Pennsylvania inheritance tax on assets passing to your brothers, sisters, nieces, nephews, friends and others. Of the probate, estates and fiduciaries code (title 20, chapter 64, pennsylvania consolidated statutes) sets forth the requirement of reporting to the department of.

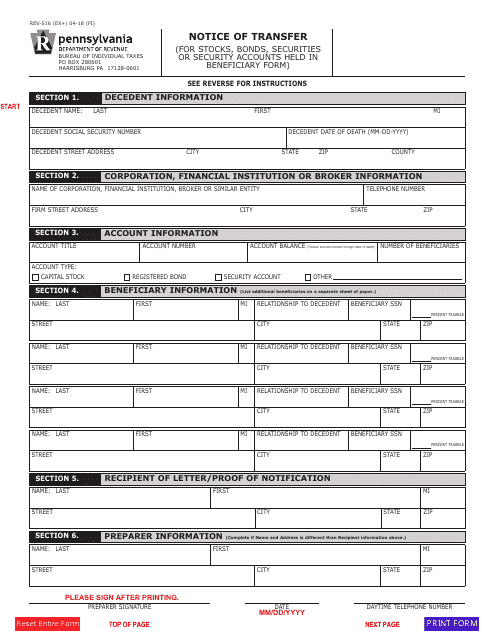

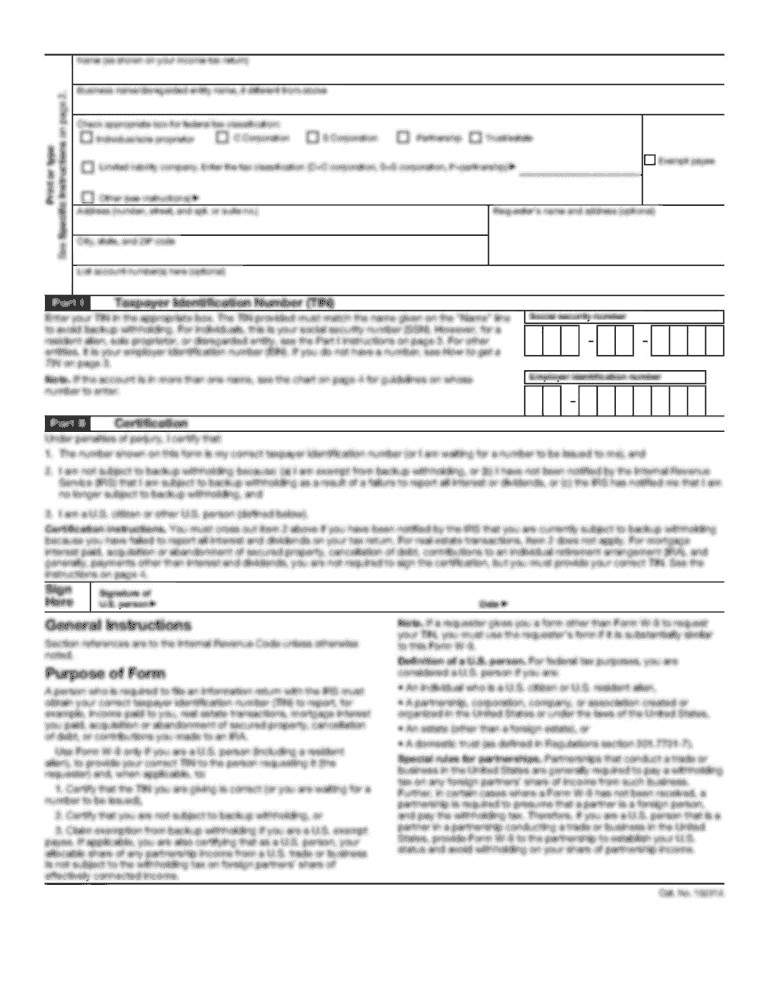

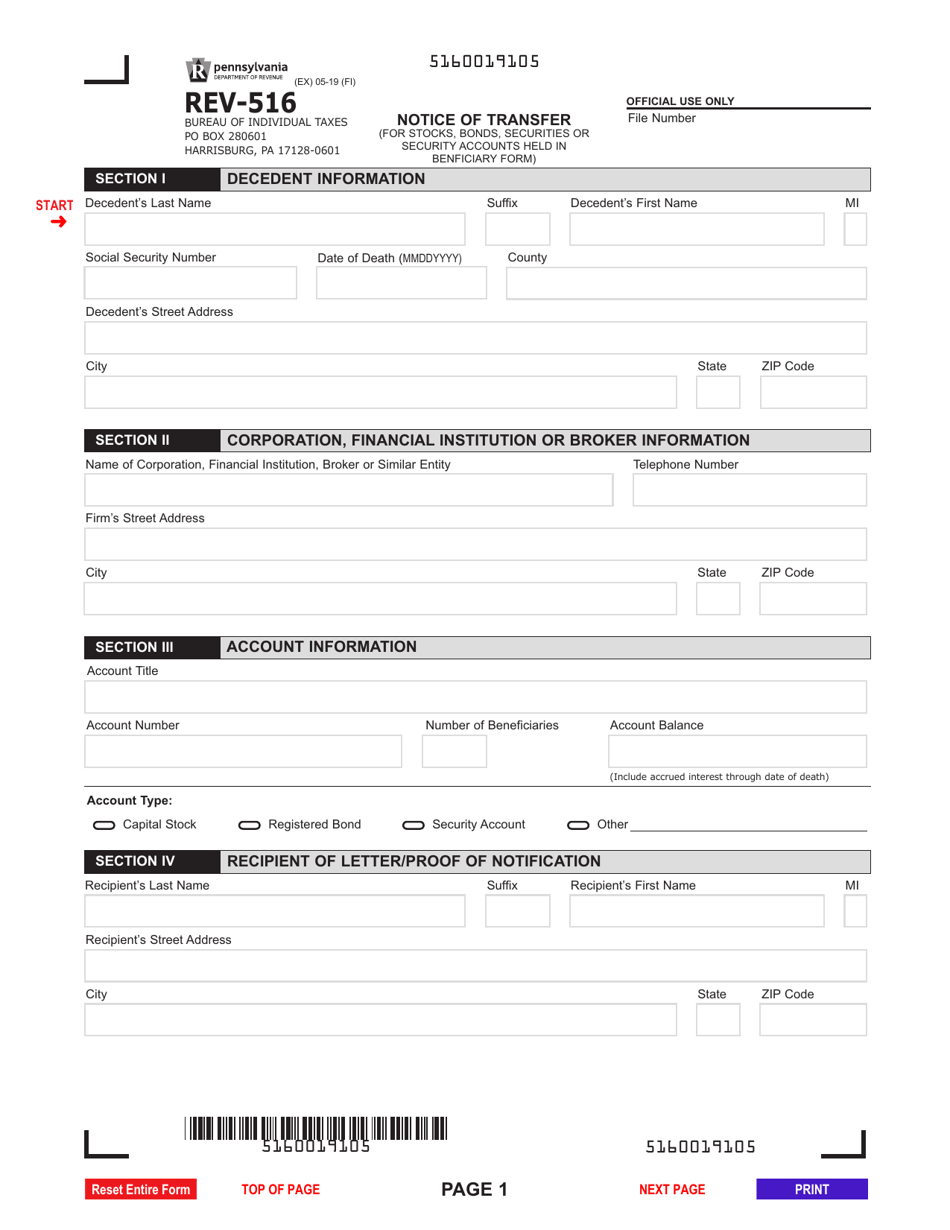

Form Rev-516 Request For Waiver Or Notice Of Transfer

After processing, you will receive a waiver letter granting the institution permission to transfer the asset to the beneficiary(ies).

Pa inheritance tax waiver form rev 516. Three beneficiaries will receive an equal 1/3 of their uncle's estate. (a) payment of inheritance tax. One waiver request must be submitted per asset.

Entities are required to report. Pennsylvania has an inheritance tax. To effectuate the waiver you must complete the pa form rev 516;

One waiver request must be submitted per asset. Revenue the transfer of securities. How can i obtain an inheritance tax waiver form that was requested by an investment company?

However, if you are the surviving spouse you or you have a tax clearance from the pit division that shows inheritance taxes have already been paid on this account, then you are not required to file this form. The estate includes a stock which will be transferred to the beneficiaries. After processing, you will receive a waiver letter granting the institution permission to transfer the asset to the beneficiary(ies).

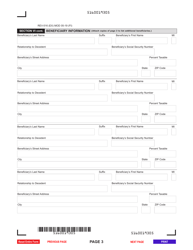

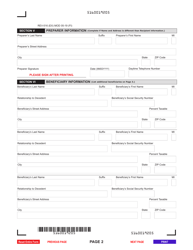

Possible, you may also receive a waiver/consent from the department of revenue prior to the transfer, or simply provide written notice of the transfer to the department within ten days of the transfer. Account will be filed on rev 1500 bill beneficiaries separately offoff beneficiary s social security number beneficiary s social security number decedent date of death (mm dd yyyy) first identifying number of asset official use only tax rate official use only tax rate. 868 best images about free templates on pinterest power this is per irs’s basic exemption of $5 million indexed for inflation in 2017.

Corporations, financial institutions, brokers, or similar. A new certificate for any share of its capital stock, its registered bonds, a security or a security account, belonging to or s tanding in. — no corporation, financial institution, broker or similar entity shall transfer on its books or issue.

To effectuate the waiver you must complete the pa form rev 516; Decedent street address city st a te zip county. Summary of pa inheritance tax • there is no pa gift tax • but gifts made within one year of death > $3,000 per calendar year are included in estate • if gifts are spread over two calendar years, you can get two $3,000 exclusions • cautions:

Instructions for filing this notice are on the reverse side. You do not need to draft another document. There is no estate or inheritance tax collected by the state.

Form Rev-516 Download Fillable Pdf Or Fill Online Notice Of Transfer For Stocks Bonds Securities Or Security Accounts Held In Beneficiary Form Pennsylvania Templateroller

2

Form Rev-516 Download Fillable Pdf Or Fill Online Notice Of Transfer For Stocks Bonds Securities Or Security Accounts Held In Beneficiary Form Pennsylvania Templateroller

Pa Inheritance Tax Waiver – Fill Online Printable Fillable Blank Pdffiller

Rev-516 – Request For Waiver Or Notice Of Transfer Free Download

Form Rev-516 Download Fillable Pdf Or Fill Online Notice Of Transfer For Stocks Bonds Securities Or Security Accounts Held In Beneficiary Form Pennsylvania Templateroller

Quickandeasycom

Form Rev-516 Download Fillable Pdf Or Fill Online Notice Of Transfer For Stocks Bonds Securities Or Security Accounts Held In Beneficiary Form Pennsylvania Templateroller

Rev-516 – Request For Waiver Or Notice Of Transfer Free Download

Pennsylvania Inheritance Tax – 39 Free Templates In Pdf Word Excel Download

Pennsylvania Inheritance Tax – 39 Free Templates In Pdf Word Excel Download

Rev-516 – Request For Waiver Or Notice Of Transfer Free Download

Pennsylvania Inheritance Tax – 39 Free Templates In Pdf Word Excel Download

Form Rev-516 Download Fillable Pdf Or Fill Online Notice Of Transfer For Stocks Bonds Securities Or Security Accounts Held In Beneficiary Form Pennsylvania Templateroller

Form Rev-516 Fillable Request For Waiver Or Notice Of Transfer For Stocks Bonds Securities Or Security Accounts Held In Beneficiary Form

Pa Inheritance Tax Waiver – Fill Online Printable Fillable Blank Pdffiller

Pa Inheritance Tax Waiver – Fill Online Printable Fillable Blank Pdffiller

Download Form Rev-516 – Formupack – Fill And Sign Printable Template Online Us Legal Forms

Form Rev-516 Download Fillable Pdf Or Fill Online Notice Of Transfer For Stocks Bonds Securities Or Security Accounts Held In Beneficiary Form Pennsylvania Templateroller