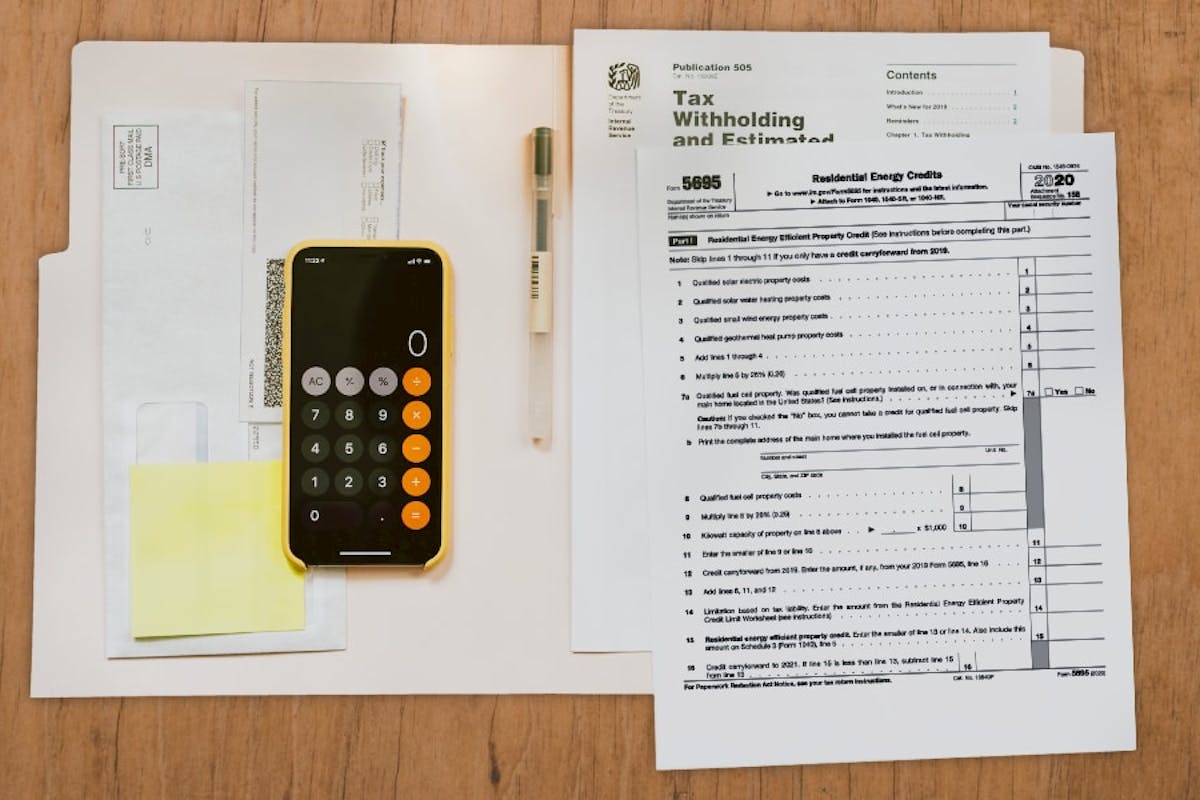

The federal solar tax credit Tax codes are complicated, so consult your tax advisor before deciding what is best for you.

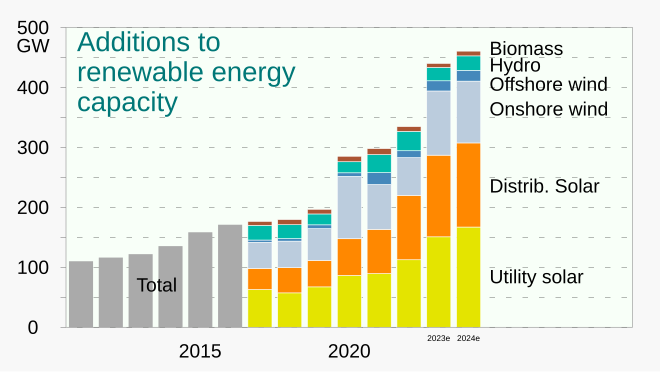

Us Renewable Energy Transition Deloitte Insights

This incentive can reduce your state tax payments by up to $6,000 or 10% off your total solar energy expenses (whichever is lower).

New mexico solar tax credit 2020 form. For property owners in new mexico, perhaps the best state solar incentive is the state's solar tax credit. The solar market development tax credit may be claimed by a taxpayer who files a new mexico personal or fiduciary income tax return for a tax year beginning on or after january 1, 2006, and has purchased and installed a qualified photovoltaic or a solar thermal system after january 1, 2006, but before december 31, 2016, in a residence, business. You will then file for the tax credit with your tax return.

For best results, download and save the nsmd application form and fill it out using a pdf application which has been tested and verified to produce a form compliant with acroform standards. To be eligible, systems must first be certified by the new mexico energy, minerals and natural resources department. Credit that is unused (e) in a tax year may be carried forward for a maximum of 5 consecutive tax years following the tax year in

Instagram photo by toppunt • may 30, 2016 at 1249am utc. The new mexico state legislature passed senate bill 29 in early 2020. It started as a 30% credit capped at $2,000 for residential projects though the provision was removed in 2008.

The tax credit would be available for eight years starting in 2020, and last expired in 2016. New mexico solar tax credit form. It covers 10% of your installation costs, up to a maximum of $6,000.

The starting date for this tax credit is march 1, 2020, and the tax credit runs through december 31, 2027. On march 2, 2020, governor michelle lujan grisham signed new. The new mexico solar tax credit is senate bill 29.

Also, you may be eligible to claim a: This new legislation gives a 10% income tax credit to homeowners who purchase solar equipment and installation. It is taken in the tax year that you complete your solar install.

New mexico state solar tax credit. Since most average sized 6kw systems cost about $1,8000, you can expect a credit of about $1,800. The solar market development tax credit may be deducted only from the taxpayer’s new mexico personal or fiduciary income tax liability.

The new mexico solar market development tax credit or new mexico solar tax credit was passed by the 2020 new mexico legislature and signed by new mexico governor michelle lujan grisham. This bill provides a 10% tax credit with a savings value up to $6,000 * for a solar energy systems. The credit may also be used for energy storage provided certain conditions are met.

Form 5695 2020 residential energy credits department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information. Nm’s 10% renewable energy tax credits are set to expire. The new mexico solar tax credit is senate bill 29.

The state tax credit is equal to 10% of the total installation costs of your solar system up to $6,000 per taxpayer per taxable year. Form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels,. Credits may be carried forward for a maximum of 10 taxable years until fully expended.

Note that solar pool or hot tub heaters are not eligible for this tax credit. This tax credit is based upon ten percent of the solar system value and is available for solar thermal and photovol taic solar systems. The maximum tax credit per taxpayer per year is $6,000.

Follow the four steps below to submit the application and documentation needed by ecmd to review and approve your new solar market development income tax credit. New mexico solar market development tax credit. Martinez gave no explanation as to why she vetoed the proposed incentive extensions, but she is the recipient of campaign funding from, and maintains close ties with, the oil and gas industry.

In 2020, new mexico lawmakers passed a statewide solar tax credit, called the “new solar market development income tax credit”. Approved film production tax credit; The solar itc is one of the greatest and most popular new mexico solar panels installation incentives which offer a certain percentage tax incentive on your gross solar system cost.

(systems installed before december 31, 2019 were eligible for a 30% tax credit.) the tax credit expires starting in 2024 unless congress renews it. This bill provides a 10% tax credit with a savings value up to $6,000* for a solar energy systems. So the itc will be 26% in 2020 and 22% in 2021.

New mexico state tax credit. Refundable medical care credit if you are 65 or older; That’s right, you’ll get back 10% of the cost of the solar panels and the installation cost.

This is an amazing opportunity to take advantage of this tax credit and invest in the future of energy. New mexico’s solar tax credit had expired in 2016, after the previous governor, susana martinez, pocketed several attempts to extend it. Since most average sized 6kw systems cost about $1,8000, you can expect a credit of about $1,800.

The federal credit is in addition to new mexico’s solar state tax credit which was reinstated in march 2020. The tax credit applies to residential, commercial, and agricultural installations.

Free Solar Panels Is It Still Possible In 2021

New Tech Recovers Pure Silicon From End-of-life Solar Cells Pv Magazine Usa

Residential Rooftop Solar 101 From Azimuth To Zoning Pv Magazine International

The 10 States Leading Solar Energy Installation In 2021 – Ecowatch

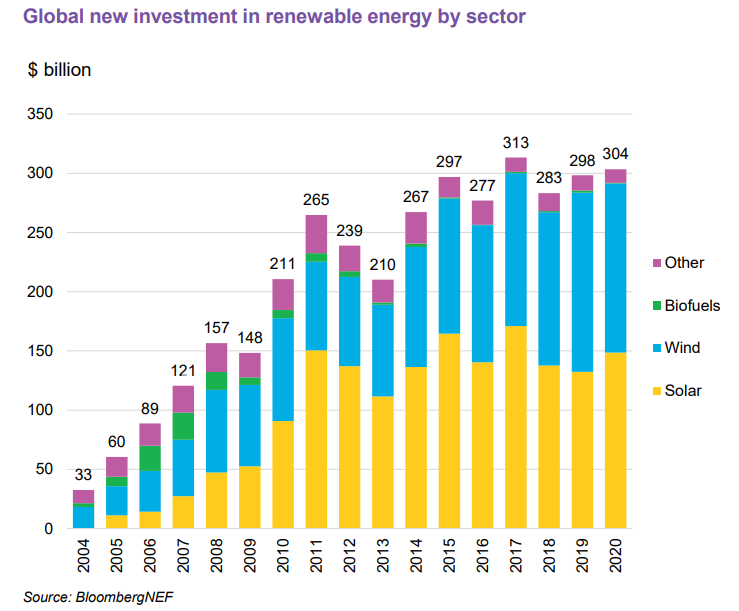

Bnef Up To 194gw Of Solar Could Be Installed In 2021 As Investments Soar – Pv Tech

Us Solar And Storage Event Hears Of Financing Hurdles Call For Standalone Itc – Energy Storage News

Top Cities For Solar Energy In Utah 2021 – Ecowatch

![]()

Grupo Clavijo Mfv Solar Announce Merger Form New Solar Tracking Company – Pv Tech

New Mexico Solar Incentives Rebates And Tax Credits

/cdn.vox-cdn.com/uploads/chorus_asset/file/22060761/Solar_Panels.0.jpg)

How Much Do Solar Panels Cost – This Old House

Power Trends Solar Leads Twitter Mentions In Q2 2021

Solar Is Now Cheapest Electricity In History Confirms Iea

Procurement Mafia Targets Gold Fieldss New Solar Pow

A Colorado Steel Mill Is Now The Worlds First To Run Almost Entirely On Solar

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

Raleigh County Utility-scale Solar Project Has New Owner Energy And Environment Wvgazettemailcom

Renewable Energy – Wikiwand

11 Smart Questions Answered The Facts On Massachusetts New Solar Program – Climate-xchange

Solar-plus-storage Replaces Coal Plant In New Mexico Makes Carbon-capture Retrofit Moot Pv Magazine Usa