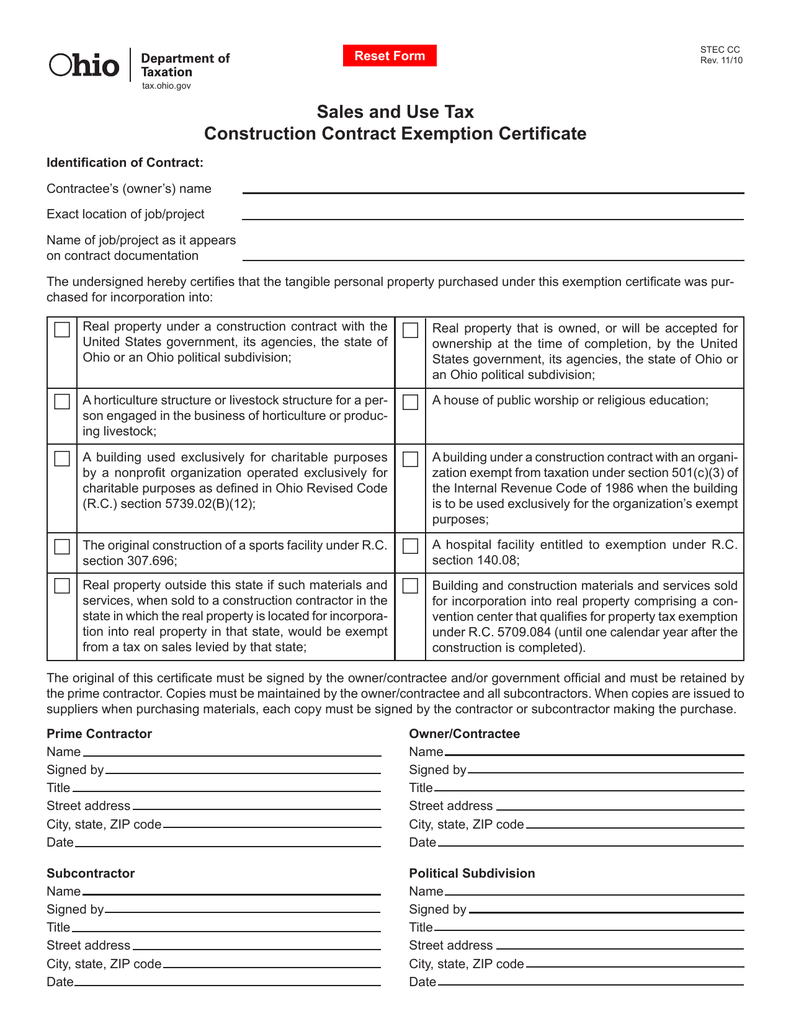

(j) forms required to be prescribed by rule are hereby prescribed for use as a construction contract exemption certificate and as a contractor's exemption certificate. “exemption” refers to retail sales not subject to the tax pursuant to division (b) of section 5739.02 ofthe revised code.

How To Get A Sales Tax Exemption Certificate In Ohio – Startingyourbusinesscom

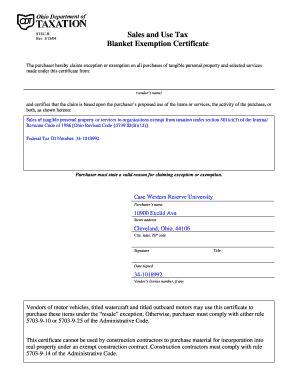

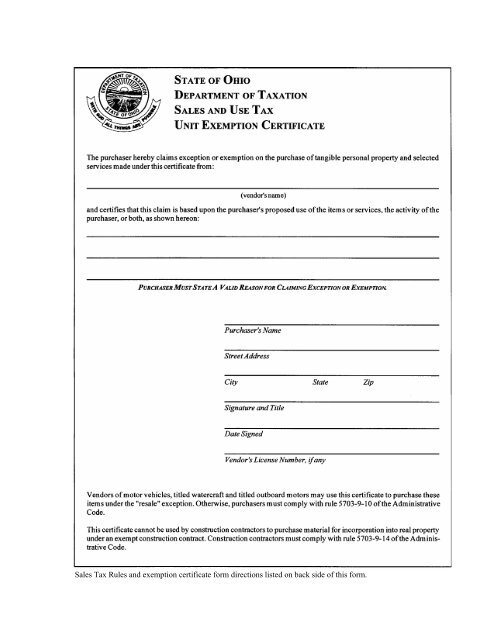

Sales and use tax blanket exemption certificate.

Ohio sales tax exemption form contractor. Sales exempted or excepted from sales and use tax (with ohio revised code references) ¾ tangible personal property to be resold in the form received. Incorporated into real property under the terms of a contract entered into with an exempt organization that has furnished (a) as used in this rule, “exception” refers to transactions excluded from the definition ofretail sale by division (e) of section 5739.01 of the revised code.

Printing and scanning is no longer the best way to manage documents. Ohio sales and use tax information. (j) forms required to be prescribed by rule are hereby prescribed for use as a construction contract exemption certificate and as a contractor's exemption certificate.

Handy tips for filling out ohio sales tax exemption certificate 2021 online. The contractee’s exemption does not apply to the contractor’s tools, equipment, rentals of personal property, form. A recent ohio ninth district court of appeals’ decision in karvo paving co.

Effective october 22, 2019, sales and installation of computer cabling are exempt from ohio sales and use tax but the contractor owes use tax on. Ad download our contractor contract & all 2000+ essential business and legal templates. The forms may be obtained from the department of taxation and are available on the department's web site.

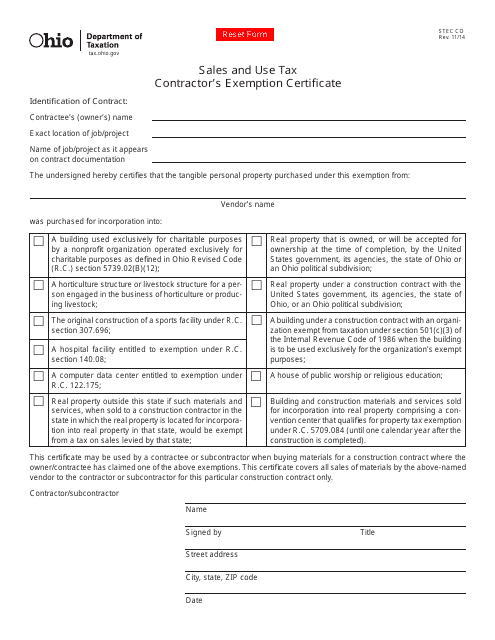

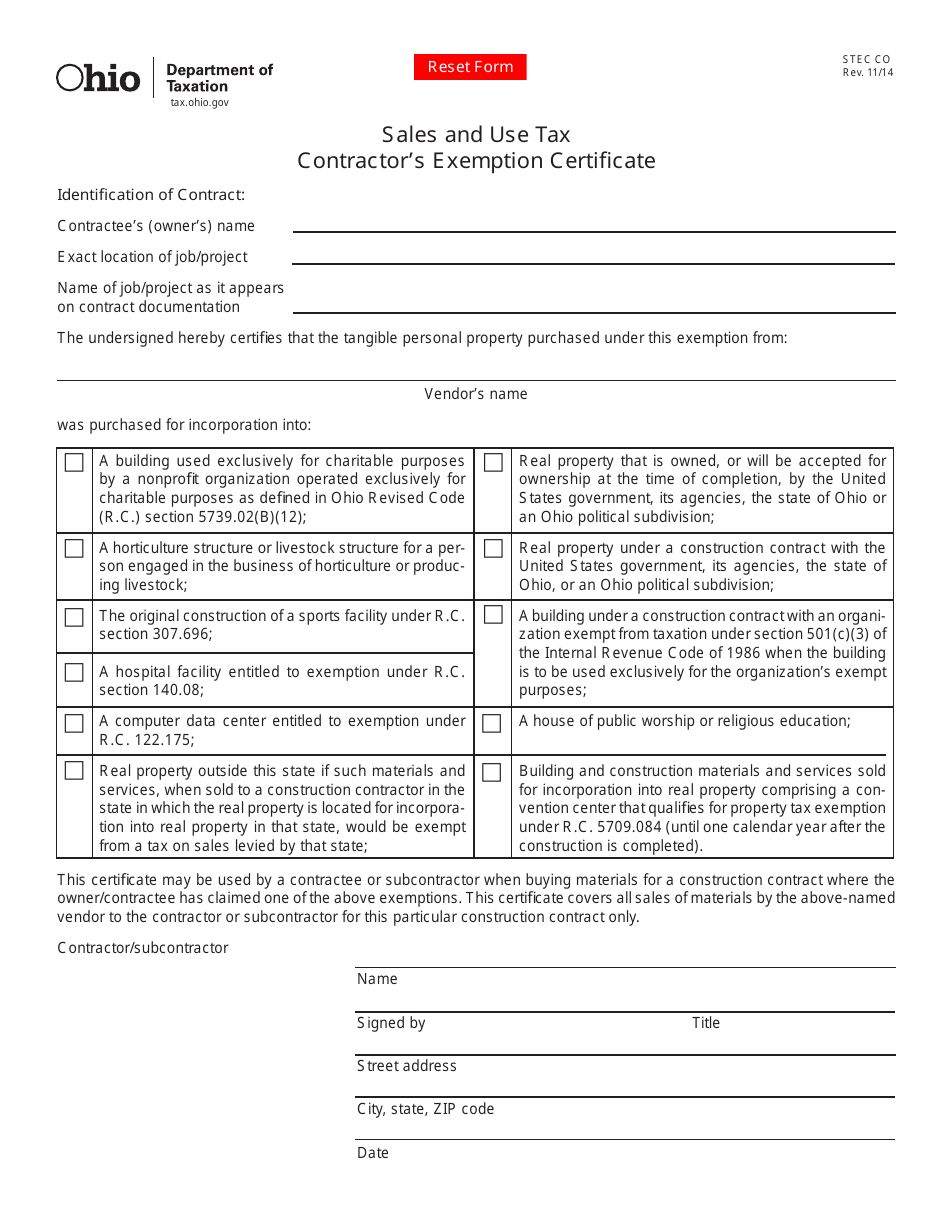

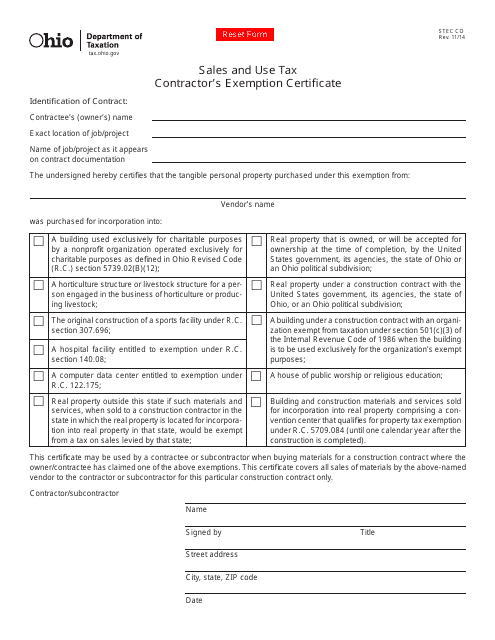

Contractee’s (owner’s) name exact location of job/project name of job/project as it appears on contract documentation the undersigned hereby certifi es that the tangible personal property purchased under this exemption from: The forms may be obtained from the department of taxation and are available on the department's web site. Select the document you want to sign and click upload.

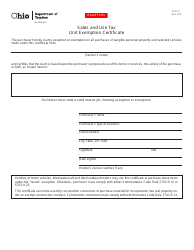

Go digital and save time with signnow, the best solution for electronic signatures. Purchaser must state a valid reason for claiming exception or exemption. The contractee assumes liability for any unpaid taxes.

A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the ohio sales tax. Download template, fill in the blanks, job done! A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the ohio sales tax.

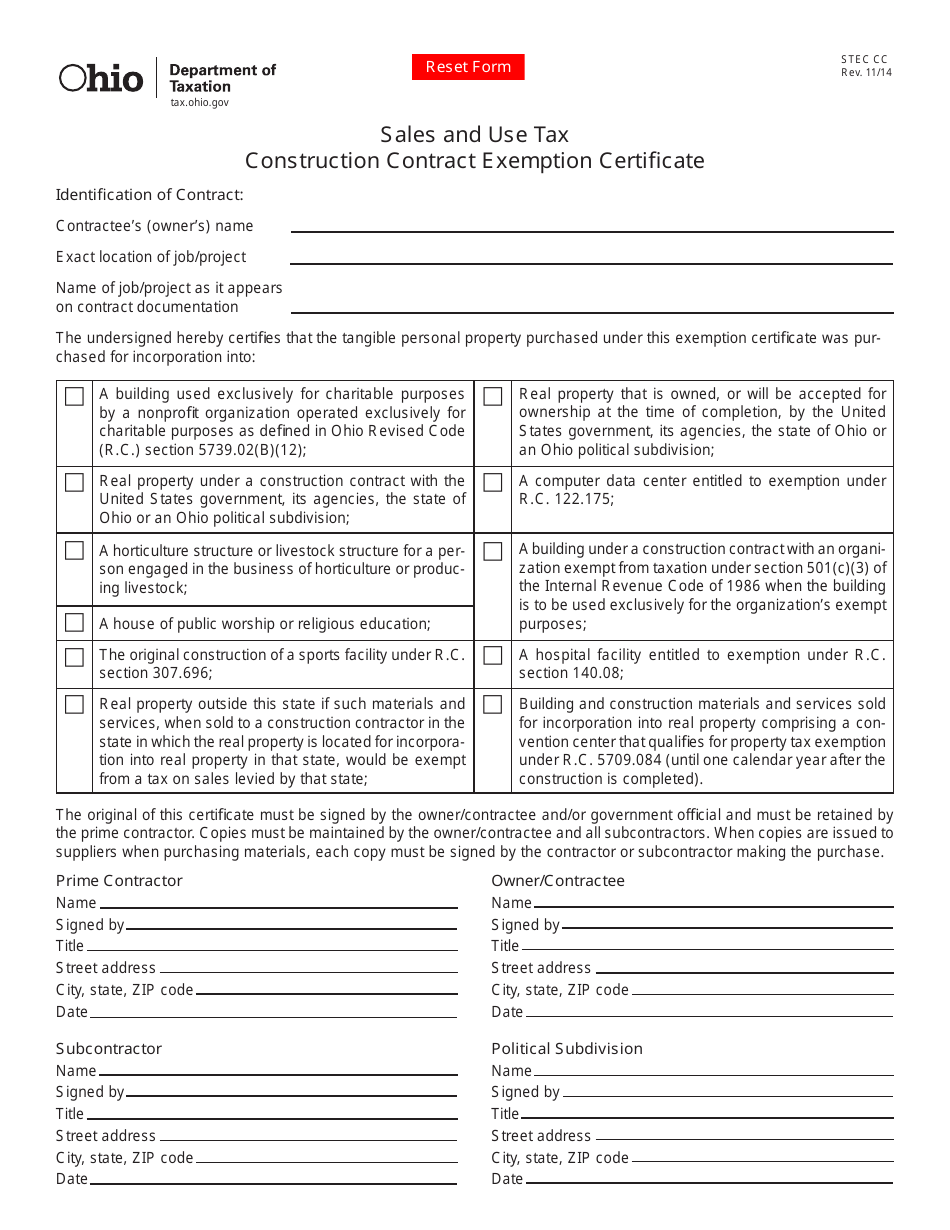

A contractee claiming one of the above exemptions must execute the construction contract exemption certificate available on the ohio department of taxation’s website. Decide on what kind of esignature to create. Testa[1] addressed several of ohio’s most commonly utilized sales and use tax exemptions.this article will focus specifically on how the karvo case shapes the application of ohio’s sales and use tax exemptions for sales for resale, affiliated party transactions and casual sales.

Sales and use tax contractor’s exemption certifi cate identifi cation of contract: How to use sales tax exemption certificates in ohio. For other ohio sales tax exemption certificates, go here.

Most states do not allow the exempt status to pass through to the contractor. Edit with office, googledocs, iwork, etc. A contractor is then protected from liability if it is later determined that the contract did not qualify for exemption;

This certificate may be used by a contractor to claim exemption from tax only on purchases of tangible personal property that is: A typed, drawn or uploaded signature. Incorporation into real property outside this state are not subject to ohio sales or use tax if such materials would be exempt from tax when sold to the contractor in the other state.

(vendor’s name) and certifi or both, as shown hereon: The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from: For other ohio sales tax.

A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the ohio sales tax.

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Form Stec Co Fillable Contractors Exemption Certificate

Sales Tax Exemption For Building Materials Used In State Construction Projects

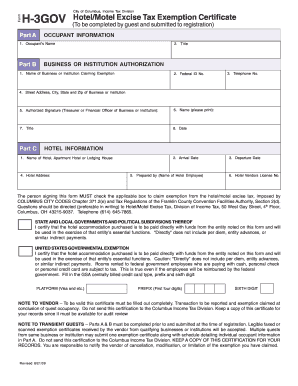

Ohio Hotel Tax Exempt Form – Fill Online Printable Fillable Blank Pdffiller

Tax Exempt Form Ohio – Fill Out And Sign Printable Pdf Template Signnow

Sales Tax Exemption Form – Fill Out And Sign Printable Pdf Template Signnow

Ohio Tax Exempt Form – Holland Computers Inc

Sales And Use Tax Construction Contract Exemption Certifi Cate

Oh Stec Co 2014-2021 – Fill Out Tax Template Online Us Legal Forms

V0xtelx4xn8mem

Kentucky Tax Exempt Form – Fill Online Printable Fillable Blank Pdffiller

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

2

2

Form Stec Co Download Fillable Pdf Or Fill Online Contractors Exemption Certificate Ohio Templateroller

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Form Stec Co Download Fillable Pdf Or Fill Online Contractors Exemption Certificate Ohio Templateroller

Exemption Certificate Forms Department Of Taxation

Form Stec Cc Download Fillable Pdf Or Fill Online Sales And Use Tax Construction Contract Exemption Certificate Ohio Templateroller