The montana state sales tax rate is 0%, and the average mt sales tax after local surtaxes is 0%. D.c.’s rank does not affect states' ranks, but the figures in parentheses indicate where it would rank if included.

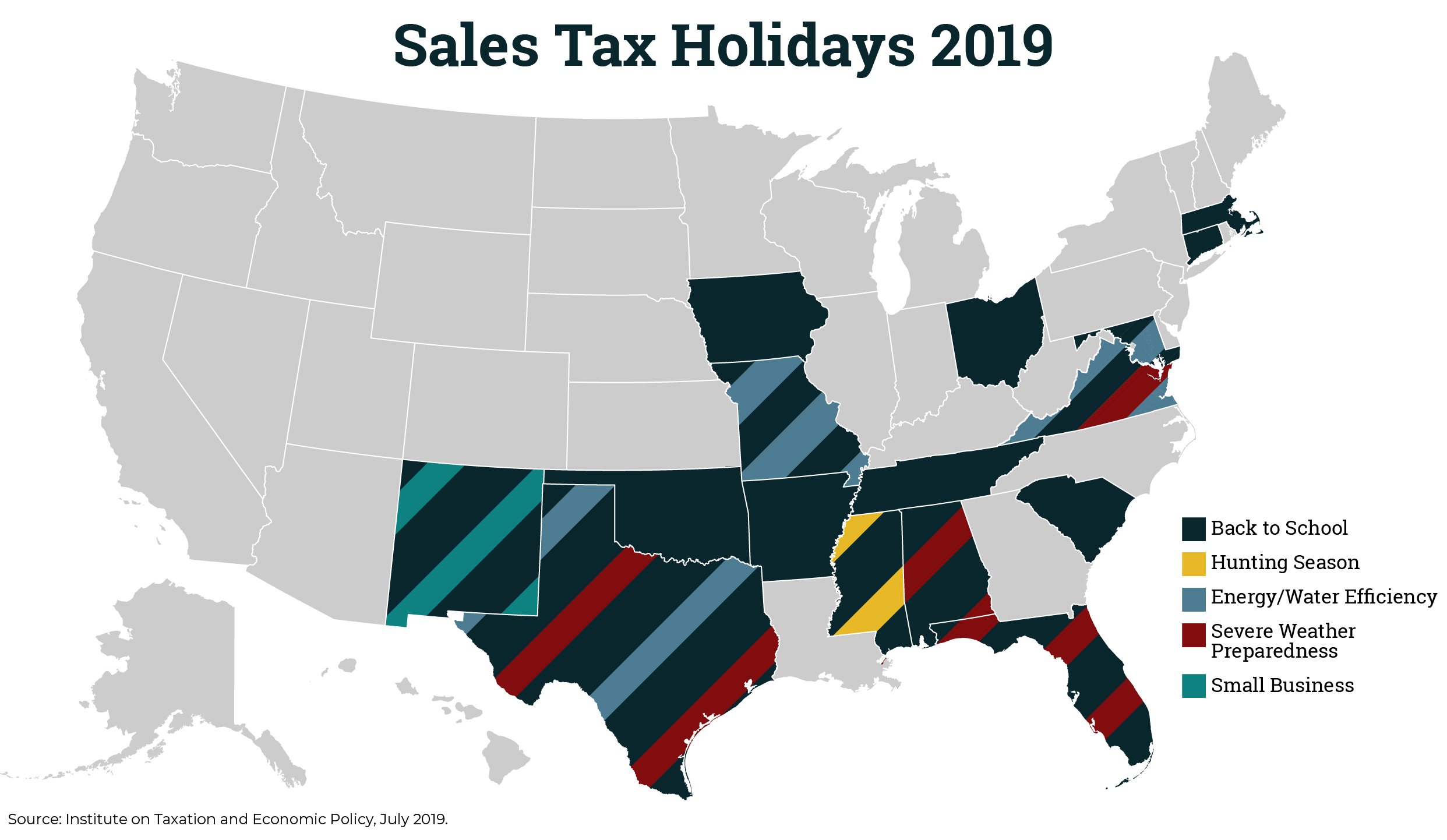

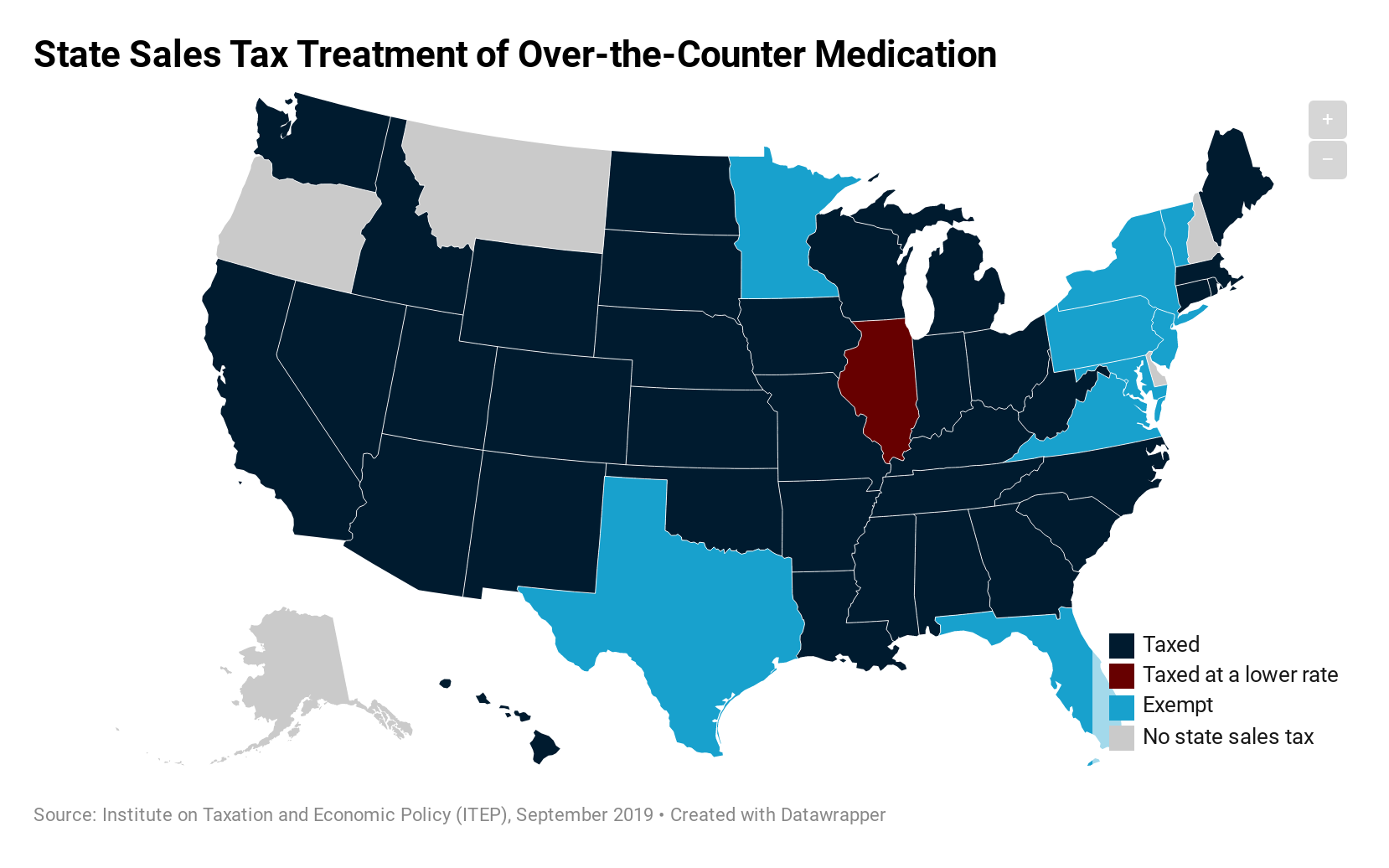

Maps Itep

Has internet sales tax internet sales tax start date minimum sales thresholds ;

Montana sales tax rate 2019. The state sales tax rate in montana is 0.000%. Montana has a progressive state income tax, with a top rate of 6.9%. Montana taxes are below national averages at all income levels.

Previous or current calendar year: Use leading seo & marketing tools to promote your store. Montana has only a few other types of taxes.

The individual income tax is paid by montana residents and nonresidents with income taxable in. Marketplace sales included towards the threshold for individual sellers The montana revenue system is outdated and just flat out unfair.

Start yours with a template!. For more information, see local sales tax information. Detailed montana state income tax rates and brackets are available on this page.

New jersey's local score is represented as a negative. Use this calculator to find the general state and local sales tax rate for any location in minnesota. While montana has no statewide sales tax, some municipalities and cities (especially large tourist destinations) charge their own local sales taxes on most purchases.

• sales tax rates differ by state, but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy. The results do not include special local taxes—such as admissions, entertainment, liquor, lodging, and restaurant taxes—that may also apply. Montana has seven marginal tax brackets, ranging from 1% (the lowest montana tax bracket) to 6.9% (the highest montana tax bracket).

The cities and counties in montana also do not charge sales tax on general purchases so. Start yours with a template!. Montana tax rate is unchanged from last year, however, the income tax brackets increased due to the annual.

2020 rates included for use while preparing your income tax deduction. Ad earn more money by creating a professional ecommerce website. Let more people find you online.

• sales tax rate differentials can induce consumers to shop across borders or buy products online. Use leading seo & marketing tools to promote your store. The following table shows tax rates for 2019.

Each marginal rate only applies to earnings within the applicable marginal tax bracket , which are the same in. Click here for a larger sales tax map, or here for a sales tax table. Find the latest united states sales tax rates.

Explore data on montana's income tax, sales tax, gas tax, property tax, and business taxes. Because there is no sales tax here (great, and yet part of the problem), property owners, especially those. Total tax burden by income level the estimated burden on a family of three of all personal taxes—income, property, general sales, and auto taxes—is provided in the tables below for three different income levels.

The montana income tax has seven tax brackets, with a maximum marginal income tax of 6.90% as of 2021. There are no local taxes beyond the state rate. First $3,100 1% next $2,300.

Salem county, n.j., is not subject to the statewide sales tax rate and collects a local rate of 3.3125%. Montana charges no sales tax on purchases made in the state. • the district of columbia’s sales tax rate increased to 6 percent from 5.75 percent.

Ad earn more money by creating a professional ecommerce website. Taxable income amount rate of tax. You must pay montana state income tax on any wages received for work performed while in montana, even if your job is normally based in another state.

% of income 13.9% 10.0%. Montana has no state sales tax, and allows local governments to collect a local option sales tax of up to n/a. Let more people find you online.

There are a total of 105 local tax jurisdictions across the state, collecting an average local tax of n/a. Adopted a sales tax on You must pay montana state income tax on any wages received for work performed while in montana, even if your job is normally based in another state.

There is no sales tax in the state and property taxes are below the national average. Learn about montana tax rates, rankings and more. Alaska * arizona * arkansas:

January 1, 2019 (administrative announcement) april 1, 2019 (enacted legislation) $100,000 or 200 or more separate transactions: Combined state & average local sales tax rate lowe.

Maps Itep

Maps Itep

Shrinking The Delaware Tax Loophole Other Us States To Incorporate Your Business

Eqkdqb7mjbevtm

Maps Itep

Ebay Sales Tax Everything You Need To Know Guide – A2x For Amazon And Shopify – Accounting Automated And Reconciled

Maps Itep

2

Best State In America Montana Whose Tax System Is The Fairest Of Them All – The Washington Post

States Without Sales Tax Quickbooks

2

States Without Sales Tax Quickbooks

Montana State Taxes Tax Types In Montana Income Property Corporate

Sales Tax Calculator

Montana State Taxes Tax Types In Montana Income Property Corporate

Printable Montana Sales Tax Exemption Certificates

Montana State Taxes Tax Types In Montana Income Property Corporate

States With Highest And Lowest Sales Tax Rates

2