The following paperwork must be presented at the time of the first registration of a vehicle. Vanity plates are available for camper trailers for an additional annual fee of $25.00.

Excise Tax Westbrook Me

Serving as the center of acadian culture in maine.

Maine excise tax on campers. Pay sales tax (5.5% of the purchase price). We are considering buying a condo as a base. The excise tax on a stock race car is $5.

Excise tax is a municipal tax. The excise tax on a stock race car is $5. Excise tax is an annual tax that must be paid prior to registering a vehicle.

Excise tax is an annual tax that must be paid prior to registering your vehicle. Do you pay excise tax on a camper in maine? Excise tax is a municipal tax.

Except for a few statutory exemptions, all vehicles registered in the state of maine are subject to the excise tax. You'll need a few pieces of information to get started. Except for a few statutory exemptions, all vehicles registered in the state of maine are subject to the excise tax.

Pay sales tax (5.5% of the purchase price). The excise tax due will be $610.80. How to register a camper trailer in the state of maine:

Excise tax is a municipal tax. If the trailer was purchased from a dealer, you will need: The state charges $8.00 for a transfer registration during the registration year.

Excise tax is an annual tax that must be paid prior to registering your vehicle. Excise tax is defined by state statute as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways. Tax applicable on camper varies based on state and even county.

The amount of the tax is a calculation involving the manufacturer's suggested retail price and the year of. Except for a few statutory exemptions, all vehicles registered in the state of maine are subject to the excise tax. Excise tax is an annual tax that must be paid prior to registering your vehicle.

Pay excise tax at your town office. If purchased from a maine. For the privilege of operating a motor vehicle or camper trailer on the public ways, each motor vehicle, other than a stock race car, or each camper trailer to be so operated is subject to excise tax as follows, except as specified in subparagraph (3), (4) or (5):

Like all states, maine sets its own excise tax. How to register a camper trailer purchased private sale: Besides, an rv sales tax tends to be significantly lower than those who pay in form of vat such as the europeans or the brits.

The state of maine has authorized falmouth to register certain automobiles, trucks and recreational vehicles. A sum equal to 24 mills on each dollar of the maker's list price for the first or current year of model, 17 1/2 mills for the 2nd year, 13 1/2 mills for the 3rd year,. Pay the appropriate registration fee.

The minimum tax is $5 for a motor vehicle other than a bicycle with motor attached, $2.50 for a bicycle with motor attached, $15 for a camper trailer other than a tent trailer and $5 for a tent trailer. A registration fee of $35.00 and an agent fee of $6.00 for new vehicles will also be charged for a total of $641.80 due to register your new vehicle. The following is a guide of sales tax deduction rates per state using the tax information publication issued on december 31, 2019 to be used in 2020.

Excise tax is defined by maine law as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways. Pay excise tax at your town office. Maine excise tax for motorhome.

Have been looking at texas and maine. You also need to pay the registration fee for your. The excise tax on campers is equal to 24 mills on each dollar of the msrp for

We are in our 4th year. Pay excise tax at your town office. Excise tax is defined by state statute as a tax levied annually for the privilege of operating a motor vehicle or.

Excise tax is an annual tax that must be paid prior to registering your vehicle.except for a few statutory exemptions, all vehicles (including boats) registered in the state of maine are subject to the excise tax.excise tax is defined by state statute as a tax levied annually for the privilege of operating a motor vehicle, boat or camper trailer on the public ways. Except for a few statutory exemptions, all vehicles registered in the state of maine are subject to the excise tax. Pay the appropriate registration fee.

The excise tax is based on the sticker price, or original list price of the vehicle. Vanity plates are available for camper trailers for an additional annual fee of $25.00. There is no excise tax on trailers unless it is a camper trailer or is ever used for sleeping (such as a horse trailer).

Please contact your local municipal office for additional information. Excise tax is defined by maine law as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways. People also ask, how much does it cost to register a trailer in maine?

After buying a camper trailer, owners must pay an excise tax in their city's local office, according to maine statute 36, section 1482. Vanity plates are available for camper trailers for an additional annual fee of $25.00. Maine has an excise tax that would cost me around $5,000 a year for the mh.

The minimum tax is $5 for a motor vehicle other than a bicycle with motor attached, $2.50 for a bicycle with motor attached, $15 for a camper trailer other than a tent trailer and $5 for a tent trailer. _____ maine.gov online services click here to see the complete list of online. Excise tax is defined by maine law as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways.

How to register a camper trailer purchased private sale: Except for a few statutory exemptions, all vehicles registered in the state of maine are subject to the excise tax. You may check the availability of a vanity plate online.

The excise tax on a camper traile r is due where the camper trailer is located either at the time of payment or on april 1, whichever is later. Please contact your local municipal office for additional information. Except for a few statutory exemptions, all vehicles registered in the state of maine are subject to the excise tax.

An excise tax is paid and kept by falmouth. Online calculators are available, but those wanting to figure their excise tax in maine can do so easily using a manual calculator or paper and pen. Other registration fees are collected, and forwarded to the state of maine.

The excise tax is an annual tax collected by the state for the use of the camper trailer on the roadways. Maine residents that own a vehicle must pay an excise tax for every year of ownership. Excise tax is defined by state statute as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways.

Pay the appropriate registration fee.

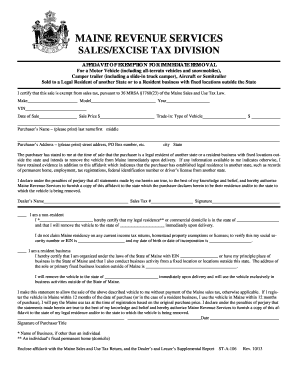

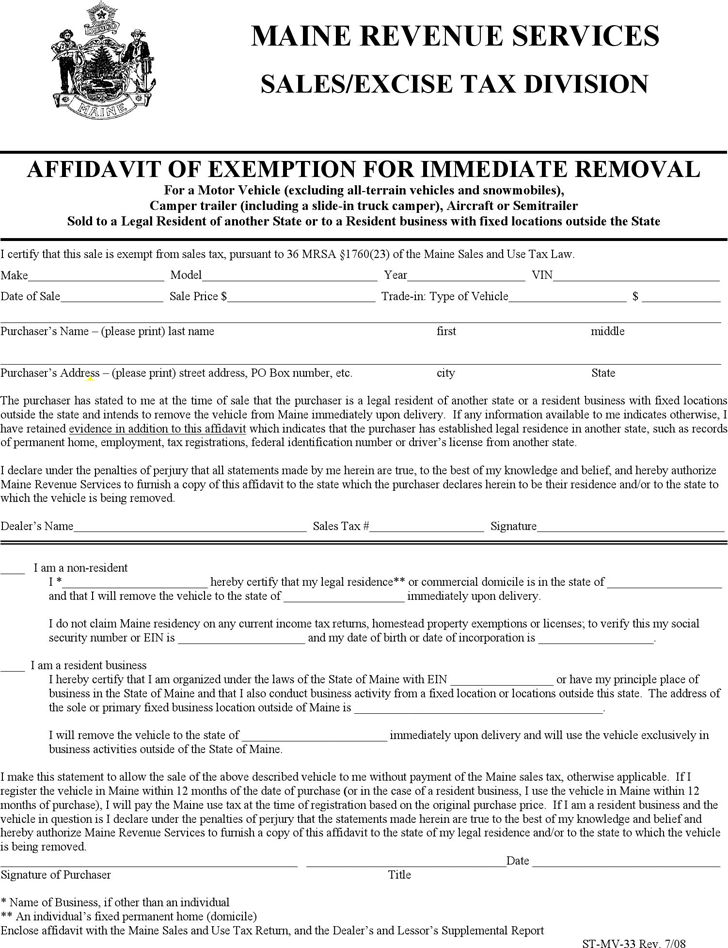

Fillable Online Maine Maine Revenue Services Salesexcise Tax Division Affidavit Of Exemption For Immediate Removal For A Motor Vehicle Including Allterrain Vehicles And Snowmobiles Camper Trailer Including A Slidein Truck Camper Aircraft

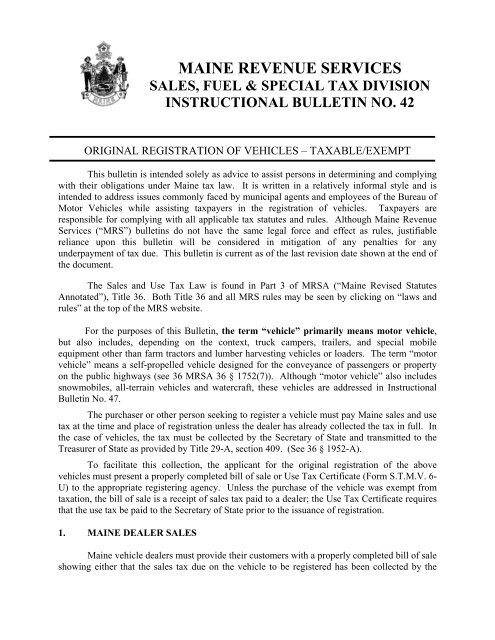

Original Registration Of Vehicles – Taxableexempt – Mainegov

Mainelegislatureorg

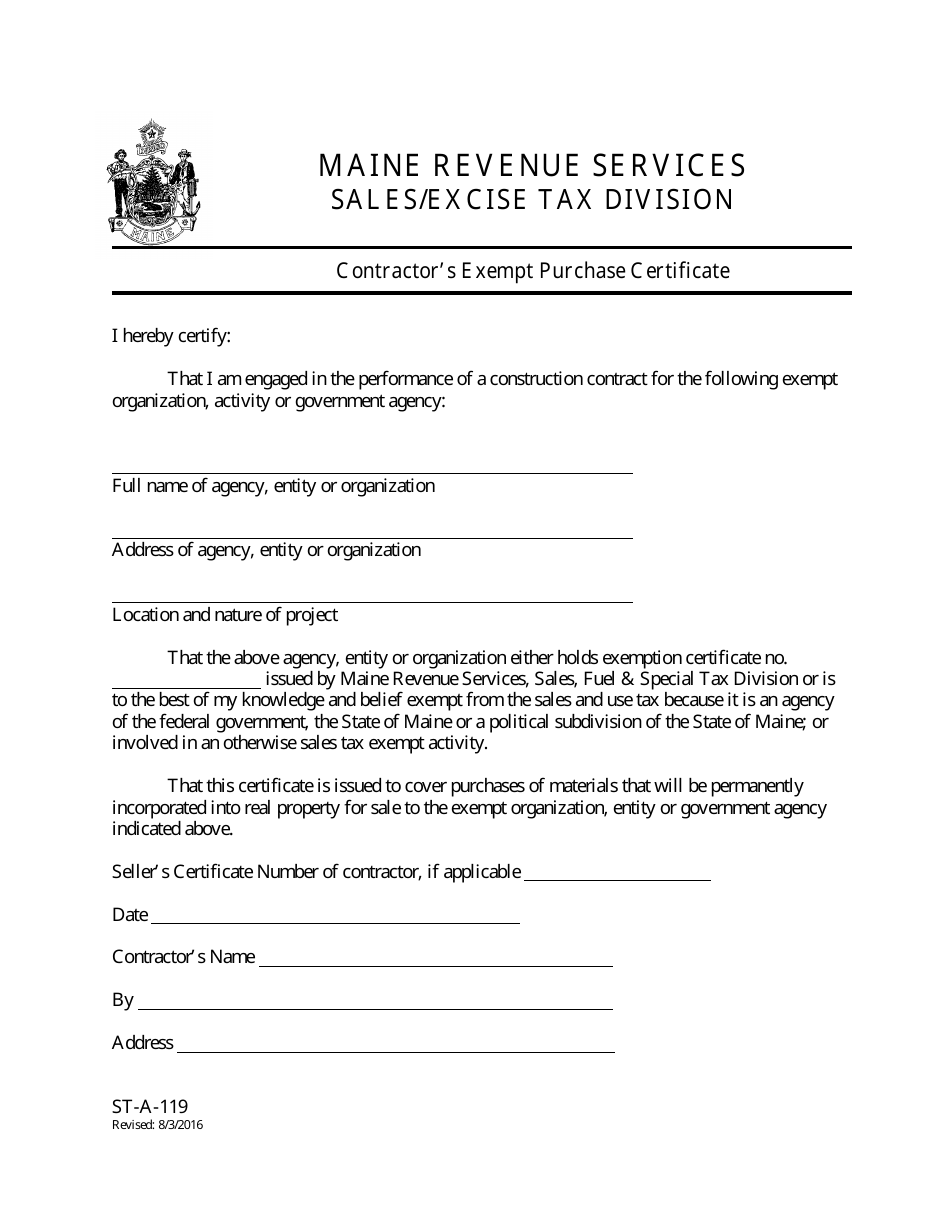

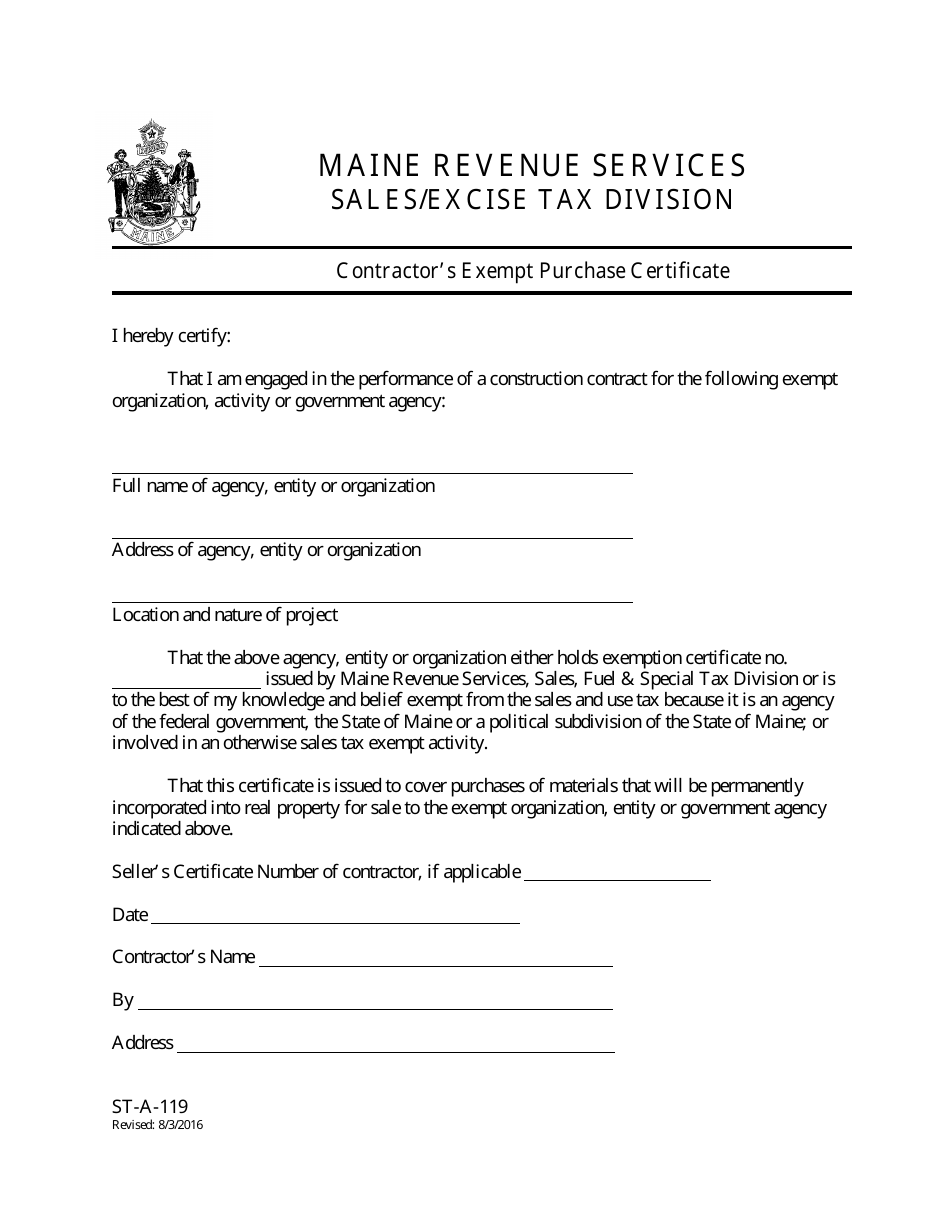

Form St-a-119 Download Printable Pdf Or Fill Online Contractors Exempt Purchase Certificate Maine Templateroller

Excise Tax Information Cumberland Me

Mainelegislatureorg

Mainegov

Mainegov

Free Maine Affidavit Of Exemption For Immediate Removal Form – Pdf 35kb 1 Pages

Excise Tax Westbrook Me

Mainegov

On A Single Plot In Rural Maine A Slew Of Rhode Island Car Registrations – The Boston Globe

Maine House Republicans – Democrats Vote For 9 Tax On Workers Residing In Seasonal Campers Seasonal Campers Are Double Or Triple Taxed Under Current Law Rented Augusta Civic Center House Democrats

Rumfordmeorg

Mainegov

Mainegov

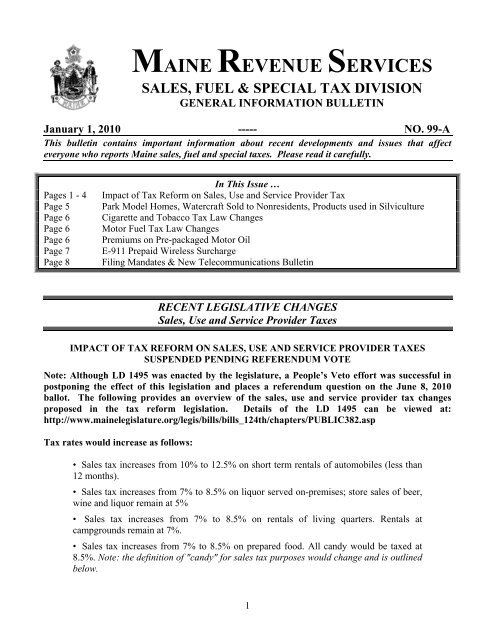

Sales Fuel Special Tax Division – Mainegov

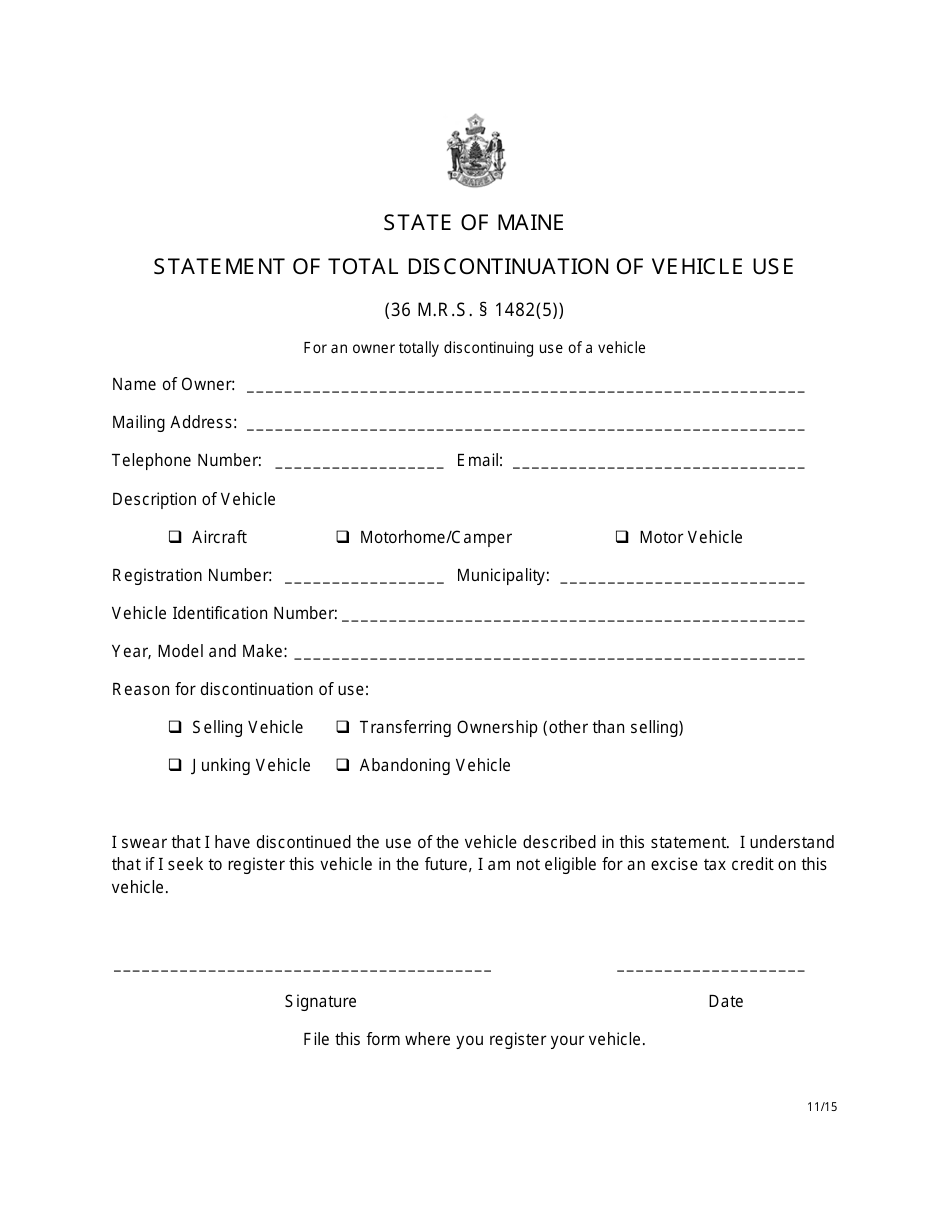

Maine Statement Of Total Discontinuation Of Vehicle Use Download Printable Pdf Templateroller

Mainegov