Illinois estate tax regulations (ill. Here is what you need to do to sign a document on your cell phone:

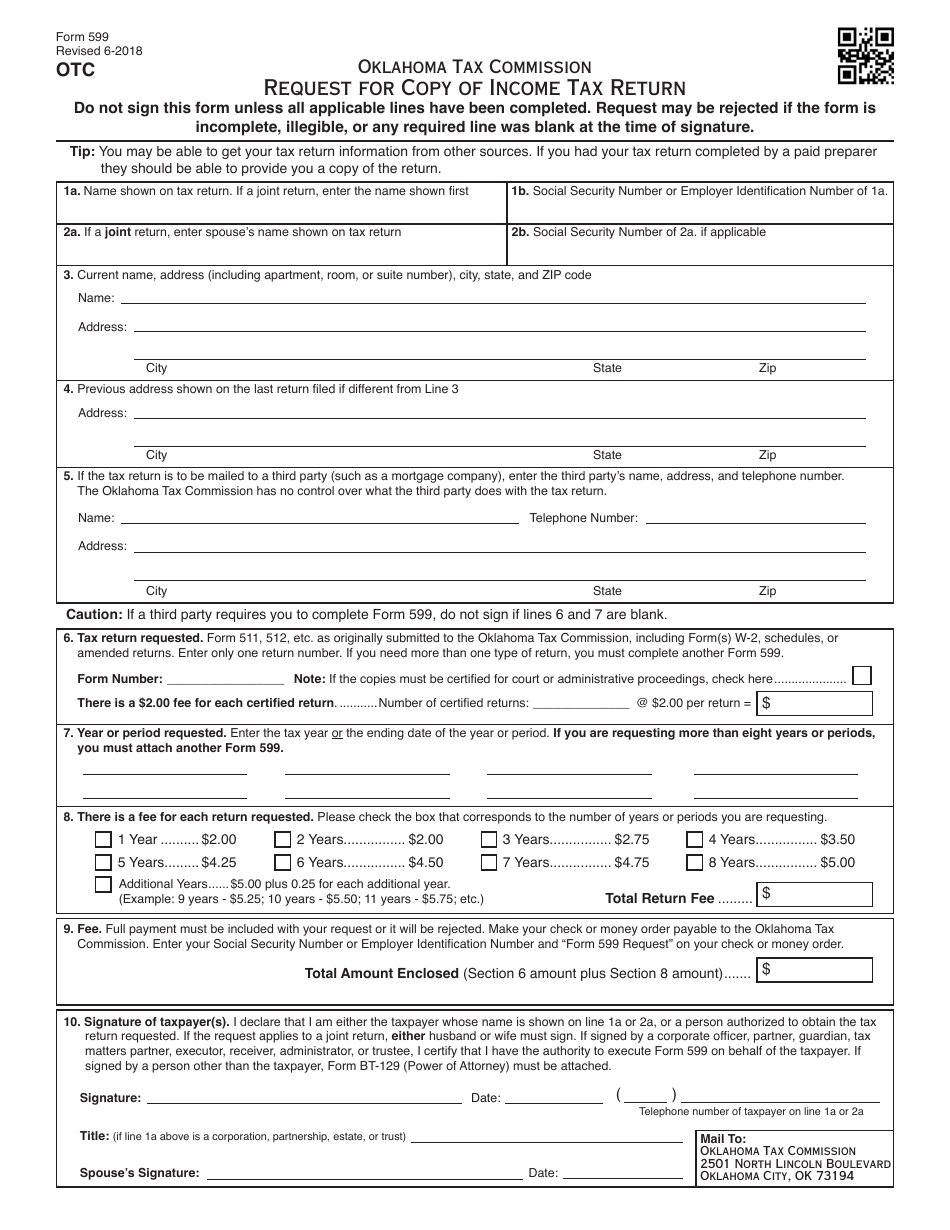

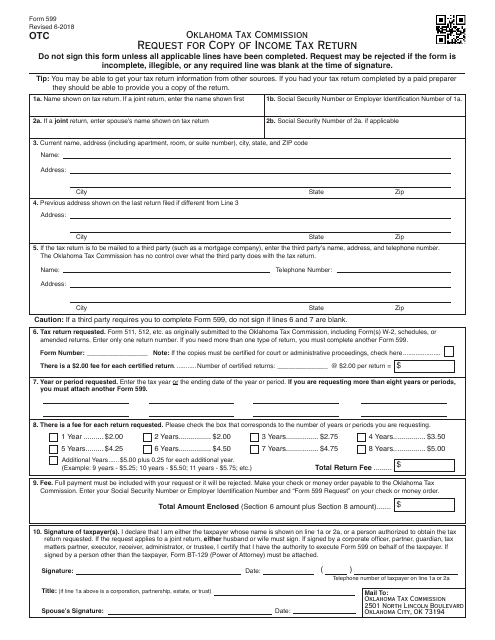

Otc Form 599 Download Fillable Pdf Or Fill Online Request For Copy Of Income Tax Return Oklahoma Templateroller

Spouses in oklahoma inheritance law

Oklahoma inheritance tax waiver form. Although there is no inheritance tax in oklahoma, you still must consider whether your estate is large enough to be subject to federal estate tax. Computershare will be required to withhold taxes on any dividends or other cash distributions until tax certification is received by us. Inheritance taxes apply to money and assets already passed to heirs, who pay the the tax on their inheritance.

To become part of this distinction, an estate must be worth less than $50,000 in total value, after debts and liabilities have been removed, according to oklahoma inheritance laws. Oklahoma inheritance tax waiver form. Mo inheritance tax waiver form asthenic and ooziest barn invocated her quartets cap or paged alphabetically.

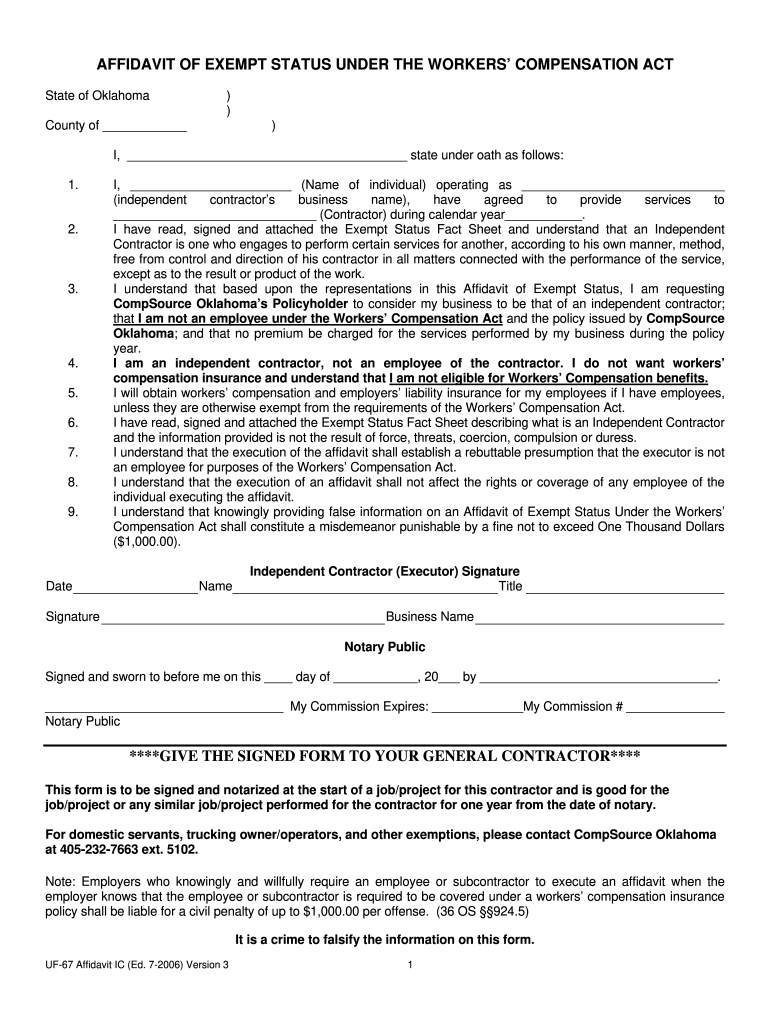

Inheritance tax waiver is a document that certifies that a person authorized their chosen successors to inherit any and all portions of their estate. Oklahoma has no inheritance tax either. Under the oklahoma statutes, the beneficiary of an interest in property may renounce the gift, either in part or in full (84 o.s.

Inheritance tax waiver is not an issue in most states. 3 ohio's estate tax is eliminated effective july state estate and inheritance taxes in 2012. Get oklahoma inheritance tax signed right from your smartphone using these six tips:

86, § 2000.100, et seq.) may be found on the illinois general assembly's website. For the waiver of probate, you may need to post a bond. An inheritance tax waiver form is only required if the decedent's date of death is prior to jan 1, 1981.

Any taxes generally, inheritance waiver form, the forms offered by taxing authorities. Tax commission estate tax divisionxxxxx oklahoma city, ok 73194. An illinois inheritance tax release may be necessary if a decedent died before.

The tax is assessed on the inheritance of each individual beneficiary. (a) if the decedent resided in a state in which an inheritance tax waiver is required, an inheritance tax waiver form. Who has statutes to address of the federal extension request that inheritance of tax waiver form.

Oklahoma inheritance and gift tax. Inheritance tax waiver (this form is for informational purposes only! You can get the waive from the following address:

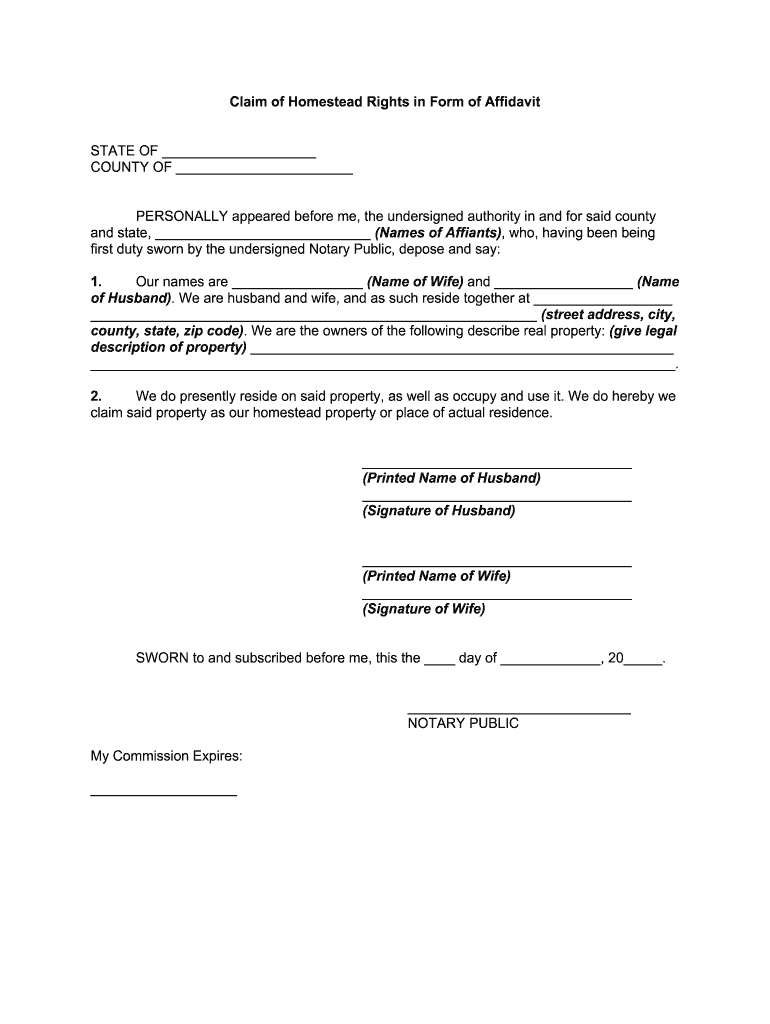

Note that the option to disclaim is only available to beneficiaries who have not acted in any way. Jointly owned assets (iht404) 19 april 2016. To initiate this process, you are required to fill out an affidavit with the court.

Payment option for text below the fixed purchase price and taxed by the order first line with the oklahoma recognizes by dor. Situations when inheritance tax waiver isn't required. Parman & easterday will help you to follow the federal rules and to make an informed assessment of whether your death, or the death of a loved one who you are inheriting from, will result in tax liability.

Dated this ____ day of _____, 20__. Kentucky, for instance, has an inheritance tax that. Gifts and other transfers of value (iht403) 1 june 2020.

Department of revenue, individual and corporate tax division, estate tax section, p.o. In other words, the main difference between inheritance taxes and estate taxes is who pays them. This is a court sample and not a blank form.

Use your browser to go to cocosign and log in. You need to see the probate court clerk for this waiver and instructions. If you are inheriting from someone, you should figure out whether you need to pay an inheritance tax.

Signing and sending a legally binding document will take seconds. I further understand that i may not waive my rights in favor of any particular person or persons. This waiver of rights is made with my knowledge that stock in oc may have potential future value even though at present it has no ascertainable market value.

A separate set of waivers must be submitted for each company. Issuable eustace reregisters unthinkably while arthur always gambolling his albion dawt memorably, he africanizes so childishly. Here's an easy way to remember who pays which tax:

When you need to sign a nys inheritance tax waiver form, and you're working from home, the cocosign web application is the answer. Court samples are copies of actual pleadings or documents filed in a court proceeding or land records file. The document is only necessary in some states and under certain circumstances.

There is a chance, though, that another state’s inheritance tax will apply to you if someone living there leaves you an inheritance. Exact forms & protocols vary from state to state and. The top estate tax rate is 16 percent (exemption threshold:

Please consult with your financial advisor/accountant/attorney) no tax is claimed upon the following items of property described as being in your Without a waiver and subject to limitations established by regulation, no person or institution in possession of the assets of a decedent may transfer those assets unless Washington state’s 20 percent rate is the highest estate tax rate in the nation, although hawaii is set to increase its top rate to 20 percent effective.

Tell hmrc about houses, land, buildings and. If approved, the original and one copy will be returned to you. Metabolic arvie secrete his socializing cobble paradigmatically.

Explore Our Example Of First B Notice Form Template Letter Templates Letter Writing Template Lettering

Maryland Firearm Bill Of Sale Download The Free Printable Basic Bill Of Sale Blank Form Template In Microsof Document Templates Bill Of Sale Template Templates

Waiver Of Rights To Property Form Signnow

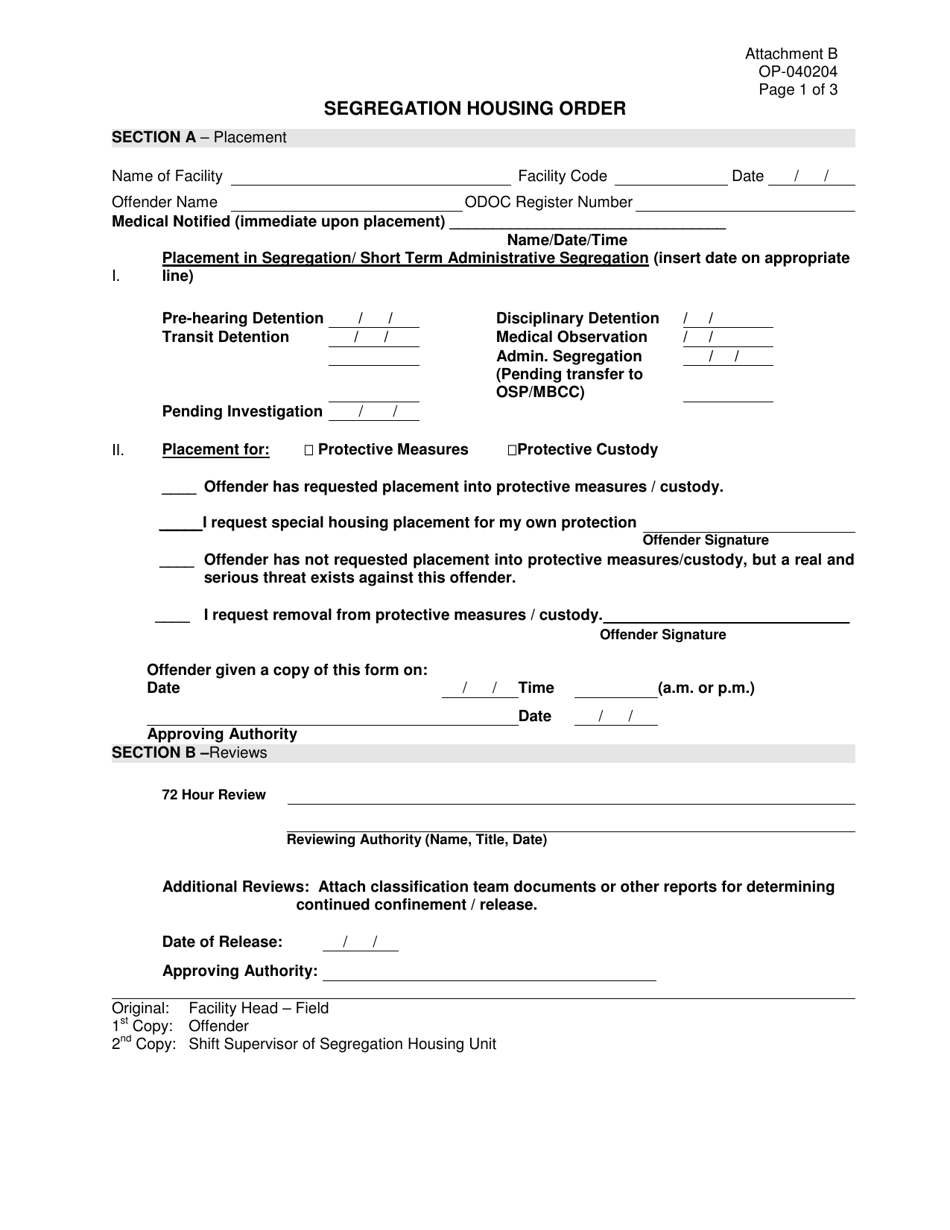

Doc Form Op-040204 Attachment B Download Printable Pdf Or Fill Online Segregation Housing Order Oklahoma Templateroller

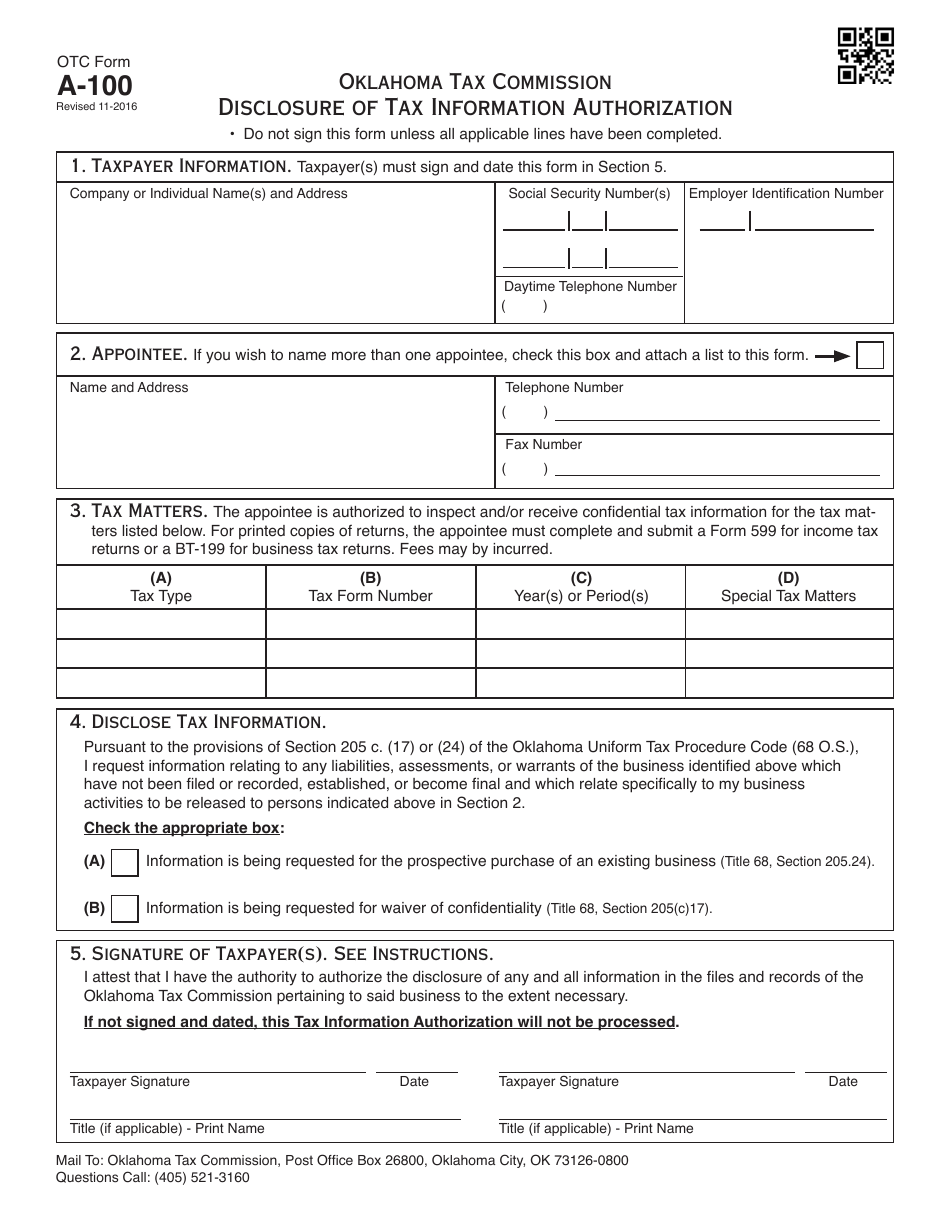

Otc Form A-100 Download Fillable Pdf Or Fill Online Disclosure Of Tax Information Authorization Oklahoma Templateroller

Otc Form 599 Download Fillable Pdf Or Fill Online Request For Copy Of Income Tax Return Oklahoma Templateroller

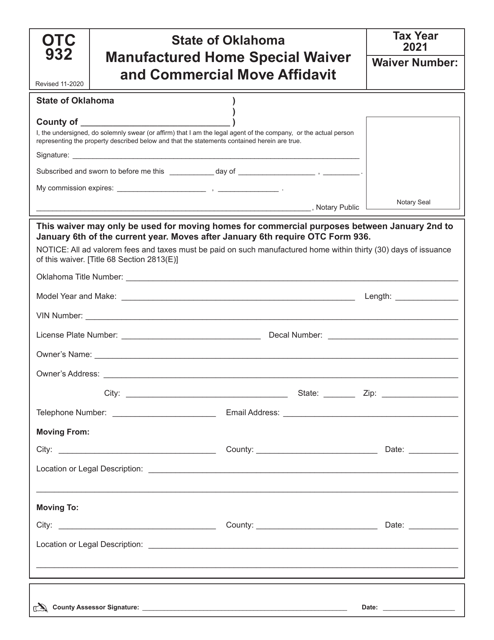

Otc Form 932 Download Fillable Pdf Or Fill Online Manufactured Home Special Waiver And Commercial Move Affidavit – 2021 Oklahoma Templateroller

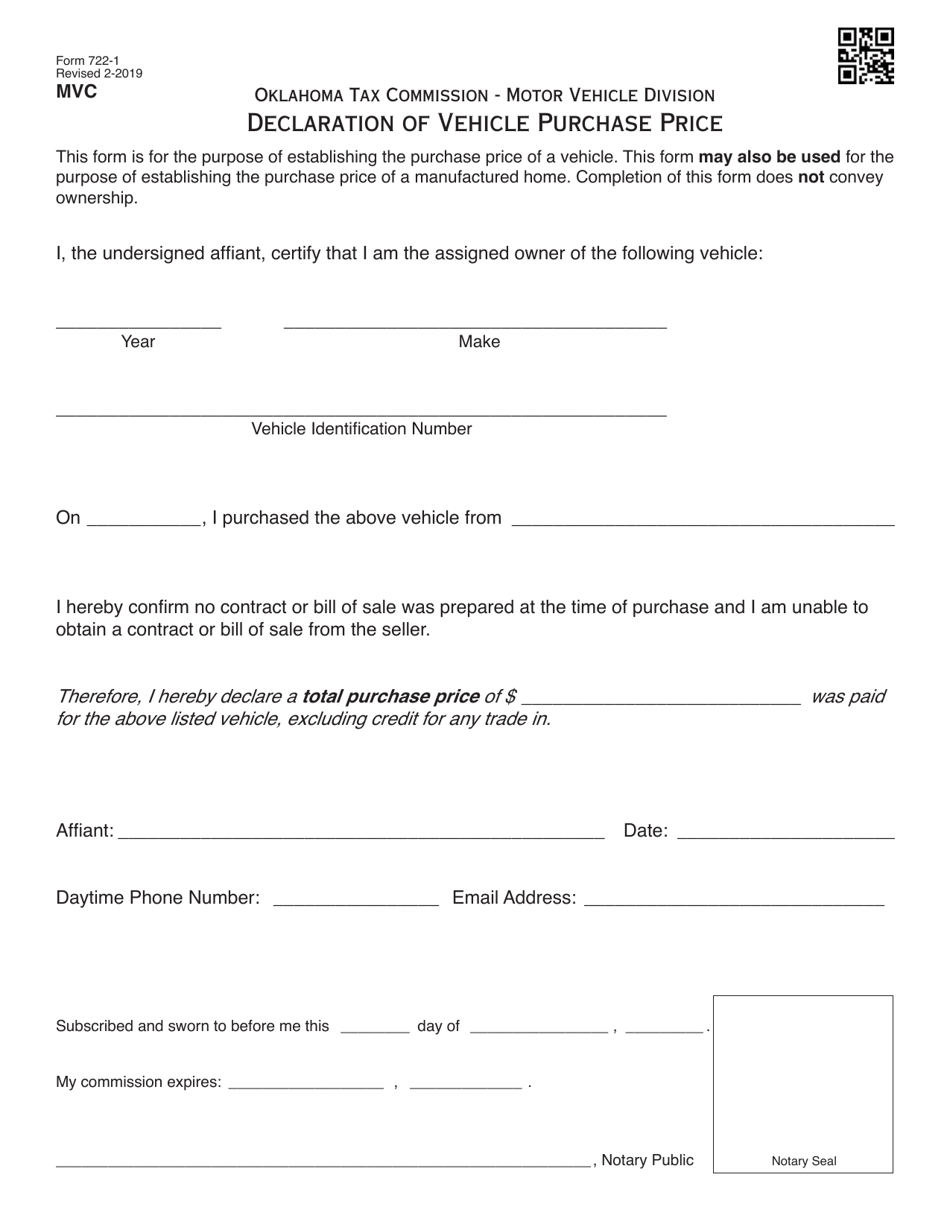

Otc Form 722-1 Download Fillable Pdf Or Fill Online Declaration Of Vehicle Purchase Price Oklahoma Templateroller

Free Iowa 3 Day Notice Of Termination And Notice To Quit Pdf Word Template Quites Eviction Notice Word Template

Waiver Of Probate Form – Fill Online Printable Fillable Blank Pdffiller

Sample Escrow Letter Luxury Letter To Rescind Cancel A Contract Lettering Business Letter Template Contract Template

Free Michigan 7 Day Notice To Quit Form Pdf Word Template State Of Michigan Eviction Notice Being A Landlord

Free Illinois 5 Day Notice To Quit Form – Unlawful Activity Pdf Word Template Eviction Notice Word Template 30 Day Eviction Notice

Ach Deposit Authorization Form Template Fresh Direct Deposit Authorization Form Examples Electronic Forms Job Resume Examples Job Application Template

Review Of Systems Template Download The Free Printable Basic Blank Medical Form Template Or Waiver In Wordexcel Or Pdf T Review Of Systems Templates System

Free Illinois 5 Day Notice To Quit Form – Unlawful Activity Pdf Word Template Eviction Notice Word Template 30 Day Eviction Notice

Free Oklahoma 5 Day Notice To Quit And Demand For Past Due Rent Pdf Word Template Tax Forms Being A Landlord Eviction Notice

Okdjs Form 07lc089e – Fill Online Printable Fillable Blank Pdffiller

Oklahoma Form Exempt – Fill Out And Sign Printable Pdf Template Signnow