Public act 477 of 1996 exempted rolling stock public act 477 of 1996 (house bill 5506) provided an (certain large trucks, trailers, and parts) from the use exemption for the storage, use, or consumption of tax if purchased, rented, or leased outside of the state, rolling stock used in interstate commerce and In other words, the sales tax act exempts the sale of rolling stock while the use tax act exempts the storage, use and consumption of it.

Efpublishersorg

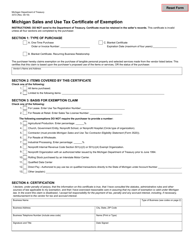

To claim a rolling stock exemption on aircraft, watercraft, limousines, and rail carrier items, the purchaser must indicate the method by which the item purchased qualifies for the exemption.

Michigan sales tax exemption rolling stock. Rolling stock, locomotives, and fuel and supplies essential to the operation of locomotives and trains are exempted from the taxes imposed by this chapter. 10.d rolling stock purchased by an interstate motor carrier. Exemption is allowed in michigan on the sale of rolling stock purchased by an interstate motor carrier or for the rental or lease of rolling stock to an interstate motor carrier and used in interstate commerce.

It is the purchaser’s responsibility to ensure the eligibility of the exemption being claimed. Certificate must be retained in the seller’s records. All claims are subject to audit.

However, if provided to the purchaser in electronic format, a signature is not required. All claims are subject to audit. Do not send to the department of treasury.

The exemption is for the purchase or use of qualified trucks and trailers (and parts affixed to them). This certificate is invalid unless all four sections are completed by the purchaser. Michigan provides a sales and use tax exemption to interstate (fleet) motor carriers for rolling stock and parts affixed to rolling stock that are purchased, rented or leased by an interstate (fleet) motor carrier and used in interstate commerce.

Certifi cate must be retained in the seller’s records. (1) all of the following are exempt from the tax under this act: In order to be exempt from michigan sales or use tax certain criteria must be met.

Instructions for completing michigan sales and use tax certificate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. Exemptions from the sales tax are not allowed unless specifically provided for by law. Instructions for completing michigan sales and use tax certificate of exemption (form 3372) purchasers.

Sales tax rate sales tax paid sales tax rate sales tax paid property tax paid on rolling stock total sales tax paid rolling stock: Michigan department of treasury form 3372 (rev. 11.d qualified data center 12.

It is the purchaser's responsibility to ensure the eligibility of the exemption being claimed. 10.d rolling stock purchased by an. Tax exemption statutes are interpreted according to ordinary rules of statutory construction, although they are strictly construed against the taxpayer.

Michigan department of traasury 3372 (rav. North dakota 5.00% $1,813 5.00% $270 $2,083 exempt ohio exempt exempt exempt oklahoma exempt 4.50% $270 $270 exempt oregon no tax no tax exempt pennsylvania exempt exempt exempt Certificate must be retained in the seller's records.

(b) electricity, natural gas, and other fuels used or consumed predominately in the repair, maintenance, or restoration of rolling stock are exempt from the taxes imposed by this chapter. For resale at retail in section 3, basis for exemption claim. It is the purchaser's responsibility to ensure the eligibility of the exemption being claimed.

Law defines “gross proceeds” and “sales price” broadly. Michigan bills would end tax exemptions for rolling stock. Do not sand to tha department of treasury.

Michigan department of treasury 3372 (rev. May use this form to claim exemption from michigan sales and use tax on qualified transactions. All claims are subject to audit.

Instructions for completing michigan sales and use tax certicate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use tax on qualied transactions. An initiative in the michigan house is intended to give the state another avenue to collect taxes on the trucking industry. Instructions for completing michigan saies and use tax certificate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions.

Truckers are all too familiar with efforts to dig into their pockets to help fill coffers. 1 o.d rolling stock purchased by an interstate motor carrier. D nonprofit organization with an authorized letter issued by the michigan department of treasury prior to june 1994.

It is the purchaser’s responsibility to ensure the eligibility of the exemption being claimed. All claims are subject to audit. This certifi cate is invalid unless all four sections are completed by the purchaser.

All equipment for which a sales tax exemption is being requested will be used for. 205.54r qualified truck, trailer, or rolling stock; As before, purchasers claiming the rolling stock exemption

This process is the same as it was prior to p.a. Instructions for completing michigan sales and use tax certificate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. Under the bill, rolling stock would be a qualified truck (a commercial motor vehicle power unit, with dimensions as specified in the act), a trailer designed to be drawn behind a qualified truck, and.

Sales tax licenses are not issued to wholesalers. Definitions (1) all of the following are exempt from the tax under this act: The use tax act exempts “the storage, use, or consumption of rolling stock used in interstate commerce and purchased, rented, or leased by an interstate fleet motor carrier.” 3.

All claims are subject to audit.

Michigangov

Nscorpcom

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Ysuedu

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Dexterschoolsorg

Ysuedu

Michigangov

Easternctedu

Tax Exemptions Live Auctions Miedema Auctioneering Michigan

Grandtraverseareaspartansorg

Michigangov

Michigan Tax Exempt Form – Fill Online Printable Fillable Blank Pdffiller

Customer Forms Lasting Impressions

Ysuedu

Farmdepotbiz

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption