The maximum annual contribution is $385.34. New york paid family leave premiums will be deducted from each employee’s after tax wages.

Pin On Coronavirus

Employees can request voluntary tax withholding

Ny paid family leave tax category. The new york department of financial services announced that the 2021 paid family leave (pfl) payroll deduction rate will increase to 0.511% of an employee's gross wages each pay period, up from 0.270% for 2020. For 2021, the contribution rate for paid family leave will be 0.511% of the employee’s weekly wage (capped at the new york The maximum contribution is $196.72 per employee per year.

New york family leave insurance ( fli ), or paid family leave ( pfl ), is a state mandated coverage for most private employers. Based upon this review and consultation, we offer the following guidance: The maximum annual contribution is $423.71.

You may request voluntary tax withholding. Paid family leave benefits are not treated as disability benefits for any tax purpose. Caring for a family member due to a health condition.

Contribution rate for paid family leave in 2020 is 0.270% of the employee’s weekly wage (capped at new york’s current average annual wage of $72,860.84). Each year, the department of financial services sets the employee contribution rate to match the cost of coverage. What category description should i choose for this box 14 entry?

The state of new york communicated paid family leave rates and initial payroll deduction guidance on june 1, 2017. The nypfl in box 14 is pfl tax that you paid. The pfl benefits will be exempt and may not be, subject to new york state income taxation.

Employees wishing to avoid tax liability for receipt of paid family leave benefits can request voluntary tax withholding from such benefits. The state begins requiring mandatory withholding beginning with checks dated on or after january 1, 2018. New york paid family leave is insurance that is funded by employees through payroll deductions.

However, premium for paid family leave is treated as the payment of a new york state tax. The coverage is funded by employee payroll contributions. If your employer participates in new york state’s paid family leave program, you need to know the following:

The maximum contribution in 2022 is $423.71 annually per employee. The maximum 2021 annual contribution will be $385.34, up from $196.72 for 2020. You do not withhold taxes on an employee’s pfl benefits because they are not included in your payroll.

The maximum contribution in 2022 is 0.511% of an employee’s weekly wage, up to but not exceeding the statewide weekly average wage of $1,594.57. Taxes will not automatically be withheld from benefits. In 2022, the employee contribution is 0.511% of an employee’s gross wages each pay period.

Based upon this review and consultation, we offer the following guidance: Now, after further review, the new york department of taxation and finance has provided important guidance regarding payroll deduction and pfl taxation. Any benefits you receive under this program are taxable and included in your federal gross income.

Your employer will not automatically withhold taxes from these benefits; State governments do not automatically withhold paid family leave federal tax from an employee’s pfl benefits. After discussions with the internal revenue service and its review of other legal sources, the new york department of taxation and finance issued guidance regarding the tax implications of its new paid family leave program.

Tax treatment of family leave contributions and benefits under the new york program. New york paid family leave is insurance that may be funded by employees through payroll deductions. In 2021, the contribution is 0.511% of an employee’s gross wages each pay period.

Currently, only california, new jersey, rhode island, new york and the district of columbia have paid family leave laws in effect, but many states are contemplating enacting their own. The paid family leave can be called family leave sdi as long as it is a separate item in box 14. The coverage can be used for wage replacement and job protection to employees who need time off due to:

Tax treatment of family leave contributions and benefits under the new york program. The pfl benefits paid by an insurance carrier are reportable on w2s, or on 1099g forms, if pfl benefits are paid by a government agency, such as the ny state insurance fund. The original turbo tax answer (about a year ago) to this question was incorrect, which is why i responded as i did, with the correct info and the nys link stating that nypfl is a state disability insurance tax.

Employees can request voluntary tax withholding Paying the tax does not mean that you received any benefits. If you did not take paid family leave you did not receive any pfl benefits so you do not check the box.

Contribution rates are community rated and are paid entirely by employees. (the state previously said that deductions for the. Big changes arrived for new yorkers on january 1, 2018, when the new york paid family leave (nypfl) benefit went into effect.

Set the appropriate ny rates for family. In 2018, 21 states were considering paid family leave laws, and even more are expected to evaluate legislation in the future. Confirm the client’s state is ny.

Forms Paid Family Leave

Pin By Alexander Osipov On Chk Live Scan Fingerprinting Fingerprint Cards State Police

Bustier Fit Flare Tulle Midi Dress – Blush Large In 2021 Tulle Evening Dress Tulle Prom Dress Evening Dresses

Pin En Zakahzakat The 3rd Pillar Of Islam Poors Right

Child Benefit Graphic Finland Vs Us Family Medical School Reform Finland

Used Car Dealer Software Carfiles Usa Jacksonville Fl Enter Sale Used Car Dealer Car Dealer Bill Of Sale Template

Unseen Passage For Class 10 Factual Cbse With Answers Cbse Sample Papers

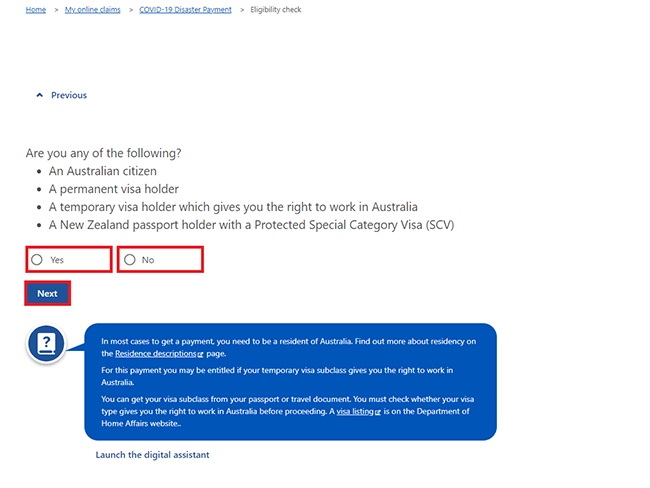

Centrelink Online Account Help – Claim The Covid-19 Disaster Payment If You Dont Get A Centrelink Or Dva Payment – Services Australia

This Is Why Obama Is So Concerned About The Middle Class Cnn Money Obama Middle Class

Understanding Your Pay Statement Office Of Human Resources

How Much Will Artists Be Paid Under The New Wage Certification Program Artist Artistic Space Paradigm

What Does Debt Look Like In America Every Generation Is Carrying Some Debt But The Amount And Cause Vary As We Finance Jobs Finance Infographic Finance Goals

Stories For Kids Stories Bedtime Stories

On This Years New York State W-2 In Box 14 There Is Nypfl And Nydbl What Category Description Should I Choose For These Box 14 Entries

Cost And Deductions Paid Family Leave

Monthly Budget Plan Template Five Moments That Basically Sum Up Your Monthly Budget Plan Tem Monthly Budget Planning Budgeting Budget Planning

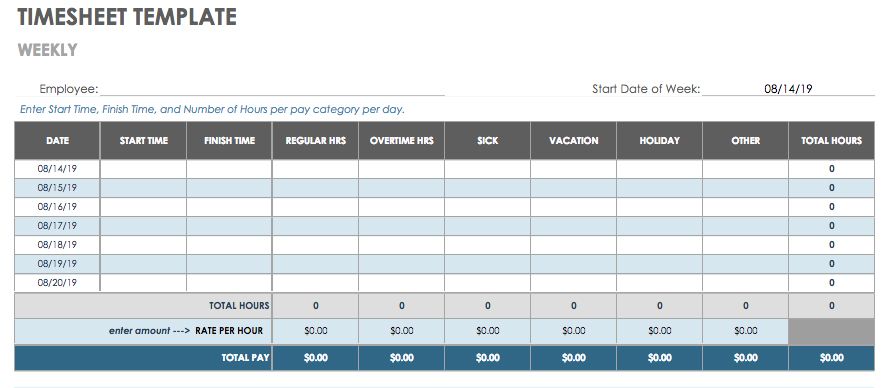

15 Free Payroll Templates Smartsheet

90s Vintage Stussy Dragon Made In In Usa Men Sweatshirt Medium Etsy In 2021 Sweatshirts Men Sweatshirt Stussy

New National Paid Leave Proposals Explained