If you did not receive a 2018 homestead benefit mailer and you owned a home in new jersey on october 1, 2018, that was your main home, call the number above for help. Njtaxation org select homestead benefit.

New Jersey Property Tax Relief Programs Property Tax Deduction Or Credit Homestead Benefit Senior Freeze Ptr Other Nj-2 Property Tax Relief Programs – Ppt Download

Homeowners who indicated when filing that they no longer own the.

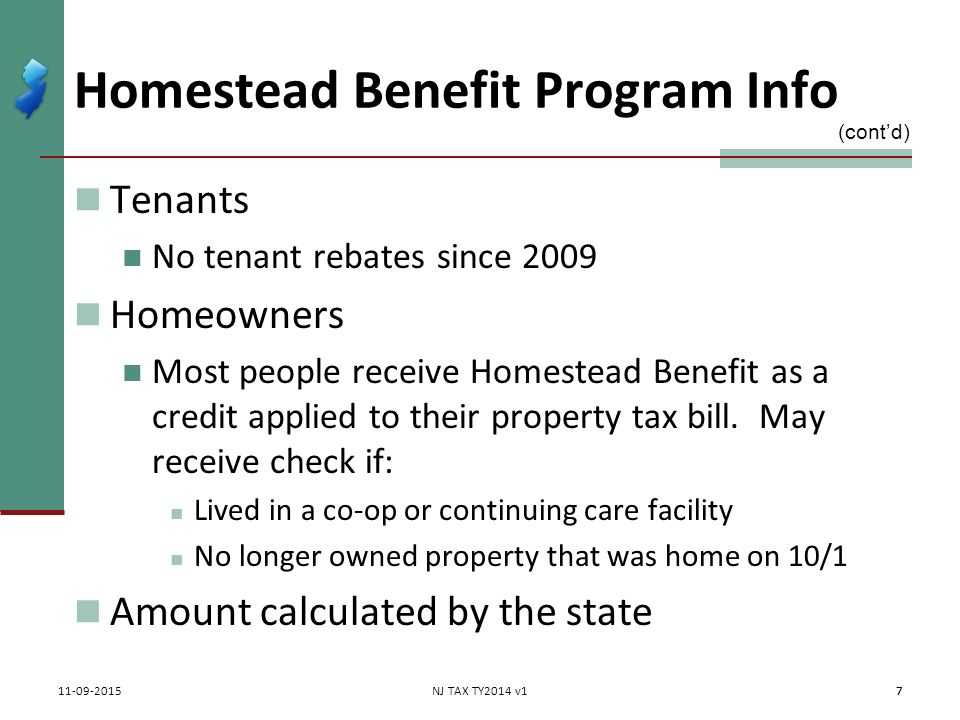

Njtaxation.org property tax relief homestead benefit. Njtaxation org online property tax relief. The new jersey homestead benefit program provides property tax relief to eligible homeowners in the form of a property tax credit that the state pays to municipalities on behalf of eligible homeowners to reduce their tax liability. When you report your property taxes paid, you already account for this benefit.

• the home was subject to local property taxes, and the 2017 property taxes were paid. New jersey property tax keeps climbing. Most recipients get a credit on their tax bills.

Property tax relief programs ; Place an ‘x’ or check mark in the space beside the type of tax limitation or surviving spouse exemption transfer you seek from your previous residence homestead and the address of the last residence homestead to the right: Credit on property tax bill.

If a benefit has been issued, the system will tell you the amount of the benefit and the date it was issued. The nj homestead benefit reduces the taxes that you are billed. Because the benefit is no longer handled as a rebate, it is no longer accounted for on your federal (or nj) tax returns.

File online or by phone. The nj division of taxation mailed new jersey homeowners filing information for the 2018 homestead benefit in october. Your tax collector issues you a property tax bill or advice copy reflecting.

Njtaxation org online tax relief. If you filed a 2017 homestead benefit application and you are eligible for the same property, see id and pin. • this also means that if you sell your home after filing this application, the only way to receive your 2018 homestead benefit is to take credit for it at the closing of your property sale.

Search here for information on the status of your homeowner benefit. 2018 homestead benefit payments should be paid to eligible taxpayers beginning in may 2022. The average 2019 property tax bill in new jersey is $9,000.

Compare search ( please select at least 2 keywords ). The benefit amount has not yet been determined. The automated telephone filing system and this website will be.

The total amount of all property tax relief benefits you receive (homestead benefit, senior freeze, property tax deduction for senior citizens/disabled persons, and property tax deduction for veterans) cannot be more than. Amounts you receive under the homestead benefit program are in addition to the state's other property tax relief programs. Little known among homestead benefit recipients, and even many state lawmakers, is how the fine print first written into the state budget more than a decade ago, continues to hold flat the amount of.

(the state budget requires that the benefit amount be calculated using 2006 property taxes.) most homeowners will receive their 2016 benefit payment as a credit on a future property tax bill. The system will also indicate whether the benefit was applied to your property tax bill or issued as a check or direct deposit to your. • if you answer “yes” at line 7, the homestead benefit will reduce the tax bill of the person who owns the property on the date the benefit is paid.

The program rules and online application are found at nj.gov/taxation (click on property tax relief programs).

Property Tax Rebates Recoveries Ptr Homestead Benefit Federal

Property Tax Rebates Recoveries Ptr Homestead Benefit – Ppt Video Online Download

New Jersey Property Tax Relief Programs Property Tax Deduction Or Credit Homestead Benefit Senior Freeze Ptr Other Nj-2 Property Tax Relief Programs – Ppt Download

New Jersey Property Tax Relief Programs Property Tax Deduction Or Credit Homestead Benefit Senior Freeze Ptr Other Nj-2 Property Tax Relief Programs – Ppt Download

Property Tax Rebates Recoveries Ptr Homestead Benefit Federal

Property Tax Rebates Recoveries Ptr Homestead Benefit Federal

Ppt – New Jersey Property Tax Relief Programs Powerpoint Presentation Free Download – Id4440099

Property Tax Rebates Recoveries Ptr Homestead Benefit – Ppt Video Online Download

2

Nj Property Tax Relief Program Updates Access Wealth

Property Tax Rebates Recoveries Ptr Homestead Benefit – Ppt Video Online Download

Property Tax Rebates Recoveries Ptr Homestead Benefit Federal

Property Tax Rebates Recoveries Ptr Homestead Benefit – Ppt Video Online Download

Property Tax Rebates Recoveries Ptr Homestead Benefit Federal

Nj Div Of Taxation Nj_taxation Twitter

Tax Deductions And Exemptions

Property Tax Rebates Recoveries Ptr Homestead Benefit Federal

New Jersey Property Tax Relief Programs Property Tax Deduction Or Credit Homestead Benefit Senior Freeze Ptr Other Nj-2 Property Tax Relief Programs – Ppt Download

Property Tax Rebates Recoveries Ptr Homestead Benefit Federal