Switch to mississippi hourly calculator. It is the same everywhere in the state, with a few exceptions.

What Is A Cars Out-the-door Price Credit Karma

The magnolia state’s tax system is progressive, so taxpayers who earn more can expect to pay higher marginal rates of their income.

Mississippi tax and tag calculator. Hinds county ms, listing of available jobs, election results, circuit court judge calendar, sheriff's department information, general county government information. These fees are separate from. Mississippi’s sui rates range from 0% to 5.4%.

The mississippi state tax tables for 2021 displayed on this page are provided in support of the 2021 us tax calculator and the dedicated 2021 mississippi state tax calculator.we also provide state tax tables for each us state with supporting tax calculators and finance calculators tailored for each state. Mississippi has a 7% statewide sales tax rate , but also has 177 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 0.052% on. 7% is the smallest possible tax rate ( abbeville, mississippi) 7.25% are all the other possible sales tax rates of mississippi cities.

There is a single, statewide sales tax of 7% in mississippi. Notably, mississippi has the highest maximum marginal tax bracket in the united states. All the other taxes are based on the type of vehicle, the value of that vehicle, and where you live (city, county).

International registration plan (irp) laws and regulations. Hindscountyms.com database back print page estimated taxes. Mississippi does not have some of the tax credits common to other states, such as the earned income tax credit or the child and dependent care tax credit.

You will be taxed 3% on any earnings between $2,001 and $5,000, 4% on the next $5,000 (up to $10,000) and 5% on income over $10,000. Once you have the tax rate, multiply it. Dealers motor vehicle assessments motor vehicle tax law mississippi code at lexis publishing (title 63, chapter 21)

Last updated on august 22, 2020. If you are unsure, call any local car dealership and ask for the tax rate. Mississippi state rate (s) for 2021.

Dealership employees are more in tune to tax rates than most government officials. Motor vehicle registration and title. The tax assessor has a tax calculator to help you estimate the cost of your property taxes.

The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Select the tax district to calculate the mill rate: This is only an estimate based on the current tax rate and.

You can learn more about how the mississippi. Please try again later for the most accurate estimations. Enter the valuation from your last tag receipt:

The mississippi (ms) state sales tax rate is currently 7%. Estimated tax title and fees are $0, monthly payment is $384, term length is 72 months, and apr is 7%. Information relates to the law prevailing in the year of publication/ as indicated.viewers are advised to ascertain the correct position/prevailing law before relying upon any document.

Mississippi state unemployment insurance (sui) as an employer, you’re responsible for paying sui (remember, if you pay your state unemployment tax in full and on time, you get a 90% tax credit on futa). On top of the state sales tax, there may be one or more local sales taxes, as well as one or more special district taxes, each of which can range between 0% and 1%. Unlike the federal income tax, mississippi's state income tax does not provide couples filing jointly with expanded income tax brackets.

Shop cars in your budget. The taxable wage base in 2020 is $14,000 for each employee. Dealerships may also charge a documentation fee or doc fee, which covers the costs incurred by the dealership preparing and filing the sales contract, sales tax documents, etc.

Erty taxes are determined and utilized in mississippi. Enter the manufacturer's suggested retail price: Please fill out the form below and click on the calculate button:

It's fairly simple to calculate, provided you know your region's sales tax. ** estimated monthly payment may be inaccurate without title, taxes, and fees. In mississippi, you pay privilege tax, registration fees, ad valorem taxes and possibly sales or use tax when you tag your vehicle.

Registration fees are $12.75 for renewals and $14.00 for first time registrations. Sales tax is a tax paid to a governing body (state or local) on the sale of certain goods and services. Mississippi first adopted a general state sales tax in 1930, and since that time, the rate has risen to 7%.

Mississippi collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. Vehicle tax or sales tax, is based on the vehicle's net purchase price. Disclaimer:the above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances.

8% is the highest possible tax rate ( tougaloo, mississippi) the average combined rate. Income below $2,000 is not taxed at the state level. Depending on local municipalities, the total tax rate can be as high as 8%.

Mississippi car registration fees are determined by local tax collectors, but generally follow state guidelines to charge drivers a standard cost. The mississippi department of revenue is responsible for publishing. The mississippi tax calculator is designed to provide a simple illlustration of the state income tax due in mississippi, to view a comprehensive tax illustration which includes federal tax, medicare, state tax, standard/itemised deductions (and more), please use.

How To Calculate Sales Tax – Video Lesson Transcript Studycom

Estimate Vehicle Tag

Arkansas Property Tax Calculator – Smartasset

Free Inventory Spreadsheet For Small Business Db-excelcom Inventory Management Templates Inventory Printable Spreadsheet Business

States That Allow Trade-in Tax Credit

Clay County Mississippi Tax Office – Real Estate Taxes

Find Out If You Have To Pay Import Tax When Shipping A Car To The Usa And How Much It Costs As Well As Information On Exemptions Gas Guzzler Tax And More

How To Calculate Sales Tax – Video Lesson Transcript Studycom

Car Payment Calculator Estimate Monthly Auto Loan Payments

Tennessee Car Sales Tax Everything You Need To Know

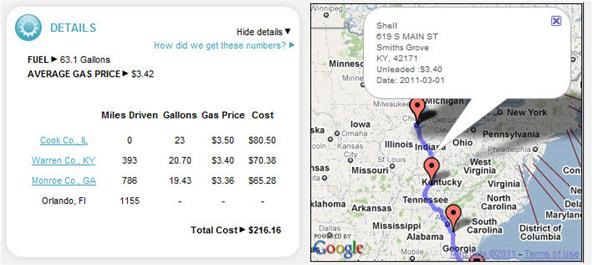

How To Calculate The Cost Of Driving Travel Tips Wonderhowto

New 2021 Ford Bronco For Sale In Dillsburg Pa Bob Ruth Ford

City Of Olive Branch Ms Tax Information – Chamber Of Commerce

Clay County Mississippi Tax Office – Real Estate Taxes

Arkansas Property Tax Calculator – Smartasset

Is Life Insurance Taxable Forbes Advisor

Octc – Fee Calculator

Car Payment Calculator Estimate Monthly Auto Loan Payments

Tax Calculation Spreadsheet Excel Spreadsheets Budget Spreadsheet Spreadsheet