Maryland taxpayers who have acquired a minimum of $20,000 in student loan debt, with $5,000 or more still outstanding, may qualify for this student loan forgiveness program from the state government. It indicates that if you apply and receive the credit that you will report the total on tax form 502, 505 or 515.

Finance Major What My Fri Perception Vs Fact – Picloco Finance Major Finance Degree Business Major

Have completed and submitted an application.

Maryland student loan tax credit reddit. If you live in maryland, you may not be aware of the student debt relief tax credit. To be eligible for the student loan debt relief tax credit, you must: I got mine today, it seems my credit amount will be $883;

From the last three years, the state of the united states of america has allocated funds to help out the graduate and undergraduate students to pay their individual student loans. Have at least $5,000 in outstanding student loan debt remaining when applying for the tax credit; Have incurred at least $20,000 in undergraduate and/or graduate student loan debt;

The maryland student loan debt relief tax credit provides qualified taxpayers up to $5,000 towards paying off existing student loans. Thousands of marylanders receive student loan debt relief tax credits, $9m total to apply for the tax credit, complete and submit this application to the maryland higher education commission by. This is my first year applying but i understand last year the average credit was $1200, last year i.

Student loan debt relief tax credit. For tax credit awards that precede tax year 2019, email your proof of payment to: At glass jacobson, our tax preparation team is always looking for ways to save our clients money.

Applications for the maryland student loan debt relief tax credit are due on sept. To qualify, you must be making payments on student loan debt incurred in pursuit of eligible undergraduate or. Md student loan tax credit.

“student loan debt is a daunting and. I believe that i will need to mail my state return in as i need to include a certification. The maryland student loan debt relief tax credit came in effect in july 2017 by the mhec.

Per the maryland higher education commission website this is a new credit for this year. In order to qualify for the credit, you must apply for the program before september 15, 2019. Nationally, student loans exceed $1.48 trillion and maryland’s average is $27,455 per graduate.

Last year the state granted over $9 million in tax credits to residents through the program. I probably spent that in billable hours applying for the thing so i'm a little disappointed. Marylanders struggling with student debt have a week left to get some help with their loans from the state.

Anyone received their student loan tax credit amount notification? The maryland student loan debt relief tax credit is an effort to help thousands of people who've racked up at least $20,000 in undergraduate or graduate student loans. Maintain maryland residency for the 2021 tax year;

Student Loans 101 How To Manage Your Student Loan Debt White Coat Investor

Student Loan Debt Relief Options When Forbearance Ends Credit Karma

6 Student Loans For Bad Credit Federal And Private – Student Loan Hero

/ProdigyFinance-18b8bbc2d6b04eb6aee0a90d44bbc537.jpeg)

Prodigy Finance Student Loans Review 2021

Student Loans 101 How To Manage Your Student Loan Debt White Coat Investor

How Does Student Loan Interest Work – Savingforcollegecom

7 Scholarships For Nursing School That Could Lessen Your Student Debt Student Loan Hero

Student Loans 101 How To Manage Your Student Loan Debt White Coat Investor

Top Student Loans Without A Cosigner Of December 2021

How To Get Rid Of Student Loans – Savingforcollegecom

Student Loans 101 How To Manage Your Student Loan Debt White Coat Investor

Student Loans 101 How To Manage Your Student Loan Debt White Coat Investor

Scholarships And Grants To Pay Off Student Loans Sofi

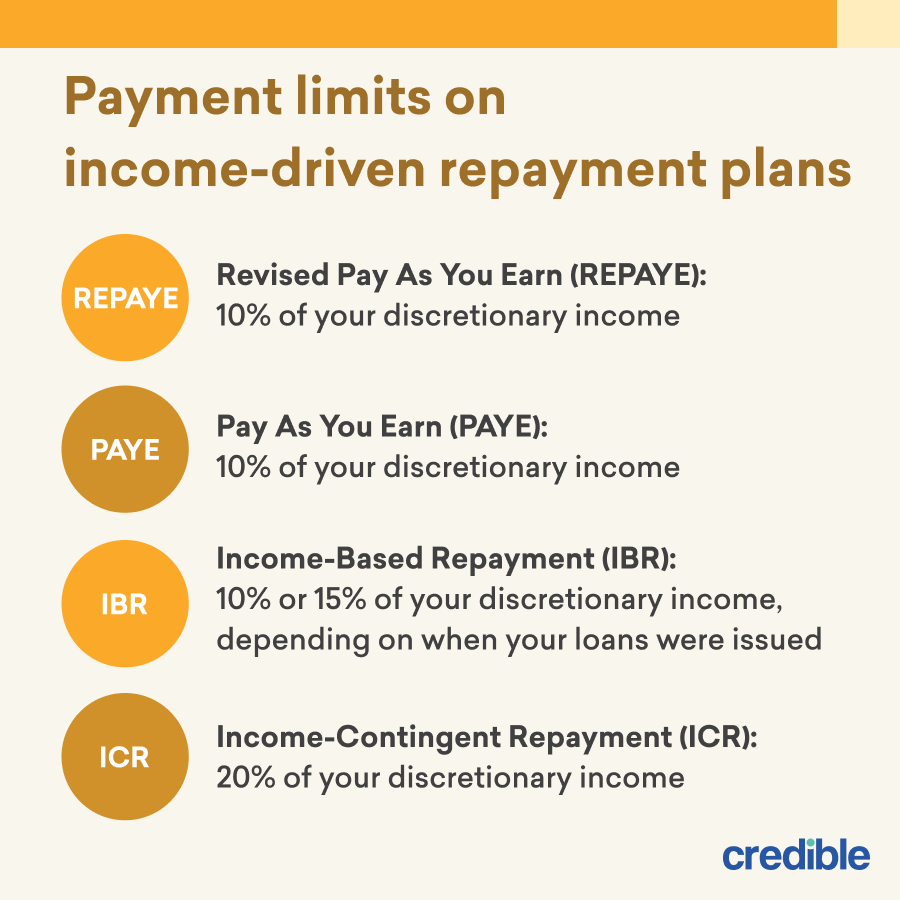

Private Student Loan Forgiveness Alternatives Credible

Student Loan Forgiveness Programs The Complete List 2021 Update

Pin By Laura Kick On Money Is Only A Tool It Will Take You Wherever You Wish But It Will Not Replace You As The Driver Student Memes Finance Finance Major

Can You Apply For Teacher Loan Forgiveness Twice No But Student Loan Hero

Student Loan Forgiveness Programs The Complete List 2021 Update

Student Loans 101 How To Manage Your Student Loan Debt White Coat Investor