2021 mississippi state sales tax. The initial tax reform proposal that house speaker philip gunn drafted, which passed the house earlier this year but died in the senate, would have phased out the state’s income tax and paid for it by increasing the sales tax for most items from 7.

25 Percent Corporate Income Tax Rate Details Analysis

2021 mississippi state sales tax rates.

Mississippi income tax rate 2021. Before the official 2021 mississippi income tax brackets are released, the brackets used on this page are an estimate based on the previous year's brackets. Mississippi collects a state corporate income tax at a maximum marginal tax rate of 5.000%, spread across three tax brackets. Because the income threshold for the top bracket is quite low ($10,000), most taxpayers will pay the top rate for the majority of their income.

The income tax in the magnolia state is based on four tax brackets, with rates of 0%, 3%, 4% and 5%. These numbers are subject to change if new mississippi tax tables are released. Personal exemption until the income tax is ultimately eliminated.

Starting in 2022, only the 4 percent and 5 percent rates will remain, with the first $5,000 of income exempt from taxation (up from $3,000). An act to create the mississippi tax freedom act of 2021; Mississippi personal income tax rates;

The mississippi tax rate and tax brackets are unchanged from last year. Exact tax amount may vary for different items. On may 13, mississippi gov.

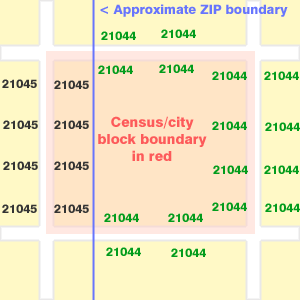

Counties and cities can charge an additional local sales tax of up to 0.25%, for a maximum possible combined sales tax of 7.25%. 2021 mississippi state use tax. It also proposed increasing the sales tax on most items from 7% to 9.5% and increasing taxes.

My first testimony to a state was in 2008, in mississippi. Keep in mind that some states will not update their tax forms for 2021 until january 2022. These rates are the same for all filing statuses, as well as for businesses.

The mississippi use tax is a special excise tax assessed on property purchased for use in mississippi in a jurisdiction where a lower (or no) sales tax was collected on the purchase. The tax brackets are the same for all filing statuses. Tax rates, exemptions, & deductions.

The mississippi state sales tax rate is 7%, and the average ms sales tax after local surtaxes is 7.07%. The bill proposed phasing out mississippi’s income tax and cutting the 7% state grocery tax in half. The ms use tax only applies to certain purchases.

In tax year 2021, only $1,000 in marginal income will be subject to the 3 percent rate, with the other $1,000 exempt. The list below details the localities in mississippi with differing sales tax rates, click on the location to access a supporting sales tax calculator. Be sure to verify that the form you are downloading is for the correct year.

Additional state income tax information for mississippi mississippi has 3 state income tax rates: Beginning in 2022, the personal exemption would dramatically increase to $47,700 for individuals, $95,400 for married couples, and $46,600 for heads of the household. Mississippi's maximum marginal corporate income tax rate is the 3rd lowest in the united states, ranking directly below north dakota's 5.200%.

Phil bryant (r) signed legislation to phase out the state’s archaic franchise tax. 1 in 10 mississippians had illegal contaminants in drinking water since 2018 According to speaker of the house philip gunn, approximately 60% of mississippians would not owe income taxes

Mississippi federal and state income tax rate, mississippi tax rate, mississippi tax tables, mississippi tax withholding, mississippi tax tables 2021

Mississippi Disability Insurance – Shop Compare And Quote Ltdi In 2021 Disability Insurance Mississippi Insurance

Daily Infographic A New Infographic Every Day Data Visualization Information Design And Infographics Page 2 Deepwater Horizon Infographic Oil Spill

These 7 Us States Have No Income Tax The Motley Fool Income Tax Map Amazing Maps

Pin On Infographics

Mississippi Tax Rate Hr Block

Top States To Buy Real Estate In The New Decade – Financial Samurai Real Estate Buying Real Estate Real Estate Prices

Free Zip Code Map Zip Code Lookup And Zip Code List Zip Code Map Coding Map

Americans Are Migrating To Low-tax States United States Map Native American Map States

Pin On Market Analysis

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

Infographic How Much Do Countries Spend On Education Education Educational Infographic Infographic

Pin On Fascinating Facts

Mississippi Income Tax Calculator – Smartasset

Applicant Tracking Spreadsheet Download Free And Free Lead Tracking Spreadsheet Template In 2021 Excel Templates Business Spreadsheet Template Spreadsheet Design

Map Of The Worst States In America States In America United States Map Usa Facts

House Democrats Tax On Corporate Income Third-highest In Oecd

Pin On Covid 19

Pin On Stocks To Watch

Mississippi Tax Rate Hr Block