This page describes the taxability of manufacturing and machinery in alabama, including machinery, raw materials and utilities & fuel. Discount is 5% on tax of $100 or less and 2% on tax over $100.

2

The alabama state sales tax rate is currently %.

Montgomery al sales tax form. City of montgomery $ this form combines sales and seller’s/consumer's use tax reporting. All tax returns are due to the business revenue office by the 20th day of the following month. 2020 rates included for use while preparing your income tax deduction.

The following tax rates are currently in effect: Combined application for sales/use tax form; (central standard time) on or before the due date, to be considered timely paid.

• deductions are to be itemized on back of form. Mail completed application and any initial tax due to: Alabama (al) sales tax rates by city (a) the state sales tax rate in alabamais 4.000%.

Total tax due (sales, use, rental/leasing, and lodging) is the sum of items 1 through 5. Instructions for uploading a file. • all returns with zero tax payment or sebp 7/02 any correspondence should be mailed to:

Sales taxes generate about $106 to $110 million for the city. Discount is not allowed on use tax, rental/leasing tax, and lodging tax. Any seller which conducts business and has a major presence within the state must collect sales tax in alabama must pay taxes to the state.

The 2018 united states supreme court decision in south dakota v. Sales tax calculator| sales tax table. Montgomery collects about $32 million in ad valorem taxes.

The 10% sales tax rate in montgomery consists of 4% alabama state sales tax, 2.5% montgomery county sales tax and 3.5% montgomery tax. Any business that sells goods or taxable services within the state of alabama to customers located in alabama is required to collect sales tax from that buyer. Rates include state, county, and city taxes.

With local taxes, the total sales tax rate is between 5.000% and 11.500%. Discount only applies to sales tax. The 36107, montgomery, alabama, general sales tax rate is 10%.

This is the total of state and county sales tax rates. The law requires that hartselle local taxes be collected, reported and remitted in the same manner as the state sales, use, rental and lodgings taxes. The sales tax discount consists of 5% on the first $100 of tax due, and 2% of all tax over $100 not to exceed $400.00.

Alabama department of revenue sales and use tax division room 4303 p.o. City of montgomery $ this form combines sales and seller’s/consumer's use tax reporting. This form should be retrurned in its entirety please read definitions on back prior to completing.

If paying via eft, the eft payment information must be transmitted by 4:00 p.m. County sales/use tax c/o sarah g. Ask for form com 101.

There is no applicable special tax. The montgomery county sales tax rate is %. Please remit the city of hartselle’s local tax to:

Sales/seller's use/consumers use tax form; Property taxes are collected by the county. If you need information for tax rates or returns prior to 7/1/2003, please contact.

Combined application for sales/use tax form; Courthouse annex iii, 101 s lawrence st. 1) form sr2 is used to obtain an unemployment compensation tax number.

Spear, montgomery county revenue commissioner po. How 2021 sales taxes are calculated for zip code 36107. 2) form cr4 is used to report wages paid to employees.

You can print a 10% sales tax table here. The minimum combined 2021 sales tax rate for montgomery county, alabama is. Has impacted many state nexus laws and sales.

Motor fuel/gasoline/other fuel tax form; This form should be returned in its entirety please read definitions on back prior to completing. Sales & use administers, collects and enforces several different taxes, including sales tax and consumers tax, and is responsible for administering, collecting, and enforcing those tax types.

The december 2020 total local sales tax rate was also 10.000%. Montgomery city hall 10101 montgomery rd. For tax rates in other cities, see alabama sales taxes by city and county.

The current total local sales tax rate in montgomery, al is 10.000%. In the state of alabama, they are taxed at a reduced rate. This will include all online businesses.

Alabama department of revenue, central registration unit, p.o. The maximum discount is $562.00. , al sales tax rate.

The combined rate used in this calculator (10%) is the result of the alabama state rate (4%), the 36107's county rate (2.5%), the montgomery tax rate (3.5%).

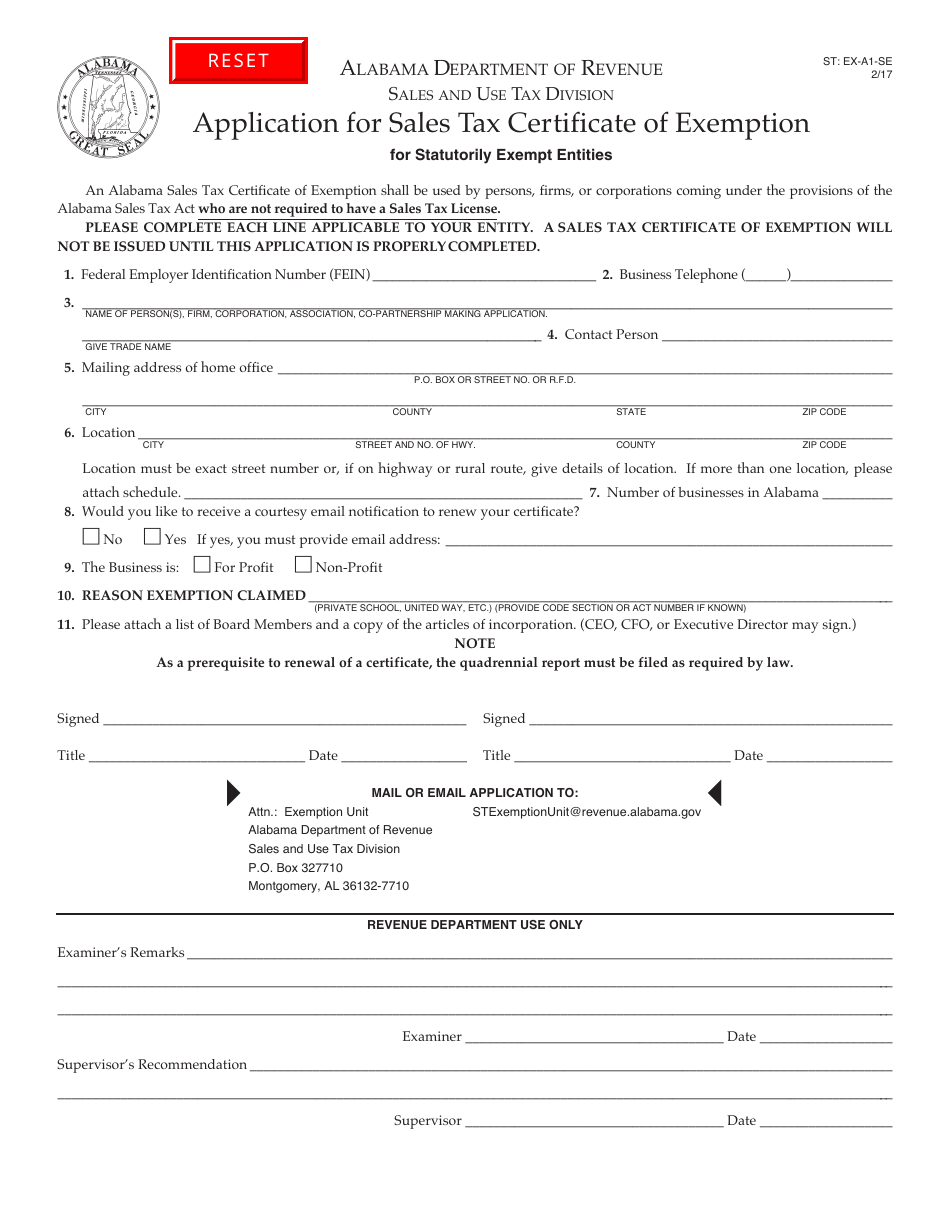

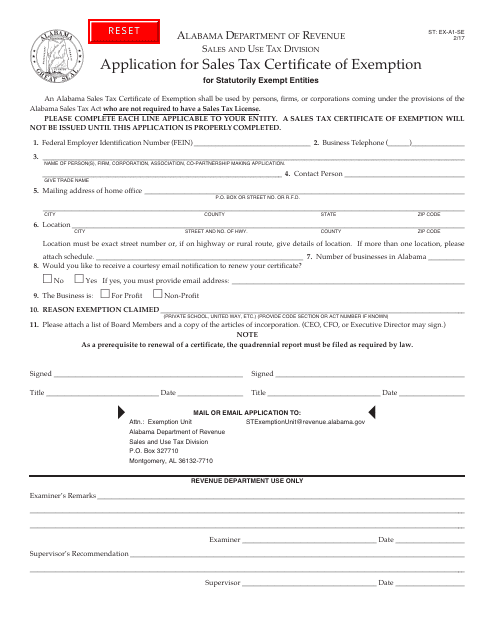

Form St Ex-a1-se Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption For Statutorily Exempt Entities Alabama Templateroller

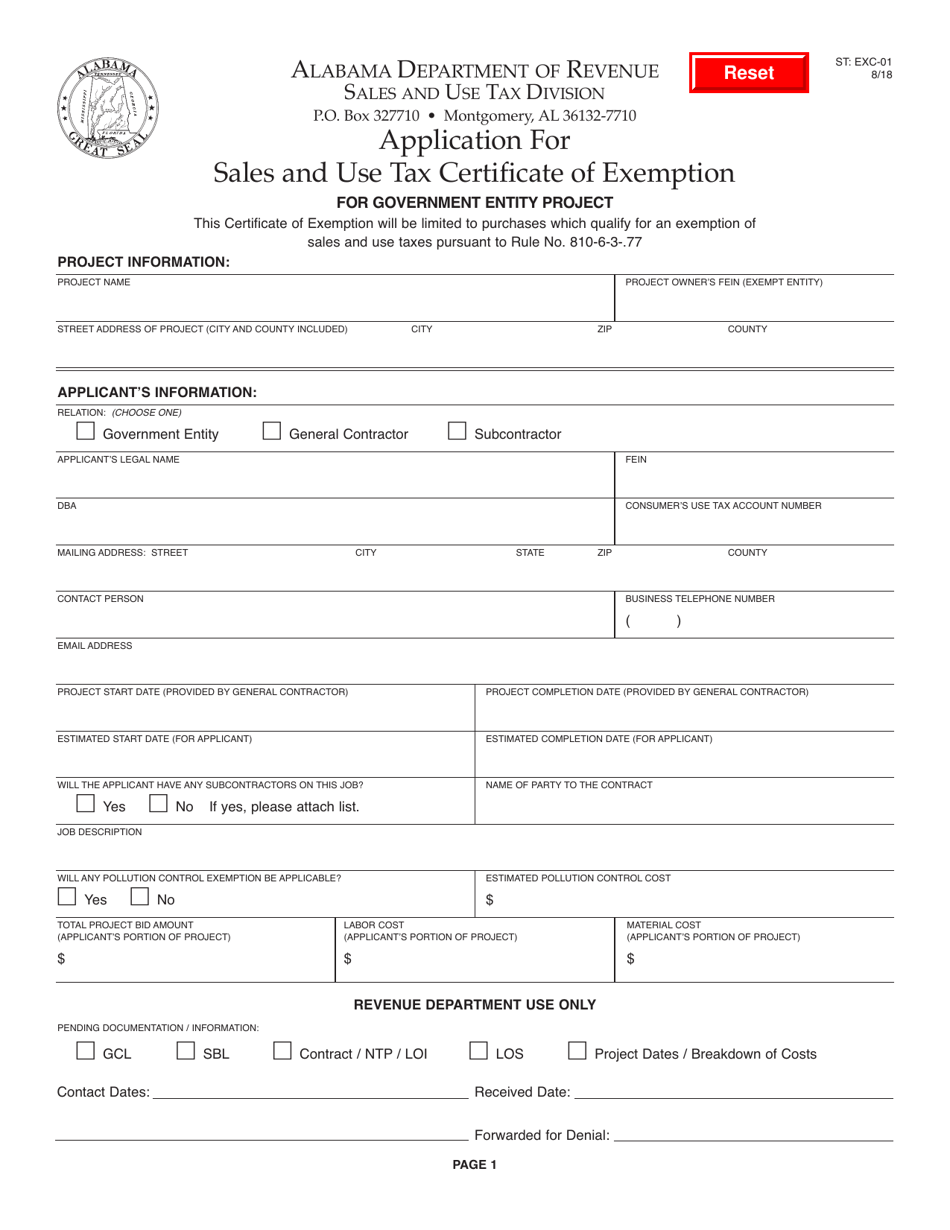

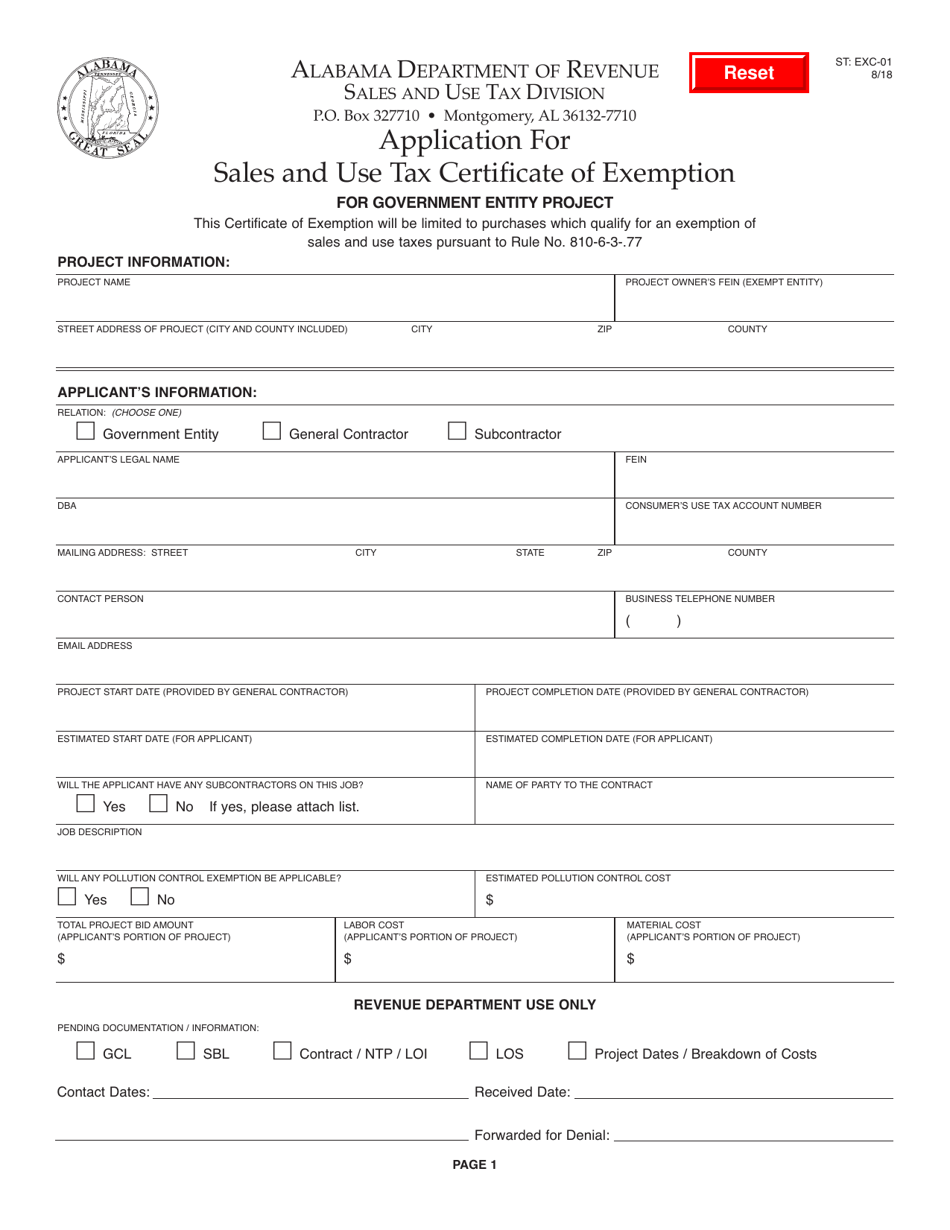

Form St Exc-01 Download Fillable Pdf Or Fill Online Application For Sales And Use Tax Certificate Of Exemption For Government Entity Project Alabama Templateroller

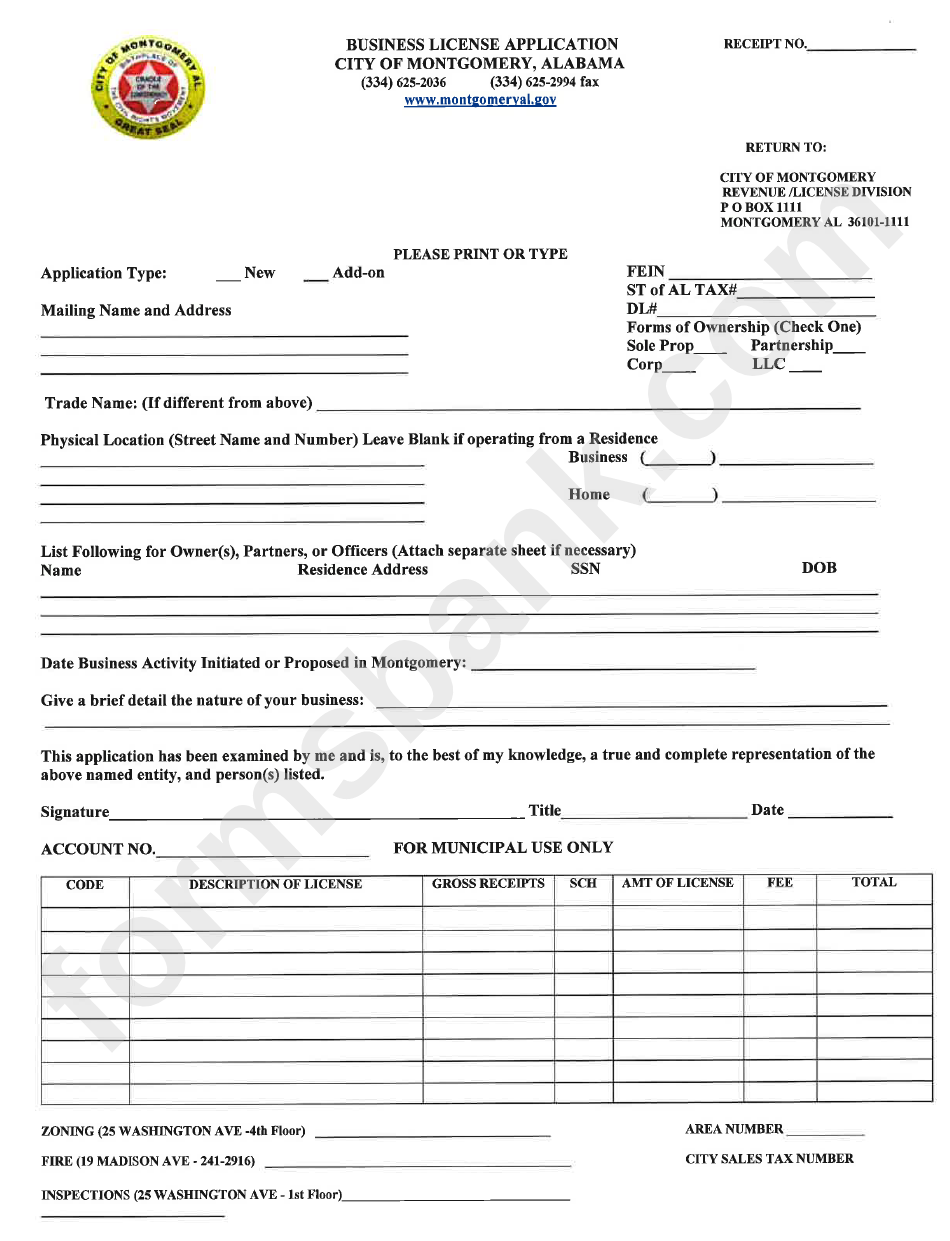

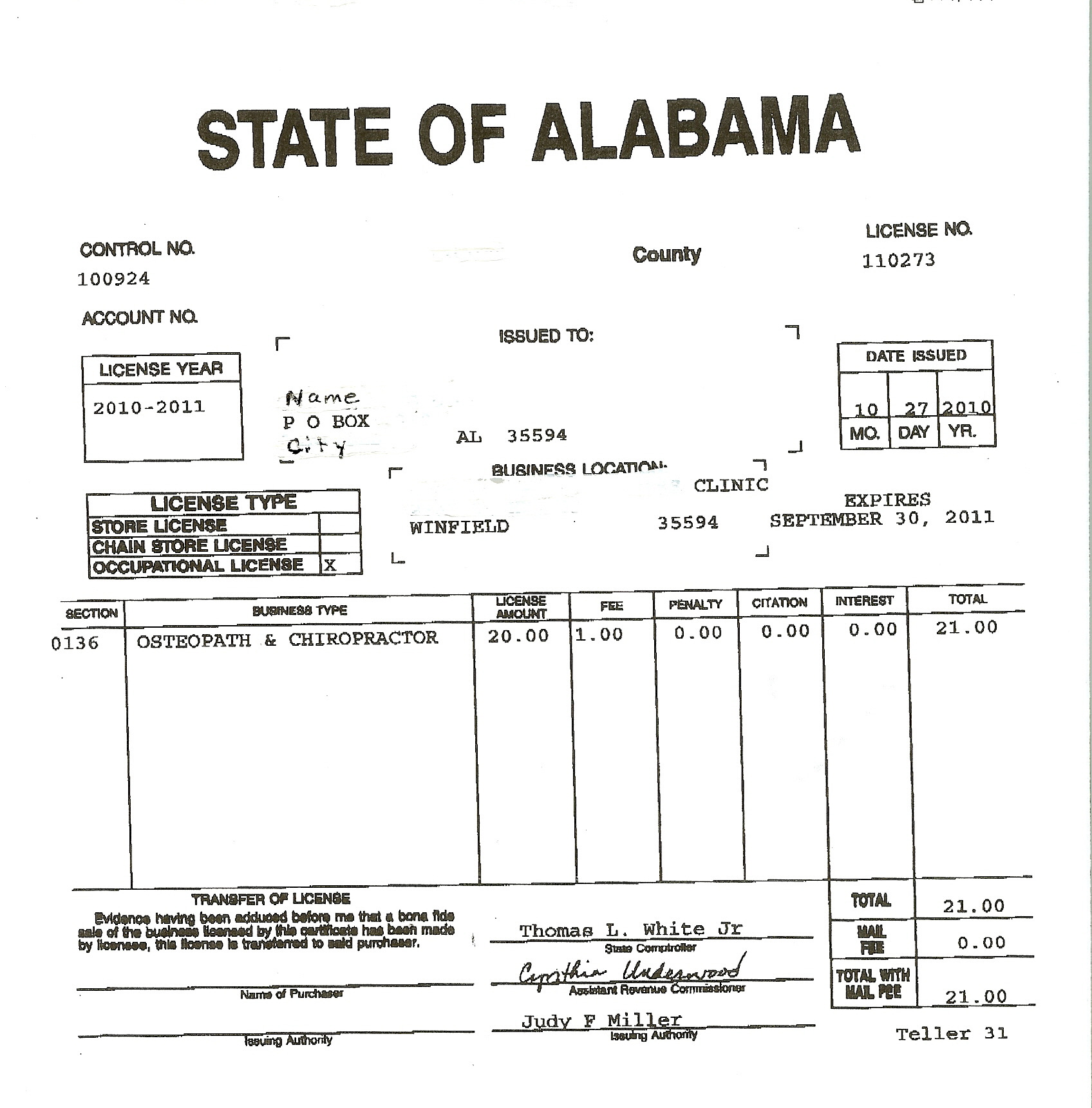

Mo Business License Tax

Form St Exc-01 Download Fillable Pdf Or Fill Online Application For Sales And Use Tax Certificate Of Exemption For Government Entity Project Alabama Templateroller

Roll Tide Alabama Cake Alabama Cakes Cake Party Sweets

Pin On Type

Increase In Rent Notice Ez Landlord Forms Being A Landlord Letter Templates Rent

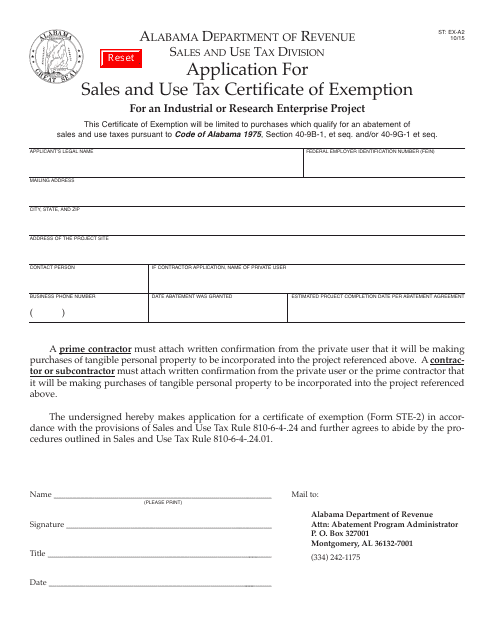

Form St Ex-a2 Download Fillable Pdf Or Fill Online Application For Sales And Use Tax Certificate Of Exemption For An Industrial Or Research Enterprise Project Alabama Templateroller

Form St Ex-a1-se Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption For Statutorily Exempt Entities Alabama Templateroller

2

2

2

710 The Cliffs Ct Waterfront Homes Outdoor Decor Patio

Sales Tax Audit Montgomery County Al

Bmx Plus 101 Freestyle Tricks Vhs Advertisement Circa 1986-87 Bmx Flatland Bmx Freestyle Bmx Bicycle

2

Gun License Application Alabama

Alabama Birth Certificate Signed By Catherine Molchan Donald Birth Certificate Alabama Digital

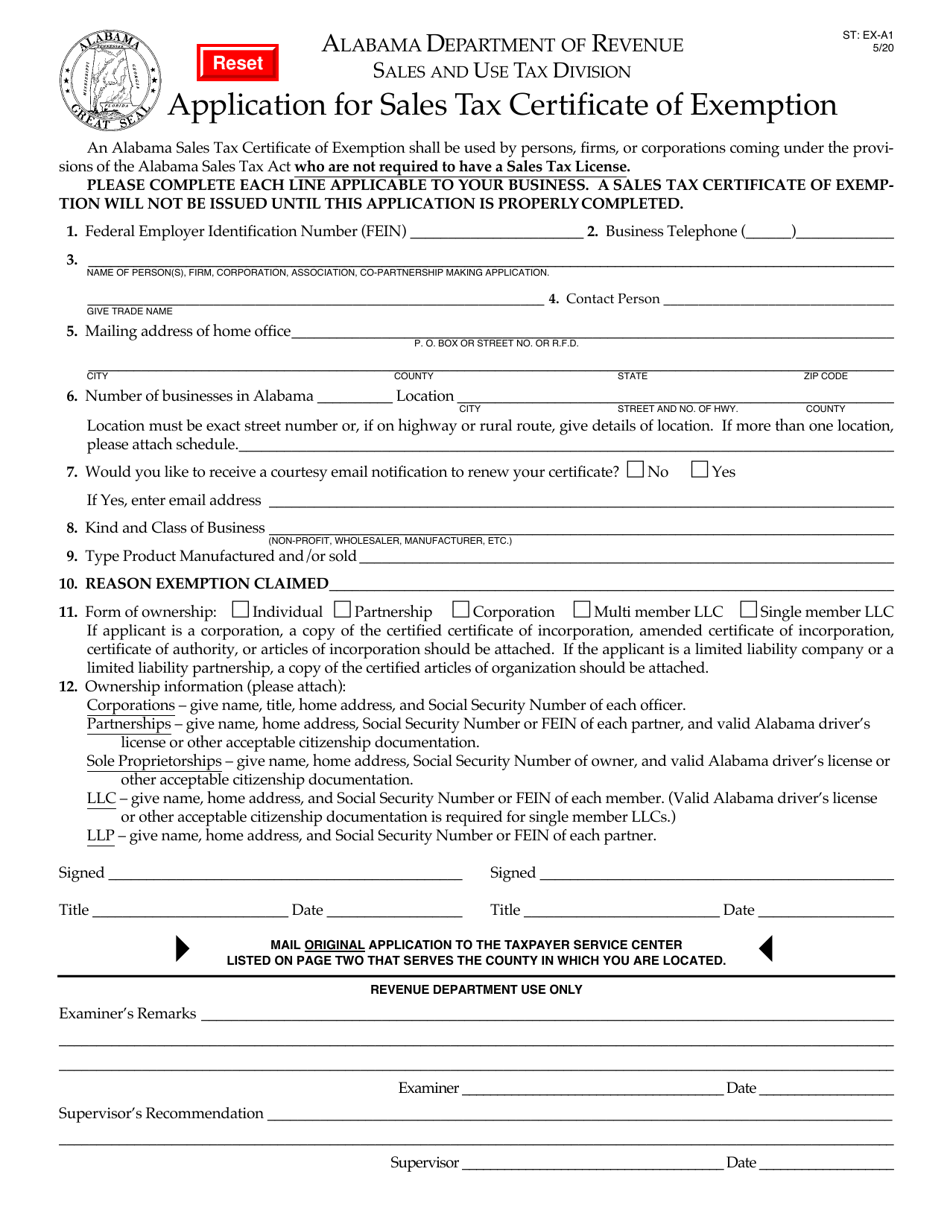

Form St Ex-a1 Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption Alabama Templateroller