$500 x.06 = $30, which is what you must pay in sales tax each month. The combined rate used in this calculator (7%) is the result of the mississippi state rate (7%).

Car Tax By State Usa Manual Car Sales Tax Calculator

Motor vehicle titling and registration.

Mississippi vehicle sales tax calculator. 7.75% for vehicle over $50,000. This level of accuracy is important when determining sales tax rates. A credit against the 4.45 percent state sales tax will be granted to residents who paid a similar tax on the purchase of the motor vehicle in the other state if.

When you enter the street address, the calculator uses geolocation to pinpoint the exact tax jurisdiction. This is only an estimate based on the current tax rate and the approximate value of the property. Exemptions from use tax are set out in the use tax law (title 27, chapter 67, miss code ann ) and.

Every 2021 combined rates mentioned above are the results of mississippi state rate (7%), the mississippi cities. Mississippi collects a 3% to 5% state sales tax rate on the purchase of all vehicles. Our calculator has recently been updated to include both the latest federal tax rates, along with the latest state tax rates.

You can find these fees further down on the page. Select view sales rates and taxes, then select city, and add percentages for total sales tax rate. The 39653, meadville, mississippi, general sales tax rate is 7%.

All the other taxes are based on the type of vehicle, the value of that vehicle, and where you live (city. With local taxes, the total sales tax rate is between 7.000% and 8.000%. You are able to use our mississippi state tax calculator to calculate your total tax costs in the tax year 2021/22.

The state sales tax for a vehicle purchase in missouri is 4.225 percent. Find your state below to determine the total cost of your new car, including the car tax. Once you have the tax.

The state general sales tax rate of mississippi is 7%. How 2021 sales taxes are calculated in mississippi. All the other taxes are based on the type of vehicle, the value of that vehicle, and where you live (city, county).

Subtract these values, if any, from the sale. Imagine that your monthly lease payment is $500 and your state’s sales tax on a leased car is 6%. Registration fees are $12.75 for renewals and $14.00 for first time registrations.

Sales tax for a leased vehicle is calculated based on the state’s tax percentage and the cost of the lease payments. Dealership employees are more in tune to tax rates than most government officials. Vehicles purchased out of state sales tax on motor vehicles purchased outside of louisiana for use in louisiana are payable by the 30th day after the vehicle first enters louisiana.

Sales tax calculator | sales tax table the state sales tax rate in mississippi is 7.000%. Registration fees are $12.75 for renewals and $14.00 for first time registrations. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location.

It's fairly simple to calculate, provided you know your region's sales tax. Mississippi has a 7% statewide sales tax rate , but also has 177 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an. The tax assessor has a tax calculator to help you estimate the cost of your property taxes.

How 2021 sales taxes are calculated for zip code 39653. In mississippi, you pay privilege tax, registration fees, ad valorem taxes and possibly sales or use tax when you tag your vehicle. 6.35% for vehicle $50k or less.

Vehicle tax or sales tax, is based on the vehicle's net purchase price. In mississippi, you pay privilege tax, registration fees, ad valorem taxes and possibly sales or use tax when you tag your vehicle. In addition to taxes, car purchases in mississippi may be subject to other fees like registration, title, and plate fees.

If you are unsure, call any local car dealership and ask for the tax rate. Cities and/or municipalities of mississippi are allowed to collect their own rate that can get up to 1% in city sales tax. 4.25% motor vehicle document fee.

Choose one of the following methods to enter the value of your vehicle. The purchase of a vehicle is also subject to the same potential local taxes mentioned above. For additional information click on the links below:

Depending on local municipalities, the total tax rate can be as high as 8%. Mississippi salary tax calculator for the tax year 2021/22. Our calculator has been specially developed.

Home » motor vehicle » sales tax calculator. Auto sales tax and the cost of a new car tag are major factors in any tax, title, and license calculator. Some states provide official vehicle registration fee calculators, while others provide lists of their tax, tag, and title fees.

For vehicles that are being rented or leased, see see taxation of leases and rentals. The mississippi (ms) state sales tax rate is currently 7%.

Sales Tax Calculator

Madison County Sales Tax Department Madison County Al

City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return

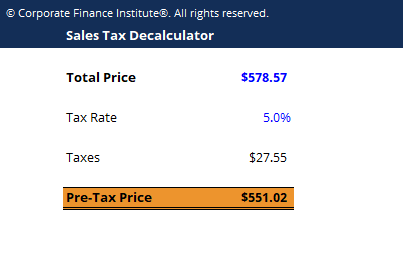

Sales Tax Decalculator – Formula To Get Pre-tax Price From Total Price

11 Invoice Templates For All Businesses Invoice Template Word Invoice Template Excel Templates

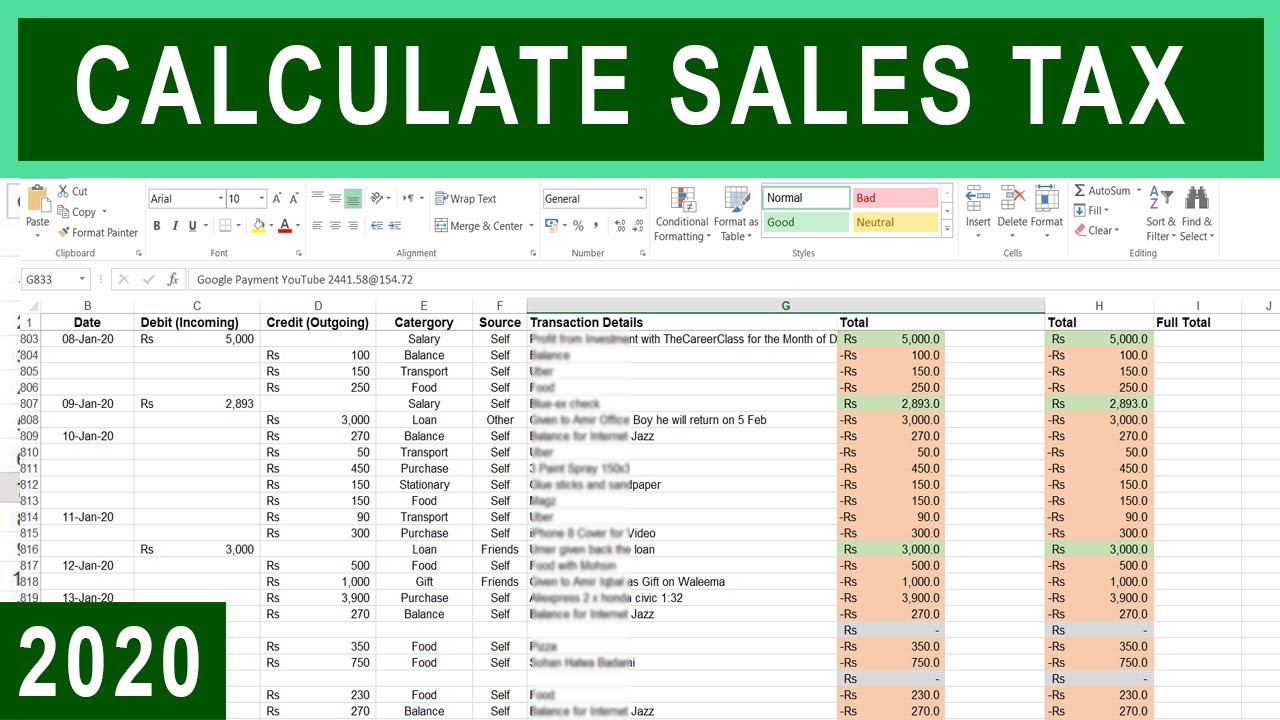

How To Calculate Sales Tax In Excel – Tutorial – Youtube

Sales Tax Calculator For Purchase Plus Tax Or Tax-included Price

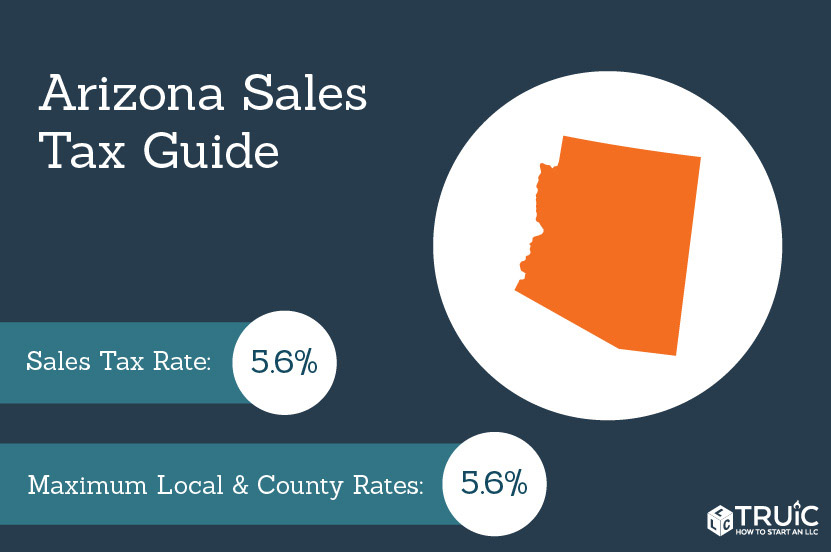

Arizona Sales Tax – Small Business Guide Truic

How To Calculate Sales Tax In Excel

Contact Sheet Template Psd Photo Word Pdf List Excel Within Blank Call Sheet Template – Best Sample Templa Sales Template Business Template Product Sales Sheet

Personal Loan Agreement Contract Template 28 Images Contract Template Personal Loans Loan

Sales Tax Rates Nevada By County English As A Second Language At Rice University

How To Calculate Sales Tax In Excel

Provide Potential Customers With A Price Quote For Goods Or Services With This Quotation Template Totals Are Calcul Quotations Quote Template Quotation Format

Contoh Faktur Dan Kwitansi In 2021 Desain Cv Tablet Desain

Connecticut Sales Tax Calculator Reverse Sales Dremployee

How To Calculate Sales Tax In Excel

Car Tax By State Usa Manual Car Sales Tax Calculator

4 Cara Untuk Menghitung Pajak Penjualan – Wikihow