8:00 to 3:00 monday, tuesday, thursday and fridays and 8:00 to 1:00 wednesdays. The 10% sales tax rate in mobile consists of 4% alabama state sales tax, 1% mobile county sales tax and 5% mobile tax.

Liability Waiver Form Template Free Inspirational Liability Release Form Form Trakore Document Templates Parent Volunteer Form Liability Waiver Volunteer Forms

The december 2020 total local sales tax rate was also 5.500%.

Mobile county al sales tax form. There is no applicable special tax. Mobile county sales tax form military/student. The revenue department administers the privilege license tax ordinances of the city of mobile, which involves collection of monthly sales & use taxes and licensing businesses/professions doing business within the mobile license tax jurisdiction.

Mobile county alabama tax lien certificates are sold at the mobile county tax sale which is held annually during april or may. The alabama state sales tax rate is currently 4%. Click any locality for a full breakdown of local property taxes, or visit our alabama sales tax calculatorto lookup local rates by zip code.

This is the total of state, county and city sales tax rates. The combined sales tax rate for mobile, al is 10%. Application for current use valuation for class 3 property return;

There is no applicable special tax. Bill of sale appraisal sales contract other closing statement if the conveyance document presented for recordation contains all of the required information referenced above, the filing of this form is not required. Alabama has a 4% sales tax and mobile county collects an additional 1.5%, so the minimum sales tax rate in mobile county is 5.5% (not including any city or special district taxes).

All retail types of sales: In completing the city/county return to file/pay montgomery county, you must enter in the jurisdiction account number field of the return your local taxpayer id number assigned to you by these jurisdictions. We also processes the monthly mobile county sales/use/lease tax.

In mobile county alabama, real estate property taxes are due on october 1 and are considered delinquent after december 31st of each year. Sales outside the city limits of mobile and prichard are taxed at the following rates: If you are unable to fill out these forms, please install adobe acrobat reader here!

The alabama sales tax rate is currently %. The total sales tax rate in any given location can be broken down into state, county, city, and special district rates. Mobile county, al sales tax rate the current total local sales tax rate in mobile county, al is 5.500%.

Billiards over 4 tables certification; Certificate of good standing request. The minimum combined 2021 sales tax rate for mobile, alabama is.

What is the sales tax rate in mobile, alabama? Business personal property and/or personal aircraft return; This is the total of state, county and city sales tax rates.

You can print a 10% sales tax table here. This table shows the total sales tax rates for all cities and towns in mobile county,. Revenue office government plaza (2nd floor) window hours:

The mobile county tobacco tax department handles the enforcement and collection of tobacco tax for mobile county cigarettes and other. Food & beverage tax form #7 (pdf file) joint petition for refund (pdf file) leasing tax form #3 (pdf file) petition for release of penalty (pdf file) sales tax form #12 (pdf file) seller use tax tax form #13 (pdf file) city of mobile alcoholic beverage application (pdf file) city of mobile business application external link Delinquency notices are mailed january 1.

The county sales tax rate is %. Please print out the forms, complete and mail them to: If you need access to a database of all alabama local sales tax rates, visit the sales tax data page.

My Postcrossing Cards Mobile Alabama Usa Mobile Alabama Alabama Sweet Home Alabama

Alabama Quitclaim Deed Form Quitclaim Deed Will And Testament Free Resume

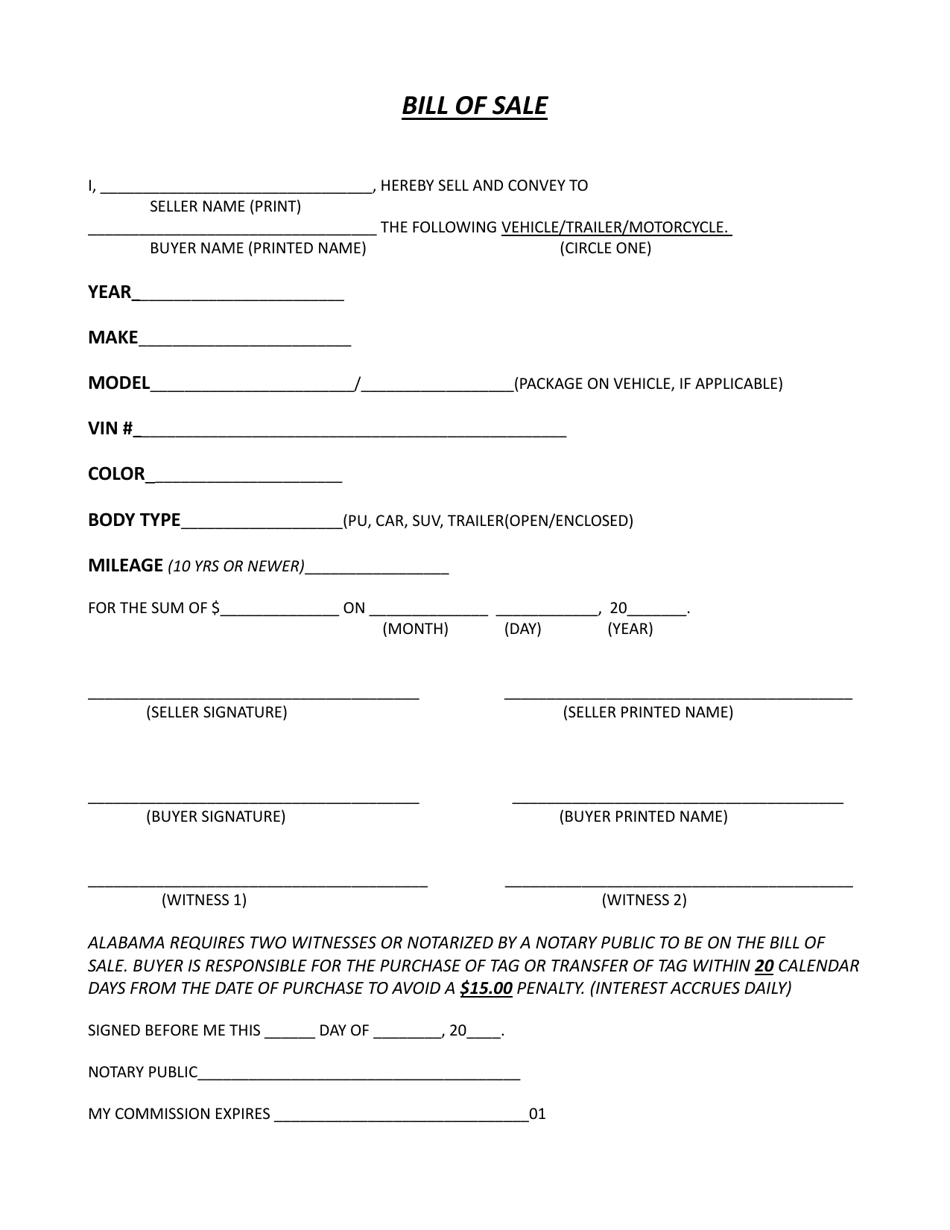

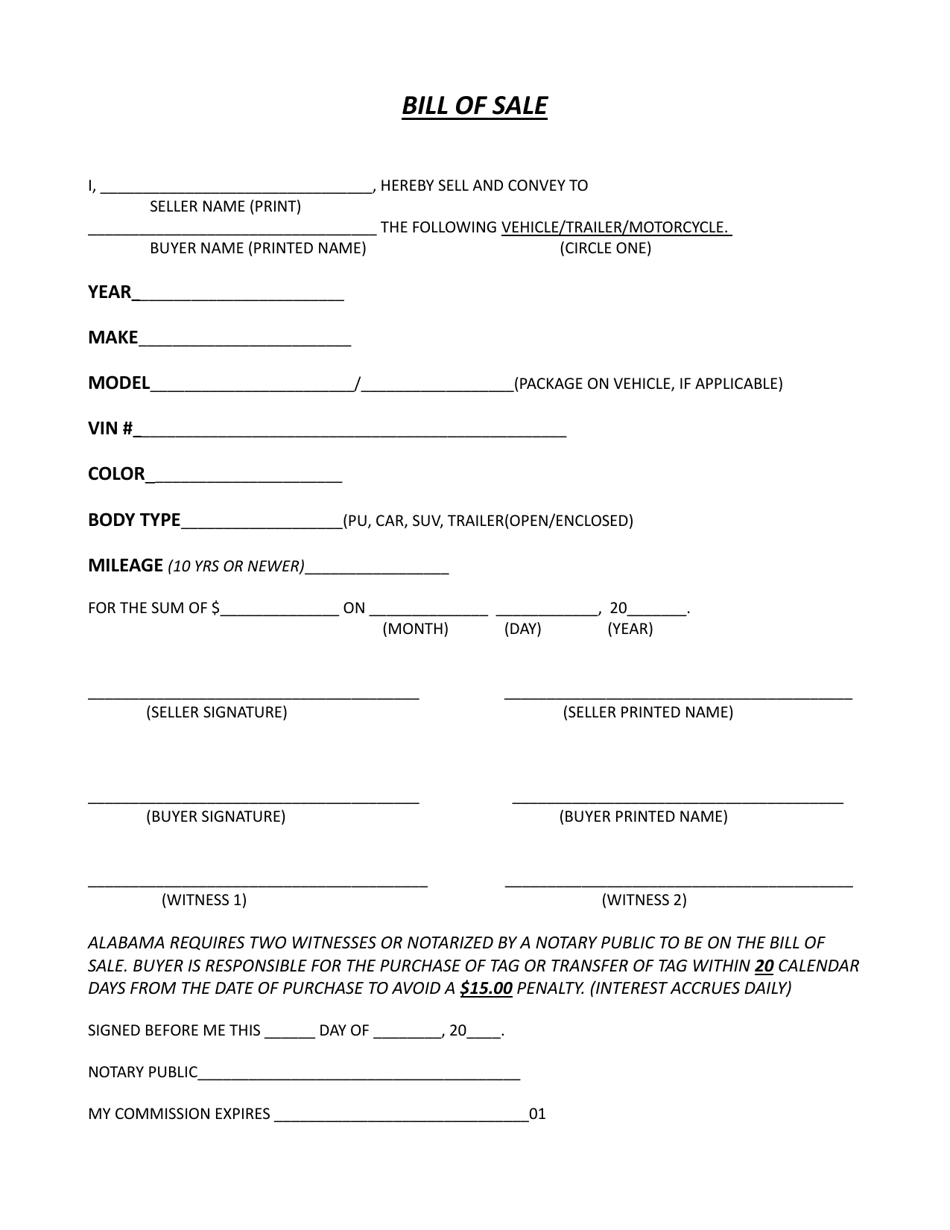

Houston County Alabama Vehicletrailermotorcycle Bill Of Sale Form Download Fillable Pdf Templateroller

2

Tax Dashboard Dark Theme Dark Tax Software Dashboard

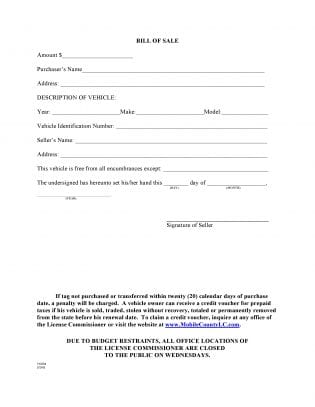

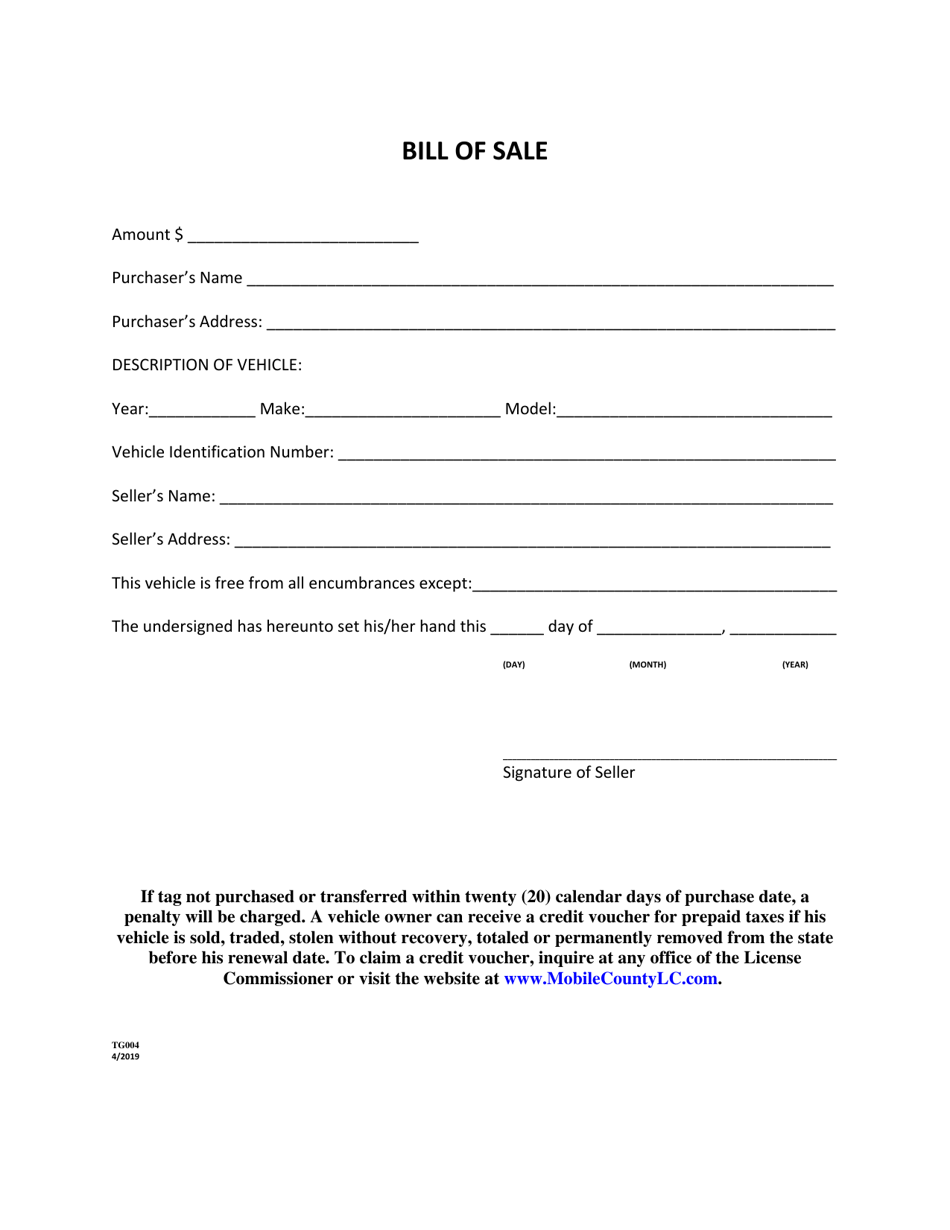

Free Mobile County Alabama Motor Vehicle Bill Of Sale Form Tg004 – Download Pdf Word Template

Mobile County Alabama Vehicle Bill Of Sale Form Download Fillable Pdf Templateroller

2001 Form Al St Ex-a2 Fill Online Printable Fillable Blank – Pdffiller

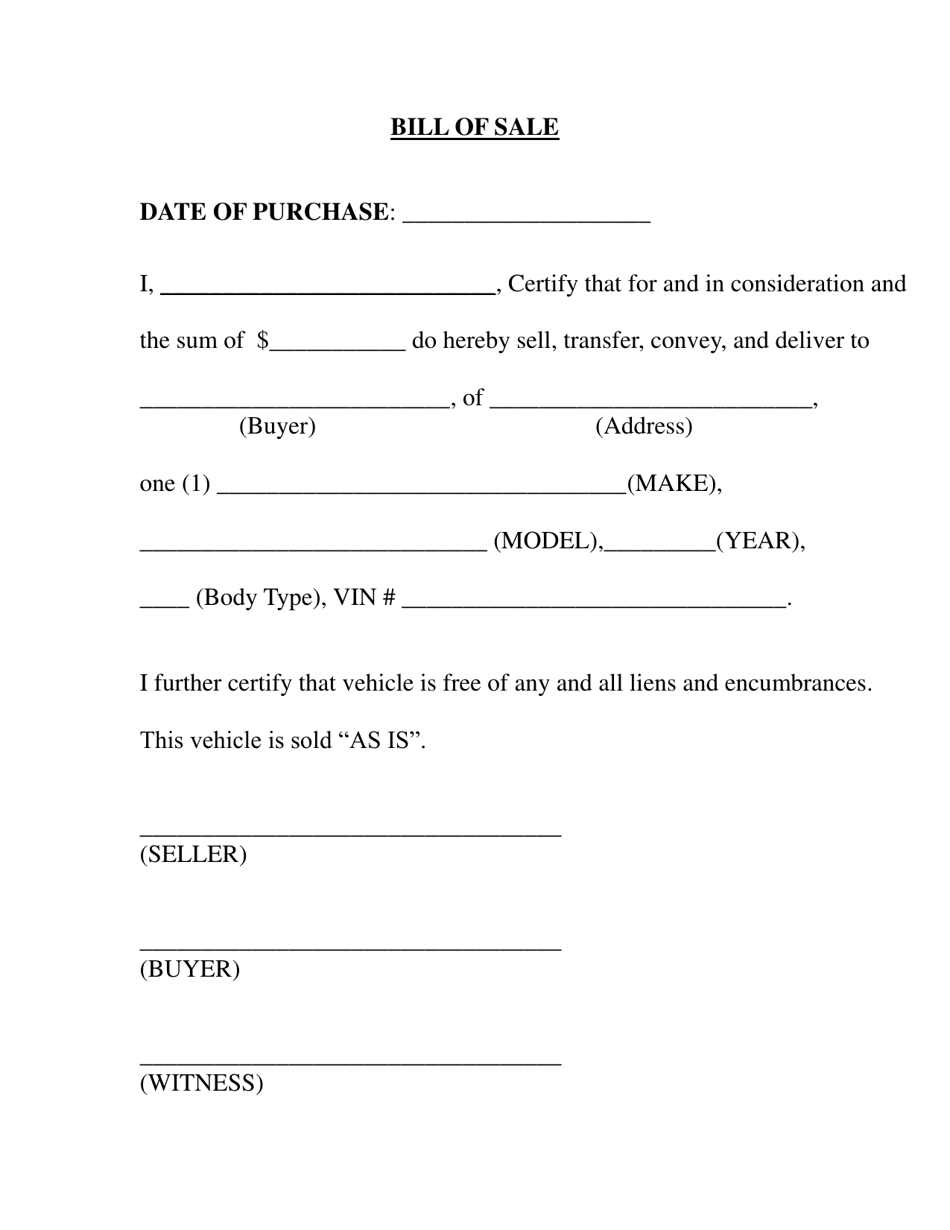

Bill Of Sale Alabama Real Estate Forms Real Estate Forms Bill Of Sale Template Room Rental Agreement

Fake Reviews Are A Growing Problem For Consumers And The Local And Product-search Sites They Rely On To Make Pur Learning Techniques Online Reviews Brand Story

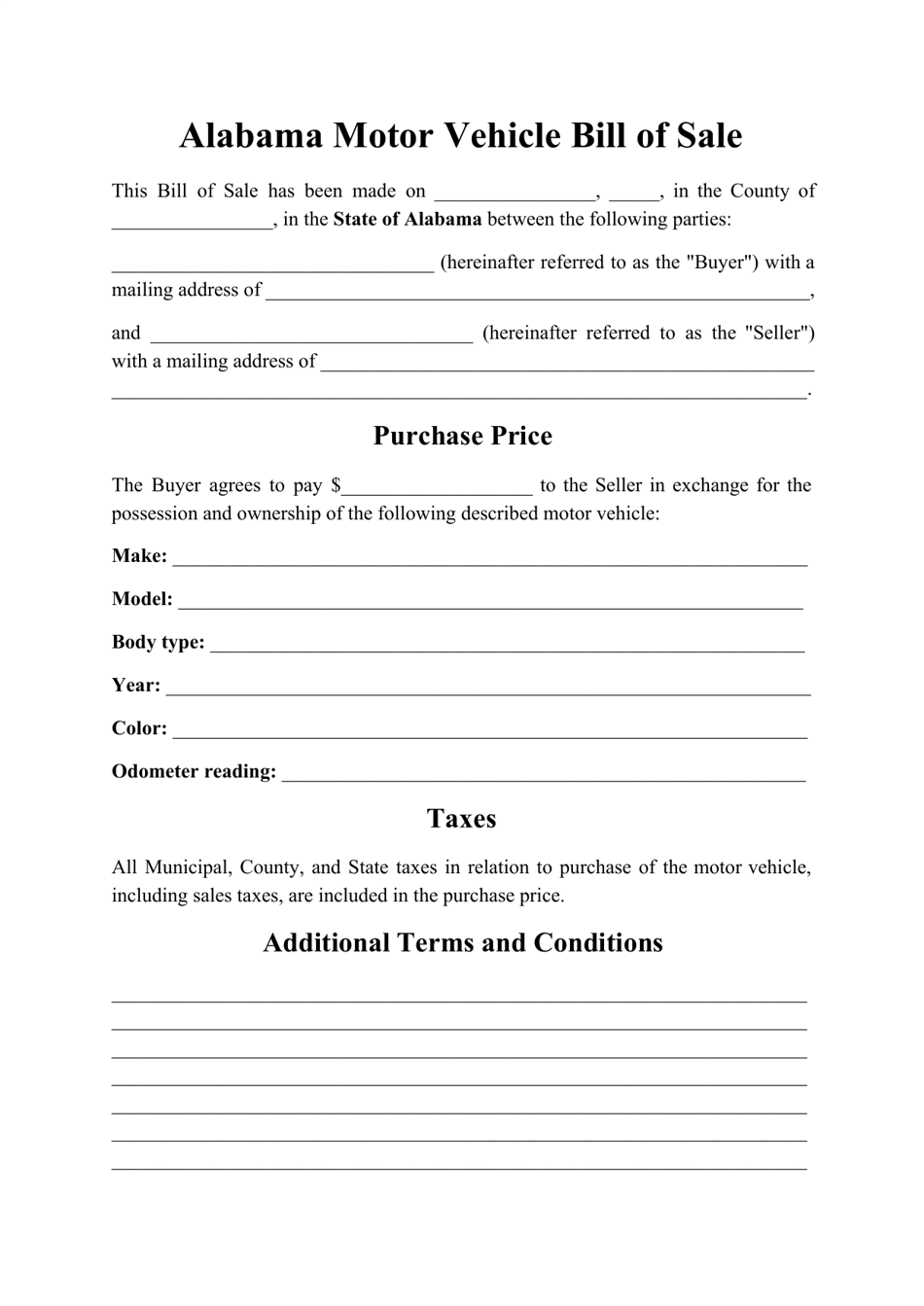

Alabama Motor Vehicle Bill Of Sale Form Download Printable Pdf Templateroller

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax States

2

Pin On Surety Bonds

Alabama Resale Certificate – Fill Online Printable Fillable Blank Pdffiller

2

Pin On Bill Of Sale Form

Alabama Resale Certificate Pdf – Fill Online Printable Fillable Blank Pdffiller

Etowah County Alabama Vehicle Bill Of Sale Form Download Printable Pdf Templateroller