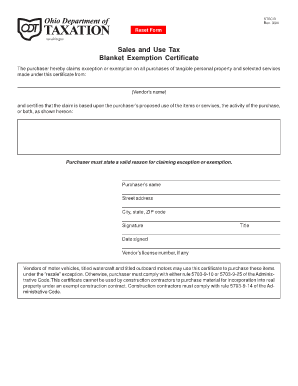

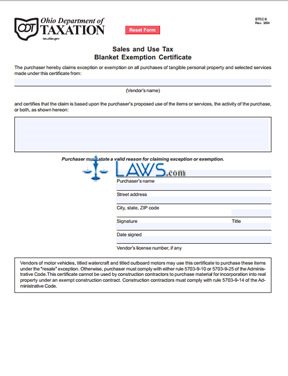

(vendor’s name) and certifi or both, as shown hereon: Steps for filling out the ohio sales and use tax exemption certificate.

Tax Exempt Form Ohio – Fill Out And Sign Printable Pdf Template Signnow

Save or instantly send your ready documents.

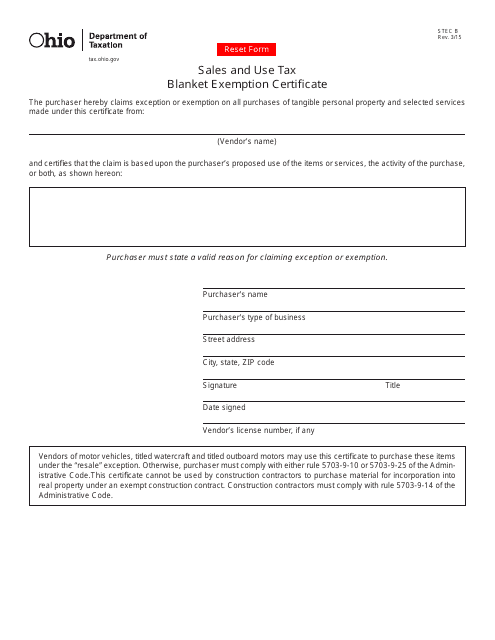

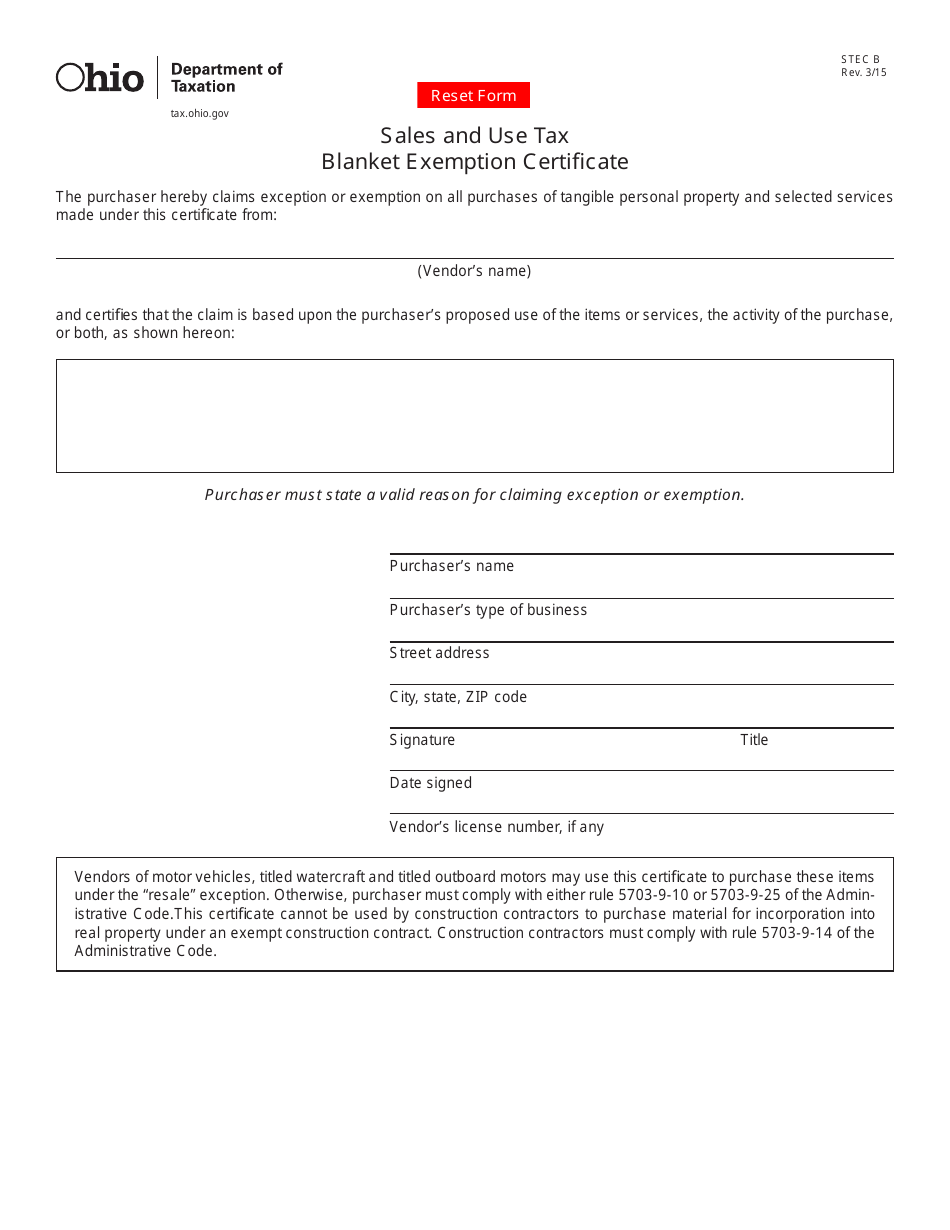

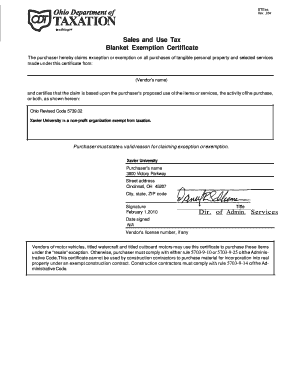

Ohio sales tax blanket exemption form 2021. (vendor’s name) and certifi or both, as shown hereon: Get 2021 printable ohio tax form signed right. Gov sales and use tax blanket exemption certi cate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certi cate from vendor s name and certi es that the claim is based upon the purchaser s proposed use of the items or services the activity of the purchase or both as.

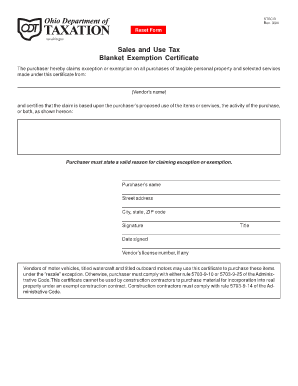

Purchaser must state a valid reason for claiming exception or exemption. Select the document you want to sign and click upload. Fill out, securely sign, print or email your tax exempt form ohio instantly with signnow.

Ohio sales tax exemption form 2021 rentals. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. All retail sales are subject to the tax unless they are specifically excepted or exempted in ohio's sales tax law.2021) note:

How to use sales tax exemption certificates in kentucky. (vendor’s name) and certi fi es that the claim is based upon the purchaser’s proposed use of the items or services, the activity of the purchase, You may submit the form by.

Education aug 16, 2019 · to claim the ohio sales tax exemption for manufacturing, qualifying manufacturers need to complete ohio sales tax exemption form stec b, which is a sales and use. Purchaser must state a valid reason for claiming exception or exemption. › posted at 1 week ago sales and use tax blanket exemption certificate.

In transactions where sales tax was due but not collected by the vendor or seller, a use tax of equal amount is due from the customer. (select the appropriate paragraph from the back of this form, check the corresponding block below and insert information requested). You can use the blanket exemption certificate to make further purchases from the same seller without having to give a.

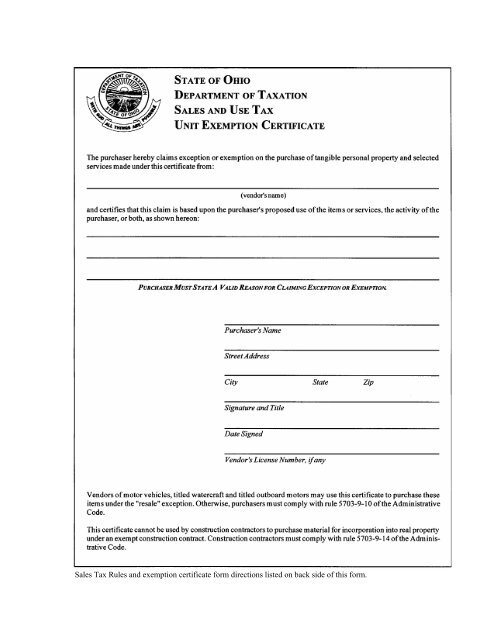

Sales and use tax unit exemption certifi cate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from: A typed, drawn or uploaded signature. In order to comply with the various state and local sales tax law requirements, trivantage is required to retain a properly executed exemption certificate from all of our customers who claim a sales/use tax exemption.

The state sales and use tax rate is 5.75 percent. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from: The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from:

If the seller does not have this certificate, it is obliged to collect the tax for the state in which the property or service is delivered. The ohio sales and use tax applies to the retail sale, lease, and rental of tangible personal property as well as the sale of selected services in ohio. Counties and regional transit authorities may levy additional sales and use taxes.

Hit the arrow with the inscription next to jump from one field to another. Easily fill out pdf blank, edit, and sign them. Decide on what kind of esignature to create.

Sales and use tax blanket exemption certificate from the state of ohio department of taxation the purchaser certifies that the claim is based on the purchaser’s proposed use of the products or services, the purchaser’s operation, or both as shown hereon on all purchases of tangible personal property and selected services made under this certificate from the vendor’s name,. If you are entitled to sales tax exemption, please click the certificate above to download. If purchasing merchandise for resale, some wording regarding the resale of.

The state general sales tax rate of ohio is 5.75%. Certificate from all of its customers (buyers) who claim a sales/use tax exemption. Ohio sales tax exemption form blanket.

Available for pc, ios and android. There is no city sale tax for the ohio cities.the ohio's tax rate may change depending of the type of purchase. This list of exemptions is merely an abbreviation of the law.

Print the form, and then complete, sign, and date it by hand. For other ohio sales tax exemption certificates, go here. Sales and use tax blanket exemption certificate.

Sales and use tax blanket exemption certificate. Generally, a buyer must be registered as a retailer for sales/use tax in states where the buyer has sales/use tax nexus. How to use sales tax exemption certificates in ohio.

Ohio cities and/or municipalities don't have a city sales tax. September 01, 2020 | odot. Fill out the required fields which are colored in yellow.

Every 2021 combined rates mentioned above are the results of ohio state rate (5.75%), the county rate (0.75% to 2.25%), and in some case, special rate (0% to 0.5%).

2

Ohio Tax Exempt Form – Holland Computers Inc

2

How To Get A Certificate Of Exemption In Michigan – Startingyourbusinesscom

2

Tax Exempt Form Ohio – Fill And Sign Printable Template Online Us Legal Forms

Ohio Tax Exempt Form For Farmers – Fill Online Printable Fillable Blank Pdffiller

How To Fill Out Ohio Tax Exempt Form – Fill Online Printable Fillable Blank Pdffiller

Form Stec B Download Fillable Pdf Or Fill Online Sales And Use Tax Blanket Exemption Certificate Ohio Templateroller

2015-2021 Oh Stec B Formerly Stf Oh41575f Fill Online Printable Fillable Blank – Pdffiller

Printable Ohio Sales Tax Exemption Certificates

Form Stec B Download Fillable Pdf Or Fill Online Sales And Use Tax Blanket Exemption Certificate Ohio Templateroller

2

Free Form Sales And Use Tax Blanket Exemption Certificate – Free Legal Forms – Lawscom

How To Get A Sales Tax Exemption Certificate In Ohio – Startingyourbusinesscom

Ohio Tax Exempt Form – Fill Online Printable Fillable Blank Pdffiller

Ohio Resale Certificate Pdf – Fill Online Printable Fillable Blank Pdffiller

2

Ohio Farming Blanket Exapmtion Certificate – Fill Online Printable Fillable Blank Pdffiller