Current tax rate (.01598) x your assessment = your taxes for the year. Consequently, the median annual property tax payment here is $5,768.

Property Tax Rates 2009 Vs 2020 Rnewhampshire

Tax rates (pdf) tax rates (excel) village tax rates (pdf) village tax rates (excel) cooperative school district apportionments (all) (pdf) county apportionments (all) state education property tax warrant (summary report) state education property tax warrant (summary report)

Nh property tax rates per town. The exact property tax levied depends on the county in new hampshire the property is located in. Click on the tax year to view reports. < 15 15 to 25 25 to 30 > 30 (tap or click any marker for more information)

240 rows in new hampshire, the real estate tax levied on a property is calculated by. The assessment ratio for 2020. Nh property tax year information.

Site created by matt goodwin Bills are sent to the address of the last known owner by state law. Total rate new hampshire department of revenue administration completed public tax rates 2018 municipality date valuation w/ utils total commitment $642,808,718 $5.79 $1.07 $1.97 $20.73 $29.56 $8,836,550 ($6.05) $6.00 $2.48 ($2.43) $0.00 $372,765,440 $6.50 $1.91 $2.29 $14.83 $25.53

The tax rate per $1,000 of assessed value is finalized with the nh department of revenue administration. New hampshire department of revenue administration completed public tax rates 2019 municipality date valuation w/ utils total commitment alstead 11/06/19 $163,042,993 $4,512,141 alton 11/05/19 $1,750,226,594 $21,548,778 alexandria 10/31/19 $197,038,051 $4,661,699 allenstown 11/06/19 $295,309,596 $9,060,367 acworth 11/08/19 $98,419,656. Rsa 76:13 during october tax rate finalized, taxes are assessed and property tax bills are mailed.

The tax rate is set in october by the dra. Claremont ($40.72) charlestown ($38.65) keene ($37.28) berlin ($35.93) canaan ($34.40) Funds may also be taken into escrow to cover upcoming tax bills.

Town of bow just received their tax rate from the department of revenue. Tax bills will be going out sometime around december 18 th. Rockingham county collects the highest property tax in new hampshire, levying an average of $5,344.00 (1.74% of median home value) yearly in property taxes, while carroll county has the lowest property tax in the state, collecting an average tax of $2,582.00 (1.07% of median home.

Taxes that have gone to lien are charged 12%. This process includes compiling assessment data, conducting ratio studies and preparing statistical reports. The outcome is the same when the market value of the properties increases above the assessed value, in this case to $275,000.

If you need an income tax deduction you need to pay your taxes by 12/31/20. State education property tax warrant (all municipalities) 2020. The 2018 tax rate is $29.40 with an equalization rate of 77.9%.

Taxes will be due in january, 30 days after the bills go out. New hampshire department of revenue administration completed public tax rates 2020 municipality date valuation w/ utils total commitment alstead 12/09/20 $193,481,509 $4,692,133 alton 11/03/20 $1,769,435,614 $24,335,622 alexandria 11/04/20 $198,181,477 $5,460,145 allenstown 11/04/20 $299,434,087 $8,652,469 acworth 10/27/20 $100,103,637. State, with an average effective rate of 2.05%.

The 2019 tax rate is $31.05 with an equalization rate of 75.3%. The tax rate is set sometime in early fall, and the final bill is due around the first of december. New hampshire property tax rates:

Use the tax calculator below to figure out what your taxes could look like, or use this simple formula: Online property tax payments please visit the property tax payments website if you wish to save time and gas. The nh property tax year for cities and towns run from april 1st through march 31st of the following year.

Nh property tax rates by town 2018 amherst 7569.94 andover 6377.32 city or town tax on a $278,000 house (see note) alstead 7519.90 alton 3889.22 alexandria 6332.84 allenstown 8381.70 acworth 7792.34 albany 4128.30 auburn 4742.68 barnstead 6185.50 atkinson 4984.54 atkinson & gilmanton academy grant (u) 0.00 antrim 7775.66 ashland 7447.62 bean's. When combining all local, county, and state property taxes, these towns have the highest property tax rates in new hampshire (as of january 1, 2021): If you change your mailing address, it is your responsibility to notify us in writing of the change.

Upon selling or purchasing a property, property taxes are prorated based on the closing date. 236 rows town total 2020 tax rate % change from 2019; View this page for training videos, reference guide and other information pertaining to the.

Interest at 8% per annum is charged on tax bills not paid by the due date. The 2020 tax rate is $23.13 with an equalization rate of 91.3%. Interest accrues at the rate of 8% per annum after the due date.

Here is a break down of what the $15.98 tax rate goes to: Valuation municipal county state ed. If you are buying a specific property, find out what the actual taxes are for a full year and ask questions about the assessment.

Nh Towns With Lowest Property Taxes – Property Walls

Nh Towns With Lowest Property Taxes – Property Walls

Budget Replaces Targeted Aid With Tax Cut Disproportionately Benefitting Owners Of Higher Valued Properties – Reachinghighernh

Does New Hampshire Love The Property Tax – Nh Business Review

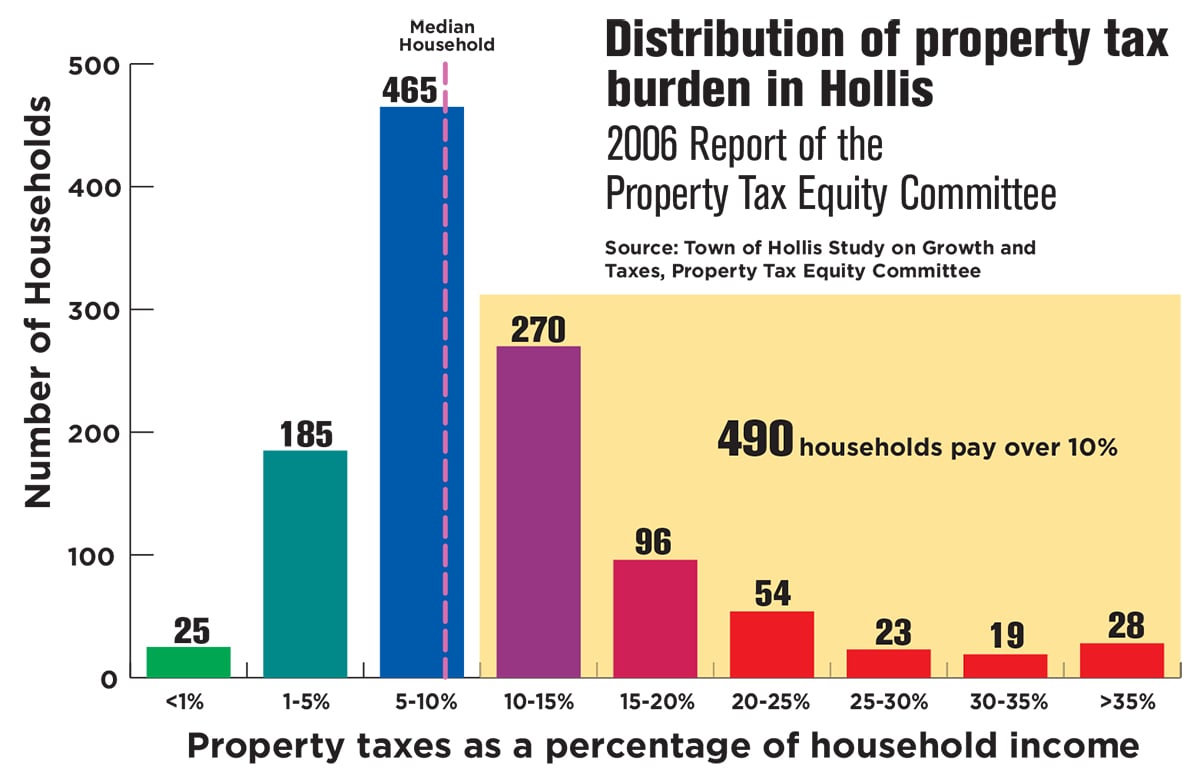

Mark Fernald Why Your Property Taxes Are So High

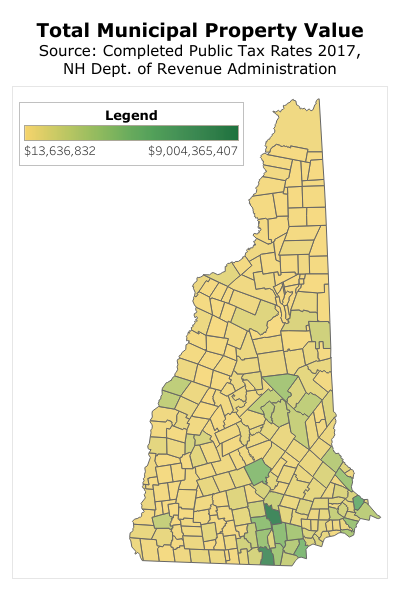

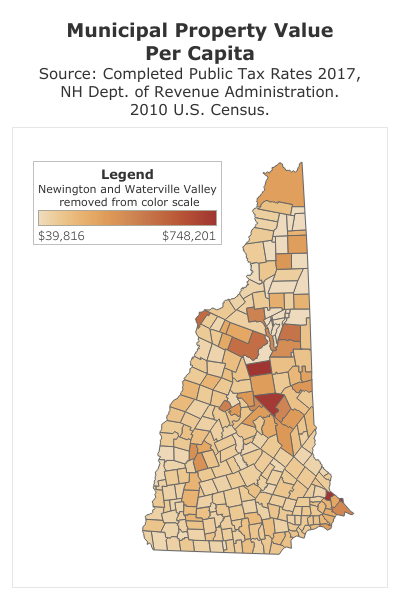

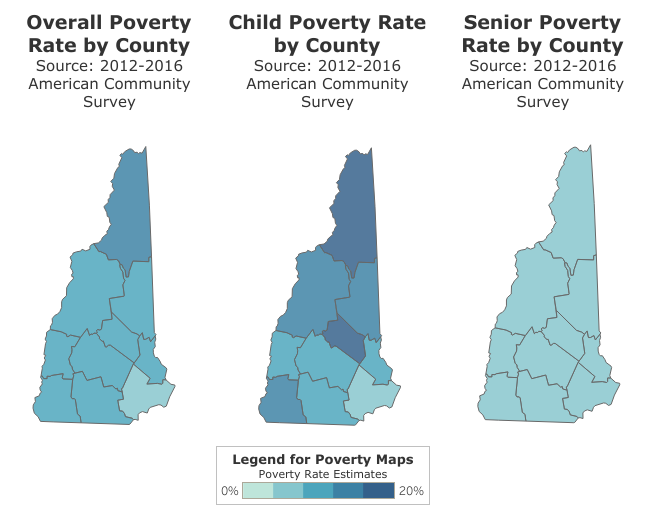

Measuring New Hampshires Municipalities Economic Disparities And Fiscal Disparities – New Hampshire Fiscal Policy Institute

Barringtonnhgov

Pdf Impacts Of Property Taxation On Residential Real Estate Development

Property Tax Information Town Of Exeter New Hampshire Official Website

Understanding New Hampshire Taxes – Free State Project

Nh Towns With Lowest Property Taxes – Property Walls

Measuring New Hampshires Municipalities Economic Disparities And Fiscal Disparities – New Hampshire Fiscal Policy Institute

Tax Rates Ratios Town Of Nottingham Nh

Nh Towns With Lowest Property Taxes – Property Walls

Nh Where Rich Towns Like Rye Get Richer And Poor Ones Like Berlin Need Help – Indepthnhorgindepthnhorg

Nh Towns With Lowest Property Taxes – Property Walls

Nh Towns With Lowest Property Taxes – Property Walls

Nh Towns With Lowest Property Taxes – Property Walls

Mark Fernald Why Your Property Taxes Are So High