Taxpayers who pay property taxes to schools and file nebraska income taxes are eligible to claim a refundable income tax credit on the amount of property taxes paid to schools. Motor vehicle tax calculation table msrp table for passenger cars, vans, motorcycles, utility vehicles and light duty trucks w/gvwr of 7 tons or less.

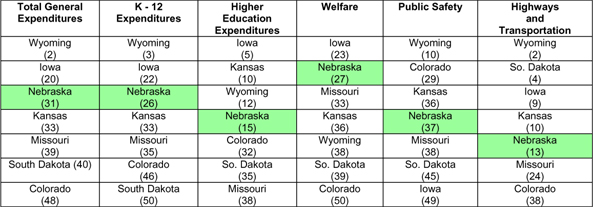

Past Policy Maps Legislative Research Office

See how your monthly payment changes by making updates.

Nebraska property tax calculator. The nebraska tax calculator is updated for the 2021/22 tax year. The city of lincoln and lancaster county. This tax calculator performs as a standalone state tax calculator for nebraska, it does not take into account federal taxes, medicare decustions et al.

Sacramento county is located in northern california and has a population of just over 1.5 million people. (ap) — nebraska taxpayers who want to claim an income tax credit for some of the property taxes they paid have a new tool. (ap) — nebraska taxpayers who want to claim an income tax credit for some of the property taxes they paid have a new tool to help them calculate what they’re owed.

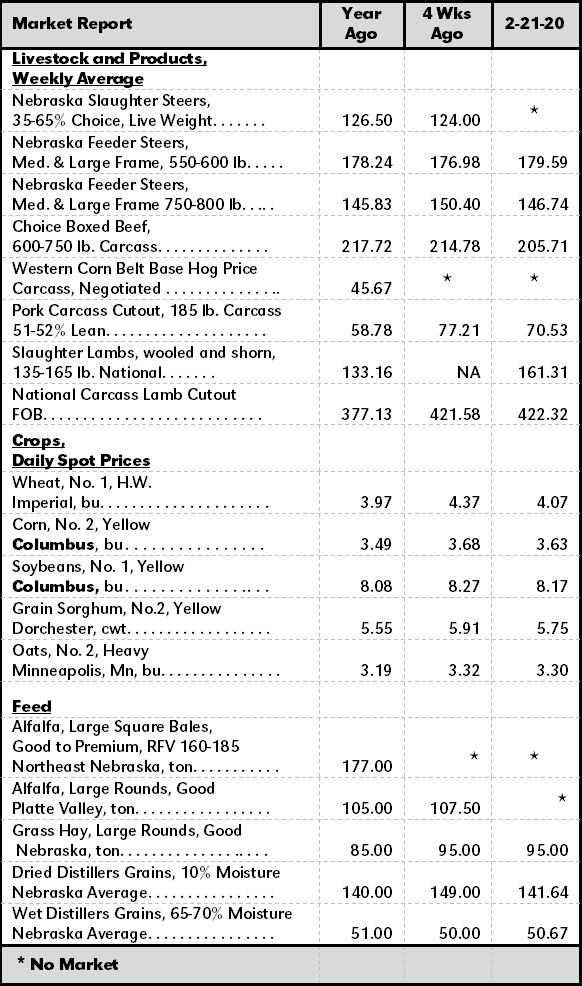

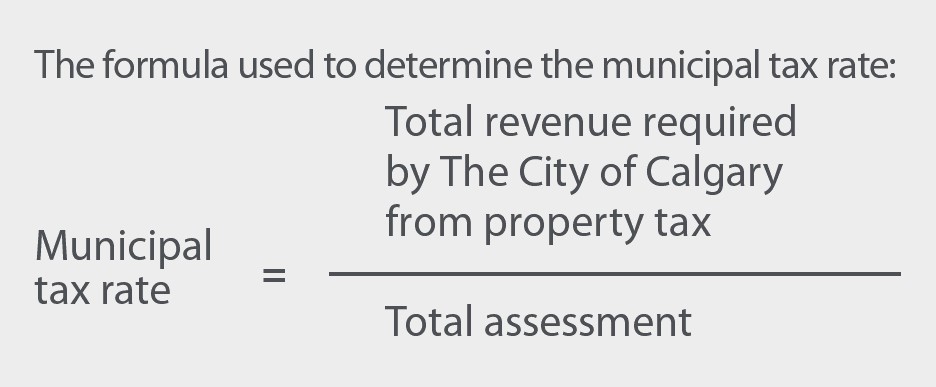

Motor vehicle fee is based upon the value, weight and use of the vehicle and is adjusted as the vehicle ages. Madison county has one of the highest median property taxes in the united states, and is ranked 620th of the 3143 counties in order of median property taxes. Property tax calculation can be summarized by:

The median property tax on a $142,800.00 house is $2,656.08 in cass county. The motor vehicle tax and motor vehicle fee replaced the property tax levied on motor vehicles beginning jan. The city of lincoln and lancaster county will receive about 16% and 15% of a lincoln property owner's tax bill, respectively.

The nebraska tax calculator is designed to provide a simple illlustration of the state income tax due in nebraska, to view a. The county’s average effective property tax rate is 0.81%. Nebraska personal property return must be filed with the county assessor on or before may 1.

For tax year 2020, the credit equals 6 percent of property taxes paid to schools and applies to taxes paid between jan. Nebraska launches new site to calculate property tax refund february 17, 2021 gmt omaha, neb. Nebraska is ranked number seventeen out of the fifty states, in order of the average amount of property taxes collected.

When owners of real estate pay property taxes, the amount is divided among several government entities such as the county, a city or village, a school district and several others. At that rate, the total property tax on a home worth $200,000 would be $1,620. The median property tax in madison county, nebraska is $1,722 per year for a home worth the median value of $100,500.

All property in the state of nebraska is subject to property tax unless an exemption is mandated by the nebraska constitution, article viii, or is permitted by the constitution and enabling legislation is adopted by the legislature.federal law may supersede the nebraska constitution with regard to taxation of property owned by the federal government or its agencies or. The median property tax paid in lancaster county is $3,061, while the state median is just $2,787. The median property tax in nebraska is $2,164.00 per year for a home worth the median value of $123,300.00.

Unfortunately, property taxes are a bit higher in nebraska than the rest of the. It's also home to the state capital of california. 50% to the county treasurer of each county, amounts in the same proportion as the most recent allocation received by each county from the highway allocation.

To show how your lancaster county tax dollars are spent, we have developed this calculator which breaks down your county taxes only by general fund agency. The state technically does not collect property taxes beyond the document stamp fee. After 1% is retained by the county treasurer the distribution of funds collected for the motor vehicle fee are:.

Nebraska launches new site to calculate property tax refund. The median property tax on a $142,800.00 house is $2,513.28 in nebraska. Sarpy county is part of the omaha metropolitan area and has the highest property tax rates of any nebraska county.

Madison county collects, on average, 1.71% of a property's assessed fair market value as property tax. County assessor address and contact information. Calculating property taxes in nebraska can be quite complicated.

The median property tax on a $142,800.00 house is $1,499.40 in the united states. Fulton is reminding property owners they dont want to leave money on the table, as the credit is fully refundable. This calculator can only provide you with a rough estimate of your tax liabilities based on the property.

To use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase. Our nebraska property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in nebraska and across the entire united states. Although each property transaction will be slightly different, our calculator will give you average property taxes based on what others in your area have paid.

Do not mail personal property returns to the department of revenue. Property tax calculation can be summarized by: Use this free nebraska mortgage calculator to estimate your monthly payment, including taxes, homeowner insurance, principal, and interest.

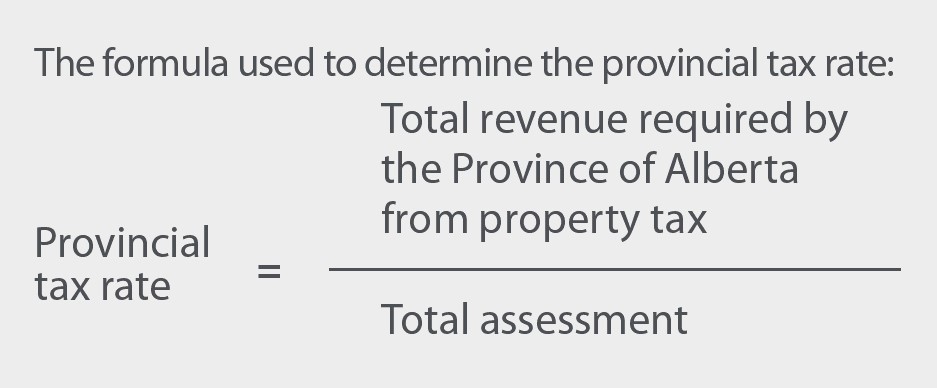

Instead, property taxes are levied by counties, cities, school districts, and other local agencies for their needs. Counties in nebraska collect an average of 1.76% of a property's assesed fair market value as property tax per year. Nebraska state tax commissioner tony fulton says one of the things that should be keeping in mind is the new income tax credit for property tax paid to local school districts that will be new for the 2020 tax year.

Nebraska Property Taxes By County – 2021

Nebraskas Sales Tax

Taxes And Spending In Nebraska

2020 Nebraska Property Tax Issues Agricultural Economics

2

State Corporate Income Tax Rates And Brackets Tax Foundation

Property Tax Tax Rate And Bill Calculation

Nebraskas Sales Tax

Nebraska Property Tax Calculator – Smartasset

States With The Highest And Lowest Property Taxes Property Tax High Low States

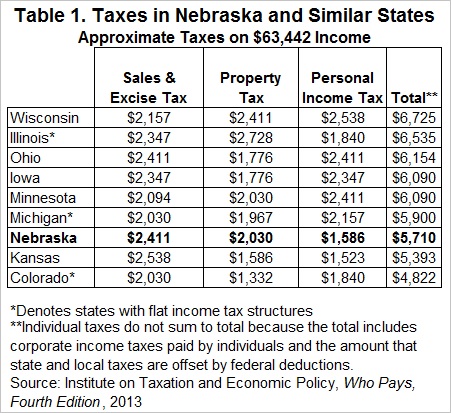

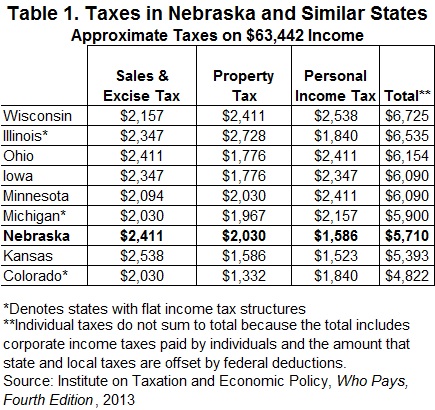

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

Jackson County Mo Property Tax Calculator – Smartasset

Nebraska Income Tax Calculator – Smartasset

:max_bytes(150000):strip_icc()/dotdash-TheBalance-best-and-worst-states-for-property-taxes-3193328-final3-4972494b00d447d58e8943ad5b82913e.jpg)

State Taxes

Nebraska Property Tax Calculator – Smartasset

Property Tax Tax Rate And Bill Calculation

Nebraska Sales Tax – Small Business Guide Truic

Nebraska Property Tax Calculator – Smartasset

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute