April 28, 2021 the 3.8% net investment income tax: • modified adjusted gross income over the threshold amount, or.

What Is The The Net Investment Income Tax Niit Forbes Advisor

If you have capital gains income above a certain amount, it’s subject to an additional 3.8% tax called the net investment income tax (niit).

Net investment income tax 2021 form. But you’ll only owe it on the $30,000 of investment income you have—since it’s less than your magi overage. Having taken effect for tax year 2013, the net investment income tax is a surtax — that is, a tax responsibility in addition to the federal income tax — calculated at a rate of 3.8 percent on a base of income that is the lesser of one’s: That means you could pay up to 37% income tax, depending on your federal income tax.

Taxpayers use this form to figure the amount of their net investment income tax (niit). If you owe net investment income tax, you must attach form 8960 to your tax return. The niit is a 3.8% tax that is imposed on net investment income, generally defined as gross income from dividends, interest, rents, royalties, annuities, certain passive activities and gains from the disposition of such activities (less certain deductions).

This election is possible by selecting the part of your qualified dividend alongside the net capital gains that you want to be part of the net investment income, which will appear in form 4952 line 4(g). For purposes of the net investment income tax, certain items of investment income or investment expense receive different tax treatment than for the regular income tax. Form 8960 instructions pdf provides details on how to figure the amount of investment income subject to the tax.

Income you earned as a resident of american samoa, as on line 15 of form 4563. Your additional tax would be $1,140 (.038 x $30,000). The net investment income tax (niit) is a 3.8% tax on investment income such as capital gains, dividends, and rental property income.

If an individual owes the net investment income tax, the individual must file form 8960 pdf. The tax applies to passive / investment income only, which includes. You won't know for sure until you fill out form 8960 to calculate your total net investment income.

Parent includes child’s income/tax on. All net investment income included on line 12 (except for alaska permanent fund dividends) is included in the parents’ net investment income. If you earn income from any of your investments this year, you may have to pay the net investment income tax, in addition to the regular income taxes you owe.

Net investment income (nii) tax protective refund claims. Income tax return for cooperative. You’ll owe the 3.8% tax.

Net investment income tax is reported on irs form 8960. If an individual has too little withholding or fails to pay enough quarterly estimated taxes to also cover the net investment income tax, the individual may be subject to an estimated tax penalty. Current revision form 8960 pdf about form 8960, net investment income tax.

Let’s say you have $30,000 in net investment income and your magi goes over the threshold by $50,000. The niit is a 3.8% additional tax on the lesser of net investment income or the excess of the child’s modified adjusted gross income (magi) over a threshold amount. Updated for tax year 2021 / october 16, 2021 02:35 am.

The supreme court recently announced that it would render a decision in 2021 on the validity of the 2010 patient protection and affordable care act (aca) that may impact certain taxes you paid in prior years. All about the net investment income tax. The niit is set at 3.8%,.

The niit was legislated back in 2010, effective for tax years after december 31, 2012. The 3.8% net investment income tax under internal revenue code section 1411 would be broadened to include any income derived in the ordinary course of. A child whose tax is figured on form 8615 may be subject to the net investment income tax (niit).

For the quarter ended september 30, 2021, capital southwest had tax expense of $0.3 million as compared to $0.4 million in the previous quarter. The exact income threshold for paying niit depends on your filing status and your modified agi. Calculate magi for the net investment income tax.

Taxpayers can decide to have net capital gains and qualified dividends as part of what they need to estimate their investment income, which helps deduct their investment interest. The net investment income tax, or niit, is an irs tax related to the net investment income of certain individuals, estates and trusts. The net investment income tax shouldn’t be an everyday or every year thing, it applies to investment income above a fairly large threshold.

Free Income Tax Filing In India Eztax Upload Form-16 To Efile Income Tax Filing Taxes Income Tax Return

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How To Calculate Additional Medicare Tax Properly

Download Pan Card Form Income Tax Department Quiz How Much Do You Know About Download Pan C Income Tax Income How To Apply

Personal Investment Agreement Sample Templates Investing Agreement Business Template

5 Simple And Important Financial Ratios That Help You To Deal With Stock Market In This Post We Learn Stock Market Stock Market For Beginners Financial Ratio

Section 80c 80cc – Deductions Income Tax Deductions Under Chapter Vi For Ay 2021-22 Tax Deductions Deduction Education Essentials

Free Income Tax Filing In India Eztax Gst Itr Accounting Filing Taxes Income Tax Income Tax Return

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

Easy Net Investment Income Tax Calculator

Printable Professional Balance Sheet And Income Statement Etsy In 2021 Balance Sheet Income Statement How To Get Money

Capital Gains Or Capital Losses Are The Gains Or Losses That A Company Or An Individual Experiences On The Sale Of A C Capital Assets Capital Gain Share Market

Hotel Pro Forma Template Fresh The Proforma In E Statement Business Plan Template Word Simple Business Plan Template Statement Template

Taxation System In Indonesia Your Guide To Income Taxation

Income That Is Non-taxable Is Called As Exempt Income Section 10 Of The Income Tax Act 1961 Includes Those Incomes Which Do N In 2021 Taxact Income Employee Services

New Income Tax Table 2020 Philippines Income Tax Tax Table Income

What Are The Things Which Are Not Taught In School Its Cliche At This Point To Say That The Most Important Things You Learn In Li Teaching School Share Market

Ulip Is Taxable In 2021 Tax Free Investments Start Up Business Income Tax

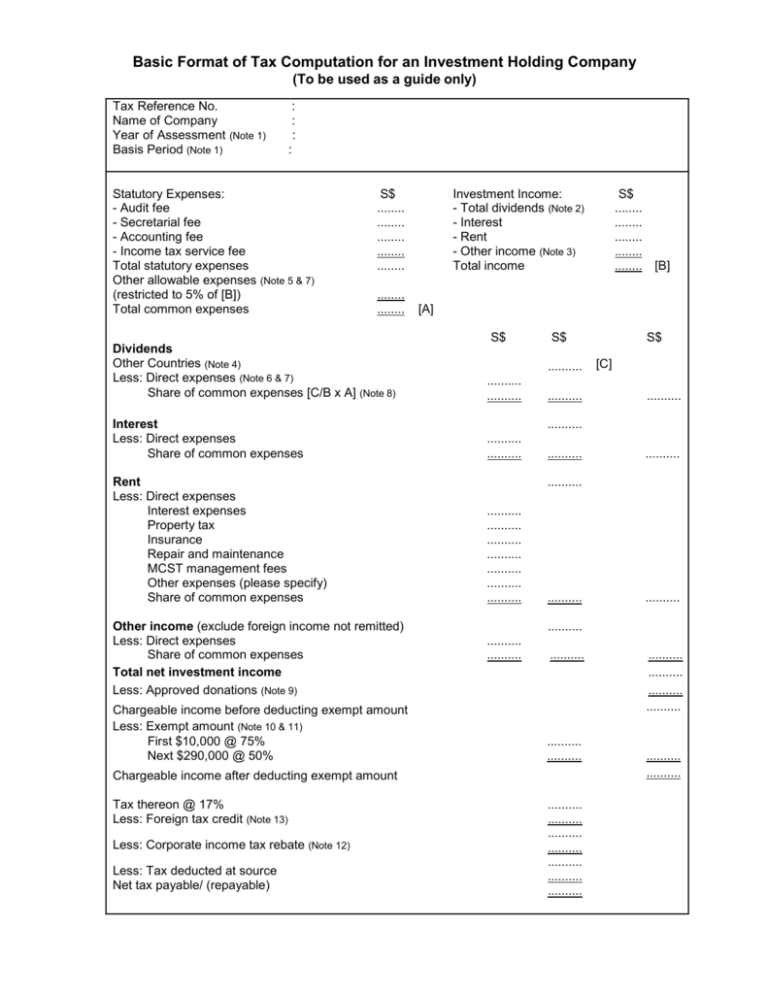

Basic Format Of Tax Computation For An Investment Holding Company