The connecticut estate and gift tax exemption amounts increased to $5.1 million effective january 1, 2020. The exemption amount will rise to $5.1 million in 2020, $7.1 million in 2021, $9.1 million in 2022, and is scheduled to match the federal amount in 2023.

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

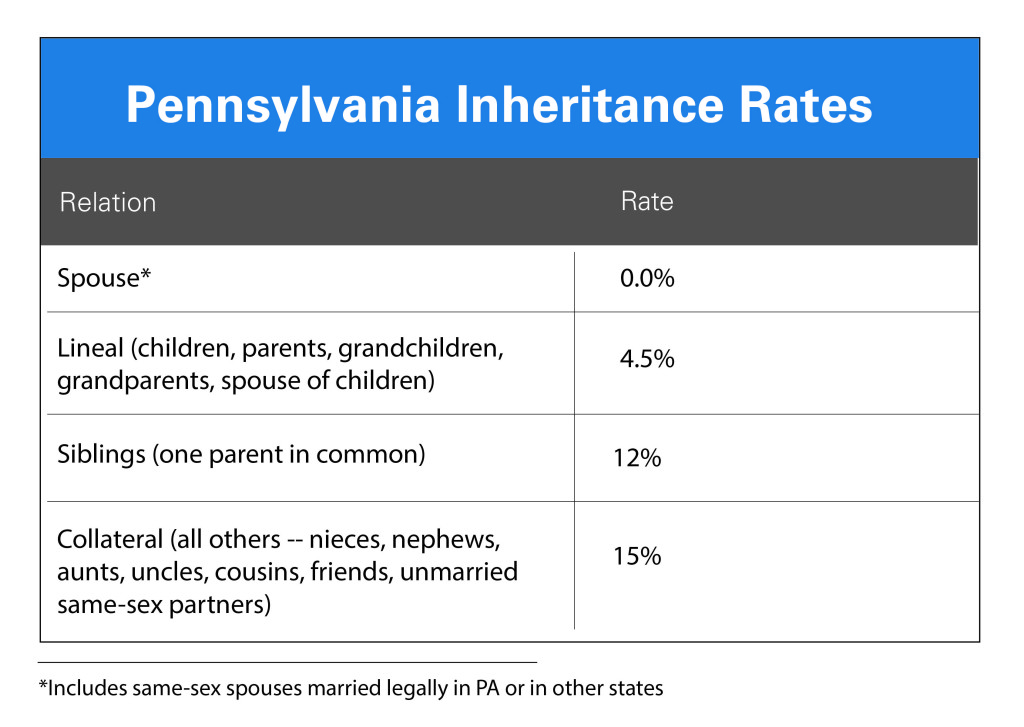

15 percent on transfers to other heirs, except charitable organizations, exempt institutions and government entities exempt from tax.

Pa estate tax exemption 2020. An estate tax exemption exists which affords you the opportunity to potentially avoid taxes. There is a 12% tax on transfers to siblings and a 15% tax on transfers to any other heir, with the exception of charitable organizations, exempt institutions and government entities that don’t pay tax. Gift splitting allows a married couple to split the costs of a gift made to an individual or organization.

Early filers should apply by september 13, 2020 to see approval reflected on your 2021 real estate tax bill. Philadelphia, pa 19115 real estate tax relief homestead final deadline to apply for the homestead exemption is december 1, 2020. $11.58 million exemption per person (an increase of $118,000) this is a combined federal gift and estate tax exemption limit.

If your estate exceeds the federal exemption amount you could face a huge liability. Pennsylvania imposes an inheritance tax on a decedent’s taxable estate. “these deductions shall be allowed only where a donor’s tax, or estate tax imposed under title iii of nirc was finally determined and paid by or on behalf of such donor, or the estate of such prior decedent, as the case may be, and only in the amount finally determined as the value of such property in determining the value of the gift, or the gross estate of such prior decedent, and only to the extent that the value of.

Starting in 2022, the exclusion amount will increase annually based on a cost of. The estate tax exclusion is $4,000,000 as of 2021, after the district chose to lower it from $5,762,400 in 2020. People that live in pennsylvania should know that pa is one of five states that tax individuals on death.

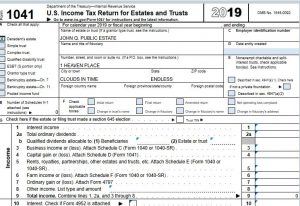

It consists of an accounting of everything you own or have certain interests in at the date of death ( refer to form 706 pdf (pdf)). Petition · upenn pay pilot taxes to philadelphia · change.org author cyberplayground posted on 07/20/2020 categories @k12newsletters , ecp educational cyberplayground , k12newsletters , nethappenings tags $29.6 billion of philly real estate is exempt from property taxes. The estate tax is a tax on your right to transfer property at your death.

The federal estate tax has been around in a variety of forms for decades. The tax applies to every dollar of the estate in excess of expenses and debts. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger;

If your estate is in the ballpark of the estate tax limits and you want to leave the maximum amount to your heirs, you’ll want to do some estate tax planning. The tax rate is dependent upon the relationship between the decedent. But just because you don’t have an issue at the state level does it mean that this can’t be a problem at the federal level.

If the total taxable value of your estate comes in under the federal estate tax exemption amount (which, according to the internal revenue service , is $11.58 million for 2020), then it. The top estate tax rate is 12 percent and is capped at $15 million (exemption threshold: The year 2018 is the first time since 2013 that the annual exclusion amount had to be increased.

The estate tax exemption for 2020 is $11.58 million, an increase from $11.4 million in 2019. There is no exemption nor is there an exclusion under which no tax will apply. $11.4 million exemption per person;

In 2018, connecticut enacted new legislation that extended the timeline for increases in the connecticut gift and estate tax exemption amounts. This essay will focus mainly on the pennsylvania inheritance tax because for most families the federal estate tax is not an issue, as it applies to only 1 in 700 deaths given its high exclusion. Citizen has an exemption of $11,580,000 against the federal estate tax and the federal gift tax.

The tax rate varies depending on the relationship of the heir to the decedent. The tax rates start out at zero between husband and wife, 4.5% for lineal descendants (your children), 12% for consanguinity (which are cousins, nieces and nephews), and 15% for people who are unrelated to you. However, the new tax plan increased that exemption to $11.18 million for tax year 2018, rising to $11.4 million for 2019, $11.58 million for 2020, and now $11.7 million for 2021.

The fair market value of these items is used, not necessarily what you paid for them or what their values were when you. Accordingly, if you gift away $5m, your remaining estate tax exemption would be $6.58m. With a few special exceptions the rates for pennsylvania inheritance tax are as follows:

Gift splitting is another option that can be utilized to avoid tax liability for giving a gift. Fortunately, pennsylvania does not have an estate tax. Property owned jointly between spouses is exempt from inheritance tax.

2

How To Minimize Or Avoid Pennsylvania Inheritance Tax Retirement Planning

5 Ways The Rich Can Avoid The Estate Tax – Smartasset

Estate Tax Exemptions 2020 – Fafinski Mark Johnson Pa

2020 Estate And Gift Taxes Offit Kurman

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

Virginia Estate Tax Everything You Need To Know – Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2017 Estate Tax Rates The Motley Fool

Thoughtful Gifting Part 1 Use It Or Lose It Now Could Be The Time To Use Your Gift And Estate Tax Exemption

Estate Gift Tax Considerations

Five Tax Planning Questions To Answer Before Year End

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Do I Need To Pay Inheritance Taxes Postic Bates Pc

Philadelphia Estate Planning Tax Probate Attorney Law Practice Limited To Business Corporation Law Tax Probate Estate Administration Wills Trusts – Estate And Trust Tax Return Preparation