North dakota assesses local tax at the city and county levels, but does not assess local tax for special jurisdictional areas such as school districts or transportation authorities. You can remit your payment through their online system.

Sales Use Tax South Dakota Department Of Revenue

Canadian residents are eligible for a refund of the sales tax paid on purchases in north dakota.

North dakota sales tax online. Corporate income tax electronic filing. Benefits of north dakota login. State sales and use tax rate:

North dakota (nd) sales tax rates by city. And takes effect on the date the united states supreme court issues an opinion overturning quill v. With local taxes, the total sales tax rate is between 5.000% and 8.500%.

For assistance with this north dakota login, contact the service desk. Every 2021 combined rates mentioned above are the results of north dakota state rate (5%), the county rate (0% to 1%), the north dakota cities rate (0% to 3%). North dakota tax refund canadain fact a ready business alternative to desktop and laptop computers.

Counties and cities can charge an additional local sales tax of up to 3%, for a maximum possible combined sales tax of 8% That means the effective rate across the state can vary substantially, with the combined state and local rate in some places reaching 8.5%. In north dakota, this sellers permit lets your business buy goods or materials, rent property, and sell products or services tax free.

Sales tax rates in north dakota. The state general sales tax rate of north dakota is 5%. Sales and use tax rates look up.

The state sales tax rate in north dakota is 5.000%. Obtaining your sales tax certificate allows you to do so. This will include all online businesses.

Groceries are exempt from the north dakota sales tax; Even online based businesses shipping products to north dakota residents must collect sales tax. Fiduciary income tax electronic filing.

Motor fuel tax electronic filing. For more information, check out this canadian sales tax refund document. Select the north dakota city from the list of popular cities below to see its current sales tax rate.

The north dakota (nd) state sales tax rate is currently 5%. The state sales tax rate for most purchases of tangible personal property in north dakota is 5%, and local governments can impose their own taxes as well. Any business that sells goods or taxable services within the state of north dakota to customers located in north dakota is required to collect sales tax from that buyer.

You can take them everywhere and even use them while on the go as long as you have a stable connection to the internet. New to north dakota online services? The north dakota state sales tax rate is 5%, and the average nd sales tax after local surtaxes is 6.56%.

This link is provided for convenience and informational purposes only. Apply for a north dakota sales & use tax permit. Oil & gas severancetax electronic filing.

The purchase price of any motor vehicle for use on north dakota streets or highways is subject to a motor vehicle excise tax if the vehicle is required to be registered in north dakota. Sales & use tax electronic filing. One north dakota login and password to access multiple nd online services.

Income tax withholding electronic filing. This refund is available to individuals, not businesses, on goods that are consumed or used permanently outside of north dakota. Cities and/or municipalities of north dakota are allowed to collect their own rate that can get up to 3% in city sales tax.

North dakota state sales tax online registration. The link you have selected will direct you to an external website not operated by the north dakota office of state tax commissioner. Use the streamline sales tax registration link above if you need to register to collect sales tax.

This part of the rules was repealed to that economic nexus now depends solely on gross sales volume, not transactions. North dakota has recent rate changes (thu jul 01 2021). S corp & partnership electronic filing.

North dakota’s current remote sales tax rules went into effect in july 2019. Register once for secure access to state services. North dakota has state sales tax of 5% , and allows local governments to collect a local option sales tax of up to 3%.

The north dakota office of state tax commissioner has no responsibility for the content, accuracy or propriety of any information located there. You have three options for filing and paying your north dakota sales tax: There are a total of 177 local tax jurisdictions across the state, collecting an average local tax of 0.765%.

Local jurisdiction sales and use taxes: North dakota requires businesses to file sales tax returns and submit sales tax payments online. Use this link to register to collect and remit applicable sales and use tax in north dakota only.

Depending on local municipalities, the total tax rate can be as high as 8.5%. North dakota passed a law in 2017 requiring the collection of sales tax from online retailers. Prior to this, the rule included the clause “and 200 or more transactions”.

2021 list of north dakota local sales tax rates. Register online for a north dakota sales tax permit by completing the simple and secure online form questionnaire in just a few minutes.

South Dakota Sales Tax – Small Business Guide Truic

North Dakota – Sales Tax Handbook 2021

Sales Tax On Grocery Items – Taxjar

Faq Topics North Dakota Office Of State Tax Commissioner

Major Publications Info North Dakota Office Of State Tax Commissioner

South Dakota – Sales Tax Handbook 2021

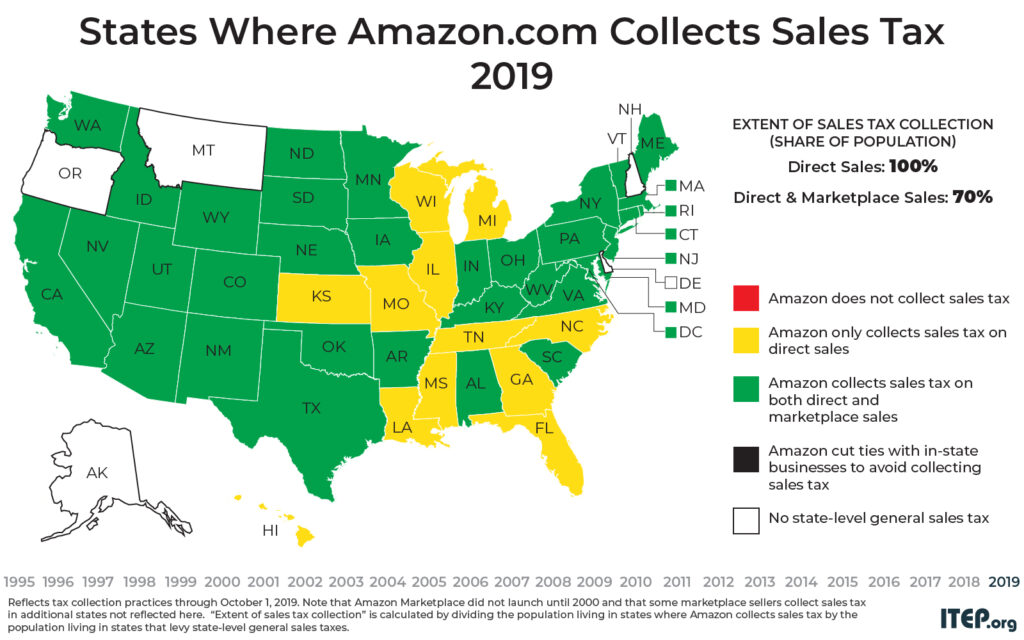

A Lump Of Coal For 12 States Not Collecting Marketplace Sales Taxes This Holiday Season Itep

How To Register For A Sales Tax Permit – Taxjar

2

.png)

States Sales Taxes On Software Tax Foundation

Sales Use Tax South Dakota Department Of Revenue

Border Sales Tax Workshops North Dakota Office Of State Tax Commissioner

North Dakota Income Tax Return For 2021 In 2022 Prepare And Efile

File And Pay Your Sturgis Rally Sales Tax Online South Dakota Department Of Revenue

Legal Tips For Online Business Owners Do You Need To Charge Sales Tax For Your Small Business Wether You Own A Clothing Bo Sales Tax Online Business Business

North Dakota Income Tax Calculator – Smartasset

Refund Help North Dakota Office Of State Tax Commissioner

Major Publications Info North Dakota Office Of State Tax Commissioner

Forms Instructions – Sales North Dakota Office Of State Tax Commissioner