A recording fee is normally a small flat amount while mortgage recording taxes are a percentage of the sale price, like transfer taxes. Real estate transfer tax (rett) is a tax charged by state or local governments when the title to a property is transferred from one owner to another.

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Your transfer tax is equal to a percentage of the sale price or appraised value of the real estate that you buy or sell.

Mortgage refinance transfer taxes. 0 percent to 2 percent; A transfer tax, also known as a deed transfer tax, is imposed by states, counties and/or municipalities when real estate is transferred from one owner to another; Nys mortgage tax rates county tax rate zone wayne 1.00% 1 westchester 1.30% ** 2 wyoming 1.00% 1 yates 0.75% 1 do you have to pay mortgage tax on a refinance?

Generally, transfer taxes are paid when property is transferred between two parties and a deed is recorded. What is the mortgage tax in westchester county? My sister wishes to transfer her third to me,.

Either the buyer or the seller will have to pay the tax. Also know, who pays transfer tax in mi? Annual premium is typically paid in full at closing.

In some states, the transfer tax is known by other names, including deed tax, mortgage registry tax or stamp tax. I live and work in conshohocken and would be happy to answer any questions you have. The new york state transfer tax rate is currently 0.4% of the sales price of a home.

Additional fees associated with a cema. A transfer tax is the city, county or state's tax on any change in ownership of real estate. One analogy refers to this as the real estate “sales tax.” some states also levy the tax when a mortgage is refinanced.

*recording fees & transfer taxes deed of trust (mortgage) tax : It might also be added that apparently there is a transfer tax if you refinance and go from a title in a person's name to a title in that person's trust. Also to know, who pays transfer taxes at closing?.

Additionally, what are transfer taxes on closing costs? So if you have a $750,000 mortgage on your primary home and $250,000 mortgage on a vacation home, you can deduct all your mortgage interest. Rather than the seller paying transfer tax on the full sale price the transfer tax is the sale price less the amount of the mortgage obtained by buyer.

In a refinance transaction where property is not transferred between two parties, no deed transfer taxes are due. Historically, maryland’s refinancing was only available for residential transactions. The irs allows you to deduct the interest paid on up to $1 million in mortgage debt, on either your primary or secondary home, or the two combined.

Cute way to tax people! Does a lender charge deed transfer taxes in a refinance transaction? This exemption can be put to use as a planning tool when coupled with maryland’s recently expanded refinancing exemption.

Thus, a deed of trust or mortgage is exempt from recordation tax to the extent that it secures the purchase price paid for real property. Regarding transfer taxes, most jurisdictions in maryland do not require you to pay new transfer taxes at the time of your refinance settlement. This may vary from one state to another.

While transferring interest in a home to refinance a loan is often straightforward, it's important to investigate the situation to avoid potential issues. Refinancing with the same lender. If a person is being added to the property deed at the time of refinancing, then the person will have to pay the transfer taxes.

Nys mortgage refinance questions (lender fees and transfer taxes) taxes in the process of refinancing our home (4.25 > 2.875) and because i have started this process with our current lender they are supposed to 1) waive lender fees and 2) reimburse appraisal fee at close. For example, shelly purchased a house worth $700,000 from karen.the state government charged a tax, say $5000 while transferring the title from. There is definitely no transfer tax in conshohocken on any type of mortgage refinance.

However, in most jurisdictions, you must pay the state revenue stamps (this amount varies by county) on the new money being borrowed. Unlike real estate transfer taxes, mortgage transfer taxes are calculated as a percentage of the mortgage, instead of a percentage of the home’s sale price. Total deed of trust (mortgage) tax :

Deed of trust recording fee (mortgage 14 pages) total recording fees : You usually will pay a mortgage transfer tax any time you take out a loan on your home — for example, when refinancing our taking out a home equity loan — not only when taking out a mortgage to purchase a new home. 25 percent of the actual consideration.

Transfer taxes transfer tax is at the rate of. Total recording fees & taxes:

Nyc Nys Seller Transfer Tax Of 14 To 2075 Hauseit

Delaware First Time Home Buyer State Transfer Tax Exemption Prmi Delaware

Refinancing Your House How A Cema Mortgage Can Help

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.57.10PM-ab1915c984414b79910a4cbaf41b8003.png)

Form 1098 Mortgage Interest Statement Definition

What If My Co-purchaser And I Dont Both Qualify As First-time Homebuyers Ratehubca

The Complete Guide To The Nyc Mortgage Recording Tax – Yoreevo Yoreevo

What Is A Mortgage Tax Smartasset

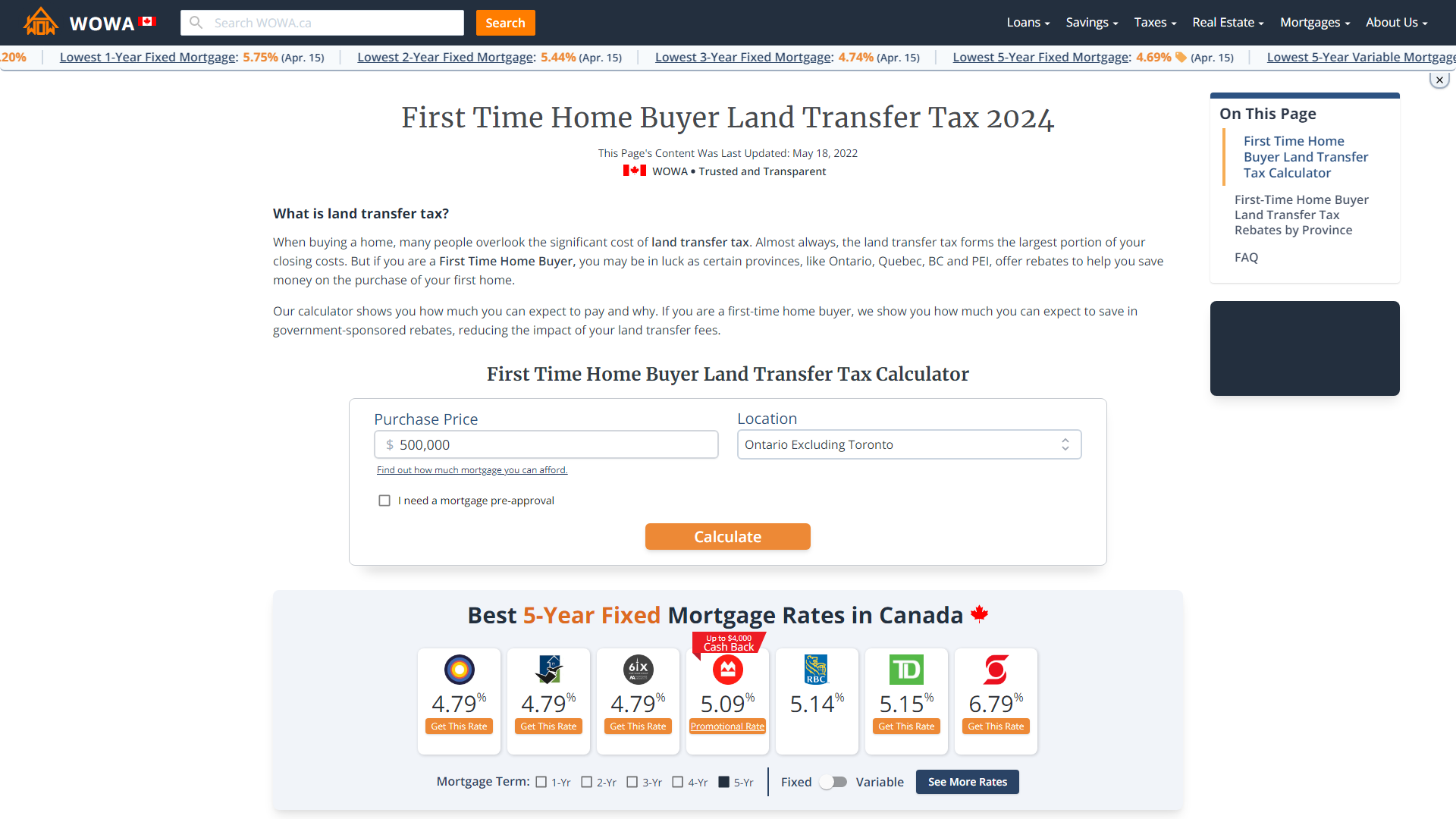

Ontario Land Transfer Tax Calculator Real Estate Lawyer Fees 450

Land Transfer Tax Home Quotes And Sayings Mortgage Quotes Refinance Mortgage

Beware Of This Common Mistake When Refinancing Your Home – Snyder Law

Understanding Mortgage Closing Costs Lendingtree

Nyc Nys Seller Transfer Tax Of 14 To 2075 Hauseit

First Time Home Buyer Land Transfer Tax Rebate Criteria

Saving New York State Mortgage Recording Tax Gonchar Real Estate

Nyc Nys Seller Transfer Tax Of 14 To 2075 Hauseit

/ScreenShot2020-02-03at1.57.10PM-ab1915c984414b79910a4cbaf41b8003.png)

Form 1098 Mortgage Interest Statement Definition

Cash-out Refinance Tax Implications Nextadvisor With Time

Closing Costs That Are And Arent Tax-deductible Lendingtree

No-closing-cost Mortgage Is It Actually Worth It – Credible