This western michigan county has an effective property tax rate (1.73%) that ranks among the highest in michigan. Here are the highlights from attom’s property tax.

Pristine 3 Acres Surrounded By Lakes Manistee River Lake Acre

Payable to county treasurer march 1:

Michigan property tax rates by county. In the city of kalamazoo, the tax rate on principal residences is anywhere from 48.13 to 50.33 mills. Delinquent property forfeits to county treasurer. Interest increases to 1.5% per month, and calculated from march 1.

Current tax cycle (pdf) delinquent tax collection (pdf) hardship guidelines and application; Each mill represents $1 of tax for every $1,000 of taxable value. Here is a listing of the communities with michigan's lowest millage rates, based on the state department of treasury's 2016 numbers.

The jackson county treasurer has compiled the following resources to assist you with questions and inquiries related to tax information: Highlights of the property tax and assessor data for oakland county, michigan. (906) 884 2765 (phone) the ontonagon county tax assessor's office is located in ontonagon, michigan.

Ontonagon county assessor's office services. Payable to county treasurer march 1: The ontonagon county tax assessor is the local official who is responsible for assessing the taxable value of all properties.

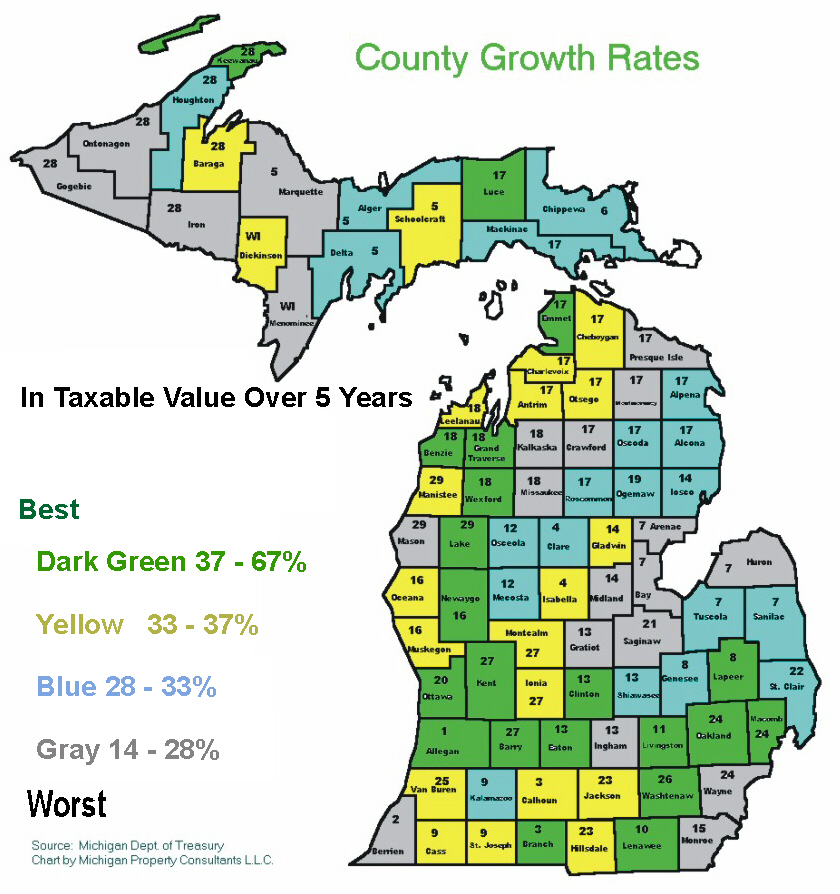

The exact property tax levied depends on the county in michigan the property is located in. When property taxes are not paid to the city or township treasurer by february 28 , the delinquent taxes are transferred to the county treasurer for collection as governed by the michigan. 2020 total property tax rates in michigan total millage industrial personal (ipp) county:

4% administration fee, and 1% per month interest is added. $175 title fee is added. The millage rate database and property tax estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes and millage rates with other local units throughout michigan.

Unpaid taxes are delinquent and turned over to county treasurer for collection. Real property tax bills are issued by the city or township treasurer twice each year in july and december. Get driving directions to this office.

Genesee county collects very high property taxes, and is among the top 25% of counties in the united states ranked. You can search online at no cost by clicking on the property search tag under online services. The median property tax (also known as real estate tax) in genesee county is $1,945.00 per year, based on a median home value of $118,000.00 and a median effective property tax rate of 1.65% of property value.

Property prices rose, and the effective tax rates remained relatively stable in oakland, michigan, from 2019 to 2020. Current local tax information is available by contacting your local treasurer’s office. Washtenaw county collects the highest property tax in michigan, levying an average of $3,913.00 (1.81% of median home value) yearly in property taxes, while luce county has the lowest property tax in the state, collecting an average tax of $739.00 (0.86% of median home value) per year.

Property tax records for leelanau county are available online. For more detailed information, such as delinquent amounts due or to pay your delinquent taxes online, you will need to click on the link below.

States With The Highest And Lowest Property Taxes Property Tax High Low States

Oakland County Michigan Professional Realtor Tom Gilliam Oakland County Michigan Oakland County Michigan

Pin By Katie Seitz On Picture Places Picture Places Great Places Metropolitan Area

10 Steps To Buying A Home Infographic Home Buying Home Buying Process Sell Your House Fast

The Human Development Index Of Us Vs Europe – Vivid Maps In 2021 Human Development Index Human Development Places To Visit

New Jersey Real Estate Property Power Of Attorney In 2021 Power Of Attorney Form Power Of Attorney Refinancing Mortgage

Michigan Property Taxes By County – 2015 Property Tax House Outline Home Icon

Pin By Kay Dedo On Good To Know Ski Town Skiing Iron River

Michigan Property Taxes By County – 2015 Property Tax House Outline Home Icon

California March Sales Report Housing Market Real Estate Information California

Mortgage News Daily Mortgage Interest Rates Mortgage Brokers Mortgage Rates

Beachwalk Resort Community Homes Sold By Fctucker Beach Walk Resort Michigan City

All It Takes Is A Big Unexpected Expense Or A Few Months Of Unemployment And Youre Behind On Your Mortgage Or Tax Pa Tax Payment Unexpected Expenses Mortgage

Pin On Misc Library

Short Sale Process Chart Shorts Sale Process Chart Money Blogging

Maureen Francis On Twitter Property Tax Financial Information Public School

Existing Home Sales Prices Infographic Real Estate Infographic Real Estate Trends Real Estate Marketing

Should You Hire A Property Manager Property Management Management Hiring

Michigan Real Estate Power Of Attorney Form In 2021 Power Of Attorney Form Power Of Attorney Power