Anyone who sells tangible personal property and collects sales tax must have an alabama sales tax number. This form should be returned in its entirety please read definitions on back prior to completing.

2

Businesses must use my alabama taxes (mat) to apply online for a tax account number for the following tax types.

Montgomery al sales tax registration. Registration requirements specify that bidders must supply the montgomery county alabama revenue commissioner's office with a completed bidder's card, request for. 2019) sales tax (updated oct. The general sales tax rate in the city of alabaster is 9% (state of alabama= 4%, shelby county= 1%, and city of alabaster= 4%).

The state of alabama also accepts the. 411 rows any business that sells goods or taxable services within the state of alabama to. 2018) gas tax (updated dec.

Businesses register with the city and are assigned an account number and reporting forms for this purpose. In all likelihood, the application for sales/use tax registration is not the only document you should review as you seek business license compliance in montgomery, al. Instructions for uploading a file.

Montgomery, al application for sales/use tax registration. We recommend that you obtain a business license compliance package (blcp)®. The state of alabama sales & use tax p.o.

Type of tax/tax area (a) gross taxable amount (b) total deductions (c ) net taxable Including city and county vehicle sales taxes, the total sales tax due will be between 3.375% and 4% of the vehicle's purchase price. Total amount enclosed make check payable to city of montgomery $ this form combines sales and seller’s/consumer's use tax reporting.

Alabama department of revenue, central registration unit, p.o. Month even if no tax is due. Enjoy the pride of homeownership for less than it costs to rent before it's too late.

Rental lease, liquor, wine, lodging is collected locally by the city of trussville, 131 main street (p. Tax rates access directory of city, county, and state tax rates for sales & use tax. For more information please write or call:

Alabama paperless filing and payment system. Montgomery county property records are real estate documents that contain information related to real property in montgomery county, alabama. To schedule an appointment at our main office in montgomery, alabama, click here.

2018) pj sales tax (updated oct. A mail fee of $2.50 will apply for customers receiving new metal plates. Registration requirements specify that bidders must supply the jefferson county alabama revenue commissioner's office with a completed bidder's card, request for taxpayer.

Public property records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents. Mail completed application and any initial tax due to: Sales and use taxes have replaced the decades old gross receipts tax.

The montgomery county alabama revenue commissioner's office may require that bidder's post 10% of the estimated amount they intend to purchase at the montgomery county alabama tax sale. Sales tax is also due on the gross receipts from places of amusement or entertainment. The license and revenue division assists businesses in the city of montgomery in issuing and maintaining appropriate business licenses and sales tax numbers.

Alabama department of revenue, 50 north ripley street, p.o. The jefferson county alabama revenue commissioner's office may require that bidder's post 10% of the estimated amount they intend to purchase at the jefferson county alabama tax sale. You can read full instructions on how to register select tax types through my alabama taxes help.

2018) pj gas tax (updated jan. Montgomery county tax records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in montgomery county, alabama. In addition to taxes, car purchases in alabama may be subject to other fees like registration, title, and plate fees.

If applicable, businesses may check with each agency to obtain their automotive, farm equipment and manufacturing rates. Ask for form com 101. These records can include montgomery county property tax assessments and assessment challenges, appraisals, and income taxes.

Box 1274, montgomery, al 36104;

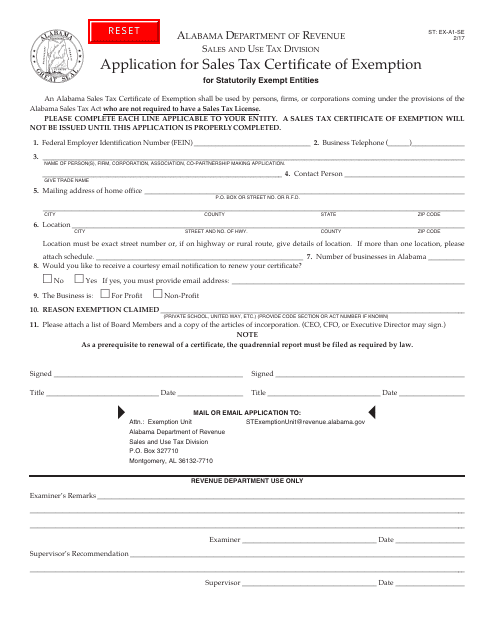

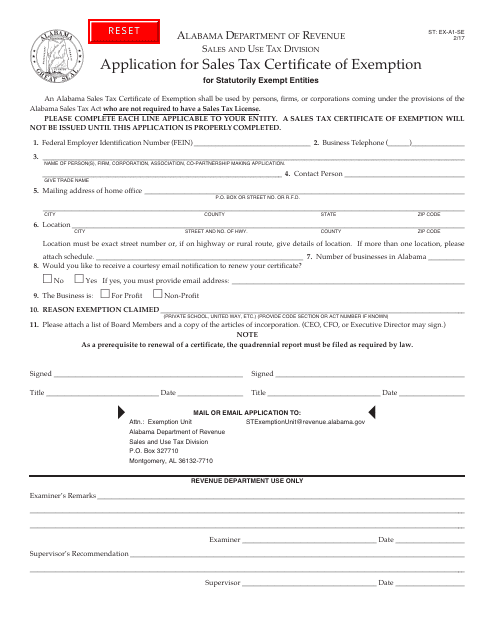

Form St Ex-a1-se Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption For Statutorily Exempt Entities Alabama Templateroller

Other Alabama Taxpayer Forms Avenu Insights Analytics Taxpayer

Sales Tax Audit Montgomery County Al

Alabama Sales Tax – Taxjar

Form St Exc-01 Download Fillable Pdf Or Fill Online Application For Sales And Use Tax Certificate Of Exemption For Government Entity Project Alabama Templateroller

Business Sign 8×10 Instant Download Yes Were Hiring Etsy In 2021 Business Signs Now Hiring Sign Job Recruiters

My Alabama Taxes – Mat

2

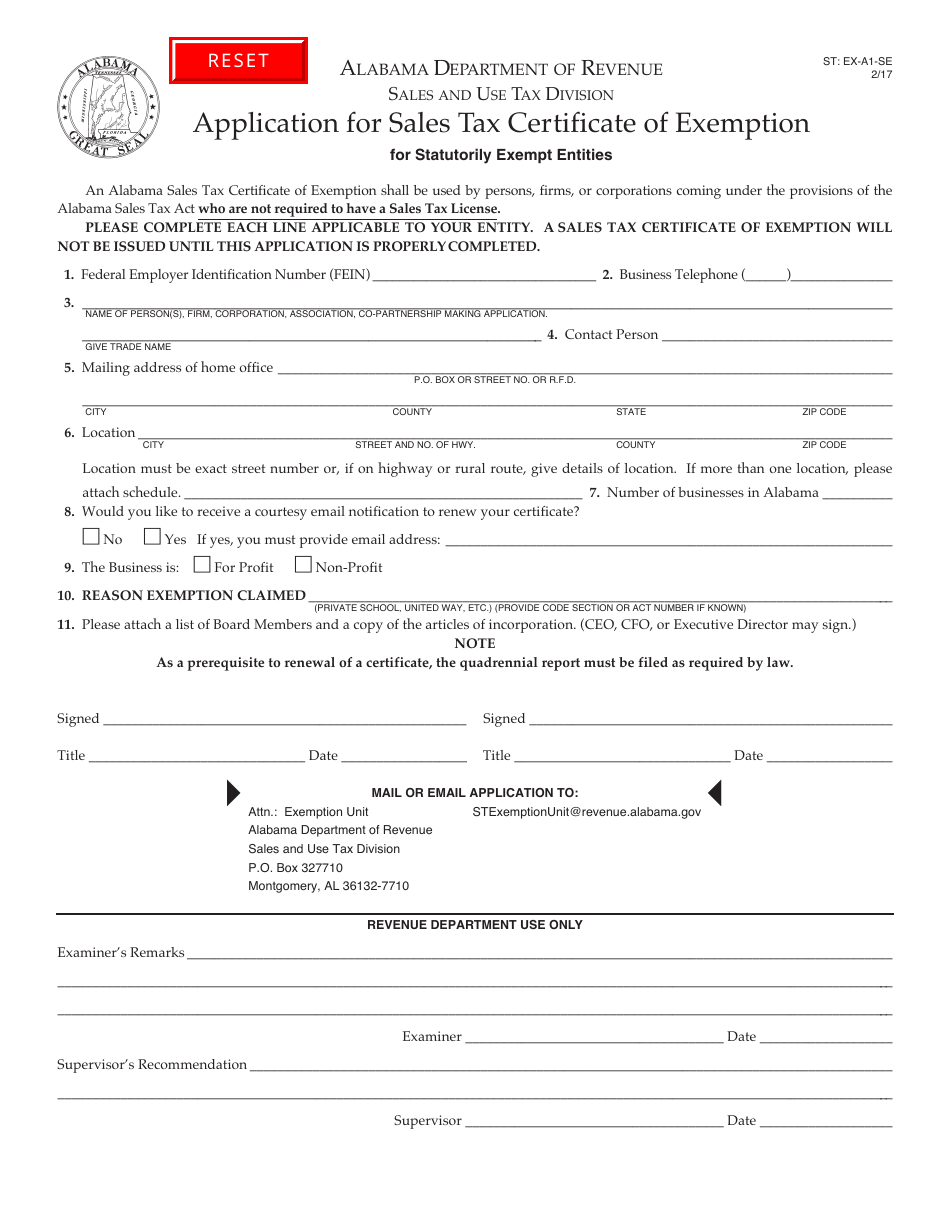

Form St Ex-a2 Download Fillable Pdf Or Fill Online Application For Sales And Use Tax Certificate Of Exemption For An Industrial Or Research Enterprise Project Alabama Templateroller

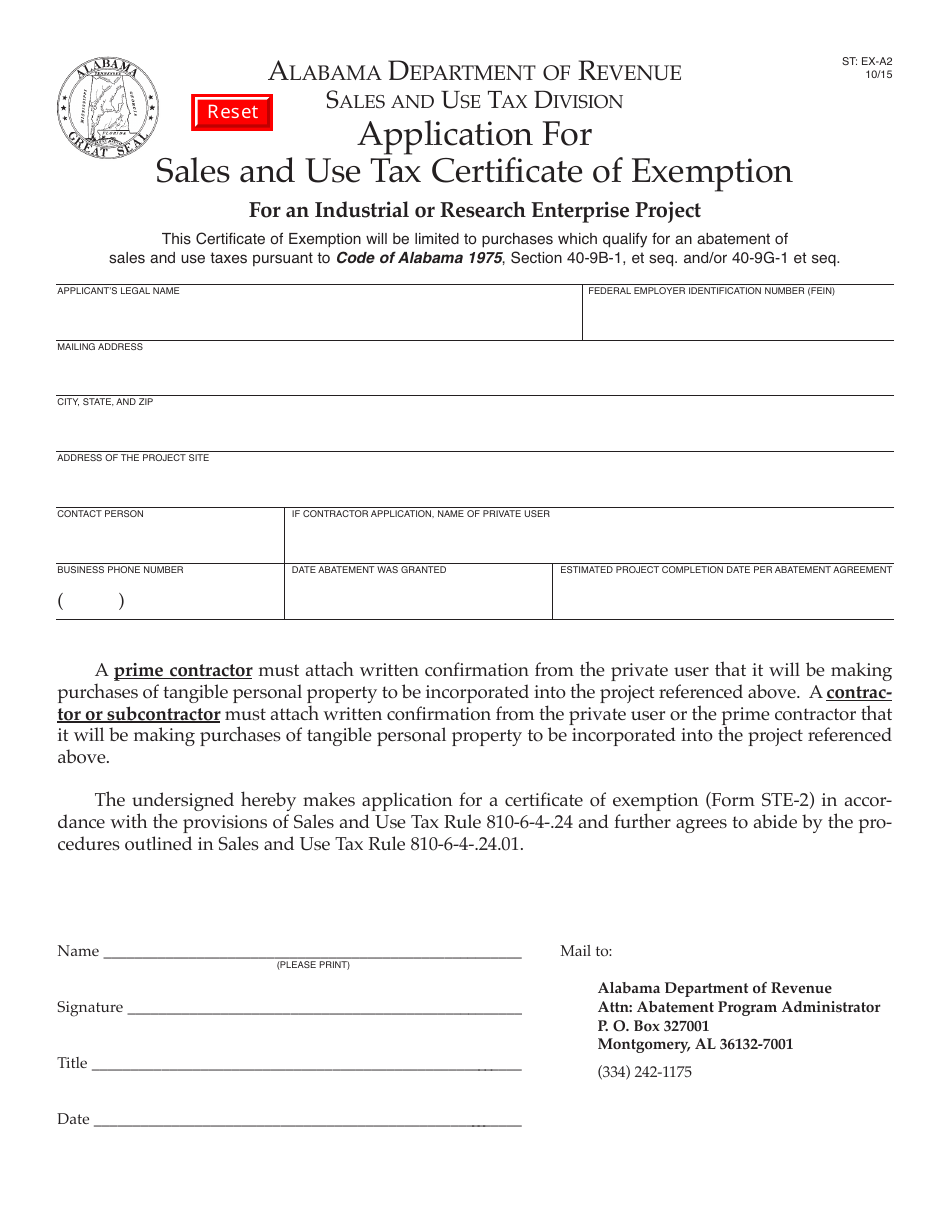

Download Instructions For Form Su Bond Sales Tax Surety Bond Pdf Templateroller

Alabama Birth Certificate Signed By Catherine Molchan Donald Birth Certificate Alabama Digital

Gulf Filling Station 1950 Gas Station Old Gas Stations Filling Station

Form St Ex-a1-se Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption For Statutorily Exempt Entities Alabama Templateroller

Business Sign 8×10 Instant Download Yes Were Hiring Etsy In 2021 Business Signs Now Hiring Sign Job Recruiters

Pin On Academic Writing Online

2

Capertons Old South Store Weogufka Al Old General Stores Sweet Home Alabama Olds

Account Payable Job Description Resume Lovely How To Price Your Freelance Services The Next Accounts

Increase In Rent Notice Ez Landlord Forms Being A Landlord Letter Templates Rent