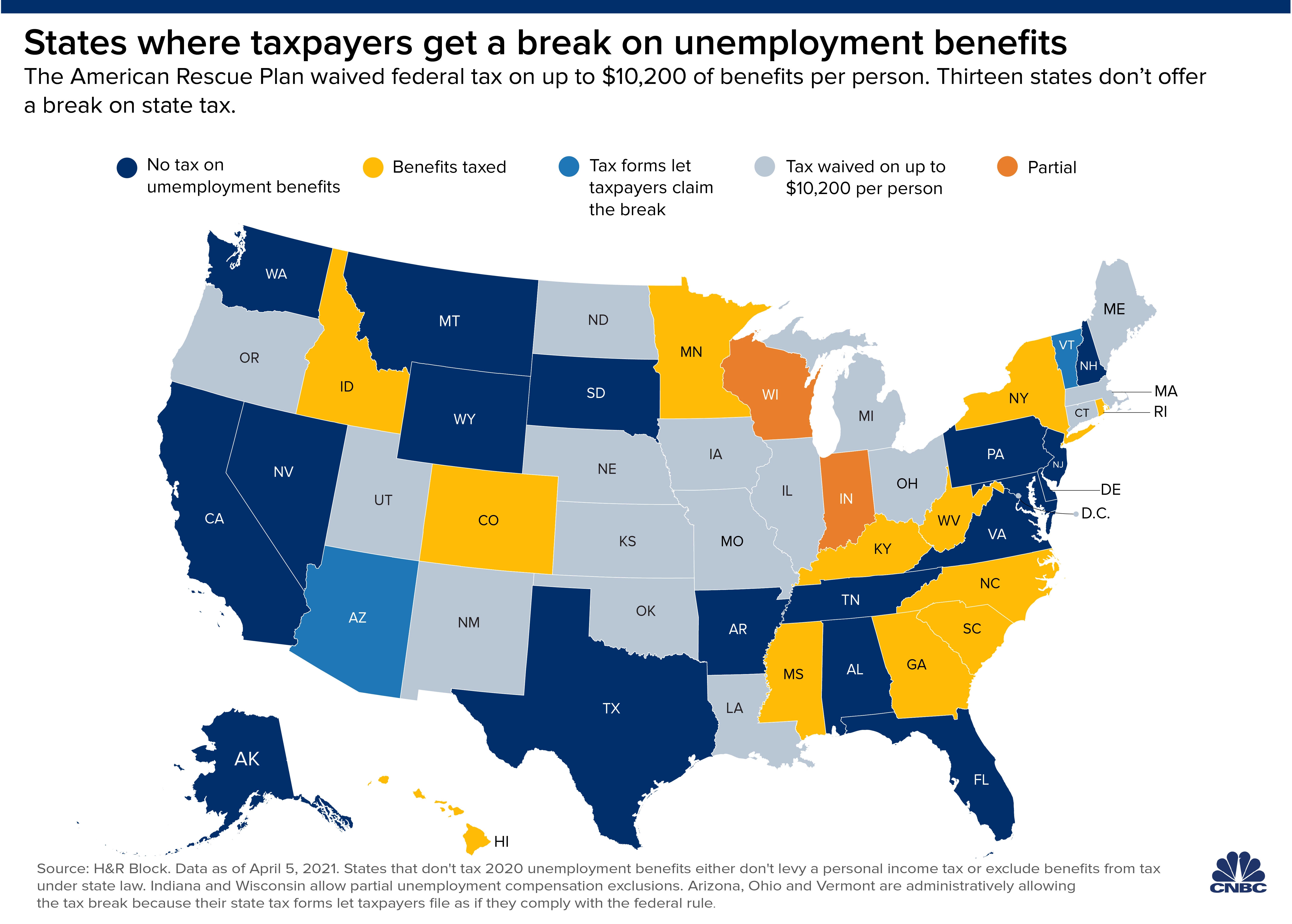

The bill excludes from income up to $10,200 in unemployment insurance compensation. The amount of the refund will vary per person depending on overall income, tax bracket and how much earnings came from unemployment benefits.

Minnesota Tax Forms 2020 Printable State Mn Form M1 And Mn Form M1 Instructions

My adjusted gross income was $41,283.00, my minnesota taxable income was $3.648.00 and my refund amount was $448.00.

Minnesota unemployment income tax refund. Refunds for about 550,000 filers who paid state taxes on the extra $300 and $600 unemployment payments issued during the pandemic likely won't go out until september, a department. Now, after the federal and state updates my state agi is $33,782.00, my mn taxable income is $10,024.00 and my refund amount is $105.00. However, not everyone will receive a refund.

The minnesota department of revenue has announced that the processing of returns impacted by tax law changes made to the treatment of unemployment insurance compensation and paycheck protection. Washington — the internal revenue service recently sent approximately 430,000 refunds totaling more than $510 million to taxpayers who paid taxes on unemployment compensation excluded from income for tax year 2020. Lawmakers also aligned the state tax code with the federal government in other areas, including home short sales.

About 500,000 minnesotans are in line to get money back from the tax break on the first $10,200 of 2020 unemployment benefits. On thursday september 9 th, the minnesota department of revenue announced the processing of returns impacted by the tax law changes made for the treatment of unemployment insurance compensation will begin the week of september 13 th. Minneapolis (wcco) — the minnesota department of revenue has started processing unemployment insurance and payback protection program (ppp) refunds that have been delayed due to tax law changes.

The minnesota department of revenue. For those who filed 2020 tax returns before congress passed an exclusion on the first $10,200 in unemployment benefits, here's how. September 15, 2021 by sara beavers.

For those that filed a 2020 income tax return that included ui compensation or ppp loan forgiveness: The average refund for those who overpaid taxes on unemployment compensation was $1,265 earlier this year. In the latest batch of refunds, however, the average was $1,189.

The minnesota state capitol in saint paul, minnesota. So far, the refunds have averaged more than $1,600. Here are my minnesota numbers prior to the federal unemployment exclusion:

That brings the total count to over 11.7 million refunds totaling $14.4. For details, read our september 9 announcement about ui and ppp tax refunds. We're adjusting more than 540,000 individual income tax returns and.

The tax agency recently issued about 430,000 more refunds (totaling more than $510 million) averaging about $1,189 each. A spokesman for the minnesota department of revenue said taxpayers don’t need to. Ppp, ui tax refunds start this week in minnesota.

The irs efforts to correct unemployment compensation overpayments will help most of the affected taxpayers avoid filing an amended. If you were among those who received unemployment in 2020 and made less than $150,000 for the year, etter says you can expect a refund for taxes you paid on the first $10,200 of unemployment you. So far, the refunds have averaged more than $1,600.;

The minnesota department of revenue (mdor) will either adjust your return and issue a refund or ask you to amend your return. We are in the process of adjusting 2020 minnesota tax returns affected by law changes to the treatment of unemployment insurance (ui) compensation and paycheck protection program (ppp) loan forgiveness. Mdor expects to communicate these findings later this summer.

The amount of the refund will vary per person depending on overall income, tax bracket and how much earnings came from unemployment benefits.

Year End Tax Information Applicants – Unemployment Insurance Minnesota

States Seek Amended Tax Returns For 10200 Unemployment Tax Refunds

Wheres My Refund Minnesota Hr Block

Ui Tax Reduction Credit Employers – Unemployment Insurance Minnesota

Ui Tax Reduction Credit Employers – Unemployment Insurance Minnesota

Irs Will Issue Special Tax Refunds To Some Unemployed Money

Minnesota Budget Deal Will Bring Ppp Unemployment Tax Relief Heres What You Need To Know Kare11com

When Should Minnesotans Expect Tax Refunds Passed In The State Budget Star Tribune

Minnesota Department Of Revenue Set To Begin Processing Unemployment Insurance And Paycheck Protection Program Refunds – Christianson Pllp

Taxes On Unemployment Benefits A State-by-state Guide Kiplinger

Minnesota Department Of Revenue Set To Begin Processing Unemployment Insurance And Paycheck Protection Program Refunds Hometown News Grey Eagle Upsala Swanville Burtrum Freeport Holdingford

Many Minnesotans Will See Automatic Tax Refunds Soon After Legislative Deal

Minnesota Pandemic Tax Refunds Start Arriving Monday Star Tribune

Irs Will Automatically Refund Taxes Paid On Some 2020 Unemployment Benefits Dsb

Unemployment 10200 Tax Break Some States Require Amended Returns

Mn Dept Of Revenue Begins Processing Unemployment Insurance Compensation Ppp Loan Forgiveness Wcco Cbs Minnesota

If You Got Unemployment Benefits In 2020 Heres How Much Could Be Tax Exempt – Abc News

Your 2020 Tax Questions Answered Mpr News

Year End Tax Information Applicants – Unemployment Insurance Minnesota