Millage rates can vary significantly by municipality. You have 4 years from the original due date to file your claim.

9 Best Tax Laws Ranked By State Tax Relief Center State Tax Tax Help Tax Rules

State education tax assessed on the taxable value of all property at 6 mills;

Michigan property tax formula. The tax you pay is the total tax rate multiplied by the taxable value of your home. For tax calculation, divide your taxable value by 1,000 as millage is levied per thousand of valuation. The county board of commissioners and the michigan state tax commission must review local assessments and adjust (equalize) them if they are above or below the constitutional 50% level of assessment.

Follow this link for information regarding the collection of set. 211.2 et seq) provides specific instructions on how to prorate taxes at a closing when no proration agreement exists between the buyer and seller. A tax rate of 32 mills ($32 of taxes for every $1,000 of taxable value.

If you’d like more practice with real estate taxes, download our “125 real estate math problems solved!” click here to get access to 125 real estate math practice problems. The property assessment system is the basis for the collection of property taxes in michigan. Please see stc bulletin 6 of 2017 for more information on poverty exemptions.

In michigan, the assessed value is equal to 50% of the market value. Michigan's property tax act, (act 206, 1893; Taxes = assessed value x tax rate.

2020 total property tax rates in michigan total millage industrial personal (ipp) cheshire twp 031030 allegan public school 33.1314 51.1314 27.1314 39.1314 33.1314 51.1314 bloomingdale public s 32.4042 50.3538 26.4042 38.3538 32.4042 50.3538 clyde twp 031040 fennville public scho 30.4224 48.4224 24.4224 36.4224 30.4224 48.4224 dorr twp 031050 Summer tax mils + winter tax mils = total annual mils. Enter the sev (state equalized value) found on the property tax records (you will use the sev to calculate the property taxes for a property that you are purchasing.

You would then add $1,800 to the $9,000 you paid in rent, for a total of $10,800. Other useful real estate math formulas 1 acre = 43560 square feet area (ft2) = (length ft) x (width ft) The median property tax in wayne county, michigan is $2,506 per year for a home worth the median value of $121,100.

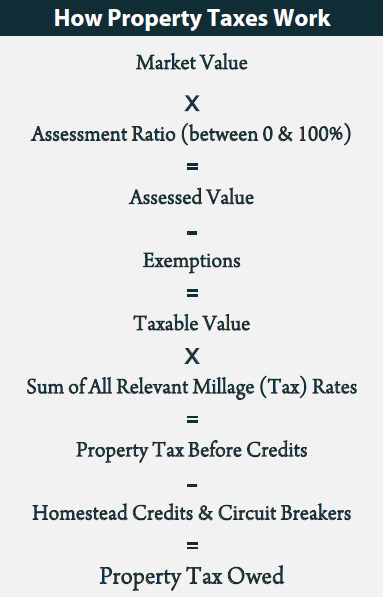

How michigan property taxes work. Property taxes are calculated by multiplying the tax rate by the taxable value. Sales tax increased from 4% to 6%, with 100% of the revenue from the additional 2% dedicated to the school aid fund (saf);

To calculate the property taxes for the current owner you will use the “taxable value” which may be less than the sev. Basic formula used to calculate a levy or property tax for one unit of government: The taxable value starts out at half your home's market value, and then rises in line with inflation.

Once you know how to find state equalized value in michigan you can then calculate your property taxes. What you have to prove when fighting your michigan property taxes is that your home is not worth what the city has assessed it at. The property tax rate in michigan varies from county to county and school district to school district.

Assumptions used to create this example: The asset test should calculate a maximum amount permitted and all other assets above that amount should be considered as available. Taxable value —a property’s taxable value is the value used for determining the property owner’s tax liability.

Tax levy = millage rate times taxable value. Wayne county has one of the highest median property taxes in the united states, and is ranked 278th of the 3143 counties in order of. Property taxes are calculated by taking the mill rate and multiplying it by the assessed value of your property.

For the home below, the city of lansing homestead tax rate (45.9519), is multiplied by the property's taxable value of $21,789 (to the next thousand = 22). Property taxes are based on the “taxable value” of the property not the sev (state equalized value). Amount of cash, fixed assets or other property that could be used, or converted to cash for use in the payment of property taxes.

$345,000 x $2.10 / $100 = $7,245. 45.9519 x 22 = $1,010 Here is a list of millage rates for michigan.

In addition to the state tax, each individual county levies an additional transfer tax of $0.55 per $500. Property tax formulas property tax rate = (assessed value) x (mill rate) assessed value = (assessment rate) x (market value) 1 mill = equal to 1/1,000th of a dollar or $1 in property tax. So, if you paid $750 in rent each month for a year, multiply $9,000 by 20 percent, which is $1,800.

You will also see this called the owner’s primary or principal residence. Multiply the amount by 20 percent, then add the amount of your property taxes or rent to the sum. Wayne county collects, on average, 2.07% of a property's assessed fair market value as property tax.

Estimated taxes = (taxable value x mills) / 1000 The first is assessed value. The city assessor looks at recent sold homes and applies their formula to come up with the state equalized value (sev).

There are two different numbers that reflect your home’s value on your michigan property tax bill. To arrive at the assessed value, an assessor first estimates the market value of. The state education tax act (set) requires that property be assessed at 6 mills as part of summer property tax.

A taxable value of fifty thousand dollars ($50,000.00) A quote from the act follows later, but basically, taxes are prorated as though paid in advance with the seller being responsible for all tax. Then apply the millage rate and the result are the annual taxes.

The state transfer tax rate in michigan is $3.75 for every $500 of property value, or 0.75% of the transferred property's value.

Property Tax Comparison By State For Cross-state Businesses

Pin On Only For Me

Michigan Property Tax Hr Block

Best Places To Retire To Make Your Retirement Income Go Farther Seeking Alpha Income Tax Retirement Income Tax Forms

How Property Taxes Work Itep

Business Magazine Layouts Graphic Design – Business Design Graphic Layouts Magazine – Magazine Layout Magazine Layout Inspiration Real Estate Advertising

How To Calculate Michigan Property Taxes On Your Investment Properties

Look Uppay Property Taxes

What Do Your Property Taxes Pay For

Frequently Asked Questions – Howard Jarvis Taxpayers Association Tax Reduction State Tax California Constitution

Michigan Property Taxes By County – 2015 Property Tax House Outline Home Icon

Property Tax Prorations – Case Escrow

States With The Highest And Lowest Property Taxes Property Tax High Low States

Maureen Francis On Twitter Property Tax Financial Information Public School

Pin By New World Group On Luxury Ads Real Estate Ads Hotel Ads Property Ad

Comparing The Real Cost Of Owning Property Across The United States Property Tax Real Estate Staging Denver Real Estate

Property Tax What Does It Mean For You

How To Calculate Property Tax And How To Estimate Property Taxes

Payroll Tax Definition Payroll Taxes Payroll Tax Attorney