You owe it, no matter how much money you make. A tax credit of 20 to 35% is available on qualifying childcare expenses, which are limited to $3,000 for one qualifying dependent or $6,000 for two or more qualifying dependents.

Suta Tax Your Questions Answered Bench Accounting

Enter your caregiver's payment info.

Nanny tax calculator florida. The futa tax rate is 6 percent, although many employers get a 5.4 percent credit against the futa tax if they pay their suta. (3) oversee property tax administration. These employer taxes are typically about 10% above the nanny’s gross payroll.

See the nanny hourly wage calculator below. Futa is only collected on your household employee’s first $7,000 of wages. You must also state an hourly wage to meet federal guidelines.

Employing an undocumented worker is a violation of immigration law. About gtm household business payroll options menu Call us for more details.

The average nanny gross salary in miami, florida is $31,416 or an equivalent hourly rate of $15. 5) calculating what you owe in nanny taxes. If neither of the two contingencies applies, you do.

In addition, they earn an average bonus of $424. It is best to also include a sample pay stub. Use the nanny tax calculator to:

Use the “pay adjustment” field to make up for any additional wages you paid (or withheld) for things such as a holiday bonus or an unpaid day off. You will not have to pay the futa tax if your nanny or household employee is: Nanny employers often qualify for favorable tax breaks that will largely offset their employer taxes.

You will need to enter your nanny’s gross weekly pay and the number of weeks you paid your nanny. Accounting of the palm beaches, llc 4851 palm brooke circle west palm beach, fl, 33417 phone: These taxes can cost you about 10% over and above what you’ve agreed to pay for services.

The nanny tax professionals of homepay provide easy and affordable payroll services for families with household employees. Half of social security & medicare (7.65%) federal and state unemployment insurance. If you pay a household employee such as a nanny, babysitter, caregiver or house manager more than $2,300 a year or $1,000 in a quarter to perform work in your home (or occasionally even out of your home such as in a nanny share), you are a household employer.

Your nanny’s filing status and allowances can be found on. The nanny tax calculator for 2015 and 2016 taxes. The internal revenue code maintains that the immigration status of your nanny or other employee has no bearing on your obligation for nanny employment taxes.

Salary estimates based on salary survey data collected directly from employers and anonymous employees in miami, florida. This will clearly demonstrate the deductions. The tax is usually 6.2% of cash wages, less a credit for state unemployment tax.

This calculator is a courtesy of care.com homepay, provided by breedlove. Form 1040 schedule h is for the household payroll tax reporting. It covers your contribution to social security (12.4%) and medicare (2.9%).

A simple solution to paydays, tax time & all points in between. It is intended to provide general payroll estimates only. When does your nanny need to be present for work?

Homework solutions specializes in providing household employers and their tax preparers real solutions for nanny tax compliance. Wages over $7, 000 a year per employee are not taxed. Overtime is not required to be paid when work is performed on a holiday.

They—and you—will owe the government employment taxes, often referred to as “nanny” taxes, when the individual is classified as an employee according to tax rules. We are nationally recognized experts in the field of household employment taxes, regularly consulted by media such as. Placement fees vary, and we assess them based on the nanny’s compensation package.

Household employers can expect to pay the following employment taxes: One of your children under 21. Contact breedlove to speak to a tax expert today.

There are important benefits to following the law. Credit is normally 5.4%, so federal tax is normally.8%. The most common practice is to agree on a standard weekly salary based on a standard number of hours worked per week.

Here are 5 helpful ways to use a nanny tax calculator. (2) enforce child support law on behalf of about 1,025,000 children with $1.26 billion collected in fy 06/07; A total of $1,000 to your employees during any quarter how to pay the “ nanny tax ” household employers file and pay the exact same employment taxes as commercial employers do.

(1) administer tax law for 36 taxes and fees, processing nearly $37.5 billion and more than 10 million tax filings annually;

Nanny Tax Payroll Calculator Gtm Payroll Services

Nanny Tax Payroll Calculator Gtm Payroll Services

Roth Ira How They Work Rules To Know Where To Begin – Nerdwallet Roth Ira Ira Investment Ira

Nanny Tax Calculator Gtm Payroll Services Inc

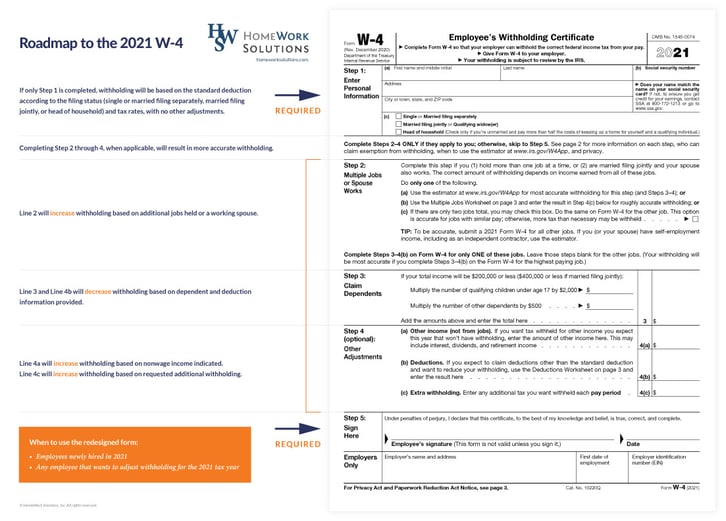

New W4 For 2021 What You Need To Know To Get It Done Right

Lamkin Wealth Managements Five Mistakes To Trigger Irs Audit Tax Deductions Tax Preparation Filing Taxes

2021 Florida Sales Tax Calculation By Zip Code For 2021 Dr-15 Etsy Florida Sales Tax Florida Zip Code Ebay Templates

What Is Payroll Tax Definition Calculation Who Pays It

Tax Tips For Uber Lyft And Other Car Sharing Drivers – Turbotax Tax Tips Videos

Tax Calculator For Families Of Boston Nanny Centre Gtm Payroll Services Inc

No You Cant Deduct That 11 Tax Deductions That Can Get You In Trouble Inccom

Free Investment Property Spreadsheet For Tax This Spreadsheet Will Help You Calculate Your Income Ex Investment Property Budget Spreadsheet Being A Landlord

Free Investment Property Spreadsheet For Tax This Spreadsheet Will Help You Calculate Your Income Ex Investment Property Budget Spreadsheet Being A Landlord

What Is Payroll Tax Definition Calculation Who Pays It

Nanny Tax Payroll Calculator Gtm Payroll Services

Currency Thai Money Currency Thai Money Wedding Ceremony Mortgage Payment Debt Payoff Credit Card Debt Relief

How To Pay Your Nannys Taxes Yourself Nanny Tax Payroll Template Nanny Payroll

Do You Have The Tools You Need To Get A Personal Services Job Check Out Our Nanny Resume Example To Learn T Resume Examples Resume Skills Good Resume Examples

Ms Excel Printable Payroll Calculator Template Excel Templates Payroll Template Excel Templates Payroll