The only work around that i have found is to manually adjust the hours under the other payroll items section in the quantity column. Oregon lane transit district (ltd) rate increased to 0.72% from 0.71% effective 1/1/2017.

Solved I Do Not See The Oregon Transit Tax Or Unemployment Taxes Being Remitted By Quickbooks Do I Have To Remit These Myself

Quickbooks supports only 3 decimal places, so the rate has been rounded up to 0.714%.

Oregon wbf assessment quickbooks. The assessment is one part of the workers compensation insurance requirements. This is the total wbf assessment due for the year. (publication 367, oregon department of consumer & business services, revised october 18, 2019.) as we reported earlier, for the seventh consecutive year, the pure premium rate will decrease.

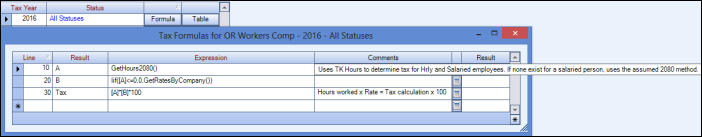

Qb incorrectly adds vacation hours and holiday hours to calculate this assessment. Wbf assessment for oregon is based on the number of hours that an employee works. Automate your vendor bills with ai, and sync your banks.

Effective january 1, 2017, the rate for the workers' benefit fund assessment (wbf assessment) will be changing. Ad generate clear dynamic statements and get your reports, the way you like them. This includes all employers with workers subject to oregon’s workers’ compensation laws (oregon revised statutes chapter 656).

Oregon wbf and suta items just need a select the items that will increase hours for this tax. I'm not looking for a workaround, i know the workarounds. Subtract box 12 from box 11.

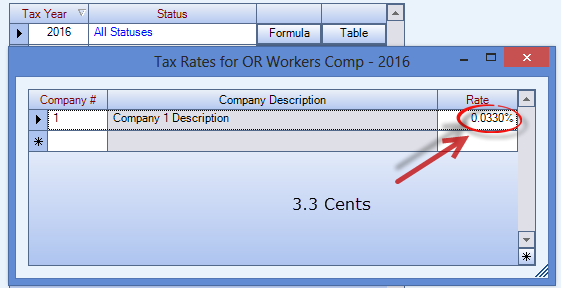

This article explains how to set up or change the or wbf in quickbooks desktop. Automate your vendor bills with ai, and sync your banks. For more information on the wbf assessment rate change (employer and employee) and the action required, please click here.

The purpose of the tax is to help fund programs in oregon to help injured workers and. (21901) oregon workers' benefit fund assessment (wbf assessment) employer and employee rates decreased to 2.4 cents per hour from 2.8 cents per hour effective 1/1/2019. Click the other tab and click the or wbf tax.

In 2021, this assessment is 2.2 cents per hour worked. 1, 2020, the tax rate is to be 2.2 cents an hour or part of an hour worked by each employee, down from 2.4 cents an hour in 2019, the department said on its website. The oregon workers´ benefit fund (wbf) assessment is a payroll tax calculated on the number of hours worked by all paid workers, owners, and officers covered by workers´ compensation insurance in oregon, and by all workers subject to oregon's workers´ compensation laws (whether or not covered by workers´ compensation insurance).

This amount should match the. If you are an oregon employer and carry workers’ compensation insurance, you must pay a payroll tax called the workers’ benefit fund (wbf) assessment for each employee covered under workers’ comp. Oregon transit tax does not appear as something for me to pay in pay liabilities (the wording is included quarterly as part of or ui, transit dist and wbf assessment but there is never any transit tax in there for me to pay.

For more information on the wbf assessment rate change (employer and. Each such employer must report and pay the wbf assessment. Oregon workers’ benefit fund assessment background.

In oregon, employers are required to pay and report the workers benefit fund (wbf) payroll assessment. Ad generate clear dynamic statements and get your reports, the way you like them. When will intuit provide a solution?

The oregon worker benefit fund (or wbf) is an hourly tracked other tax that is different from oregon workers compensation. The wbf assessment must not be confused with workers’ compensation insurance. Oregon lane transit district (ltd) rate increased to 0.74% from 0.73% effective 1/1/2019.

(21902) wage limit for state unemployment insurance (ui) increased to $40,600 from $39,300. We have qb premier edition 2018. The oregon department of consumer & business services announced the final 2020 workers' compensation rates, which match those proposed in september 2019.

Click the taxes button to display the federal, state and other tabs. Oregon lane transit district (ltd) rate increased to 0.72% from 0.71% effective 1/1/2017. This is the net wbf assessment due.

For more information on the wbf assessment rate change (employer and employee) and the action required, please click. The wbf assessment for all people on its payroll who are or legally should be covered by workers’ compensation insurance in oregon. Effective january 1, 2017, the rate for the workers' benefit fund assessment (wbf assessment) will be changing.

Workers’ benefit fund assessment (wbf): We can edit the payroll item through the employee center page. The oregon workers´ benefit fund (wbf) assessment is a payroll tax calculated on the number of hours worked by all paid workers, owners, and officers covered by workers´ compensation insurance in oregon, and by all workers subject to oregon's workers´ compensation laws (whether or not covered by workers´ compensation insurance).

They are two separate programs. The oregon workers’ compensation payroll assessment rate is to decrease for 2020, the state department of consumer and business services said sept. It is automatically added by payroll, but requires a manual entry of the worker's assessment rate for each employee and company rate.

It appears to be calculating correctly on employee paystub and in quarterly reports. The rate for the workers' benefit fund assessment (wbf assessment) will be changing. The edit employee window opens.

Quickbooks fails to provide a solution to correctly report wbf hours when there is a holiday and they have always failed on these two taxes as far as i know. Let me guide you how: From 0.7118% (rounded to 0.712% in quickbooks) effective 1/1/2013.

Oregon Statewide Transit Tax

How To Pay Employment Taxes Online Jobs Ecityworks

Oregon Statewide Transit Tax

Oregon Statewide Transit Tax

Oregon Statewide Transit Tax

Oregon Statewide Transit Tax

Oregon Workers Benefit Fund Payroll Tax

Oregon Workers Benefit Fund Payroll Tax

Or Dor Oqoa 2012-2021 – Fill Out Tax Template Online Us Legal Forms

Oregon Statewide Transit Tax

Oregon Statewide Transit Tax

Oregon Workers Benefit Fund Wbf Assessment

Oregon Statewide Transit Tax

Oregon Wbf

Payroll Liabilities Paid But Showing Up As Due In

Oregon Form 132 Export

Oregon Statewide Transit Tax

How To Set Up Workers Compensation – Pdf Free Download

Oregon Workers Benefit Fund Payroll Tax