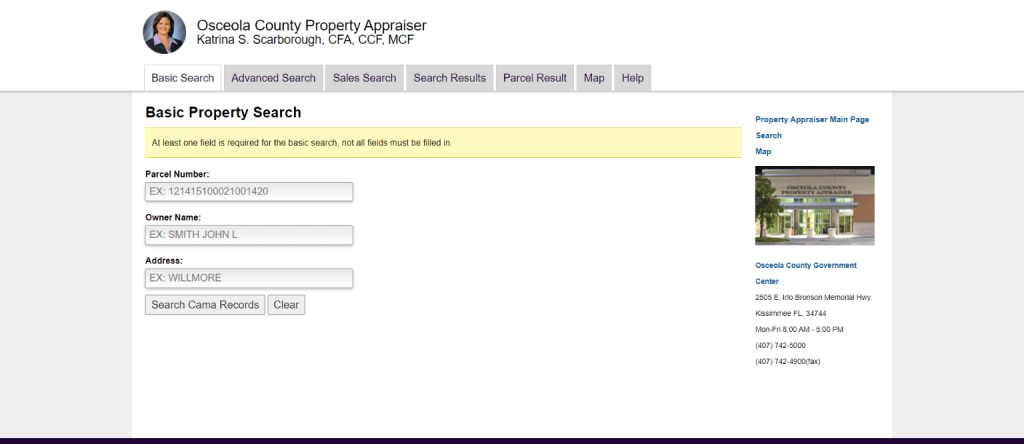

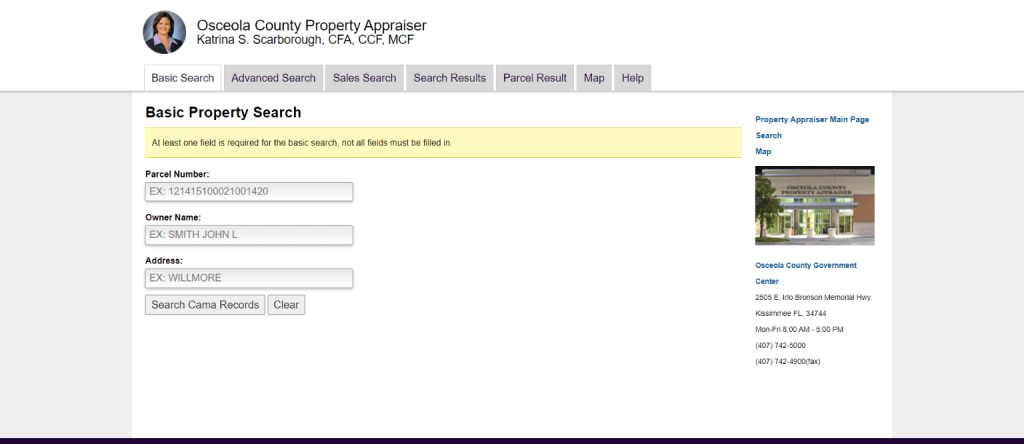

2.100% of assessed home value. Parcel number owner name address;

Osceola County Property Appraiser How To Check Your Propertys Value

This calculator can only provide you with a rough estimate of your tax liabilities based on the.

Osceola county property tax estimator. If purchasing new property within florida, taxes are estimated using a 20 mill tax rate. If the estimated tax is greater than $100.00, tangible personal property taxes may be paid quarterly. For more information, go to the tax roll/millages link on the homepage.

The following services are offered by the property appraiser's office. You can now access estimates on property taxes by local unit and school district, using 2019 millage rates. Osceola county property appraiser katrina s.

The median property tax on a $101,100.00 house is $1,637.82 in michigan. Osceola county collects, on average, 0.95% of a property's assessed fair market value as property tax. If you have questions you can reach us at:

Simply enter the sev (for future owners) or the taxable value (for current owners), and select your county from the drop down list provided. Parcel number owner name address; The median property tax (also known as real estate tax) in osceola county is $1,887.00 per year, based on a median home value of $199,200.00 and a median effective property tax rate of 0.95% of property value.

Osceola county, florida property search. 1300 9th street, suite 101b. The median property tax on a $199,200.00 house is $2,091.60 in the united states.

Tangible personal property tax is an ad valorem tax assessed against the furniture, fixtures, and equipment located in businesses and rental property. Search all services we offer. Property appraiser's office 2505 e irlo bronson memorial hwy kissimmee, fl 34744

Find osceola county home values, property tax payments (annual), property tax collections (total), and housing characteristics. Renew vehicle registration search and pay property tax search and pay business tax pay tourist tax edit business tax account run a business tax report run a real estate report get bills by email. The median property tax on a $101,100.00 house is $1,152.54 in osceola county.

Osceola county home & property tax statistics. Property taxes in brevard county are somewhat lower than state and national averages. The estimated tax range reflects the lowest to highest total millages for the taxing authority selected.

(annual) how your property taxes compare based on an assessed home value of $250,000. You will then be prompted to select your city, village or township along. Remember to have your property's tax id number or parcel number available when you call!

Osceola county has one of the highest median property taxes in the united states, and is ranked 516th of the 3143 counties in order of median property taxes. 4730 south orange blossom trail. The county’s average effective property tax rate comes in at 0.86%, with a median annual property tax bill of $1,534.

The median property tax on a $101,100.00 house is $1,061.55 in the united states. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in osceola county. Taxes become delinquent on april 1st each year, at which time.

Visit their website for more information. The median property tax (also known as real estate tax) in osceola county is $1,148.00 per year, based on a median home value of $101,100.00 and a median effective property tax rate of 1.14% of property value. 2.160% of assessed home value.

Base tax is calculated by multiplying the property's assessed value by the millage rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay. If you have not received your first notice by june 15, contact your county tax collector's office. 2521 shanti dr, kissimmee fl 34746.

Osceola county collects very high property taxes, and is among the top 25% of counties in the united states ranked by property tax collections. Osceola county collects relatively high property taxes, and is ranked in the top half of all counties in the united states by property tax collections. The median property tax in osceola county, florida is $1,887 per year for a home worth the median value of $199,200.

If the estimated tax is greater than $100.00, tangible personal property taxes may be paid quarterly. Therefore, the county’s average effective property tax rate is 0.86%. Renew vehicle registration search and pay property tax search and pay business tax pay tourist tax edit business tax account run a business tax report run a real estate report get bills by email.

The rates are expressed as millages (i.e. The tax collector will mail your first notice of payment due, with instructions. We use a market value range of 87.5% to 112.5% of the purchase price you enter.

“find us at one the following locations”.

Osceola-county Property Tax Records – Osceola-county Property Taxes Fl

Ayment Ptions – Osceola County Tax Collector

One Cent For Transportation

Property Search Osceola County Property Appraiser

2021 Best Places To Buy A House In Osceola County Fl – Niche

Property Tax By County Property Tax Calculator Rethority

Osceola County Property Appraiser How To Check Your Propertys Value

One Cent For Transportation

Osceola County Property Appraiser How To Check Your Propertys Value

School Board Meeting Agenda Packet – Osceola County

Property Search Osceola County Property Appraiser

Property Tax By County Property Tax Calculator Rethority

Property Appraiser

Osceola-county Property Tax Records – Osceola-county Property Taxes Fl

How To Pay Osceola County Tourist Tax For Vacation Rentals

Osceola County Property Appraisers Public Outreach Program

Distrito Escolar Del – Osceola County School District

Estimated Cost – Osceola County School District

Property Tax By County Property Tax Calculator Rethority