1 for individual income, corporate income, and sales and use tax purposes. Taxpayers can use this new credit against california state income taxes or sales and use taxes.

25 Percent Corporate Income Tax Rate Details Analysis

How to claim the main street small business tax credit.

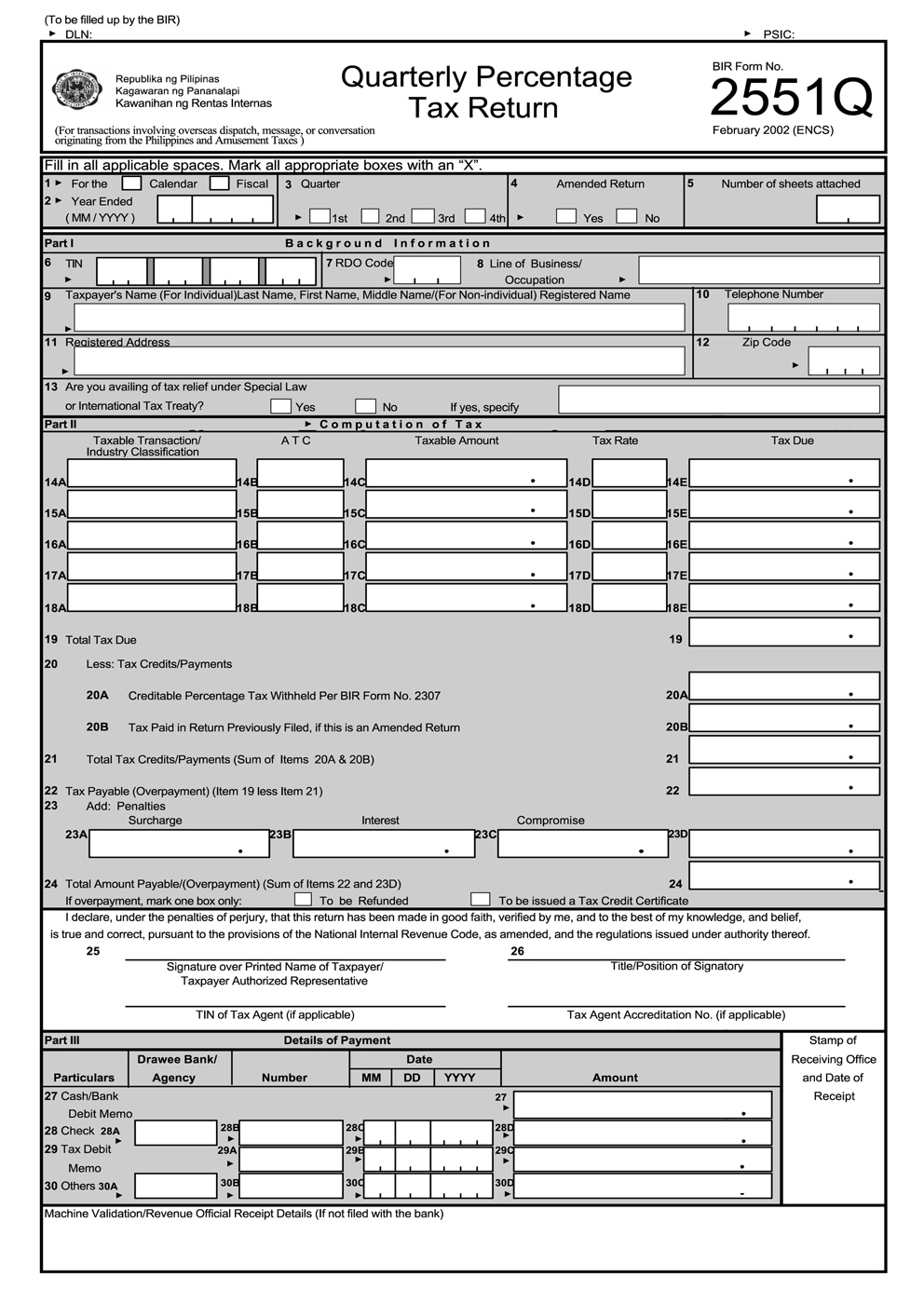

Main street small business tax credit 1. Beginning november 1, 2021, and ending november 30, 2021, the california department of tax and fee administration (cdtfa) will be accepting applications through their online reservation system for qualified small business. When will the credit be available? Include your main street small business tax credit (ftb 3866) form, to claim the credit.

The california department of tax and fee administration oct. If not, then does it mean the credit is lost forever if it is not claimed on the original tax return? The program allows a small business hiring credit against california state income taxes or sales and use taxes to certain qualified small business employers.

By bettywilliams | aug 30, 2021 | cdtfa |. Does anyone know if credit for ca “main street small business tax credit 1” can be claimed on amended tax return? We’re currently updating the ftb 3866 for the 2021 tax.

You can find more information on the main street small business tax credit special instructions for sales and use tax filers page. Last week, california’s main street small business tax credit launched, offering some relief for small businesses. This allows businesses to be a part of the revitalization of the downtown areas all while saving tax.

Provide the confirmation number (received from cdtfa on your tentative credit reservation) when claiming these credits. We're currently updating the ftb 3866 for the 2021 tax year and it will be available by january 1, 2022. 31, 2019, and (2) suffered a 50% or greater decrease in income tax gross receipts when comparing second quarter 2020 to.

Qualifying businesses may claim the main street small business tax credit for 2021, equal to $1,000 for each net increase in qualified employees, up to $150,000. Taxpayers that qualified for employee retention credit may also qualify for the main street small business tax credit. File your income tax return.

Tentative credit reservation amounts will be reduced by credit amounts reserved or received under the first main street small business tax credit program. 2021 california main street small business tax credit. California cdtfa announces 2021 main street small business tax credit ii available beginning nov.

Visit instructions for ftb 3866 for more information. File their income tax return. Upon review by the california department of tax and fee administration, the employer will be notified if a credit has been allocated and the amount of the credit.

The reservation system will be. This hiring tax credit applies to businesses that (1) had 100 or fewer employees as of dec. Beginning november 1, 2021, qualified small business employers need to apply for a credit reservation through the california department of tax and fee administration (cdtfa).

On november 1, 2021, the california department of tax and fee administration will begin accepting applications for tentative small business hiring credit reservation amounts through our online reservation system. Include the main street small business tax credit (ftb 3866) form in the tax return. Beginning on november 1, 2021, and ending november 30, 2021, the california department of tax and fee administration will be accepting applications through their online reservation system for qualified small business employers to reserve.

Use credit code 240 when claiming the credit. Main street small business tax credit dental practice owners may benefit the most from the main street small business tax credit. August 27, 2021 at 12:18 pm #313261.

28 announced that reservations are available for the 2021 main street small business tax credit ii, beginning nov. This bill provides financial relief to qualified small businesses for the economic disruptions in 2020 and 2021, resulting in unprecedented job losses. The credit may be applied against sales and use taxes, or income taxes.

California main street small business tax credit ii begins 11/1/21. Automotive, small business tax briefs. (the 2021 will be available by january 1, 2022.) provide the confirmation number received from cdtfa on the tentative credit reservation.

File your income tax return timely. Provide the confirmation number (received from cdtfa on your tentative credit reservation) when claiming the credit. Employers that had fewer than 500 employees on december 31, 2020, subject to california withholding laws, would be considered qualified small businesses.

The 2021 main street small business tax credit ii is set to provide further financial relief to qualified small business employers. Businesses must be registered to file their state excise tax electronically. Include your main street small business tax credit (ftb 3866) form, to claim the credit.

The credit will allow those who qualify to offset their income tax or sales and use tax when filing. On september 9, 2020, california governor, gavin newsom, signed the senate bill that established the “main street” small business hiring tax credit. Include form ftb 3866, main street small business hiring credit (coming soon), to claim the credit.

Tax credits are used to help reduce the amount of taxes business owners all over the state owe. The tax credit applies to small business meeting the following criteria. Credit reservations for qualified small business owners will be available from november 1 st 2021 through.

On or after january 1, 2020, and before january 1, 2021, a main street small business tax credit is available to a qualified small business employer that received a tentative tax credit reservation from the california department of tax and fee administration (cdtfa). In late september 2021, governor newsom signed assembly bill (ab) 150 establishing the main street small business tax credit ii.

.png)

Maximizing Tax Deductions For The Business Use Of Your Car – Turbotax Tax Tips Videos

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

Understanding The 1065 Form Scalefactor

What Are The Taxes A Small Business Needs To Pay Info Plus Forms And Deadlines Ifranchiseph

Ho6-o5kszjzl7m

How To Start A Real Estate Business Infographic Real Estate Infographic Business Infographic Real Estate Business

Income Statement Example Income Statement Profit And Loss Statement Statement Template

How To File Previous Year Taxes Online Priortax Filing Taxes Previous Year Tax

Free Client Information Sheet Templates Word Pdf Business Template Business Printables Executive Summary Template

Ftz Fueled Mcallens Development – Vbr In 2021 Mcallen Business Leader Rio Grande Valley

Fillable Form 1003 Loan Application Standard Form Application Form

North Carolina Sales Tax – Small Business Guide Truic

Can Cellphone Expenses Be Tax Deductible With A Business – Turbotax Tax Tips Videos

California State Controllers Office – Home Facebook

Tax Id Numbers Why Theyre Importnat And How To Get One Bench Accounting

Basic Income Statement Example And Format Income Statement Profit And Loss Statement Balance Sheet Template

What Is Schedule A Hr Block

How Fortune 500 Companies Avoid Paying Income Tax

Turbotax Vs Hr Block Which Online Tax Service Is Best