Tax bills will be going out sometime around december 18th. 236 rows town total 2020 tax rate % change from 2019;

Redfins Hottest Affordable Neighborhoods Of 2019 Real Estate Articles The Neighbourhood Real Estate News

Taxes will be due in january, 30 days after the bills go out.

Nh property tax rates by town 2020. Property assessments and calculation of the tax rate are overseen by the select board. The median property tax in new hampshire is $4,636.00 per year for a home worth the median value of $249,700.00. The first billing of each year (may or june) is calculated at 50% of the previous year tax rate.

The nh department of revenue administration has all the nh city and town tax rates and valuations online. Town of bow just received their tax rate from the department of revenue. Fire district 1 (total rate) 20.03:

This is an increase over the 2019 property tax rate, reflecting the increased appropriations for both the town and the school approved by town voters at the annual town meeting in march ( view the full update ). Please visit the property tax payments website. Fire district 2 (total rate) 19.76:

The tax year is april 1st through march 31st. This is required every five years according to the nh constitution and nh dra rules. Fremont completed a statistical revaluation for the 04/01/2020 tax year.

Tax rate and ratio history. Please click here to view. State education property tax warrant (all municipalities) 2020.

All real estate taxes are assessed on april 1st of each year. Our next process will be for the 2025 tax year. Tax rate (per thousand) $19.22:

The tax rate for 2020 was set at $28.55/1000 valuation. During this most recent year of qualified sales, the overall media assessment to sale ratio dropped to 84.1%.this means that sale prices are approximately 17% higher than current assessments. New hampshire department of revenue administration completed public tax rates 2020 municipality date valuation w/ utils total commitment alstead 12/09/20 $193,481,509 $4,692,133 alton 11/03/20 $1,769,435,614 $24,335,622 alexandria 11/04/20 $198,181,477 $5,460,145 allenstown 11/04/20 $299,434,087 $8,652,469 acworth 10/27/20 $100,103,637 $2,921,681

Antrim's 2020 tax rate is $28.55. However, the school portion of the tax rate has increased from $13.18 to $14.80 representing a 12% increase. 14 rows yearrateassessed ratio2021 2020 2019 2018 2017 2016$21.31 $28.48 $26.96 $27.23.

The first bill each year is based on one half of the previous year’s tax. If there has been a change in the assessed valuation of the property since the previous bill was issued, the bill is based on the new appraisal. Counties in new hampshire collect an average of 1.86% of a property's assesed fair market value as property tax per year.

Municipal property tax rates and related data. Over the last seven years the town portion of the tax rate has remained flat or has decreased. Tax amount varies by county.

Tax rates and valuations for all nh towns and cities. For the final 2019 tax year, derry's median ratio was calculated to be 89.6%. If you need an income tax deduction you need to pay your taxes by 12/31/20.

Town of bristol, nh 5 school street, bristol, new hampshire 03222 tel: Property taxes are billed semi annually in wakefield. We are happy to report that once again it will remain flat this year at $10.57.

Tax rates (pdf) tax rates (excel) village tax rates (pdf) village tax rates (excel) cooperative school district apportionments (all) (pdf) county apportionments (all) state education property tax warrant (summary report) state education property tax warrant (summary report)

Budget Replaces Targeted Aid With Tax Cut Disproportionately Benefitting Owners Of Higher Valued Properties – Reachinghighernh

Montana State Taxes Tax Types In Montana Income Property Corporate

South Carolina Property Tax Calculator – Smartasset In 2021 Retirement Calculator Retirement Strategies Savings And Investment

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Tax

Are There Any States With No Property Tax In 2021 Free Investor Guide

Tax Friendly States For Retirees Best Places To Pay The Least

States With Highest And Lowest Sales Tax Rates

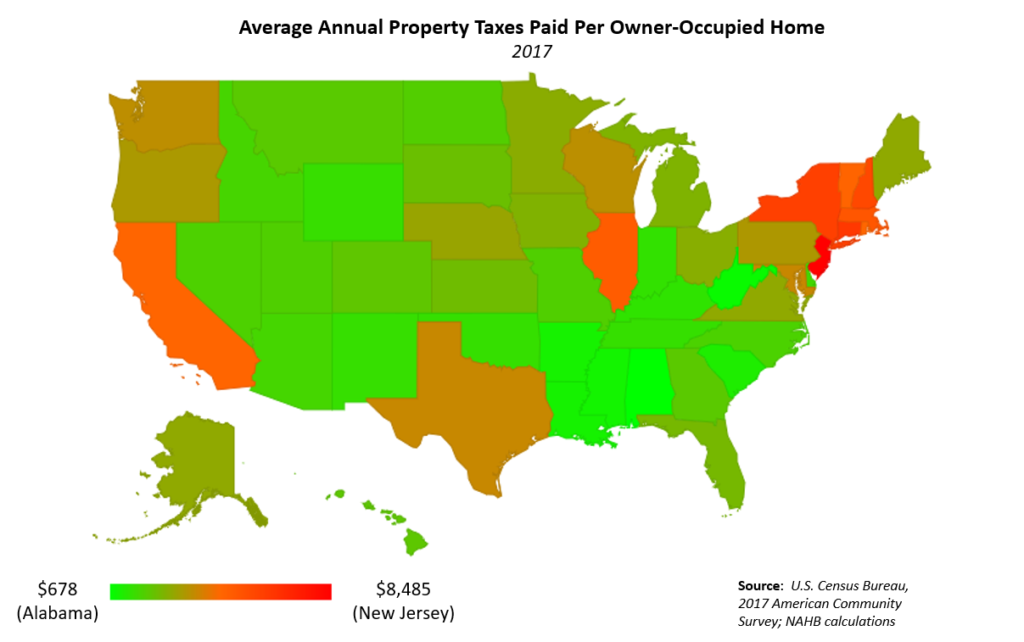

Property Taxes By State 2017 Eye On Housing

Which Us Areas Had The Highest And Lowest Property Taxes In 2020 – Mansion Global

Tax Friendly States For Retirees Best Places To Pay The Least

Wyoming Tax Benefits – Jackson Hole Real Estate – Ken Gangwer

Where Do New Jerseys Property Tax Bills Hit The Hardest New Jersey Future

Property Tax Comparison By State For Cross-state Businesses

Property Tax Information Town Of Exeter New Hampshire Official Website

Property Taxes Levied On Single Family Homes Up 54 Percent Attom

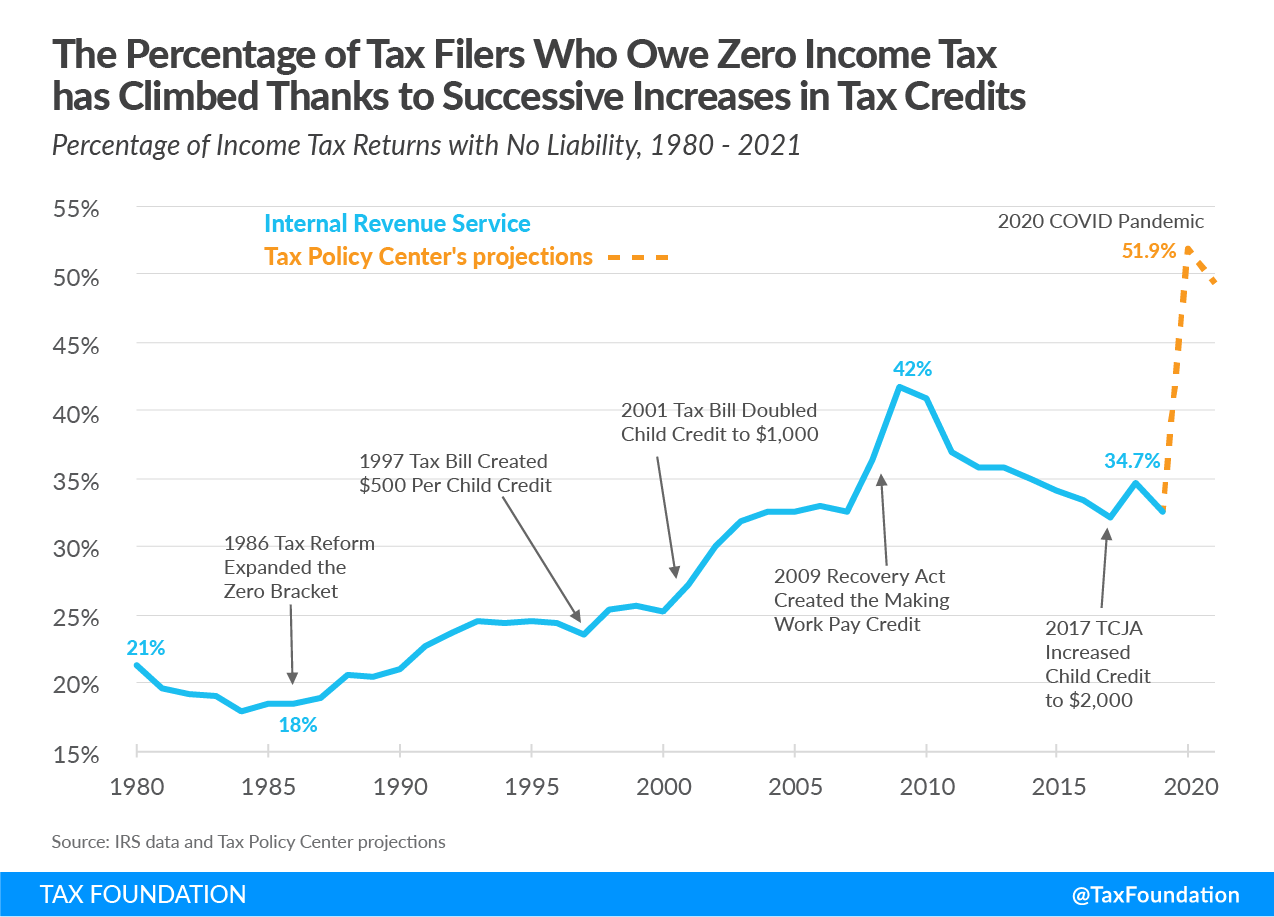

Increasing Share Of Us Households Paying No Income Tax

South Carolina Property Tax Calculator – Smartasset In 2021 Retirement Calculator Retirement Strategies Savings And Investment

New Mexico Property Tax Calculator – Smartasset

Property Taxes – Department Of Tax And Collections – County Of Santa Clara