – Cnet

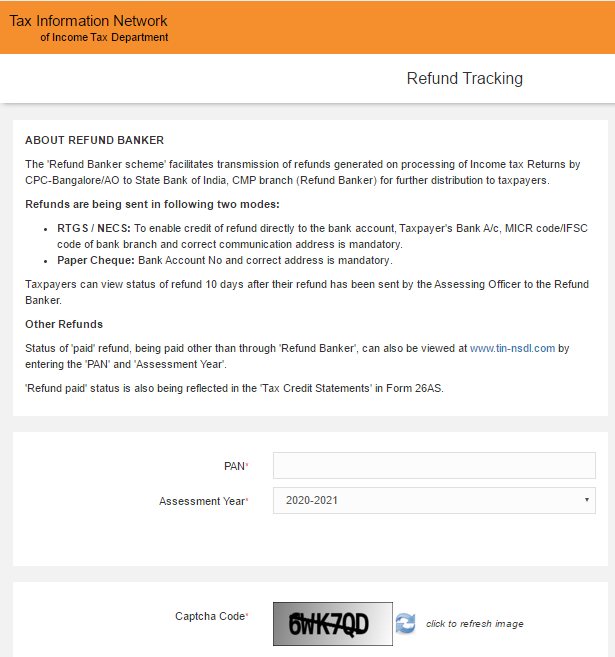

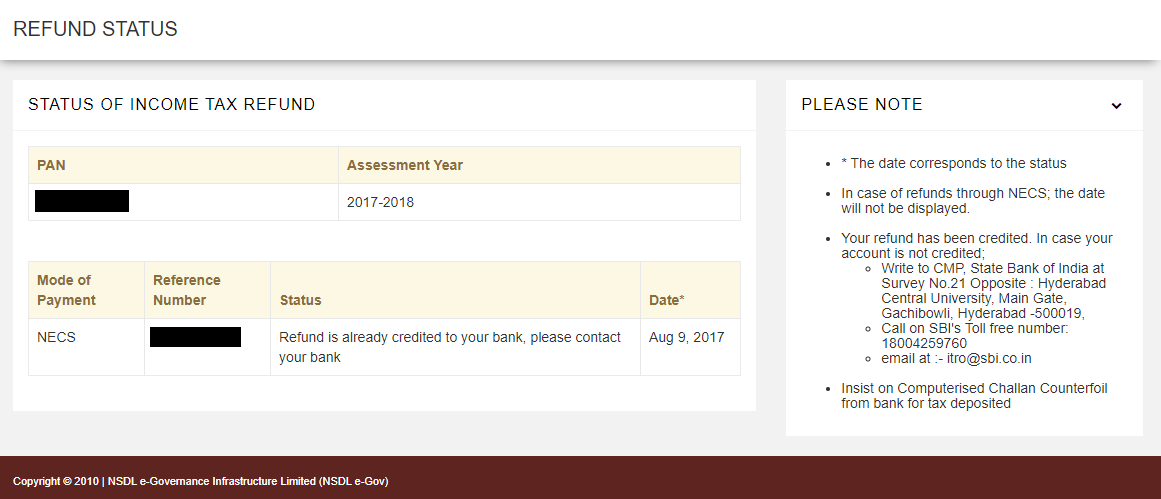

Income Tax Refund How To Check Claim Tds Refund Process Online

Will I Owe The Irs Tax On My Stimulus Payment Irs Taxes Tax Return Income Tax

The 2020 Tax Season Has Started Heres How You Can File Free And When To Expect A Refund Check Tax Return Tax Season Tax

Quick Tax Refund If You Worked In Norway Rt Tax

Where Is My Tax Refund How To Check The Status After Filing Your Return Pittsburgh Post-gazette

Missing Stimulus Payment But Arent Required To File Taxes Irs Says Youll Have To File This Year To Get That Money – Abc7 Chicago

Pin By Strategic Tax Resolution On Tax Problems Tax Questions Tax Services Life Insurance Facts

Unemployment Tax Refunds Irs Says Millions Will Receive One – Mahoning Matters

Income Tax Refund How To Check Claim Tds Refund Process Online

Quick Tax Refund If You Worked In Norway Rt Tax

Vatgst Refund Receipt Tax Refund Tax Free Tax Free Shopping

Still Waiting On Your Tax Refund Here Are Some Options For You Cbs 17

Faqs On Tax Returns And The Coronavirus

Quick Tax Refund If You Worked In Norway Rt Tax