New york is one of the states that administers their own ny estate tax and has a relatively low ny estate tax exemption amount. The 2022 federal estate tax exemption will be $12,060,000.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

In new york, the tax rate currently ranges from 3.06% to 16%.

Ny estate tax exemption 2022. The estate tax exemption amount is. This increase means that a married couple can shield a total of $24.12 million without having to pay any federal estate or gift tax. The current federal estate tax exemption amount is $11,700,000 per person.

The current exemption from new york estate taxes is 5.93 million, indexed for inflation. The new york estate tax exemption amount is currently $5,930,000 (for 2021). The information on this page is for the estates of individuals with dates of death on or after april 1, 2014.

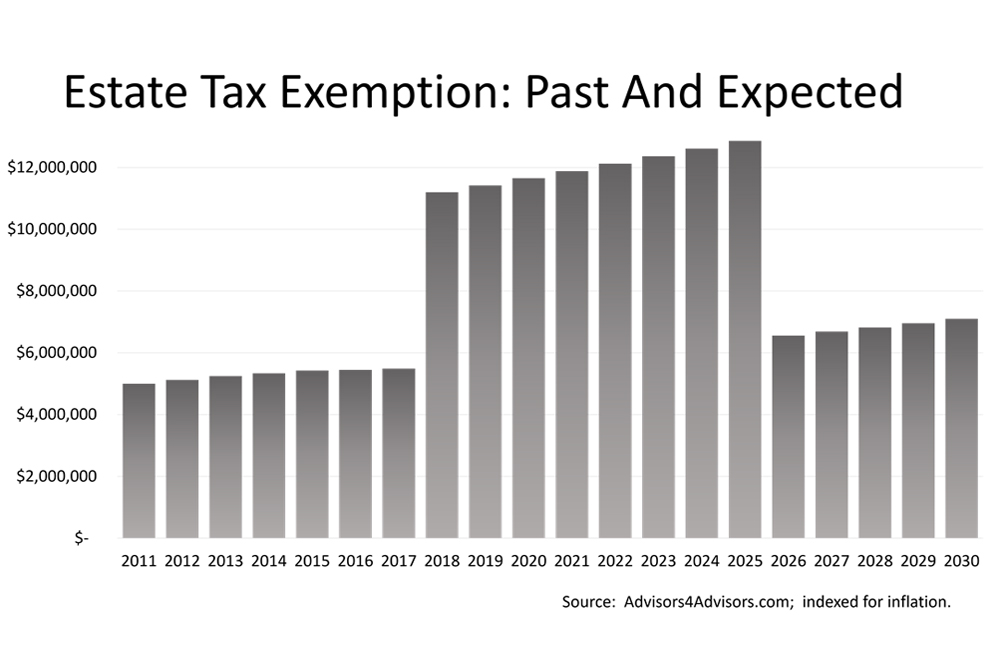

Estate tax surprises and traps in biden's 2022 budget. The proposed bill reduces the federal estate and gift tax exemption from $11.7 million per person to $5 million per person, indexed for inflation, prior to the scheduled sunset on january 1, 2026. Under current law, this number will remain until january 1, 2022, at which point it will rise again with inflation.

Now in 2022, the estate tax exemption amount increases to an impressive $12,060,000 per person and $24,120,000 per married couple. For the first 14 years, projects will be eligible for a 100% exemption. Us citizens and permanent resident aliens are entitled to the federal estate tax exemption.

The taxable estate is the value of the estate above the $5.25 million exemption (unless the estate reaches that cliff of 105% of $5.25 million, then the whole estate is taxable). Compare your take home after tax and estimate your tax return online, great for single filers, married filing jointly, head of household and widower As of january 1, 2022, the federal estate tax exemption amount could potentially be cut in half to approximately $6,020,000 per person or $12,040,000 for a married couple.

2022 new york tax tables with 2022 federal income tax rates, medicare rate, fica and supporting tax and withholdings calculator. For a married couple, that comes to a combined exemption of. The basic exclusion amount for new york state estate tax for dates of death on or after january 1, 2021, and before january 1, 2022, is $5,930,000.

Qualified homeowners will be able to claim this new property tax relief credit for taxable years 2021, 2022 and 2023. In short, the proposed build back better act (“bbba”) does the following: Even if a deceased’s estate is not large enough to owe federal estate tax, individuals may still owe an estate tax to the state of new york.

This means that if you die in 2021, the federal government will not tax on the first $12,060,000 that you pass on (unless you have made large gifts in previous years). Effective january 1, 2022, the bbba reduces the gift, estate and gst tax exemptions from $11,700,000 per person (or $23,400,000 for a married couple) to an amount estimated to be $6,020,000 per person (or $12,040,000 for a. For previous periods, see information for dates of death on or after february 1, 2000, and.

The estate tax rate for new york is graduated. Homeownership projects outside of manhattan. In addition, the estate and gift tax exemption will be $12.06 million per individual for 2022 gifts and deaths, up from $11.7 million in 2021.

For people who pass away in 2022, the exemption amount will be $12.06 million (it's $11.7 million for 2021). Within this range, the rate increases with the size of the estate. For example, last year it was 5.85 million.

The state of estate taxes. Estate taxes apply to estates worth more than the basic exclusion amount of $5,930,000 as of 2021. New york estate taxes new york has an estate tax ranging from 3.06% to 16%.

For months reports suggested that the current. The unified credit against estate and gift tax in 2022 will be $12,060,000, up from $11.7 million Effective january 1, 2022, the $11,700,000 current federal estate tax exemption amount would drop to $5 million (adjusted for inflation) assets held in a revocable trust that is created on or after the legislation in enacted, will be included in the tax exemption, upon the individual’s death, effectively preventing the trust from fulfilling its primary intention

This exemption is up from $11,700,000 in 2021. It starts at 3.06% and goes up to 16% for taxable estates worth more than $10.1 million. The legislation also provides a personal income tax credit for new york resident homeowners with incomes of up to $250,000 and whose total property tax exceeds a fixed percentage of their income.

The biden administration’s proposed 2022 budget and tax proposals are far from final, however, the proposal should still prompt all clients to review their existing estate plans with their estate planning professionals in the next few months. The current new york estate tax exemption amount is $5,930,000 for 2021.

Untitled Document

Will The Lifetime Exemption Sunset On January 1 2026 – Agency One

New York Estate Planning Elder Law Tax Cuts And Jobs Act Tcja

New Yorks Death Tax The Case For Killing It – Empire Center For Public Policy

The Senate Introduced A New Estate And Gift Tax Law – Hartmann Doherty Rosa Berman Bulbulia

Preferred Ny Financial Groupllc

New Yorks Death Tax The Case For Killing It – Empire Center For Public Policy

Historical Estate Tax Exemption Amounts And Tax Rates 2022

What Is New Yorks Estate Tax Cliff 2021 – Round Table Wealth

New York Budget Raises Tax Rates Provides Relief To Address Pandemic Pillsbury Winthrop Shaw Pittman Llp – Jdsupra

2

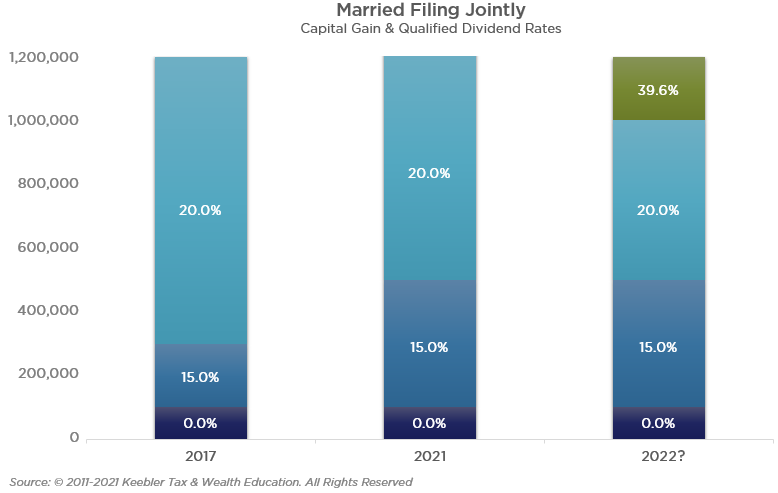

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Thoughtful Gifting Part 1 Use It Or Lose It Now Could Be The Time To Use Your Gift And Estate Tax Exemption

How Do The Estate Gift And Generation-skipping Transfer Taxes Work Tax Policy Center

Eye On The Estate Tax Nottingham Advisors

New Yorks Death Tax The Case For Killing It – Empire Center For Public Policy

Estate And Gift Taxes 2020-2021 Heres What You Need To Know – Wsj

2021 Guide To Potential Tax Law Changes

Estate Tax Exemption Amount Goes Up For 2022 Kiplinger