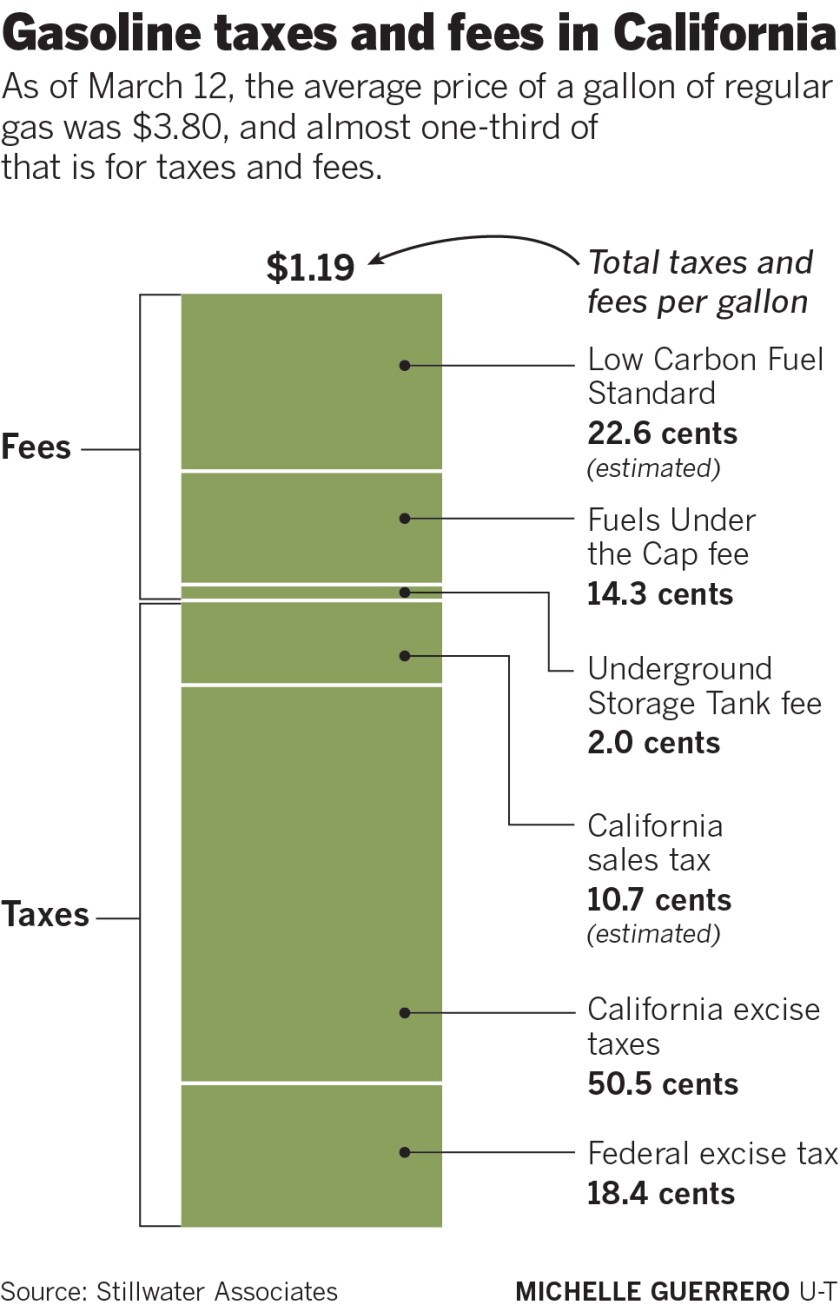

When gas is $3.89 per gallon, that amounts to another 21 cents per gallon in taxes. 1, 2017, as a result of the 2015 legislation.

How Long Has It Been Since Your State Raised Its Gas Tax Itep

† these tax rates are based on energy content relative to gasoline.

Michigan gas tax increase history. Ten states have gone two decades or more without a gas tax increase. When gas is $3.89 per gallon, that amounts to another 21 cents per gallon in taxes. Per gallon state gas tax, and the 18.4 cents per gallon federal fuel tax.

The 3% sales tax was on retail sales of tangible goods. The current federal motor fuel tax rates are: Michigan fuel taxes last increased on jan.

On july 1, the gas tax will increase by 0.1 cents and the diesel tax by 0.2 cents. It is estimated that proposal 1 would raise state revenues from sales and use taxes by. Gas and diesel tax rates vary each month in michigan alongside changes in the price of fuel.

Of that $175 million, $68 million will go to state roads, $68 million to county projects and $38 million to cities. Congress votes to extend the tax and increase the rate to 1.5 cents a gallon. Whether gas costs $2 per gallon or $4 per gallon, the amount collected for those two taxes remains the same.

The formula also applies to $175 million in general state tax dollars that legislators have earmarked to fix roads this year, on top of gas tax and vehicle registration tax revenue. Compressed natural gas (cng) $0.184 per gallon †. And the state’s gas tax as a share of the total cost of a gallon of gas stood at 17.7 percent.

This tax is established in the motor fuel tax act (2000 pa 403). Most states tax motor fuels with a per unit tax, such as the 26.3 cents per gallon levied by michigan. In 1960, voters approved an increase of the 3% sales tax to 4%, effective january 1, 1961.

The state’s legislature passed a fuel tax increase in 2017 to raise $49 million annually for state and local road projects. Included in the gasoline, diesel/kerosene, and compressed natural gas rates is a 0.1 ¢ per gallon charge for the leaking underground storage tank trust fund (lust). 1934 when prohibition ends (so the feds can again tax booze), the gas tax falls back to 1 cent a gallon, where it.

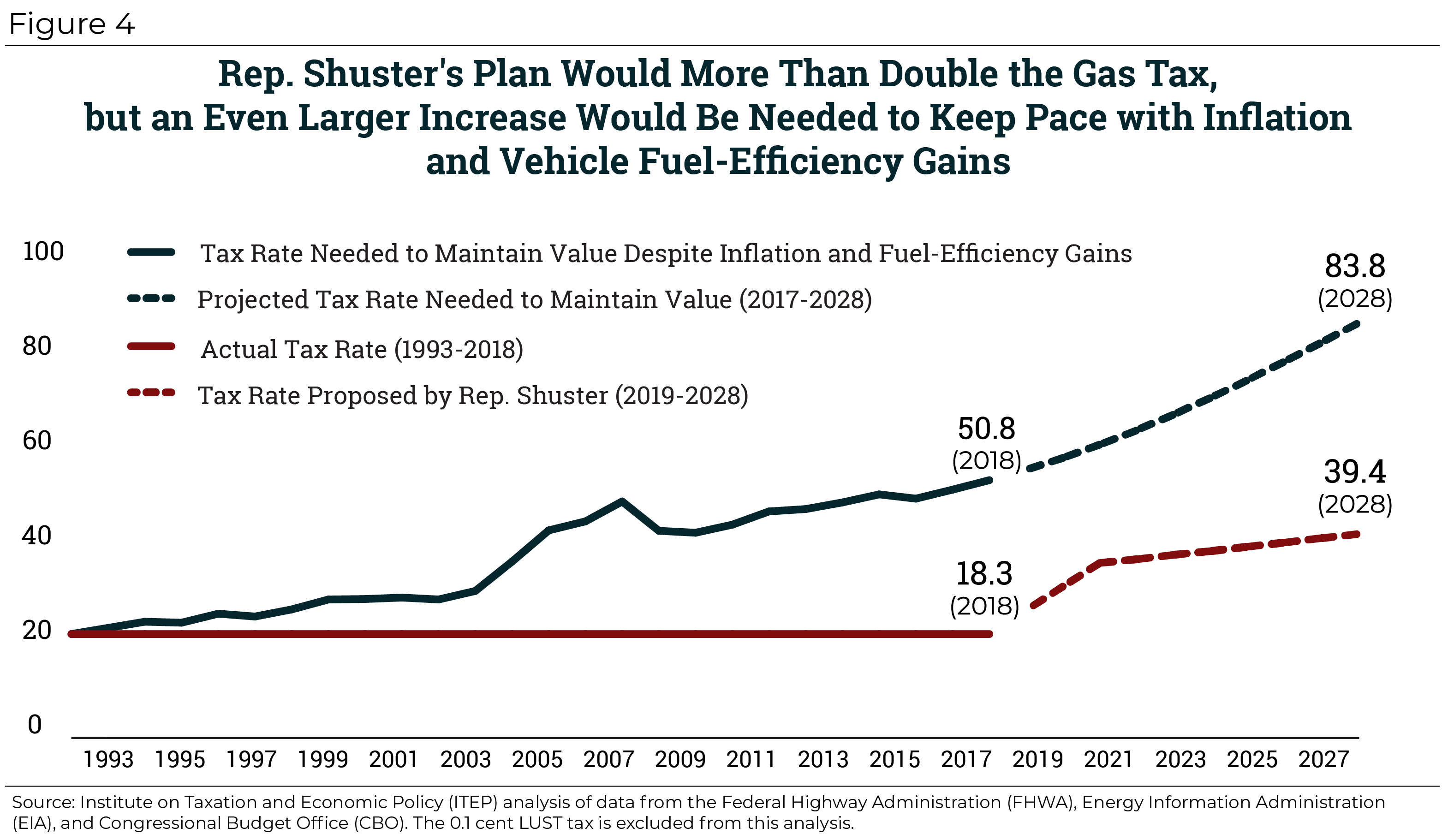

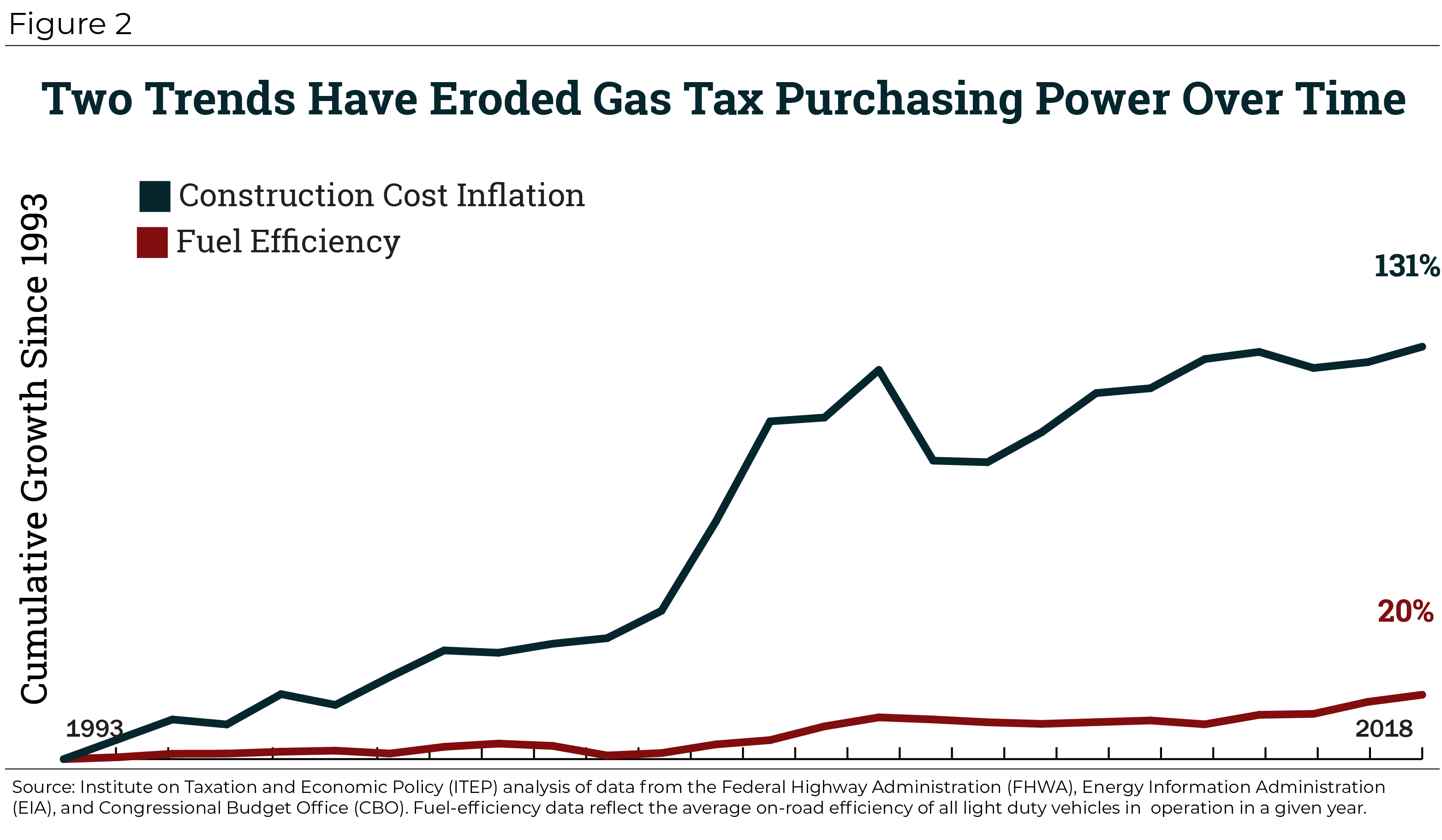

Fuel rate (which applies to both gasoline and diesel fuel) will rise to 26.3 cents per gallon. While the current rate for federal gas tax purposes is 18.4 cents per gallon (24.4 cents per gallon for diesel), a rate that hasn't changed since 1993, state gas taxes have much more volatility. The motor fuel tax on gasoline is expected to generate over $839 million for

Two years later, in 1927, the rate was increased to three cents per gallon. Michigan first enacted a fuel tax in 1925, at a rate of two cents per gallon. Since 2013, 33 states and the district of columbia have enacted legislation to increase gas taxes.

Thus far in 2021, two states—colorado and missouri— have raised their state gas tax, although technically it was a fee in colorado. Substitute offered in the senate on may 21, 2014. Michigan’s 6% sales tax levied on gasoline is not spent patching potholes.

$0.219 / gallon* *most jet fuel that is used in commercial transportation is.044/gallon The bill in virginia raised the gas tax by 10 cents over two years, while. Didn't gas taxes just go up?

As of january of this year, the average price of a gallon of gasoline in michigan was $2.37. A proposal to amend the state constitution to increase the sales/use tax from 6% to 7% to replace and supplement reduced revenue to the school aid fund and local units of government caused by the elimination of the sales/use tax on gasoline and diesel fuel for vehicles operating on public roads, and to give effect to laws that provide additional money for roads and other transportation purposes by. Gas and diesel taxes will each rise by 1.4 cents per gallon because of a formula implemented in 2013 that ties the tax rate to increases in the rate of inflation and in the price of motor fuel.

But you also pay the michigan 6 percent sales tax. When those three taxes are added Effective january 1, 2022 and each year thereafter, the motor fuel tax rate will be adjusted for inflation.

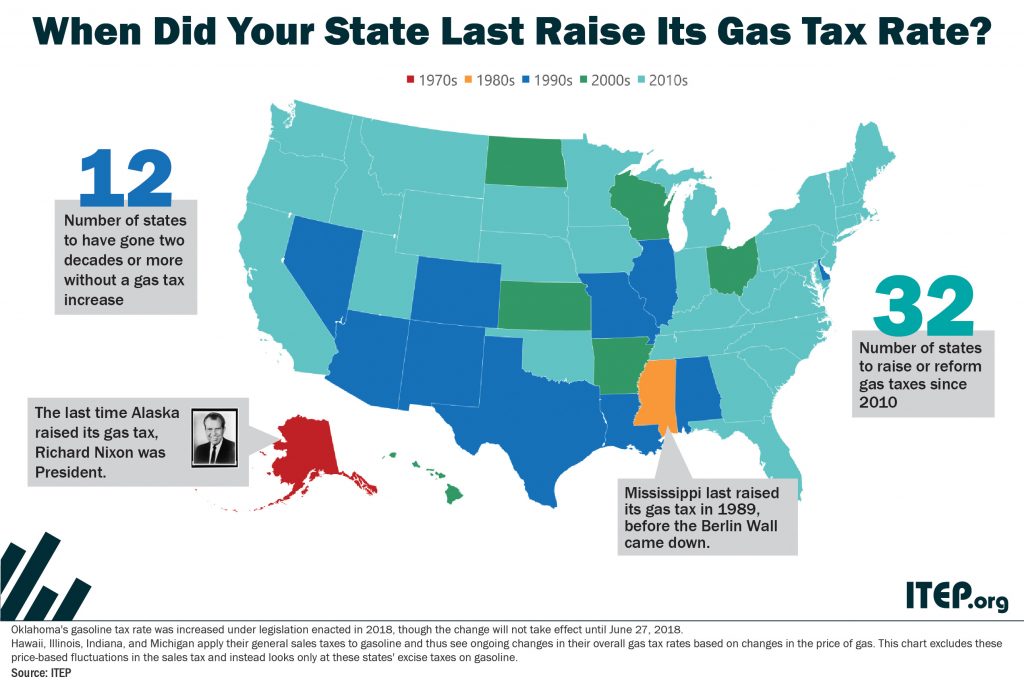

Fourteen states and the district of columbia have waited a decade or more since last increasing their gas tax rates. In 2020, one state—virginia—and d.c. Michigan's diesel fuel tax was adopted in 1947, at a rate of five cents per gallon.

Five states have waited more than 30 years since last raising their gas tax rates: Alaska last boosted its gas tax in 1970 followed by mississippi in 1989, louisiana and arizona in 1990, and colorado in 1991. Instead, the estimated $894 million annual amount is mostly put toward the state’s school aid fund with the rest.

The state’s gasoline tax rate subsequently increased by 5 cents and another increase of 1 cent will be phased in through 2023.

Rep Shusters Mixed Bag Doubling The Gas Tax Before Repealing It Entirely Itep

Michigan Gasoline And Fuel Taxes For 2021

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Gas Taxes Rise In A Dozen States Including An Historic Increase In Illinois Itep

Motor Fuel Taxes Urban Institute

How Much Are You Paying In Taxes And Fees For Gasoline In California – The San Diego Union-tribune

2

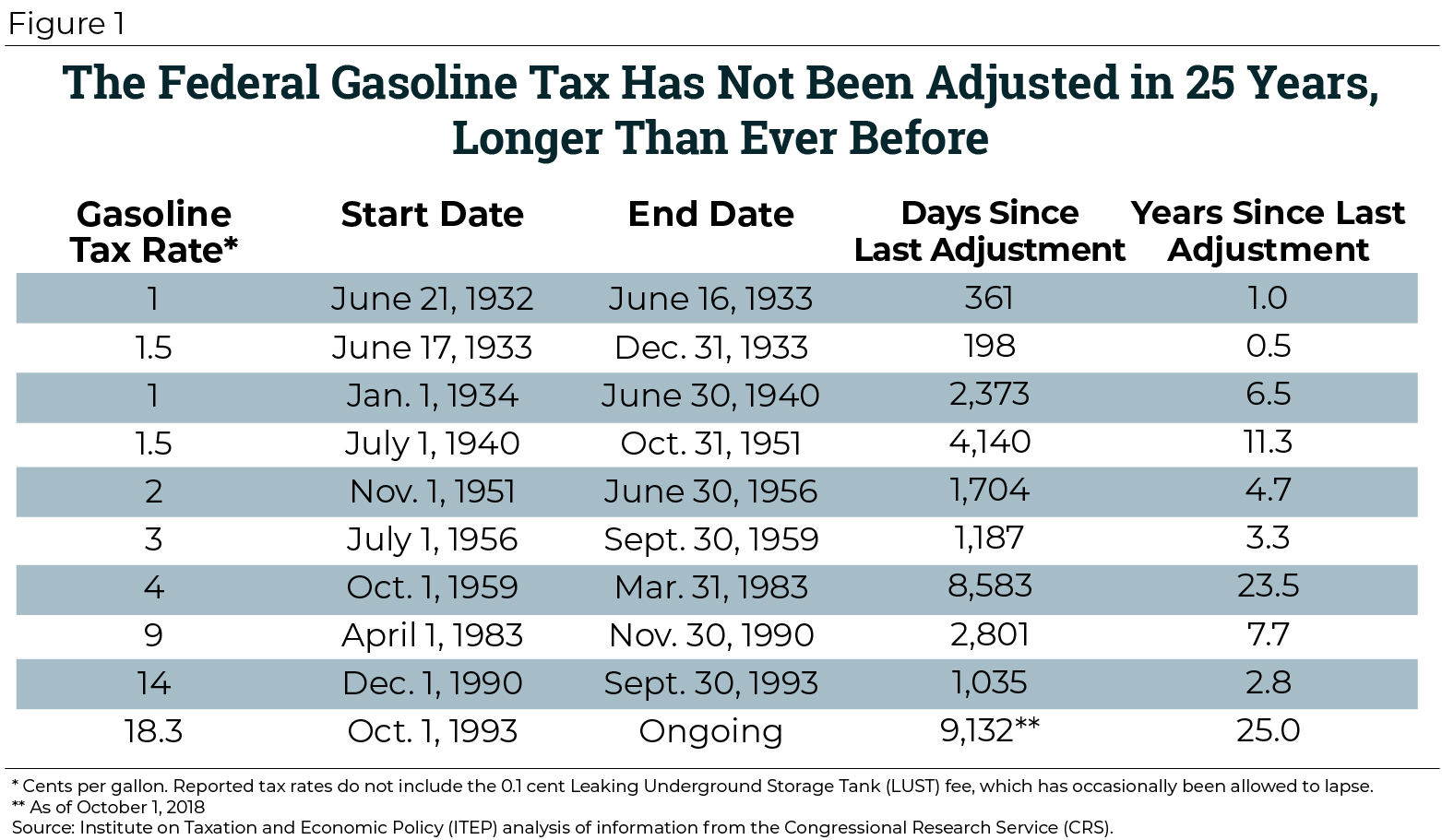

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

Us States With Highest Gas Tax 2021 Statista

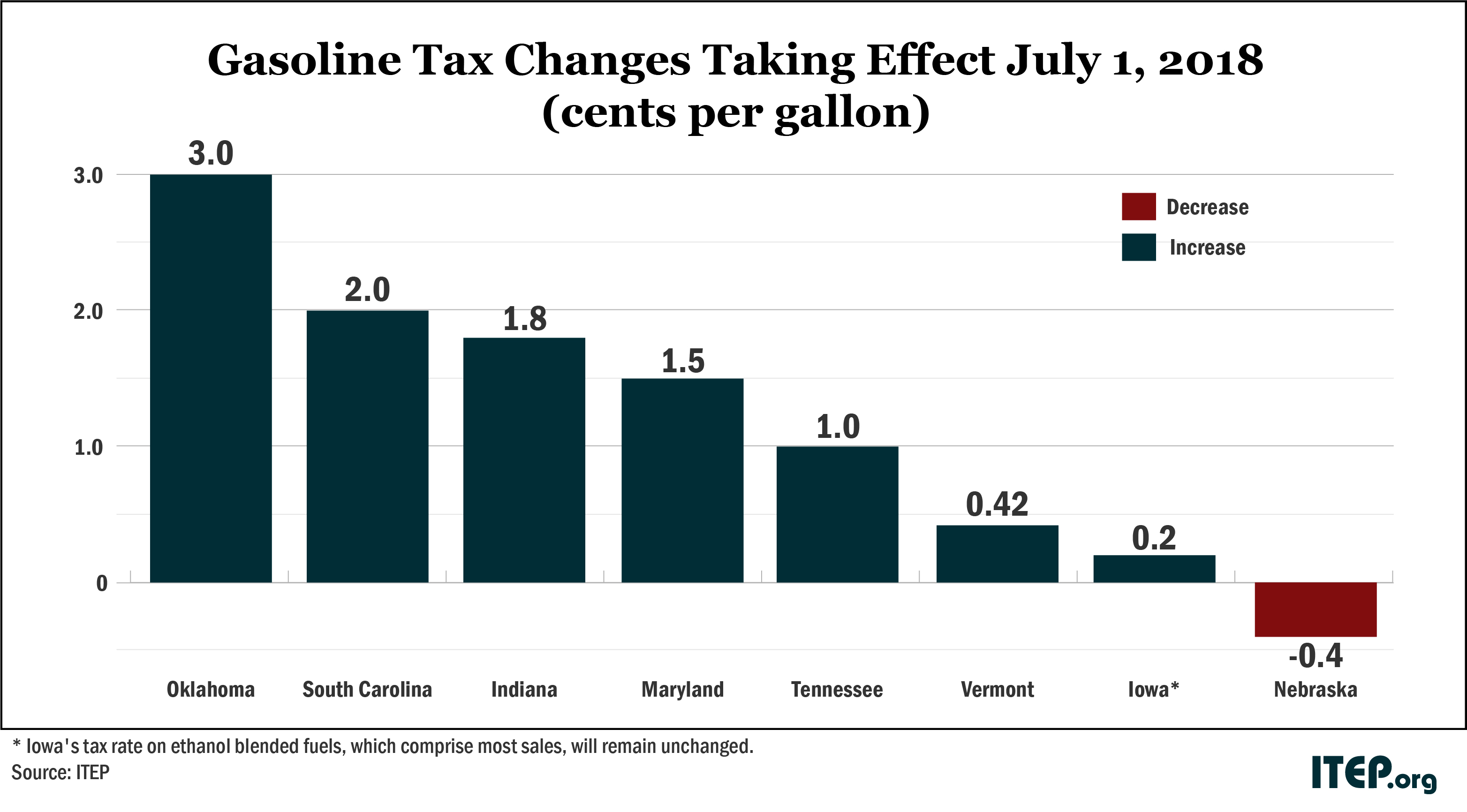

Gas Taxes Rise In Seven States Including An Historic Increase In Oklahoma Itep

.png)

Map State Gasoline Tax Rates Tax Foundation

State Motor Fuel Tax Rates – The American Road Transportation Builders Association Artba

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

Pin On Infographics And Data Visualization

Michigan Sales Tax Increase For Transportation Amendment Proposal 1 May 2015 – Ballotpedia

Its Been 10000 Days Since The Federal Government Raised The Gas Tax Itep

Michigan Gas Tax Going Up January 1 2022

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

How Long Has It Been Since Your State Raised Its Gas Tax Itep